Whether you’re a C-suite executive, salesperson, marketer, or product developer, knowing who your competitors are and having detailed competitive monitoring in place that documents how they are performing is pivotal. To succeed in your respected industry, you need to understand as much as you can about who you’re up against.

From companies dominating the market to the up-and-comers who might bring a different twist to an established product or service, your competition can directly affect how you sell, market, and operate your business and determine whether you’re successful or not.

Effectively monitor your competitors.

Monitor your competition with real-time alerts – try Crunchbase for free

That’s where competitive monitoring comes in – to help your business rise above the competition. When monitoring, you’ll look at every move your competitors make, from their funding and acquisitions to pricing. Next, use that data to perform a competitive analysis, revise your business plan, and adapt to changes in your industry. With the right tools, competitive monitoring and analysis can be simple and easy.

By the end of this article, you’ll walk away with the knowledge you need to start effectively monitoring your competitors and beat the competition. Here’s what to expect:

- What is competitive monitoring?

- Which competitors should you be monitoring?

- Who should be monitoring your competitors?

- How to begin competitive monitoring

- Critical competitor data points to track

What is competitive monitoring?

Competitive monitoring, also known as competitive analysis, is the process of identifying and auditing your competitors’ products, pricing, and sales prospecting and marketing strategies. Analyzing and reviewing this data can help you position your business to stay ahead.

From marketing initiatives to acquisitions, watching your competition gives you valuable insight that will allow you to make more data-driven choices, so you can stay a step ahead of other businesses in your space.

Monitoring your competition is also an important part of the market research process. It can reveal competitor weaknesses, giving you an opportunity to use any shortcomings to your advantage. You can evaluate how their business plans are performing in the market and adapt yours accordingly to learn from their mistakes or successes. With the right data and quality analysis, you can also get important intel that may hint at future intentions.

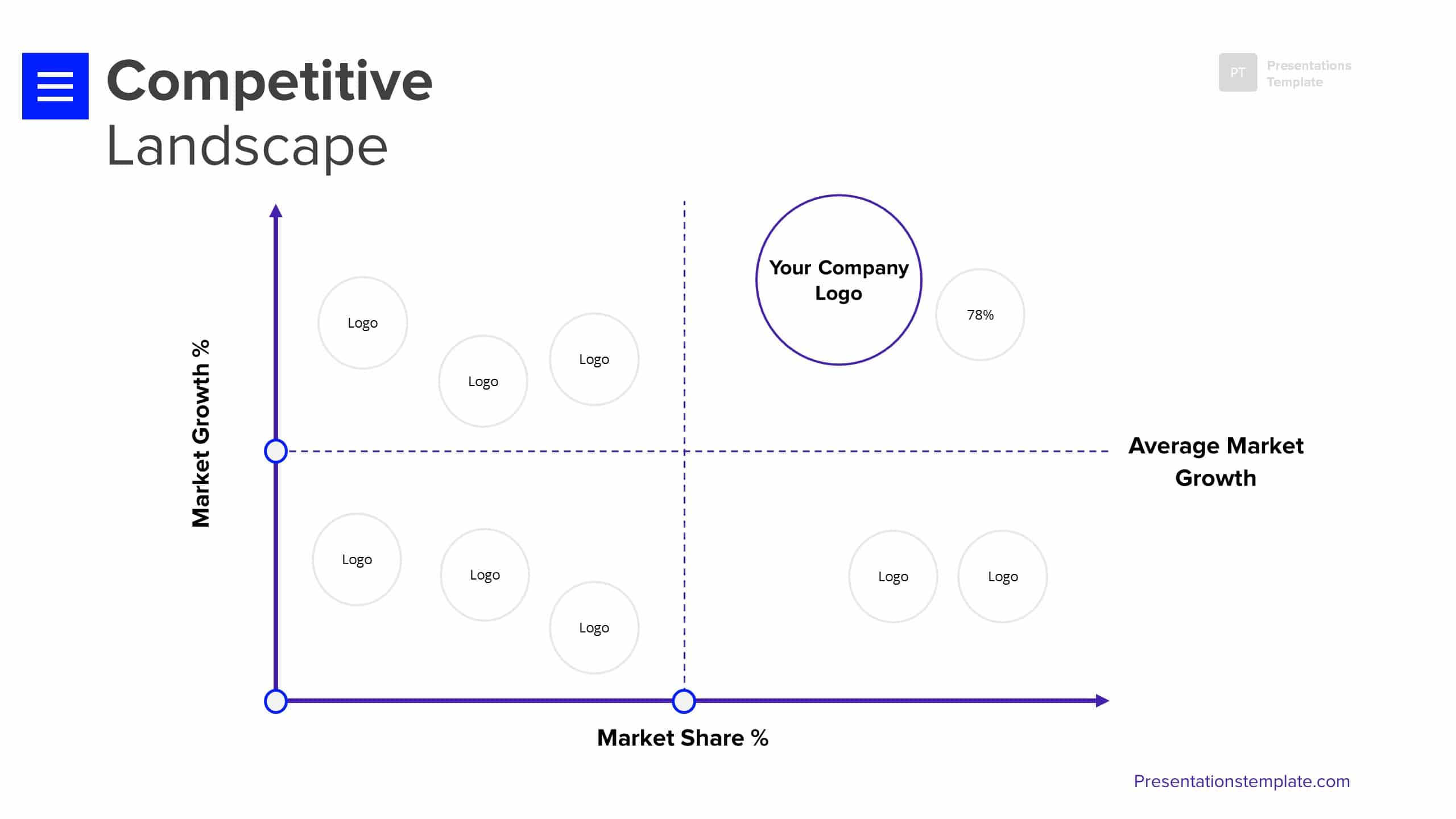

Competitive monitoring is a visual window into your industry as a whole. When looking at multiple competitors, you can see where the market is moving and how to fill in the gaps. This will help your company become the leader of the pack and capitalize on market share and growth.

Which competitors should you be monitoring?

The truth is, your customers don’t and won’t engage with just one or two businesses that sell the same or similar products and services as you do. Nor will they be exposed to just your company with all of the other companies competing for their attention — especially in today’s tumultuous economic climate, which has forced many salespeople to cast a wider net than they may have before. .

As you conduct competitive analysis and market research for your startup, it’s imperative that you track your competition on a regular basis. The only issue is, it almost seems like an endless sea of businesses and services that you’ll have to sift through. How do you know where to begin? First, you need to find who is worth monitoring and who isn’t.

The two types of competitors you should be monitoring are direct competitors and indirect competitors.

Direct competitors

Companies that offer a product or service that is the same or similar to yours are direct competitors. They are the Pepsi to your Coke, the Uber to your Lyft. Your potential customers will compare you and them based on factors such as price, product, and availability.

Direct competitors are the businesses you want to keep in the forefront of your mind when monitoring and analyzing data. They’re your immediate threat. Satisfying the desires that their products or services don’t meet in your industry and evolving your business before they do will give you the upper hand you need to dominate.

Indirect competitors

Businesses that offer different products or services than you do, but tap into the same consumer base, are your indirect competitors. If you’re a restaurant, they are a grocery store. While your challengers may not serve lasagna or sub sandwiches, they sell the ingredients to make those meals and can still satisfy the needs and wants of your consumers – indirectly.

Indirect competitors are not as much of a threat to your business as your direct competitors but monitoring and analyzing them offers a wealth of information and insight. The data you find can also give you a fresh outside perspective of your respected industry. This is especially true if they introduce new ideas that aren’t normal practices or services for you and your direct competitors. Just like your direct competition, they can also inspire you to adapt your business and grow into something more.

The following diagram is an example of an indirect competitor map in which the company in the middle is assessing who its competitors in each sector related to its offerings are.

Who in your organization should be monitoring competitors?

Competitive monitoring can (and should) be leveraged across nearly all functions in your organization. Here’s how competitor information can be used across your company.

Sales teams

A sales team’s success is tied to how deeply they understand their competition and how good they are at selling prospects on their strengths over competitors.

Often prospects will want to know exactly how a product or service stacks up against its direct competitors. Salespeople need to be able to handle objections effectively by clearly articulating what differentiates them from their competitors.

Marketing teams

Marketing teams can use competitive monitoring and analysis in a variety of ways. This includes understanding how competitors are positioning themselves in the market, the audiences they’re targeting and channels they’re using, messaging, pricing strategies, and more.

This information can help marketing teams determine their own strategies and how to position themselves in the market to differentiate their messaging and/or offerings.

Product teams

Though product roadmaps are rarely shared publicly, there are other signals to watch out for that can provide insight into where a company is headed. These include new feature announcements, new funding rounds, leadership hires, and more. This information can help product teams understand what they should develop to either compete directly with competitors or differentiate themselves.

Business development teams

Business development and partnerships teams are often looking to expand capabilities with relevant partnerships. At first glance, your competitors might not seem like companies you’d want to partner with, but in some cases, these partnerships can help both companies succeed.

Leadership teams

This goes without saying, but company leadership should be watching your competitors like a hawk. As the ultimate decision-makers, staying up-to-date on competitor activity can be the difference between a billion-dollar unicorn and a failed startup.

How To Begin Competitive Monitoring

How you monitor the competition and think through your competitive analysis can give you quite an edge. Searching the internet for information such as funding options or a list of investors can be time-consuming. Plus, ensuring your data is reliable can be difficult.

Not everything on the web is real or accurate. Without the right competitor tracking tools and services, you could find yourself with dated information, waste time analyzing the wrong data, or even miss new businesses that are trying to enter your industry.

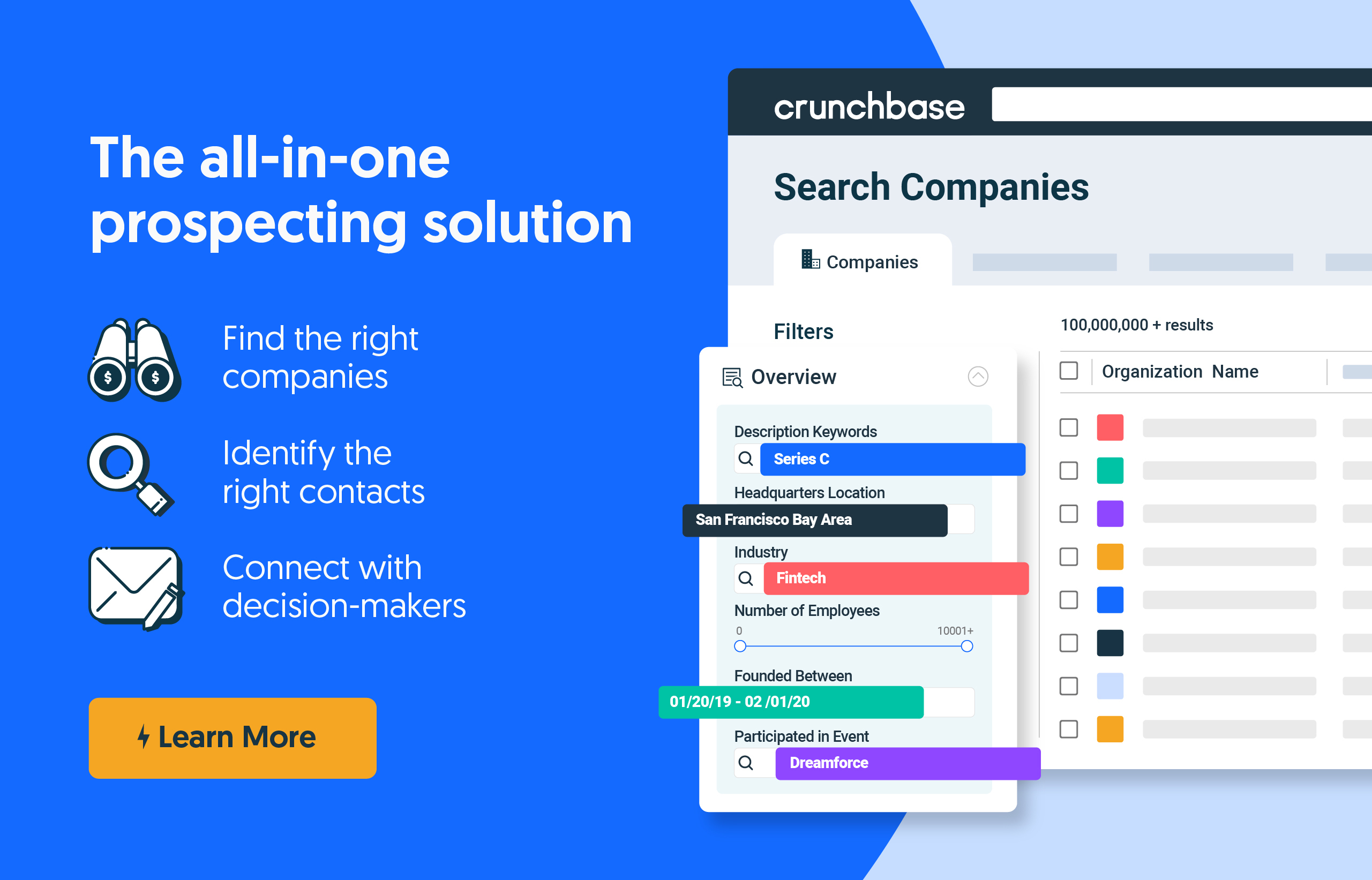

Crunchbase can help you identify your competitors, collect reliable data, then visualize and analyze that information to make informed, actionable decisions about refining your businesses’ strategy.

Here’s how to get started:

- Start a company search and apply filters like ‘Industries,’ ‘HQ location,’ or ‘Total Funding’ to start identifying direct and indirect competitors. If you have a list of competitors you’re already monitoring, here’s how to upload it right to Crunchbase.

- Save your search and give it a name, like “West Coast Competitors.”

- Set an alert cadence to hit your inbox with updates on your competitors in real-time.

- Click ‘New Additions’ to get alerted when up-and-coming competitors show up in your industry.

- Export your search results as a CSV so you can share this list of competitors with your team.

Ready to get started? Customize this search template using the Industries filter to look up software companies.

Now it’s time to dive into the specific competitor data you should be tracking.

Critical Competitor Data Points to Track

The real competitive advantage comes from understanding critical data points that will inform whether or not you need to adjust your roadmap to win against rising competitors in your industry.

It’s easy to get lost in a sea of advice about what competitor information you should be looking for. Depending on the intent of your research, you could go a variety of different ways when it comes to data collection.

To keep things simple, here’s a quick list of the four most critical competitor data points you should be tracking. And, the best part is, each of these data points can easily be found right within Crunchbase.

1. Recent acquisitions and investment in new technology made by your competitors

Don’t miss out on how and where your competitors are acquiring new technology. New technology means new focus areas, which can provide insight into the direction a business is headed. And, if your competitors acquire another company, that’s an indicator of new capabilities and likely product expansion in this direction in the future.

Acquisition and technology investment information can be leveraged by leadership, product, sales, and marketing teams alike to refine and adjust strategy.

2. Board members and investors

Digging into your competitors’ investors can help teams better understand a competitor’s trajectory.

Are their investors known for helping companies scale quickly, or do they invest in companies with a certain vision? This information can help you piece together what your competitors’ roadmaps and future plans might look like.

Crunchbase tip: Find comprehensive investor information on Crunchbase.

3. Last funding date, amount, and type

Keep an eye on your competitor’s financial growth to ensure you are always aware of the most relevant competitors, up-and-comers, and where you stand in the market.

Understanding your competitors’ funding stages can be a signal for how your competitors might scale. A Series A round, for example, could mean a competitor will build out more foundational features. On the other hand, a Series C round could mean they’ll build on the capabilities of existing features.

In a tumultuous economic climate, signals such as layoffs or a pause in hiring can tell a lot about where a company stands financially. Crunchbase’s advanced search filters make it easy to see which companies are hiring, and which ones aren’t.

Keeping an eye on competitor funding can also help you craft competitive messaging when positioning your own product.

4. News mentions

Keep an eye on how your competitors are being talked about in the media to stay caught up on their market positioning, popularity, direction, and any product changes. This can also inform when you announce changes to your own products and how you position them.

Crunchbase tip: You can find recent press mentions on your Crunchbase homepage, or in the ‘Recent News & Activity’ section of any company profile.