Whether you’re an entrepreneur, market researcher or marketing enthusiast, knowing your competitors inside and out is a crucial part of the job.

Competitive analysis is more than a quick online search; instead, it’s a systematic process that allows you to gain valuable insights into your competitive environment. By examining the strengths, weaknesses, strategies and market positions of rival companies, you can make informed decisions that help you come out on top.

Let’s dive into what competitor analysis is and how to do it, as well as the tools and templates you need to thrive in the modern market.

What is competitive analysis?

Competitor analysis, often referred to as competitive analysis, is the systematic process of gathering and evaluating information about your competitors to gain a deep understanding of the competitive landscape in your industry. It involves delving into your competitors’ business models, marketing practices, product offerings, target audiences and much more.

This practice helps you keep a pulse on competing products in the market and make well-informed decisions for your business. It also enables you to find opportunities for growth, anticipate trends and proactively respond to potential threats.

Benefits of competitor analysis

The advantages of doing competitive analysis can have a meaningful impact on your bottom line. Here are just some of its key benefits:

- Informed decision-making: By understanding your competitors’ strategies, you can make well-informed decisions about your own business. This includes choices related to product development, marketing and pricing.

- Identification of market opportunities: Competitor analysis can reveal gaps in the market or areas where your competitors may be underperforming. These insights can help you identify new opportunities for growth and expansion.

- Risk mitigation: By staying aware of your competitors’ activities, you can better anticipate potential threats and challenges. This proactive approach enables you to develop strategies to effectively mitigate risks and overcome threats before they happen.

- Benchmarking: Comparing your business to competitors helps establish benchmarks for performance. This allows you to measure your progress and identify areas where you excel or need improvement.

- Product and service enhancement: Analyzing competitors’ products and services can inspire improvements in your offerings, leading to increased customer satisfaction and loyalty.

- Improved marketing strategy: Understanding how your competitors market their products or services can help you refine your own marketing strategy to better reach your target audience.

- Adaptation to market shifts: The business environment is constantly evolving. Competitor analysis helps you stay agile and adapt to changes in customer preferences, technology and market trends.

- Competitive advantage: Armed with insights from competitive analysis, you can develop strategies to gain a competitive advantage in your industry.

- Long-term sustainability: Consistent competitor analysis allows your business to plan for the long term by identifying potential challenges and opportunities that may arise in the future.

Together, these benefits can empower you to thrive in the face of competition and establish a strong presence in the market.

How to do competitor analysis

To harness these advantages, you’ll need to learn how to perform competitive analysis effectively. The process is quite structured and involves several key steps to ensure that you gather relevant data and gain actionable insights.

- Identify your competitors

- Define your objectives

- Collect data

- Look for the 4 Ps

- Conduct a SWOT analysis

1. Identify your competitors

To pinpoint your competitors, create a list of organizations that compete with you both directly and indirectly in the marketplace.

Direct competitors are organizations that offer similar products or services to the same target audience. In other words, they’re the businesses that potential customers could choose instead of your company.

To identify your direct competition, start by examining businesses that operate in the same industry or niche. Ask yourself questions such as:

- Who offers products or services that are nearly identical to ours?

- Who targets the same customer segments and geographical areas as we do?

- Who are our primary rivals when it comes to market share and sales?

Once you have identified these direct competitors, you can create a list or spreadsheet to keep track of their names, key characteristics and any available data that will be useful in your analysis.

Next, you’ll want to identify your indirect competitors. Indirect competitors serve a similar target market as your company, but may offer different products or services. They are indirect rivals because they can influence consumer choices, even though they are not in direct competition with your business. To identify indirect competitors:

- Look for businesses that serve the same customer needs, even if their products or services are not identical to yours.

- Consider how customers might choose between your offerings and those of indirect competitors.

- Examine businesses that could potentially expand into your market.

Including both direct and indirect competitors in your analysis provides a more holistic view of your competitive landscape and helps you anticipate shifts in consumer preferences or market dynamics.

Remember that the business environment is constantly changing, and new competitors may emerge over time. Regularly updating your list of competitors is essential to ensure that your competitor analysis stays relevant.

2. Define your objectives

The next step in competitive analysis is to clearly outline your objectives. This will ensure that you’re gathering relevant information that directly supports your business strategy. Here’s how to define your objectives effectively:

- Clarify your goals: Begin by outlining your overarching goals. Common objectives may include improving market share, optimizing pricing strategies, enhancing product development or refining marketing tactics.

- Identify your information needs: Use your goals to determine exactly what kind of information you’ll need. Ask yourself: What kind of data or insights will be most helpful in achieving your stated objectives? For example, if you want to improve product development, you may need data on your competitors’ product features, customer reviews and pricing.

- Develop KPIs: Write down the key performance indicators that are most relevant to your objectives. KPIs are quantifiable metrics that will help you measure your progress. For instance, if your goal is to enhance marketing strategies, relevant KPIs might include website traffic, conversion rates or social media engagement.

- Determine a time frame: Understanding the time frame of this project will influence the depth and scope of your analysis. Are you conducting a one-time competitor analysis, or is this an ongoing process?

- Align with business strategy: Ensure that the above aligns with your overall business strategy. Your competitor analysis should directly contribute to the success and growth of your business.

- Adapt when necessary: Be open to adjusting your objectives as needed. The business landscape can change rapidly, and you may need to adapt in response to new opportunities or challenges.

When you define your objectives, you give yourself a clear roadmap for your research. This helps you focus on gathering the most pertinent data and ensures that your analysis directly benefits your business. Whether you’re looking to outperform competitors in a particular area or gain a broader understanding of the competitive landscape, well-defined objectives are the cornerstone of a successful analysis.

3. Collect data

Effective data collection is another fundamental step in the competitor analysis process, as the quality and relevance of the data you gather directly influence the insights you gain. Begin by identifying data sources that will give you the information you’re looking for. These sources can include both online and offline channels.

Online sources are often the richest and most accessible. Common data sources for competitive monitoring include:

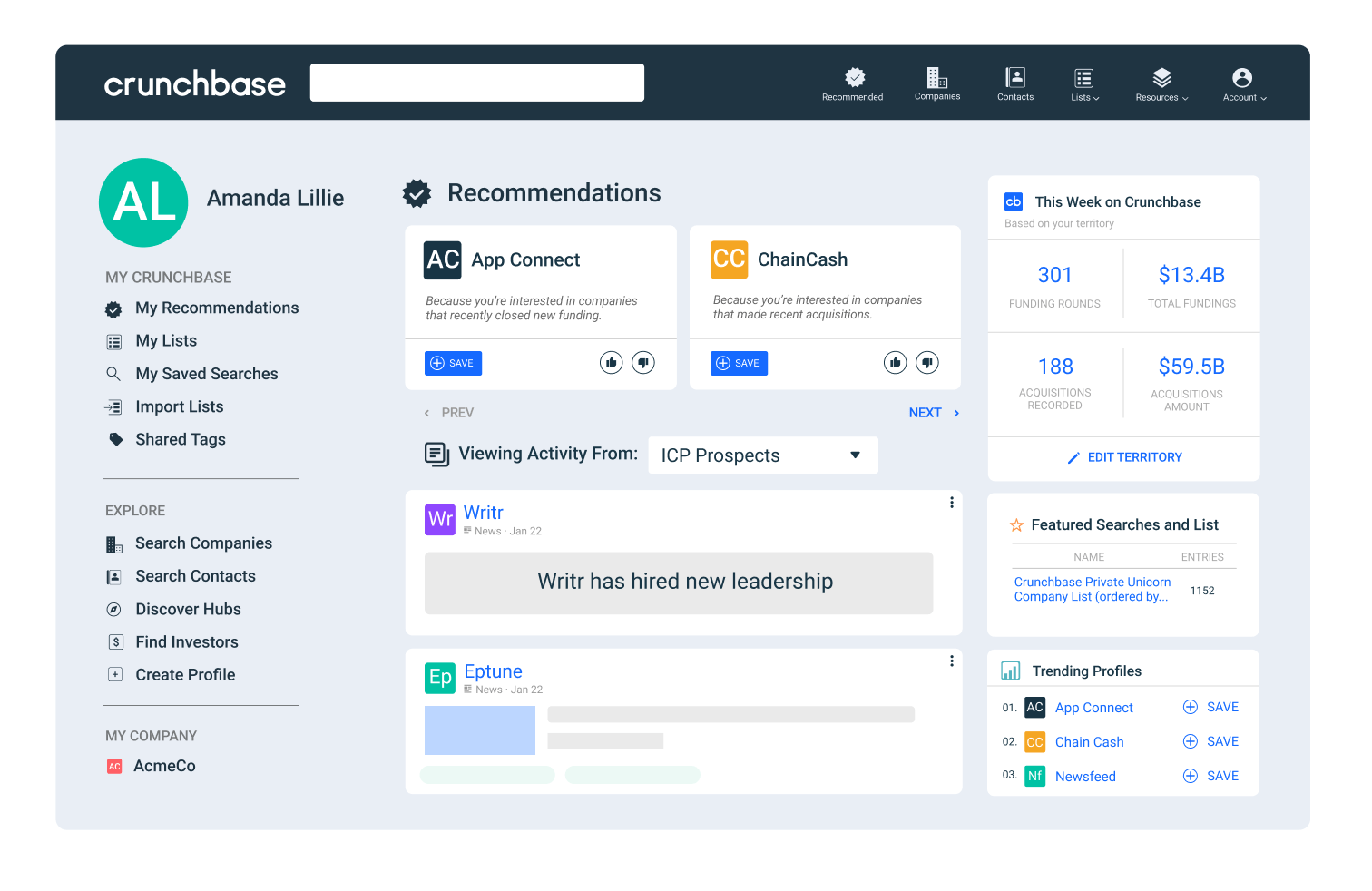

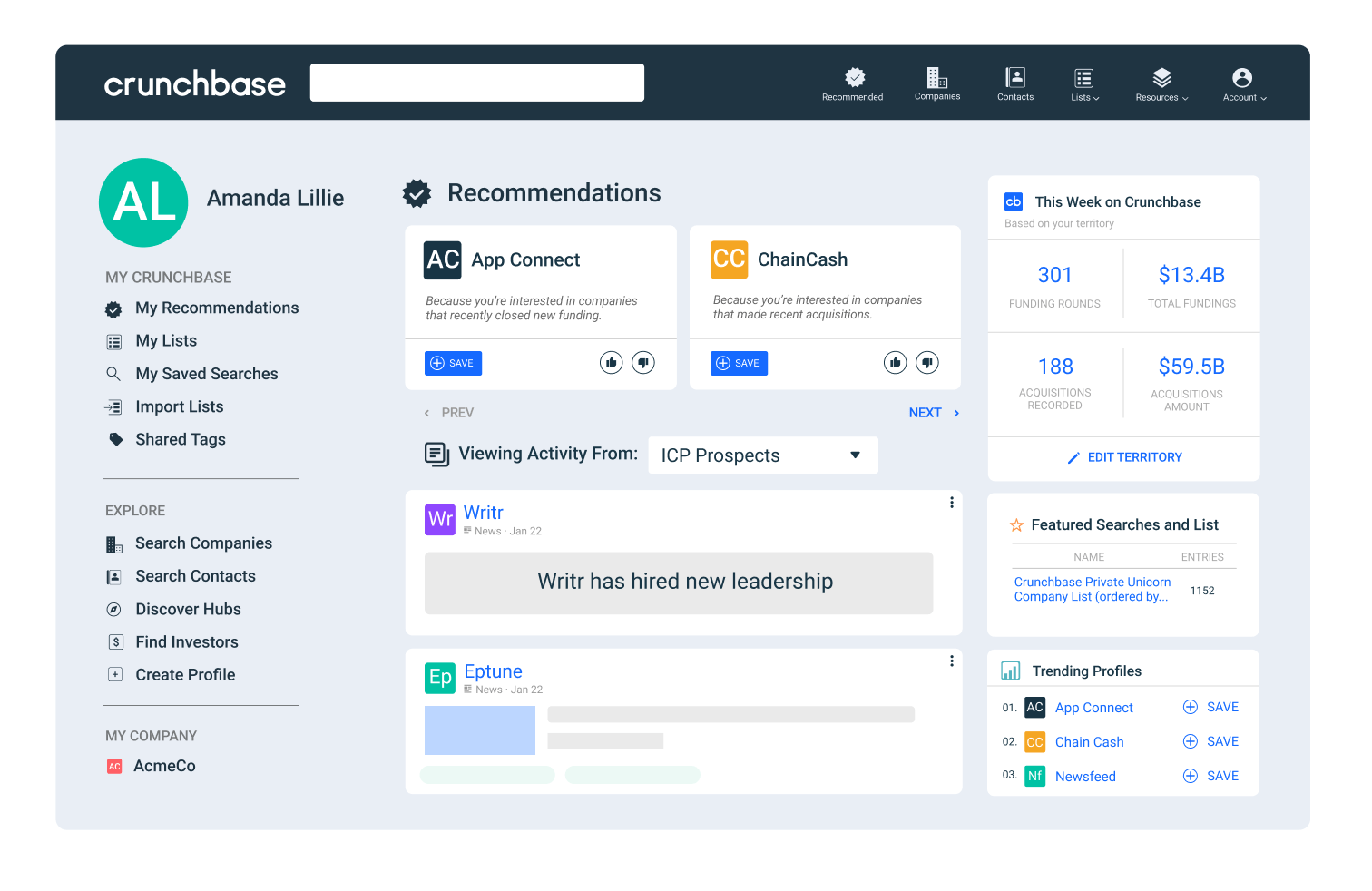

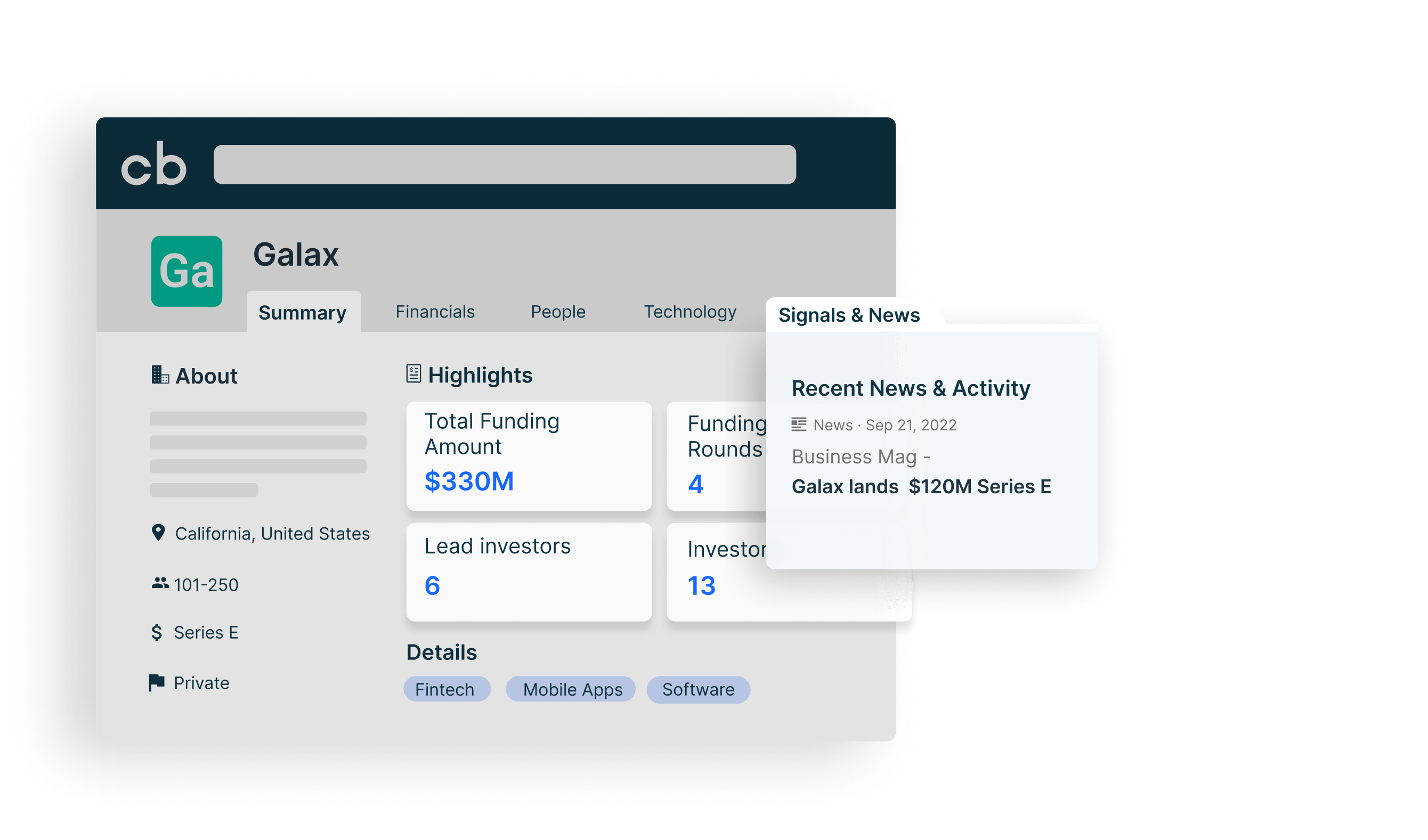

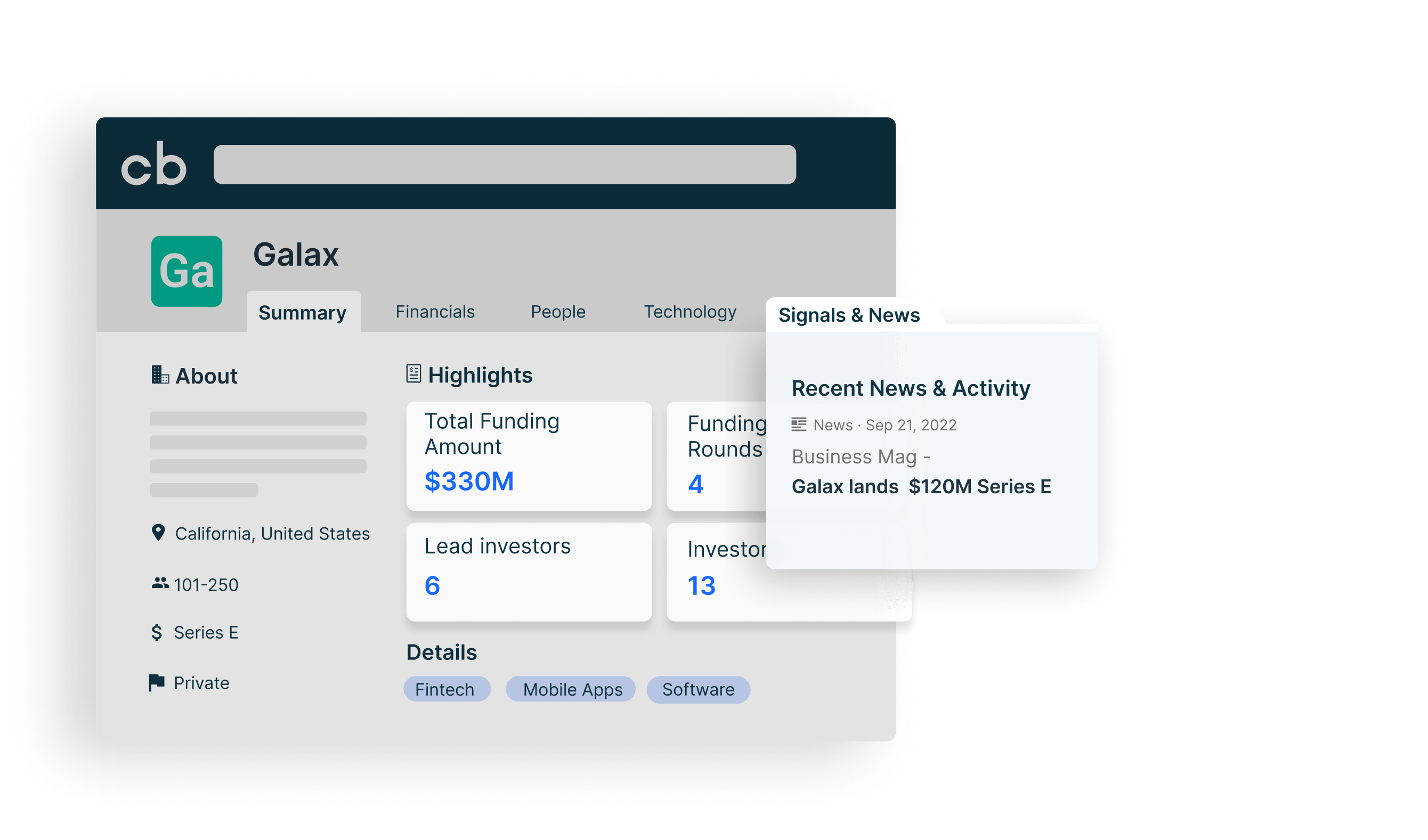

- Crunchbase: Crunchbase is a valuable resource for gathering data about companies, including your competitors. It offers details about a company’s firmographics, funding, leadership team, investor relationships and key metrics. This data helps you understand your competitors’ financial health, investment history, growth strategies and potential areas of expansion.

- Company websites: Competitor websites are valuable sources of information about your competitors’ products, services, pricing and promotional strategies. They provide direct insights into how your competitors present themselves to customers and the market.

- Social media: Social media platforms such as Facebook, X (formerly Twitter), Instagram and LinkedIn offer a glimpse into your competitors’ marketing and promotional efforts. Analyze their posts, content engagement and follower interactions to understand their messaging and customer engagement strategies. You can also use social media to monitor comments, reviews and conversations to gauge customer sentiment and identify your competitors’ strengths and weaknesses.

- Customer review sites: Review sites like G2, Capterra or dedicated industry-specific review platforms also offer candid customer feedback. Analyze the reviews to understand customer satisfaction levels, identify pain points and discover areas where your competitors excel or underperform. Some reviews may also mention pricing, which can help you determine how customers perceive the value of your competitors’ products or services.

- Market reports: Market research companies like Nielsen, Gartner, Forrester and Euromonitor International often produce comprehensive market reports across various industries. They often include data on market size, growth projections and emerging opportunities, helping you assess the overall landscape your competitors operate in. Market reports may also include company profiles, giving you information about their market share, strategies and financial performance.

- Industry publications: Business publications and journals often publish in-depth articles and analysis about trends, innovations and market players. They can provide valuable information about your competitors’ strategies, market positioning and noteworthy developments. Crunchbase News, which offers data-driven reporting on private markets, is a great place to start.

- Government databases: Government databases can provide access to financial and regulatory information about companies, including your competitors. This data may include financial statements, business registrations and industry-specific regulatory compliance, helping you understand their financial health and legal compliance.

As you gather this data, make sure you have an organized place to put it. A good idea is to create a competitor matrix, also referred to as a competitor grid, which is a spreadsheet for organizing your research. List out your competitors on one axis of the grid (either the horizontal or vertical axis is fine). On the other axis, list the data points you’re looking to collect, such as company location, market position, price and branding.

A couple additional notes: pay attention to both your data accuracy as well as any ethical considerations. Confirm that the information you gather is up to date and reliable, as outdated or inaccurate data can lead to erroneous conclusions. On top of that, be mindful of legal requirements. Respect privacy rights, copyright and intellectual property laws when gathering data.

4. Look for the 4 Ps

Next, you’ll want to analyze your competitors’ marketing strategies. A systematic way to approach this is by looking at the 4 Ps of marketing, also known as the marketing mix. These are product, price, place and promotion, which you can break down into the following questions:

Product

- What are the key features and attributes of our competitors’ products?

- How does the quality of our competitors’ products compare to ours?

- Are there any unique or innovative features in our competitors’ products that we should be aware of?

- What is the product life cycle of our competitors’ offerings, and how does that impact their market presence?

- How do our competitors brand and position their products in the market?

- Do our competitors offer a wide product range, or do they focus on a niche market?

- What are the customer reviews and feedback on our competitors’ products, and what strengths or weaknesses do they highlight?

- How do our competitors handle product updates, customer support and warranties?

Price

- What are the pricing strategies employed by our competitors (e.g., premium, value, competitive or penetration pricing)?

- How do our competitors price their products or services compared to our pricing?

- What types of discounts, promotions or special offers do our competitors use, and how frequently do they change them?

- Do our competitors offer bundle pricing or product packages?

- How do our competitors handle pricing changes and adjustments based on market conditions or demand?

- What is the perceived value of our competitors’ products or services in relation to their pricing?

- Are there any loyalty programs or customer rewards related to pricing that our competitors offer?

- How do competitors communicate their pricing to customers, and does it align with their branding and positioning strategies?

Place (distribution)

- What distribution channels do our competitors use to reach their customers (e.g., direct sales, retailers, e-commerce or wholesalers)?

- How extensive is the geographic reach of our competitors’ distribution networks?

- Are there specific partnerships or collaborations that our competitors have with distributors or retailers?

- What is the availability and accessibility of our competitors’ products or services, both online and offline?

- How do our competitors handle inventory management, logistics and fulfillment to ensure timely delivery to customers?

- Do our competitors have a physical presence, and how does it impact their brand and customer engagement?

- What is the overall customer experience with the distribution and availability of our competitors’ offerings?

- Are there any supply chain or distribution challenges that our competitors face?

Promotion

- What are the core elements of our competitors’ marketing and advertising strategies (e.g., online ads, content marketing, social media, traditional media)?

- How do our competitors position their brand, and what is their unique selling proposition?

- What messaging and tone do our competitors use in their advertising and marketing campaigns?

- How do our competitors engage with customers on social media, and how do they manage their online reputation?

- What content marketing tactics do our competitors employ to educate and engage their audience?

- Do our competitors use influencer marketing or partnerships with other brands or organizations?

- What customer feedback, testimonials or case studies do our competitors use in their promotional materials?

- How do our competitors measure the success and impact of their promotional efforts, and what adjustments do they make based on these metrics?

These questions will force you to think hard about your competitors and the ways they position their product or service in the market. Be sure to make a note of these data points so you have an organized spreadsheet with your competitive analysis.

5. Conduct a SWOT analysis

Now, conduct a SWOT analysis using all the data and insights you’ve gathered. A SWOT analysis is a competitive analysis framework for systematically evaluating your competitors’ strengths, weaknesses, opportunities and threats. Create a table or slide deck with the following notes about each competitor:

- Strengths: Consider areas like product quality, brand reputation, financial stability and unique capabilities. What does your competitor excel at? What are their key assets and resources? What advantages do they have over your business and other competitors?

- Weaknesses: Analyze your competitors’ weaknesses, which are internal factors that put them at a disadvantage. Evaluate areas where they struggle, such as customer service issues, product limitations or operational inefficiencies. Where does your competitor fall short? What are their operational or financial weaknesses? Are there aspects of their products or services that receive consistent criticism?

- Opportunities: Consider the external factors and opportunities that your competitors can capitalize on. These may include market trends, emerging customer needs, technological advancements or changes in regulations. Here, you’ll want to ask yourself the following questions: What market opportunities are your competitors pursuing? Are there emerging trends that they are well-positioned to benefit from? How do they adapt to changing market conditions and customer demands?

- Threats: Evaluate the external factors and threats that pose risks to your competitors’ business. These could be increased competition, economic downturns, changing consumer preferences or regulatory challenges. What are the external threats that our competitors face? How do market or industry conditions pose risks to their operations? Are there competitive pressures that could erode their market share?

After identifying the strengths, weaknesses, opportunities and threats of your competitors, it’s time to analyze the findings. Look for connections and relationships between these factors. For example, how do strengths offset weaknesses, or how can opportunities be leveraged to mitigate threats? Consider how these factors impact your competitors’ overall competitive positioning.

Competitive analysis templates

Competitive analysis is a complex task, but you don’t have to start from scratch. These competitor analysis templates provide a structured framework for gathering and analyzing data about your competitors:

- Competitor research template

- Competitor matrix template

- Social media competitor analysis template

- SWOT analysis template

1. Competitor research template

This advanced search template is a helpful starting point for gathering data about competing companies. You can customize the template by adding multiple search filters, such as industry, geographic location and funding information, to pull up the companies that match your competitor profiles. The more you fine-tune your search, the more precise your list of competitors will be.

2. Competitor matrix template

A competitor matrix template, like this one from HubSpot, allows you to systematically compare key features, pricing and other attributes of your products or services with those of your competitors. By comparing these attributes side by side, you can better assess your biggest threats and identify areas where your business can excel.

3. Social media competitor analysis template

This social media competitor analysis template offers a structured framework for assessing and comparing your social media performance with that of your competitors. With sections for tracking key metrics, content strategies, audience engagement and more, this template simplifies the process of understanding how your social media efforts stack up against the competition.

4. SWOT analysis template

This SWOT analysis template represents one of the most important types of competitive analysis templates. A template can simplify the SWOT analysis process and ensure that nothing falls through the cracks, helping you identify areas for improvement, capitalize on advantages and mitigate potential risks.

Competitive analysis examples

To understand how competitive analysis works in practice, let’s explore a few real-world examples that highlight its significance within different industries:

1. Apple vs. Samsung

Tech giants Apple and Samsung have long been rivals in the smartphone market. Both companies must scrutinize each other’s product launches, innovations and market share to stay competitive. Their competitive analysis involves a deep dive into one another’s product features, pricing strategies, branding and marketing tactics.

2. Coca-Cola vs. Pepsi

Coca-Cola and PepsiCo have engaged in one of the most iconic and enduring business rivalries. Competitor analysis here includes assessing their advertising campaigns, product diversification, distribution networks and customer preferences. These two giants need to continuously monitor each other’s market positioning in order to win over consumers.

3. Amazon vs. Walmart

Amazon and Walmart are leaders in e-commerce and retail. They must perform ongoing competitive analysis to compare delivery speeds, pricing structures, customer experience and market expansion strategies. Both companies are committed to staying ahead by understanding the strengths and weaknesses of the other.

4. Airbnb vs. Booking.com

Another iconic competitor analysis example is within the online travel industry. Airbnb and Booking.com are key competitors that need to evaluate each other’s user reviews, property listings, pricing and website user experience. Both platforms continuously track each other’s offerings to enhance their competitive position.

5. Nike vs. Adidas

Nike and Adidas are major players in the athletic apparel industry. These companies closely follow each other’s strategies to dominate the market. Their competitive analysis includes examining product innovations, brand endorsements, athlete sponsorships and global market presence.

Competitor analysis tools

In order to conduct robust competitive analysis like the companies above, you’re going to need the right tools. These include everything from online databases to website monitoring platforms. Here are our top recommendations:

- Crunchbase

- Brandwatch

- SEMrush

- SimilarWeb

- IPqwery

1. Crunchbase

Crunchbase is a comprehensive business intelligence tool that provides best-in-class data about both public and private companies, including your competitors. You’ll get insights into funding, leadership teams, key metrics and investor relationships, allowing you to understand your competitors’ financial health, investment history and market focus. This information is vital for identifying potential threats in the market, as well as opportunities to differentiate yourself. Learn more about market research on Crunchbase.

2. Brandwatch

Brandwatch is a social listening and consumer intelligence platform that helps you monitor your competitors’ social media mentions, customer sentiment and brand reputation. This allows you to gauge public sentiment about your competitors and identify areas where you can strengthen your brand’s image and stand out in the market.

3. SEMrush

SEMrush is most commonly known as an SEO platform, but it’s also a useful competitive analysis tool. It helps you analyze your competitors’ digital marketing strategies, keywords, backlinks and advertising efforts. Ultimately, this gives you insights into your competitors’ online presence and helps you identify their strengths and weaknesses in the digital space. Note that you can view SEMrush web traffic data directly from Crunchbase.

4. SimilarWeb

SimilarWeb is a market intelligence platform that offers insights into website traffic, audience demographics and online performance. It allows you to benchmark your website’s performance against those of your competitors, discover their traffic sources and understand their online audiences.

5. IPqwery

IPqwery is a competitive analysis tool that offers insights into your competitors’ patent portfolios, technological innovations and intellectual property strategies. This allows you to assess innovation, identify potential partnerships, and evaluate the intellectual property landscape. IPqwery data is available with Crunchbase Data Boost.

Achieve sustainable growth with competitor analysis

Competitive analysis doesn’t only involve gathering information, but it’s also about turning insights into actions that drive your business forward. Competitor analysis is an important part of market research for startups and large companies alike, as it’s fundamental for long-term success. By carefully assessing your rivals and industry trends, you can adapt your strategies and stay ahead of the curve.