Everyone has developed an exit strategy at some point in their life. Going to a family function and don’t want to get caught up in conversation with your crazy uncle? You probably have an exit strategy for how and when you’re going to get out of that discussion.

But, as a business owner or investor, have you thought about what an exit strategy means for your company? Why should you have one? And are there different types of exit strategies?

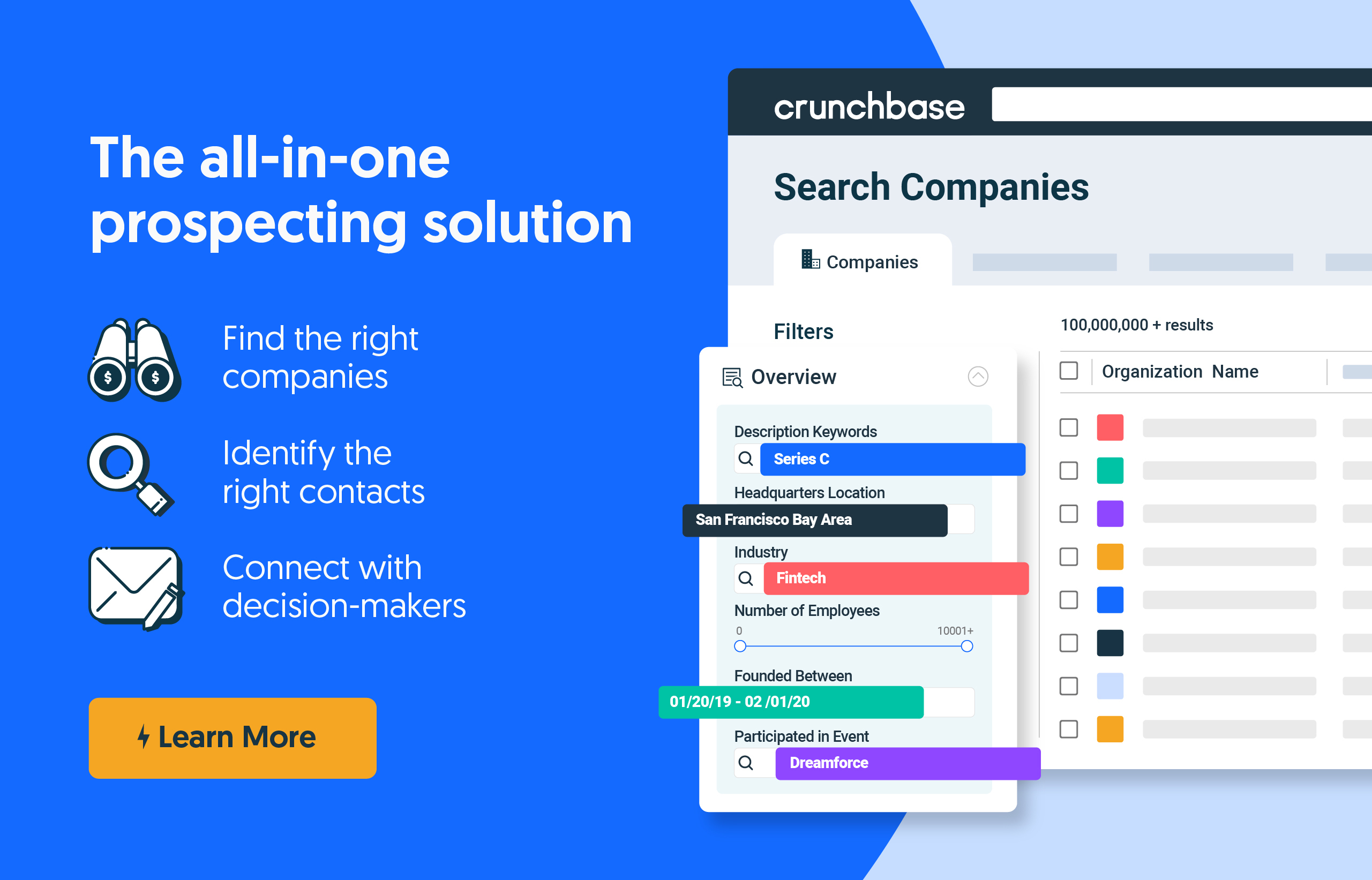

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Here is an opportunity for you to begin thinking about how and why an exit strategy may be good for your business.

What is an Exit Strategy?

Whether you’re an investor or business owner, it’s always crucial to think ahead. This also includes considering your exit strategy, a planned approach to relinquishing ownership or terminating a situation that will either maximize benefit or minimize damage. For entrepreneurs, this refers to a strategic plan on how to sell ownership to investors. Business owners can actually make a substantial profit if they generate a successful exit strategy. You should always assess your personal and business goals to identify which exit strategy aligns with your future goals.

So then, why should you have an exit strategy?

- Planned exits are a lot more favorable than unforeseen ones.

- The longer you withhold investments, the less you’re able to contribute to retirement.

- Be able to take on health problems without having to stress about what could happen to your business and investments.

- Stay on top of interest changes.

- You will be prepared for unexpected offers.

- If you set out on a more lucrative business venture, you can quickly liquidate your current situation.

- If you find yourself in a situation where you need to raise money quickly, an exit strategy can help.

- There will come a moment when personal time takes precedence, and this will help you be prepared for that.

Types of Exit Strategies

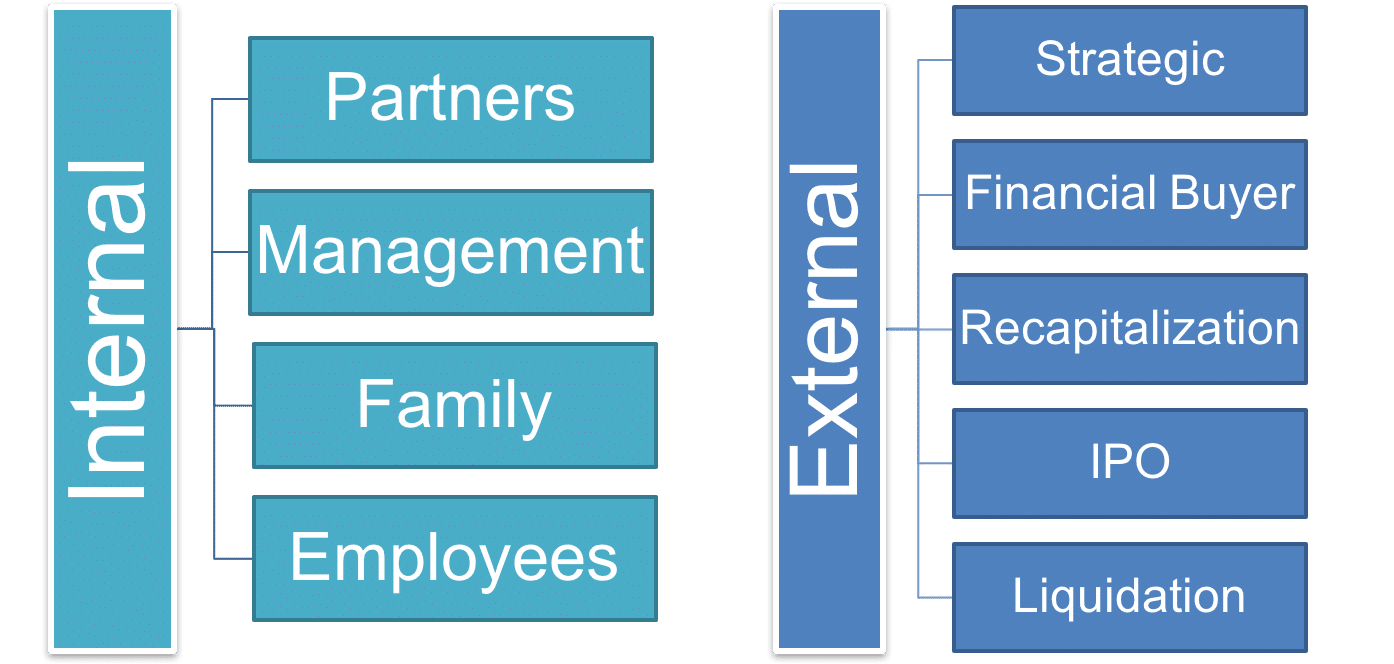

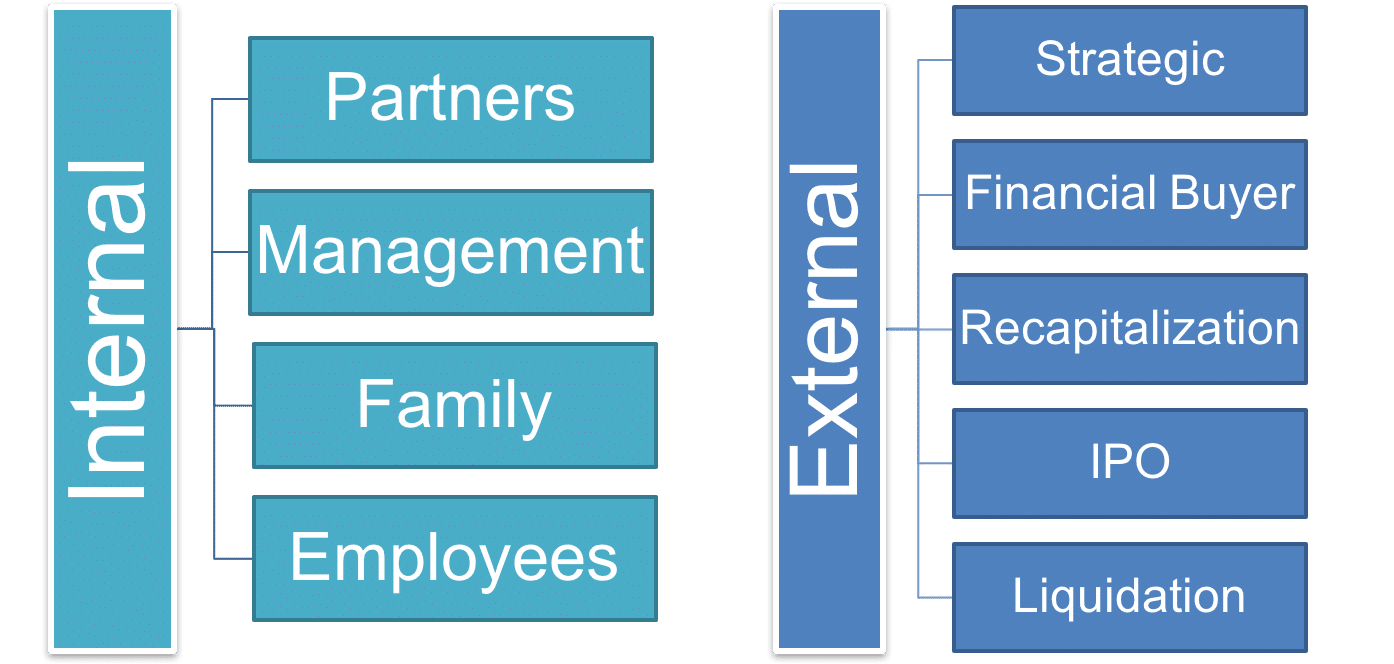

There are several types of exit strategies that successful investors and entrepreneurs consider. Among them are:

Lifestyle company exit

The Lifestyle company exit prioritizes the profit of the owner without a clear plan for future expansion. By keeping the business expenses at a minimum, you can pocket a majority of the profits rather than putting much into helping the business grow. This works best for a small business, allowing you to dissolve the company when it’s no longer turning a profit. Keep in mind that this generally only works if you have a good revenue stream and have partners that are on the same page as you.

Legacy

The Legacy exit applies to the notion of keeping business in the family. This is a recommended exit strategy for those who want to transition the company to a child or other relative. You can mold successors over time, which will assist in seamless execution of your exit strategy.

Mergers and acquisitions

M&A’s are ideal for any company. Start-up companies, in particular, look forward to the day where they will be able to sell their controlling interest to a larger, more profitable business. In this type of exit strategy, owners are often still in the picture post-merger. With this one, you should always make sure you trust that whoever is acquiring your company has your company’s best interest at heart.

Acquihires

Acquihires are an exit strategy in which a company buys out a business for the sake of acquiring its skilled employees. This type of acquisition is actually very beneficial to your employees, ensuring that they will be taken care of in the long run.

Management and employee buyouts

Employee buyouts are when those who know how the business works already transition into larger roles in the company and can help maintain your company’s legacy. This allows for more flexibility in your exit strategy.

Selling your stake to a partner or investor

Selling your stake is a way to keep business running as usual. It’s a very common exit strategy and allows owners to simply sell off their stakes without having to make huge changes to the company.

Initial public offering (IPO)

IPOs are the method of selling shares of stock of your privately owned business to the public. If you’re looking for the most lucrative exit strategy, this is it – if done properly. This type of strategy brings in large amounts of cash within a short period of time. However, with that comes repercussions. Be diligent with this type of strategy so you’re not caught up in the expenses of going public. Plus, make sure business conditions exceed the expectations of the public. Even if your business is doing well, your industry may lack appeal to the public.

Liquidating

Liquidating as an exit strategy is where you close your business and sell all of your assets – typically at a lower cost. Not to be seen as a bad option, this is a recommended strategy when the time has come to simply move on. If you choose this route, just know that you will need to use cash to pay your shareholders if there are any as well as eliminate any debts.

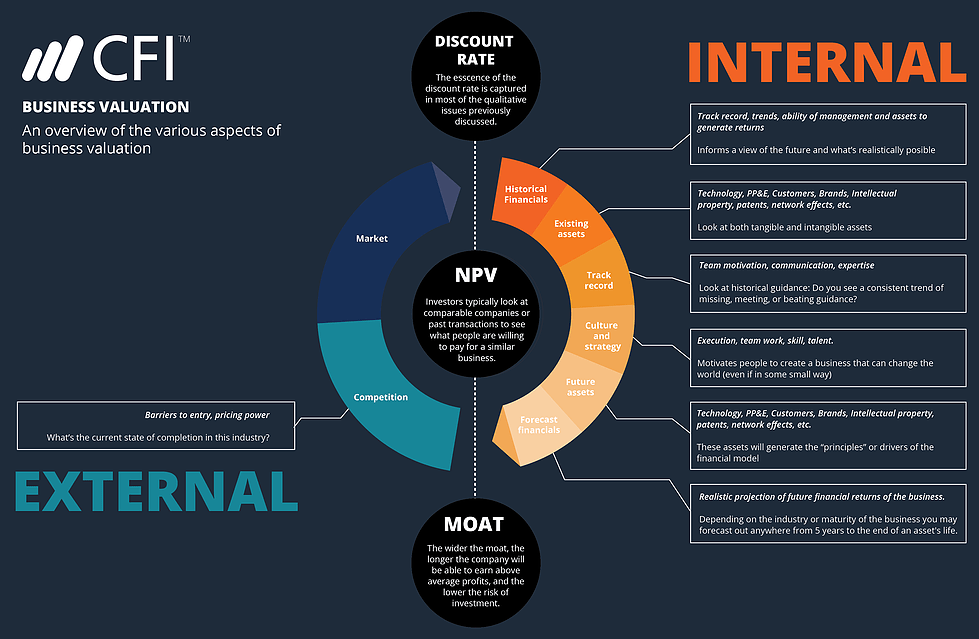

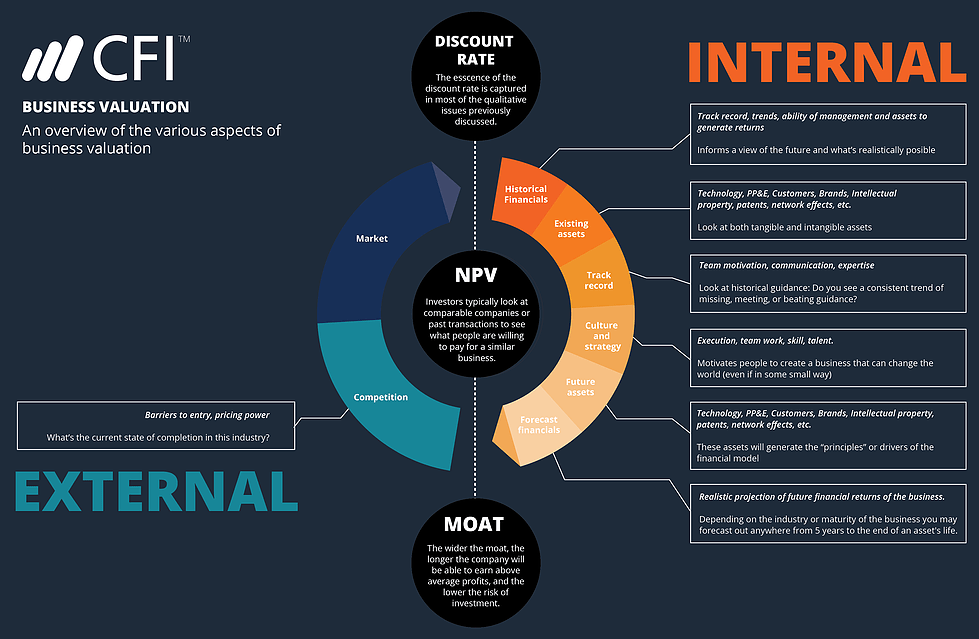

Timing Your Exit: How to Value a Small Business

There is no perfect time to execute your business strategy. When you look at the lifecycle of a business, you’ll see four distinct stages:

- Inception

- Growth

- Maturity

- Renewal or decline

The cycle your business is in will impact how sellable it is. This could determine when to open an exit strategy. Less mature, yet booming businesses – while showing off how profitable they are – might need more time to grow before getting ready to sell. Seasonality, industry trends and the consideration of what’s right for the business also play a huge part in when to put your exit strategy into play. At the end of the day, you don’t need to be profitable, booming or failing to sell your business. You just have to be ready.

Dissolving a Partnership and Measuring ROI

When dissolving a partnership, make sure to review your agreement. Make sure everyone is on the same page down to the vote. A successful acquisition, liquidation, or any settlement involves paying debts and distributing the assets properly. Also, check with state policies for proper documentation.

When it comes time to close the door on a business venture, you want to make sure you’re maximizing on your ROI. You’re going to want to be cash-efficient and raise as little money in the beginning to start or grow the business – so your return in the end is a lot more rewarding. Another less common way is to be a booming startup in a frothy environment so you can raise money at elevated situations.

Being a business owner means knowing how to plan ahead. Whether you’re limiting your losses, looking for something new or you’re at the peak of your profit and want to act on it while you’re still on top, it never hurts to have a plan waiting in your back pocket. Success means planning for any possible situation that lies ahead, especially when it comes to the future of your business.