Software as a service, or SaaS, is a relatively new industry that’s rapidly taken off in recent years. Chances are, many applications you use every day, from email to cloud storage, are delivered in the form of a SaaS platform.

SaaS presents an entirely new paradigm, which means selling it requires a different approach. In this article, we’ll dive into the basics of SaaS sales, including what it is, how the SaaS sales process works, and share a few tips to ensure your success — even in today’s tumultuous economic climate. Here’s what you’ll learn:

- What is SaaS sales?

- Stages in the SaaS sales cycle

- How to choose a SaaS sales model

- How to sell SaaS: Tips for success

- 6 key SaaS sales metrics to track

What is SaaS sales?

SaaS sales is the process of selling software that can be used online, otherwise known as software as a service platforms.

Selling software as a service is distinct from other software in two respects. The first is that it doesn’t need to be installed on the user’s computer. Instead, it resides “in the cloud” and can be accessed anywhere with a web browser.

The second and more significant distinction is that SaaS uses a subscription-based pricing model, influencing the selling approach. This subscription-based model can present a challenge for SaaS sales, meaning salespeople new to the field may not be able to rely on traditional selling strategies.

Like any software product, SaaS exists to solve a particular problem. To sell it successfully, sales reps often need to explain the product to the prospect. This is especially the case for highly customizable SaaS platforms that target businesses and enterprises.

When selling SaaS, business managers and corporate clients require a much more in-depth approach. While they’ll be interested in how the software works, they’ll mostly want to know how it will streamline their day-to-day processes and how it can improve their user experience.

Because of the complexity and time needed to sell SaaS products, SaaS sales specialist roles can be lucrative. According to ZipRecruiter, average annual salaries for SaaS sellers start at around $78,898, and that’s not including commission. Let’s take a look at the similarities and differences between SaaS sales cycles and traditional sales cycles.

SaaS sales cycle stages

Like any other product, SaaS sales follow a predictable cycle of roughly five stages:

Lead generation is the first step. It’s where you generate excitement and attract attention to your SaaS product. Typical lead generation tactics like content marketing, advertising and email marketing can be used successfully in selling SaaS. Building this hype around your product or service is crucial to the sales process — people are much more likely to purchase services they feel excited about.

Once you’ve successfully generated a pool of interested buyers, your sales reps can engage with these leads through outbound sales tactics. This involves traditional prospecting approaches like cold calling, email and social selling.

One of the most important steps in any sales process is lead qualification, in which sales reps must qualify each lead to verify if the company and contact is the right fit for the product. Qualifying leads is essential, so reps don’t waste time talking to a prospect that has zero chance of buying.

Facilitating a demo of the SaaS platform is also a fundamental part of the sales process. This can be done live with an account executive (AE) or sales engineer (SE) walking a prospect through key product features or with a video clip or trial of the SaaS platform. This is the stage in the SaaS sales cycle that differentiates it from other sales cycles–offering free week-long trials isn’t an option for most other industries.

The last part of SaaS software sales is, of course, closing the deal. This is where you set terms with the prospect, and they make the first payment. They’re now officially a user.

While every SaaS sales process follows these five stages, the actual length of each depends on two main factors: price and decision-makers.

As a rule of thumb, the higher the price tag, the longer the sales cycle. The reason is obvious: It takes more convincing to sell a $10,000/year product versus one that’s just $100/month.

The second factor is related to the first. Unless you go straight to the owner or CEO of a company, a higher price tag requires signoff from more decision-makers. This is especially true for enterprise SaaS sales, where buying decisions can take an even longer time—oftentimes weeks or months.

Aside from these factors, there are a few additional, subtle variables at play.

If your SaaS niche is particularly crowded, it will take more time to convince a buyer to pick you over your competitors — especially in today’s fast-changing circumstances. The same goes for a complex SaaS product since it will take more time to explain and demonstrate the benefits to a prospect.

Free trials can also lengthen your overall SaaS sales cycle. For example, if you offer a 30-day trial, you can expect the sale to potentially start only after that period.

Choosing a SaaS sales model

As mentioned in the last section, several factors dictate the length of your SaaS sales cycle. These factors also determine another crucial decision in the selling process—which SaaS sales model to adopt.

Your SaaS sales model is how you’ll sell your SaaS product to customers. It tells you how many salespeople you should hire, how customers buy your product, and even the sales cycle length, among other things.

In the SaaS world, you’ll generally encounter three sales models:

1. Customer self-service sales model

Customer self-service sales is the most straightforward SaaS selling process. That’s because you need minimal—or zero—sales agents in this model. All the details about the service are described online. Once customers decide to subscribe to the SaaS platform, they can do so themselves by signing up directly through your website.

The vast majority of end-user/retail SaaS platforms operate in this model. Think of how you buy, say, a Spotify subscription or a higher-tier storage plan in Google Drive. For most cases, it’s as simple as digging your credit card out of your wallet and paying for the service.

The self-service model is best suited for lower-priced SaaS plans aimed at individual users or small teams. The lack of a sales team might lead to a lower operating cost, but it also means your marketing does most of the legwork. As a result, tactics such as free trials or freemium subscriptions are particularly effective for self-service sales.

2. Transactional sales

The transactional sales model is where you have a sales team to sell your SaaS platform, mainly to small and medium-sized businesses. This is regarded as the “old school” way of selling since it’s how software was sold even before the advent of SaaS.

Transactional sales are best reserved for slightly higher-priced, complex SaaS products with a higher degree of customization. Explaining and tailor-fitting your solution to the prospect’s situation is the primary reason salespeople are required.

Compared to the self-service model, this model relies more on sales than marketing. The key to successfully pulling this model off is a highly trained sales team. Empowering your sales team with the option to offer discounts and add-ons is also beneficial. But don’t forego marketing tactics entirely, as they can still be a good source for lead generation.

3. Enterprise sales

Enterprise sales are considered the most complex and lengthy of the three SaaS sales models. This model is used to sell $1,000-a-month-plus platforms targeted at larger companies. Often, these SaaS products are complicated, highly specialized and require extensive configuration to deploy.

The process used for enterprise sales is similar to transactional sales. However, selling to enterprises is more prolonged and much more intensive. Sales agents typically talk to multiple decision-makers for months to land a single sale. Thus, enterprise sales produce a lower number of deals at a much higher revenue.

The key to enterprise sales is more extensive technical training for sales reps since they need to be both a subject matter expert on your solution and be able to converse with subject matter experts about how your solution can impact their company’s bottom line. At higher prices, prospects also expect a higher level of customer service and support, so it’s important to make sure your teams are prepared to deliver.

How to sell SaaS: Tips for success

In many ways, selling SaaS is both similar and different from selling other products. However, while the process is the same, SaaS has nuances that demand a unique approach.

Here are a few ways you can improve your SaaS sales game:

Consider your trial periods carefully

Trial periods are fantastic ways to entice users to your SaaS platform, but you shouldn’t do it haphazardly. Remember that an extensive trial period can lengthen your sales periods unnecessarily.

A good rule of thumb is that the simpler the SaaS product, the shorter the trial period. This makes sense since users need a shorter time to familiarize themselves with your platform. Seven to 14 days is a good baseline trial period length for most SaaS products, with a month for more complex platforms.

Highlight your annual plan

An annual subscription is preferable because oftentimes a majority of churn happens monthly. When customers are locked in for a year, that encourages them to stick with your product. It also gives you the chance to work through any hiccups and resolve technical issues they might encounter.

A good tactic to encourage users to opt for an annual plan is to discount it compared to your monthly plan (assuming you offer both) and highlight it prominently in your marketing.

Upsell to existing customers

Your focus shouldn’t just be on getting new users to your platform. Getting existing customers to upgrade to a higher plan is an easier and more effective way to increase your revenue. The key, however, is to tailor-fit these upsells to your prospect’s current needs. Don’t simply spam them with emails pushing them to upgrade to the most common plan — schedule a meeting, ask thoughtful questions and determine which upgrade is right for their specific needs.

Don’t forget to use sales tools

SaaS sales can be lengthy and complicated, so you need to have a way to manage them effectively. Using customer relationship management (CRM) software is an excellent approach. It ensures you’re always on top of your prospects’ journey and won’t miss sales opportunities.

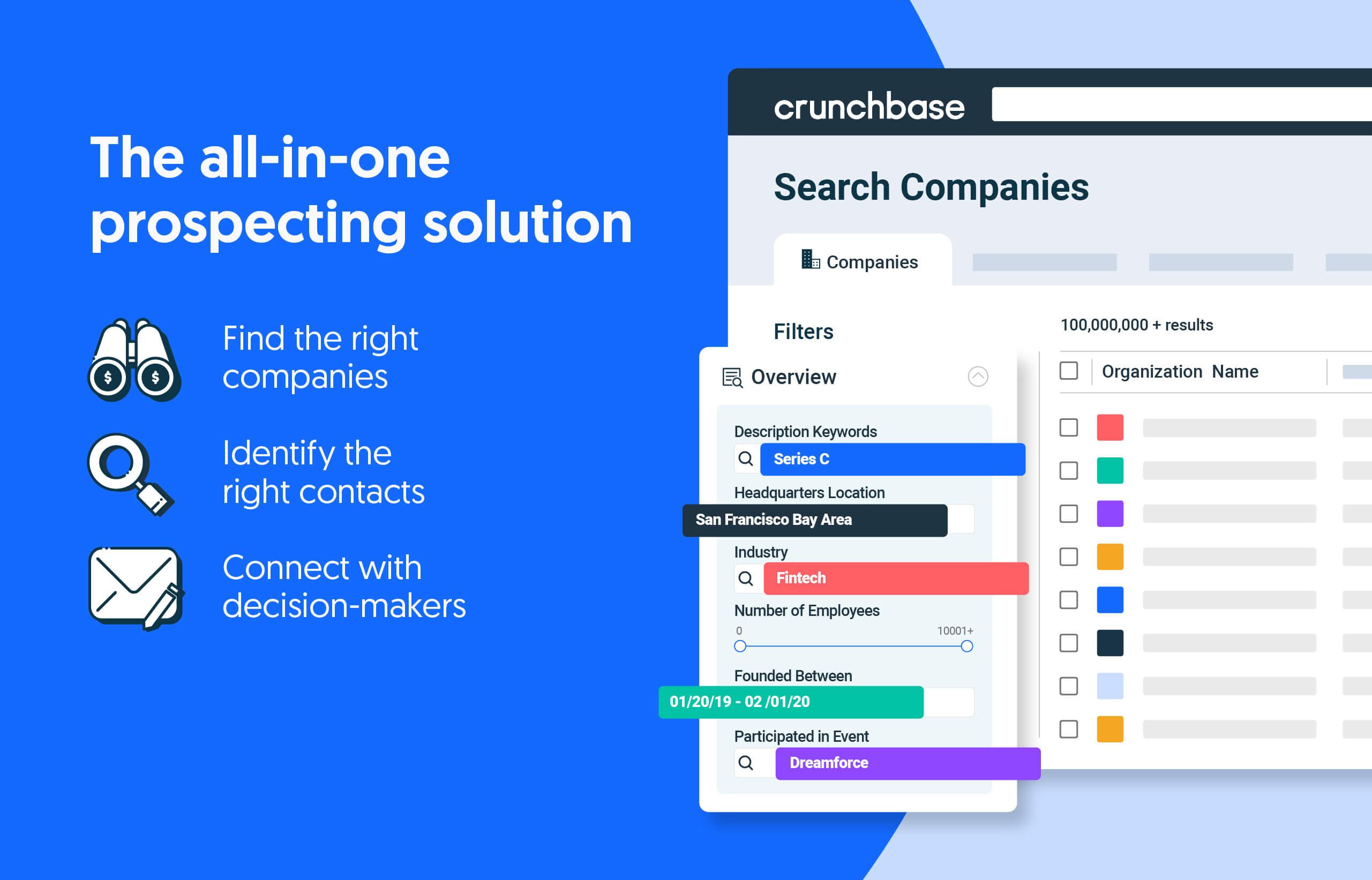

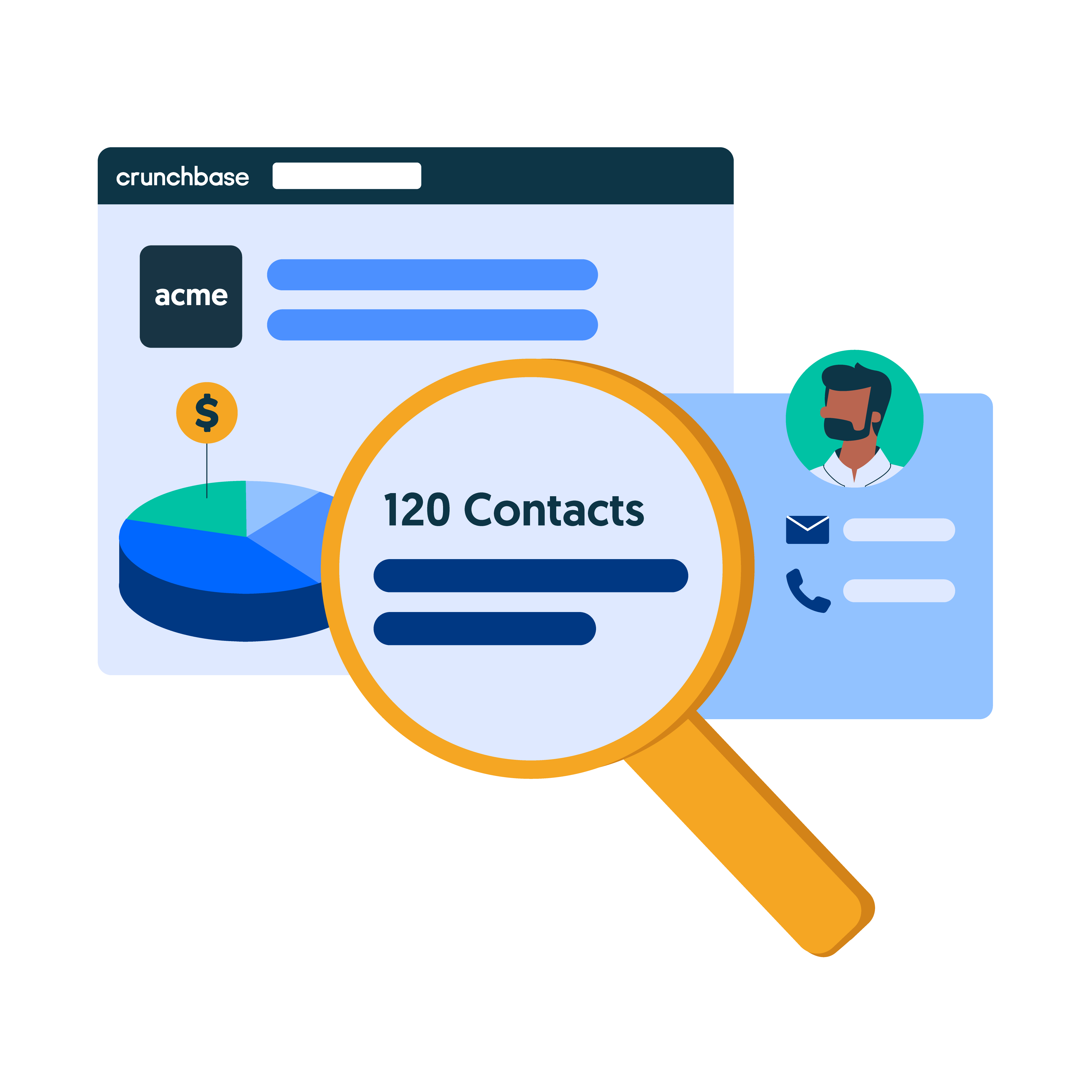

If you’re focused on B2B SaaS sales, having a good prospecting and lead generation strategy is paramount. Sales prospecting tools like Crunchbase can help you discover qualified companies that could benefit from your product. And, Crunchbase now has verified contact data and an engagement suite that enables you to find and connect with decision-makers. You can also ensure that the timing and content of your outreach is informed by company growth signals and news alerts to stay relevant in today’s fast-changing circumstances. When you partner with Crunchbase, you’ll have instant access to all the information you need — all in one platform.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

6 key SaaS sales metrics to track

Due to the unique nature of SaaS sales, there are several metrics you need to track in addition to overall revenue. These six metrics can provide your team with insights that go beyond financials and into customer satisfaction.

1. Customer acquisition cost (CAC)

Customer acquisition cost, or CAC, is arguably the most critical SaaS metric to track. In a nutshell, it tells you how much it costs to acquire a new user. The lower the CAC, the cheaper it is to increase your user base.

CAC is calculated by using the formula:

CAC = (Marketing and Sales Costs) / (Number of New Customers)

For example, if you spent $100,000 in a year to get 500 new customers, then your CAC is $200. In other words, you need to spend $200 to get one customer.

CAC is crucial because it tells you about the profitability and scalability of your business. It doesn’t matter if you acquired 10,000 customers in a single month; if they cost you far more than what you’re making, it can be a losing game. On the flip side, a low CAC value means it will be easier for you to scale.

Of course, by itself, CAC only tells you one aspect of your profitability. It needs to be combined with other metrics to give you a better picture of your financial health. An additional important factor to track is your customers’ lifetime value.

2. Customer lifetime value (LTV)

Customer lifetime value, or LTV, is the total revenue you’re earning from each of your users. A higher LTV means your customers are spending more or staying with you for a long period of time—both good indicators.

There are many ways to calculate LTV, but the simplest way to go about this for SaaS businesses is this formula:

LTV = Monthly Revenue / Churn Rate

The churn rate (which we’ll discuss in a bit) considers the rate at which you’re losing customers (every month or year, depending on the subscription plans you offer). If your SaaS product costs $100 per month and you have a churn rate of 20 percent, then your LTV is $500. That means you earn roughly $500 for every customer.

LTV is particularly powerful when combined with CAC. When your LTV is higher than your CAC, you have a profitable SaaS business. In the example above, a CAC of $200 might be worth it if your LTV is $500.

On the flip side, if your CAC is higher than your LTV, it means you’re losing money with each customer you get.

3. Churn rate

The churn rate is, as mentioned, the rate at which you lose customers for a set period (usually monthly or yearly). It’s calculated with the formula:

Churn Rate = Dropped Customers / Total Customers at Start of Period

You can calculate the number of customers that dropped by getting your user count at the end of the month and subtracting your count at the beginning. So if you began this month with 20,000 users and ended with 19,500, 500 users left during that period. Thus, your churn rate is 500 / 20,000 or 2.5 percent.

Churn rate is a crucial metric because it tells you how satisfied or disappointed users are with your SaaS platform. A little churn is unavoidable, but it can be a sign of trouble if it’s excessively high. It might mean you need to improve your service or onboarding sequence to keep more users from discontinuing your service.

4. Lead velocity rate (LVR)

Lead velocity rate, or LVR, is a sales-oriented metric that measures the growth of your qualified leads.

A high LVR means you’re drumming up interest in your SaaS platform, a good indicator of a genuine market need for your product. A consistently high LVR is also a good predictor of success since it means you have a sales pipeline full of prospects that are likely to turn into paying customers.

On the flip side, a low LVR can tell you that your sales or marketing initiative needs more work.

LVR is calculated with the formula:

LVR = (Current Month’s Qualified Leads – Previous Month’s Qualified Leads) / Previous Month’s Qualified Leads

For example, if you had 70 qualified leads this month and 50 last month, your LVR is 40 percent. That means there’s a 40 percent increase in your qualified leads. LVR is most effective when you compute it monthly, as it can tell you if you’re on an upward or downward trend.

5. Win rate

Of course, your LVR only describes one part of your sales equation. A high LVR would be useless if your sales team can’t convert these leads into actual sales. This is where the win rate metric comes in.

Your win rate is a measure of the percentage of your prospects that become paid customers in a given timeframe. A high win rate means your sales team is very effective. It’s calculated by the formula:

Win Rate = Leads Closed / Total Leads

Hence, if you closed a total of 20 customers from a pool of 80, then your win rate is 25 percent.

Win rate is best used as a benchmark metric. You can compare your win rates from previous successful months and figure out how you can replicate that success. You can also reverse engineer your win rate to determine the number of leads you need to close to achieve a specific percentage target.

6. Monthly recurring revenue (MRR) & annual recurring revenue (ARR)

Monthly recurring revenue, or MRR, and annual recurring revenue (ARR) are simple ways to track your revenue over time. They tell you if your sales are dipping or rising sharply and, more importantly, help you figure out why. You can calculate MRR and ARR with this formula:

MRR = Active Users X Average Subscription Price

ARR = Active Users X Average Yearly Subscription Price

So if you have 1,000 users paying an average of $50 per month, your MRR is $50,000. And if you have 1,000 users paying an average of $600 per year, your ARR is $600,000.

MRR and ARR are essential metrics that analysts and owners use to summarize a SaaS company’s profitability quickly. Therefore, a consistently increasing MRR and/or ARR is a good sign that the business is profitable.

For more advanced businesses, it’s helpful to split the MRR and ARR into three separate categories:

- New MRR/ARR (from new customers);

- Expansion MRR/ARR (from existing customers upgrading to a higher plan), and;

- Churned MRR/ARR (lost revenue from churned users).

Splitting MRR and ARR into these more granular categories gives you a lot more context when these metrics shift.

For instance, if you suddenly have a $1,000 increase, your new MRR might tell you that an influx of new users caused it. You can then focus on your acquisition efforts to increase this number further.

Boost your SaaS sales with Crunchbase

Crunchbase is an all-in-one sales prospecting tool that can help your SaaS sales team discover new accounts and connect with decision-makers.

Interested in learning more about how Crunchbase can help you? Sign up for a free trial, or contact us to learn more.