The Crunchbase “Female Founder Series,” is a series of stories, Q&As, and thought-leadership pieces from glass-ceiling-smashers who overcame the odds, raised funding, and are now leading successful companies.

Every entrepreneur knows raising funding is no easy task. Add in a pandemic and a social justice movement and things get even more complicated. For Autumn Adeigbo, the past 24 months have been filled with over 200 meetings with investors, nearly a thousand follow-up calls, and even more meetings after that.

With all that hustle behind her, Adeigbo raised $1.3 million in seed funding from Fuel Capital, making her the first eponymous fashion brand led by a female, Black designer to raise more than $1 million in venture capital funding.

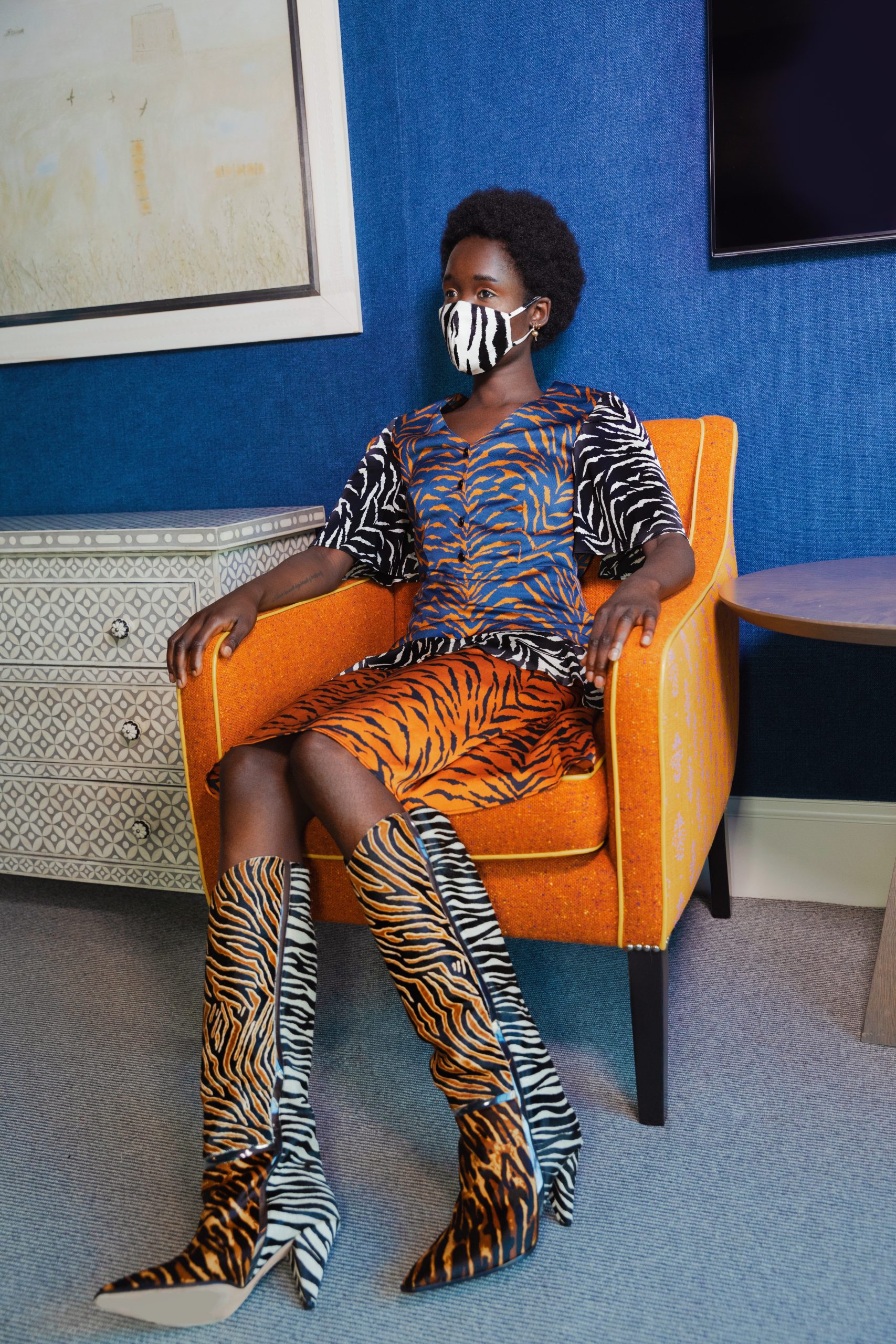

Adeigbo was inspired to become a fashion designer after watching her Nigerian mother sew the clothes she wore as a little girl; even earning the superlative “Best Dressed” in her 4th grade class. Today, the Autumn Adeigbo brand is connecting women across cultures through colorful and conversational contemporary women’s wear, artistically crafted with culture and conscience.

The company’s mission and bold design caught the attention of Fuel Capital’s Leah Solivan, earning her the $1.3 million in seed funding she needed to bring the Autumn Adeigbo brand to life.

“We are so excited to support Autumn as she brings her unique, bold and beautiful designs to the world,” said Solivan. “We believe that Autumn will build something truly special. Her unique yet universally loved designs will make a meaningful impact in the lives of every person who touches them.”

As a founder who raised funding during the 2008 financial crisis, Solivan understands just how challenging it can be to secure funding in an uncertain economy. As an investor, she also has an idea about why so many underrepresented founders aren’t given the same opportunities.

“While some investors tend to shy away from businesses outside of their prior investing realm, Fuel is committed to investing in founders and ideas that don’t fit the typical mode,” Solivan said. “We think this is one of the biggest blind spots in the venture community and one of the main reasons why underrepresented founders and their ideas often don’t get the attention they deserve.”

After Fuel Capital’s seed investment in Autumn Adeigbo, Solivan and Adeigbo sat down (virtually, of course) to discuss how having female allies at the table helped bring their unique perspectives to life, and share their experiences and advice for other founders who don’t “fit the mold.”

Q&A

Q: How have externalities impacted your fundraising process and what has it taught you most?

Solivan: I founded TaskRabbit and raised my first round of pre-seed funding right as the 2008 financial crisis hit. It was a struggle to say the least. Raising funding during a pandemic and a resulting financial crisis is even more challenging.

Adeigbo: It’s been a journey, to say the least. But, for me, it’s been about so much more than just building a business and raising capital through a recession. It’s been about being a Black founder in the middle of a social justice movement.

Black Lives Matter generated a lot of attention around Black-owned businesses and founders, which in turn accelerated my fundraising process. I would have never thought I would successfully close this round during an economic recession. BLM definitely lit a fire under some investors–including those I have around the table–to make a difference.

This fundraising process has taught me that everything comes down to timing. You have to be patient and wait until it is your time. If you work hard enough and you have integrity, your time will come.

Q: Going through your fundraising process, how important was it for you to have female investors around the table?

Adeigbo: Ironically, the first person to write me a six-figure check was a previous male client. But he is not your typical man or your typical male investor. He has a unique insight into me as a founder due to our previous history, as well as a strong intuition, something I didn’t come across with many other male investors.

That said, the majority of my investors (14 out of 17) are women. They believed in me because they see my unique perspective as a founder and they love the product as a customer.

I was also very fortunate to have some awesome female founders and investors as mentors and advocates. One in particular, Brit Morin, has been incredibly helpful since the day I met her. She wore my dresses when she did segments on the “Today” show, helped me with my pitch deck, and introduced me to my first VCs. The woman who really took me under my wings was Sonja Perkins from Broadway Angels who has opened up her network to me time and time again. These women have had a profound impact on me and my business. The Pipeline Angels (like Tawana Burnett and Anna Tosach) have really come through for me, even loaning me capital to meet production needs after their initial investments closed.

Solivan: My first institutional investor was Ann Miura-Ko at Floodgate. It was so great having a female ally from the company’s earliest days. I distinctly remember the energy being different when a female was in the room; they immediately understood the need for TaskRabbit services–moms and busy female executives were our beachhead customers.

Q: What has your experience been building a nascent brand during not only a financial crisis but a social justice movement as well?

Adeigbo: No one could have seen this crisis coming. But I do feel like Autumn Adeigbo is in a fortunate position relative to many established brands. There is definitely a bit of white space as other brands are pivoting away from retail. Since Autumn Adeigbo doesn’t have the overhead that comes with retail businesses, we can be nimble and meet our customers where they are.

For example, we have had the opportunity to pivot to other lines, introducing face masks during this time and hair accessories earlier this year. The face masks are a novel and fashion-forward take on a necessity right now and the hair accessories help our customer feel ready and dressed for her endless Zoom calls, even if she is wearing pajamas from the waist down. That being said, these are unprecedented times for everyone, and I hope this moment will lead to ways to make the fashion industry healthier for everyone involved along our collective supply chains.

Solivan: As I mentioned, I founded TaskRabbit during the Great Recession of 2008. While many nascent businesses struggled to get off the ground at that time, it was actually a great time to start a business like TaskRabbit for many reasons, not the least of which was that there was an unprecedented amount of highly skilled professionals looking for work.

Q: Did you come across this bias when raising capital? Why did you seek funding from VCs versus other options available to you?

Adeigbo: Absolutely, I came across that bias. In fact, it was pervasive. That’s why I felt so lucky to meet Fuel and have a firm in my corner that was willing to step outside of the typical mold and take a bet on me.

History is stacked against me. I am only the 36th Black woman to raise more than $1 million in venture funding and the first to raise a $1 million seed round in venture capital for an eponymous brand.

Other forms of capital were equally challenging. I was rejected by countless banks as a Black woman when I sought a loan to fund production. Things are inherently stacked against minorities–not being born into a family that can send you to one of the best schools, not getting funding from your own family or friends. These opportunities are not available to many underrepresented founders so all funding options are difficult.

Solivan: My firm, Fuel Capital, proudly led your $1.3 million seed round this month. While some investors tend to shy away from businesses outside of their prior investing realm, Fuel is committed to investing in founders and ideas that don’t fit the typical mode. We think this is one of the biggest blind spots in the venture community and one of the main reasons why underrepresented founders and their ideas often don’t get the attention they deserve.

Q: What advice do you have for other founders who don’t fit the typical mold? How can they build their network to succeed as an entrepreneur?

Adeigbo: My advice would be to go where the money is. It’s important to treat yourself “exclusively” when it comes to business and your brand. What I mean by that is to be exclusive with your time, your network and who you choose to associate with. I deliberately chose to work at places and companies where I could expand my network, working at Paul Smith (where suits can cost $2,000), for example.

My customers were likely to be people who could be angel investors themselves, or were connected to angels, or perhaps even institutional investors. You need to think about ways you can network. I gained experience in the fashion industry by working at those places over a decade ago, and slowly building my personal community. It takes time and certainly doesn’t happen overnight, but it was a strategy that worked for me.

Solivan: Like you, I was a bit of an outsider when I founded TaskRabbit. I definitely didn’t fit the typical Silicon Valley mold when I moved here back in 2010. As a result, I had to hustle to build the connections and network. I once flew across the country on a moment’s notice to meet with Tim Ferriss for an hour. It was well worth it in the end because it was this meeting that led to an introduction to Ann Miura-Ko.

Q: What is your biggest piece of advice to founders, particularly at the beginning of their entrepreneurial journey?

Adeigbo: My biggest piece of advice to entrepreneurs is to find the thing that you would do for free. Find the gift that is uniquely yours. You would be surprised at what can be turned into a business.

When things get hard–and they will–it will be this passion that refuels you and allows you to take on the world anew each morning.

Solivan: My biggest piece of advice for new founders is to “wake up each day and see how far you can take the company in the next 24 hours.”

Q: How do you think about priority setting as a solo entrepreneur?

Adeigbo: I’ve been actively looking for a partner who has the same level of passion and energy as I do for quite some time now; a person who believes in what we are building as much as I do. But it is hard to find someone who has the same level of blind faith as a founder, it’s not dissimilar from the experience of finding the right investors. It’s lonely as a solo entrepreneur. No matter how close someone is to you, they won’t get what you are dealing with if they don’t live it day to day.

In terms of priority setting, I feel like everything is priority. But I tend to go by deadline. If there is a partner who needs your line in the store by a certain date, that is the priority. Typically the thing that is going to bring the revenue in becomes the most urgent need at this stage of the business.

Solivan: I was a solo founder like you and it was one of the biggest challenges I faced in the early days: having to deal with the day-to-day on my own. It was hard doing everything myself. When you are going it alone, it’s all about setting priorities – yearly, monthly and frankly, daily. Every morning, I’d write down the most important tasks that needed to be done that day to move the company forward. If I could tackle those, I knew I would be making progress and advancing the business. It was my way of coping with the madness of everything that needed to get done.