Sales forecasting can make or break a business. Preparing for the future gives you an inherent advantage over the competition. However, each business is unique, and there’s no one-size-fits-all revenue forecast model that works for every company.

It’s important that your sales forecasting methodology matches how you run your organization, the industry you operate within, and what you want to achieve. Developing the right sales forecasting model gives you powerful insights into your company’s performance and empowers you to make more intelligent business decisions.

Here’s what you need to know about the importance of forecasting, along with a few relevant examples of sales forecasting models that can help put you ahead of the competition.

What is sales forecasting?

In addition to providing your team with the right sales prospecting tools, it’s crucial to take proactive action with sales forecasting in order to set them up for success. Sales forecasting combines your expertise, business data and current sales activity with predictive analytics to estimate future sales volume and revenue. Forecasting can be used for any period, whether you’re looking at a few weeks from now or a few years in the future.

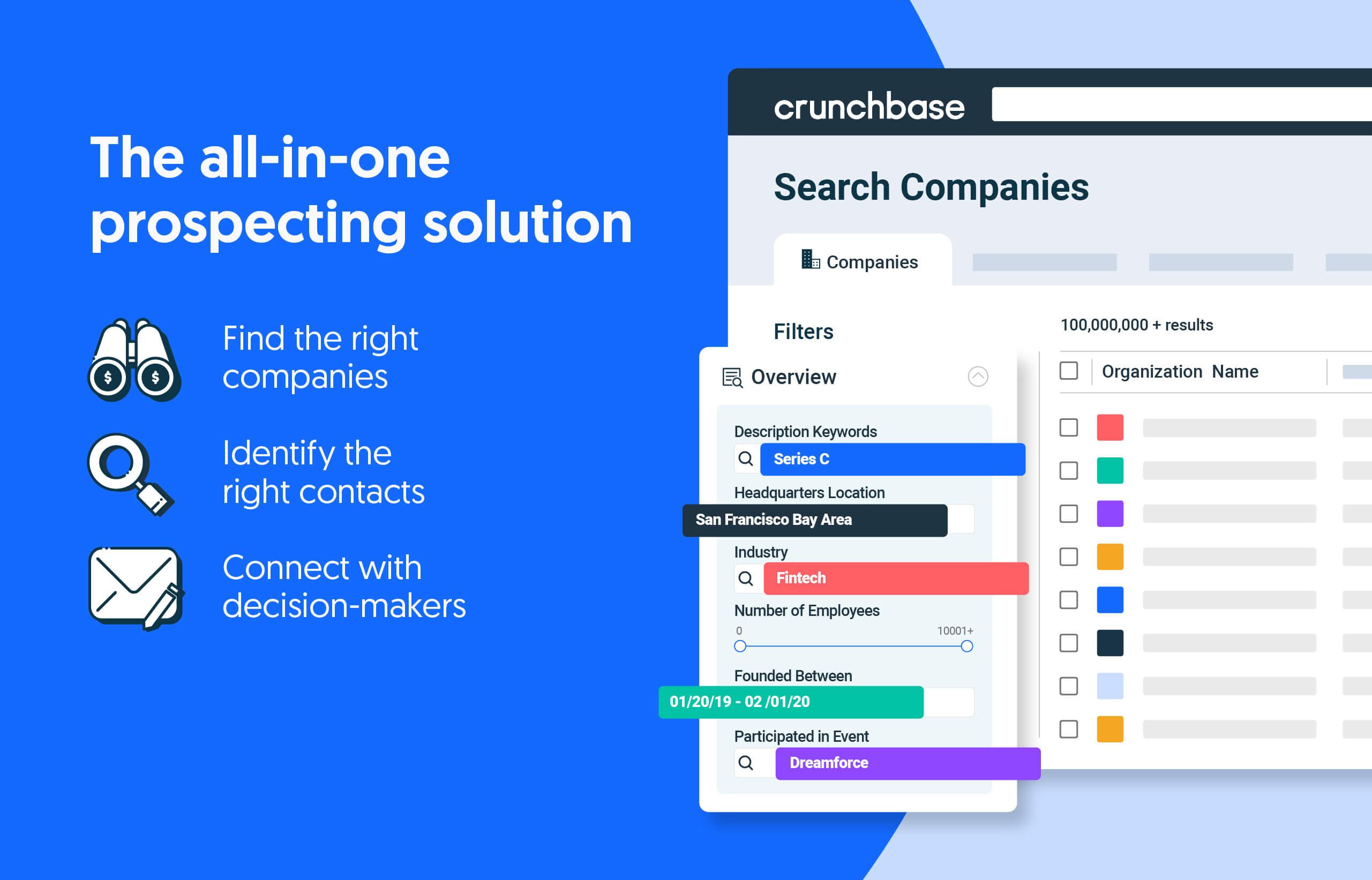

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Every successful sales team has its own revenue forecasting models with a defined methodology. The definition of a great forecast is one that uses real-world data to estimate probable outcomes.

Even though most sales forecast methods are primarily designed for estimating sales, there are many other reasons you might want to perform a forecast. Teams may use their forecasts as a guide for budgets, hiring and risk management.

The concept has existed for decades, constantly integrating new technologies and ways of doing business. Narrowing down your methodology is one of the first steps to taking an average sales team and turning it into an industry-leading operation.

Three types of sales forecasting techniques

Before discussing specific types of sales forecasting, let’s break down modern sales forecast methods into three distinct categories. Understanding these categories empowers you to choose the techniques that align with your business goals.

1. Qualitative techniques

Qualitative techniques are designed for those situations in which you’re lacking real-world data. All businesses will use qualitative techniques at some point.

The most common situation to employ this set of techniques is when bringing a new product to market. Because you lack existing data, you need to take advantage of rating schemes and your own judgment.

Use factors that are logical, systemic and unbiased. Since it’s difficult to estimate—as you’re starting from scratch—your methodology must be defined as part of a whole family of techniques.

Every business that sells products and services must have a way of forecasting for products when data is unavailable.

2. Time series analysis

If you’ve got the data, you may decide to use a time series analysis. These techniques use statistics taking advantage of several years’ worth of data for a product or service. Time series analysis is useful when you’ve already got clear information.

Begin by taking a speedometer reading of your current sales rate. Measure whether the speed is increasing or decreasing, and based on these readings, you have a foundation for forecasting. Use mathematical techniques, to develop your projections.

While it sounds simple, time series analysis is far more complex than it sounds. Projecting future figures from raw data is difficult because you need to know where the patterns and trends lie. Raw data needs to be processed before converting it into something usable.

The time series itself is points of raw data in chronological order. It could be sales of a specific service by month or year, or even several years. By using a time series analysis, you can identify things such as:

- Seasonal sales trends

- Cyclical patterns over long periods

- Trend growth rates

After analyzing and processing raw data, you finally get to start forecasting future sales. Time series analysis can be further broken down into specific methods of sales forecasting to get various insights into your business.

3. Causal models

If you’ve already extracted historical data and performed the analysis necessary to explain the relationship between different factors—such as business, economic and socioeconomic—you can build a causal model.

Causal models are the most sophisticated sales forecasting techniques. The causal relationships can be expressed using a specific mathematical figure. You’ll incorporate aspects like market surveys and inventory. Causal models also use the results from a time series analysis.

Causal models account for everything, such as your business’s affairs, actions by your competitors, and other related economical effects, which directly and indirectly influence your business.

But what if you’re missing certain pieces of data? It doesn’t mean you can’t use a causal model. Instead, you can make educated assumptions about the relationships between different factors.

Businesses use causal models to predict sales far into the future and identify potential turning points.

Why is sales forecasting important?

Sales forecasting methods are a crucial part of any business. The most obvious reason is to identify whether you’re meeting your sales targets over a specific time period; it shows where your organization stands and whether it’s performing to the required standard.

Sales forecasting also allows you to identify whether your business needs to make changes. For example, if your sales forecast indicates you’re likely to exceed your target sales for this quarter, you can purchase additional inventory in advance. You can also use forecasts to show whether your business needs to expand its sales staff or temporarily bring in cover for busy seasonal periods.

On the flip side, if your sales team looks like it will miss its targets, you can take proactive action. When business is expected to be slow, you can use your forecasts to justify your lead generation budget increase. You can also focus more of your attention on existing accounts to cover the lack of new business. Knowing how you’re likely to perform has massive benefits extending beyond your sales team.

It’s important to note that inaccurate forecasting can cause a lot of damage. Relying too much on your intuition or using erroneous information can lead to poor visibility in planning for the future.

Accuracy is vital

One study from Gartner showed that 50 percent of sales leaders have little faith in their company’s ability to forecast sales accurately. In other words, if you’re not carrying out forecasting, or performing forecasts poorly, you’re already at a significant disadvantage.

For example, if a company has over-forecasted its expected sales and under-delivers, it may impact investor confidence in the company. If the opposite happens, it could open the door to new investment. As you can see, sales forecasting models that use inaccurate data can change the face of a company by giving an incorrect image of the company’s success.

While you can’t forecast the future, you can spot the signs. Only through using sales forecasting techniques can your business prepare for what’s to come. The brand that moves in the right direction first is the brand that defines itself as an industry leader.

8 types of sales forecasting methods

Figuring out how to forecast sales using historical data isn’t always straightforward. There are countless pure and hybrid models companies might decide to employ. Discovering the right one for you is the first step to take advantage of the power of sales forecasting models.

To help you get a head start on the competition, here are eight methods of sales forecasting, the pros and cons of each, and when to use them.

1. Gut-feel forecasting

The gut-feeling model relies on close collaboration with your team, starting from the bottom up. Engage your reps and gauge how they feel about their current leads and the likelihood of closing those deals, and get a health check on their existing accounts.

As you can imagine, it’s the least accurate forecasting model because it relies heavily on human opinion. It’s strongly recommended that you take the results of a gut-feel forecast with a grain of salt because trying to predict swing deals and slippage using this model can end up being inaccurate.

For example, let’s say you’ve reached the end of Q3, and you ask your sales manager to provide forecasts for the upcoming quarter. Based purely on the anecdotal evidence of this model, the company predicts that it’ll experience an increased sales volume of 10 percent.

The forecast was based on the idea that Q3 was a bumper quarter. The obvious flaw in this strategy is that just because the last quarter saw a company exceed its goals doesn’t mean it’ll do so again in the next quarter.

You may be wondering why we’re even including this sales forecasting model in this article if it’s so unreliable. While it may seem risky, there are times when gut-feel forecasting comes in handy.

Smaller sales organizations and teams that have closed fewer deals in more traditional industries may use this model. It’s also not uncommon to use it when you have a longer sales cycle.

The success or failure of this model relies on the experience and expertise of the team. Depending on your team to make predictions for the months and years ahead always comes with risk. It’s generally recommended only for judging your team’s confidence in their efforts and the ongoing activities of the company.

2. Almanac forecasting method

Revenue forecasting models using historical data to indicate what might happen in the future is known as the almanac method. It’s far more accurate than using the gut-feeling model simply because you’re relying on data, not feelings.

Newer entrepreneurs may see the almanac method and believe it’s enough for forecasting. However, there are some cons of using this method. Forecasting based purely on historical data—no matter how much historical information you have—assumes your industry and the business landscape will stay the same in the months and years ahead.

It doesn’t take into account economic conditions, alterations to your industry, or any changes that may come on a micro level. The most obvious example of this is the onset of the COVID-19 pandemic. Firms using the almanac method saw their 2019 projections wiped out due to lockdowns and new health and safety regulations.

Again, it does have its uses, but only if you can say with some surety that no significant changes will impact your line of business over a set period. Understandably, most business owners would agree that this is an optimistic assumption at best.

For example, let’s say you approach your sales manager to forecast the next quarter. Viewing your previous quarterly performance over five years may show that you traditionally experience a down period at that time of year.

You might also dig into the individual performances of your sales team to show who’s performing best and with what accounts they perform best with. Using data like this can allow you to organize your team to maximize their respective abilities.

Due to its reliance on data over long periods, established companies will use the almanac forecasting technique. The more data you have, the more effective this technique becomes. Ideally, you should have a minimum of two to three years worth of data. However, five to 10 years will result in radically more accurate forecasts.

3. Funnel forecasting

The concept of funnel forecasting is using the performance of your sales funnel to show what might happen in the future. You’ll dig into different metrics to understand how your sales team is performing.

Examples of metrics you may want to incorporate into these revenue forecasting models include your win rate and the average sales cycle duration. You may also decide to look into your upselling rates on existing accounts.

For example, if your company’s average sales cycle is two months and you have a win rate of 40 percent, you can use the information to make mathematical projections. Someone who has 10 opportunities worth $1 million per deal closed would predict a quarter worth $4 million if they were being conservative.

Funnel forecasting methods use pipeline coverage. The healthier your pipeline coverage is, the more effective this model becomes. Companies with longer sales cycles will benefit more from these techniques than those with shorter ones.

Companies that generally secure homogenous deals will find this model the most useful. Homogenous deals are both predictable and consistent. Again, the health and hygiene of your pipeline coverage are critical.

Fill your pipeline with Crunchbase.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

4. Portfolio forecasting

Professionals working in the financial management industry will use a portfolio management system that harvests existing financial data to forecast performance and manage risk. Sales agents also use portfolio forecasting to create a forecast.

These sales forecasting methods are a hybrid of the strategies mentioned above. Sales managers will use the almanac method because they’re using historical data. They’re also using pipeline coverage from funnel forecasting and the gut-feel approach by incorporating their expertise and experience.

So, how will it work in practice?

Your sales manager starts by digging into historical sales data, then review the pipeline and perform a health check. Finally, they will consult with their reps to assess the information gathered. Using their experience and expertise, they create a forecast.

The primary purpose of portfolio forecasting is to mitigate risk. Based on this forecast, if a manager predicts a decline in business during Q3, they may shift their resources to upsell existing customers rather than focus on gaining new customers.

They might do this because if the manager isn’t expecting much in the way of new business, they would rightly predict that the income gained from existing customers is more sustainable and, therefore, more profitable.

5. Multivariate regression analysis

Predicting incoming revenue is vital for the future of any company. The multivariate regression analysis uses statistics as a way of projecting future revenue. Taking into account different variables will allow you to create an accurate figure for revenue over the next quarter or year. By altering these input variables, you get a different output.

Successfully employing multivariate regression analysis relies heavily on current, complete and accurate data. A single inaccurate input can derail this model entirely and lead to an incorrect assessment.

Multivariate regression is also a foundation of machine learning. With more and more companies turning to sales forecast methods that incorporate machine learning, multivariate regression is one of the most critical models.

For example, a company decides to employ an insights analyst to run a multivariate regression analysis. This analysis takes data from previous sales activity and the number of closed deals. Using this data, they can find out more about current sales activity and then plot the likelihood of closing a deal.

Data-driven firms rely on this model and use more sophisticated tools to create their sales forecasts. While the output usually hinges on revenue, there are various outputs you can get from using this forecasting method.

6. Length of sales cycle forecasting

Many standard forecasting models use data from your sales cycle to make projections. Knowing how long it takes for a lead to convert into a paying customer and how various marketing channels play into this can enable you to shift resources appropriately.

For example, you can increase the value of your forecasts if you already know that the average cold-calling cycle takes five months and you’ve been working on a lead for two-and-a-half months, you know there’s a 50 percent chance that that lead will eventually turn into a paying customer.

The value in length of sales cycle forecasting is that it’s entirely objective. It’s based on the numbers rather than the views and opinions of your team. Someone feeling like they’ve got a hot lead doesn’t play into this model.

Based on the source, you can also apply it to practically any sales cycle. Your total sales cycle length does have value, but smarter companies dig down into each channel.

You can, for example, measure the length of the sales cycle of a specific social media channel, such as LinkedIn. You can also analyze more traditional channels, such as cold calling or newsletter marketing.

There’s no reason you can’t drill down even further by separating the length of your sales cycle when cold calling someone on Facebook versus when a lead reaches out to you first. You have so many valuable insights to work with by mixing the length of sales cycle forecasting into your operations.

Companies that track how and when a prospect enters their pipeline will get the most benefit from this method. You need close collaboration between your sales and marketing teams to make it work.

Keep in mind that firms with siloed departments will struggle to maximize the potential of this forecasting method.

7. Lead-driven forecasting

Forecasting by leads is a great option for companies with lots of different marketing channels. This sales forecasting method works by analyzing each lead source and assigning an objective value based on the behavior of previous leads acquired via individual sources.

Creating forecasts based on lead values can help you understand the probability that a lead will convert. These figures can be further incorporated into other sales forecasting models.

Business owners who use this model can better assign resources based on the likelihood of winning over a lead and turning it into a paying customer.

Lead-driven forecasting relies on three key data points to construct this model:

- Average sales price by source;

- Leads per month; and

- Lead to conversion rate by source.

There are downsides to using this model, however. It is susceptible to being broken by significant changes to your lead-generation strategy and customer behavior. If something within your industry changes, your projections may become outdated and inaccurate.

For example, if your team changes its lead-generation strategy to match up with market trends, the number of leads from each source will change. The problem with that is it also changes your customer conversion rates.

Thankfully, you can counter these vulnerabilities by ensuring your sales and marketing teams are plugged into the latest changes and incorporate those changes when making forecasts.

Lead-driven forecasting is best paired with other forecasting strategies to iron out the wrinkles and consider the results based on more comprehensive projections.

8. Machine learning and AI models

The world of forecasting is changing—going through dramatic changes to improve the usability of sales forecasts and to make them easier to compile. There’s a demand for faster, real-time and more accurate projections.

Modern machine-learning algorithms are trained to objectively analyze historical data and assign values based on weights and biases. Both machine learning and AI pinpoint the trends in data that humans are likely to miss.

It takes time to train the algorithms to know what to look for. Still, once trained, tested and integrated into your company’s setup, these algorithms are significantly more accurate.

Models that use machine learning fall into the 99th percentile where accuracy is concerned. Despite the sophistication, these sales forecast methods produce reports that are easy to understand and simple to explain to stakeholders.

For example, a sales team decides to train a model focusing on several key data points from the team, such as the average contract value, number of days required to close, and win rate. The algorithm can then provide insights on what influences these figures, such as seasonal cycles.

Your machine-learning model may discover that spring and autumn are the best times to increase your attention on generating more leads and onboarding new customers. Decision-makers can take action because they know that machine-learning models have an extremely low margin for error.

With low confidence in sales forecasting techniques posing a big problem throughout the business world, machine-learning and AI technologies have the potential to boost morale among sales teams and stakeholders.

But how can you use these sophisticated technologies?

Traditionally, access to these cutting-edge technologies was reserved for companies with big budgets and the time to sufficiently train and test the algorithms. But an increasing number of consumer platforms have become available to even the smallest sales teams.

In other words, even small businesses have acquired access to this technology without breaking the bank. Investing in state-of-the-art forecasting programs could be one of the best investments you make in your company.

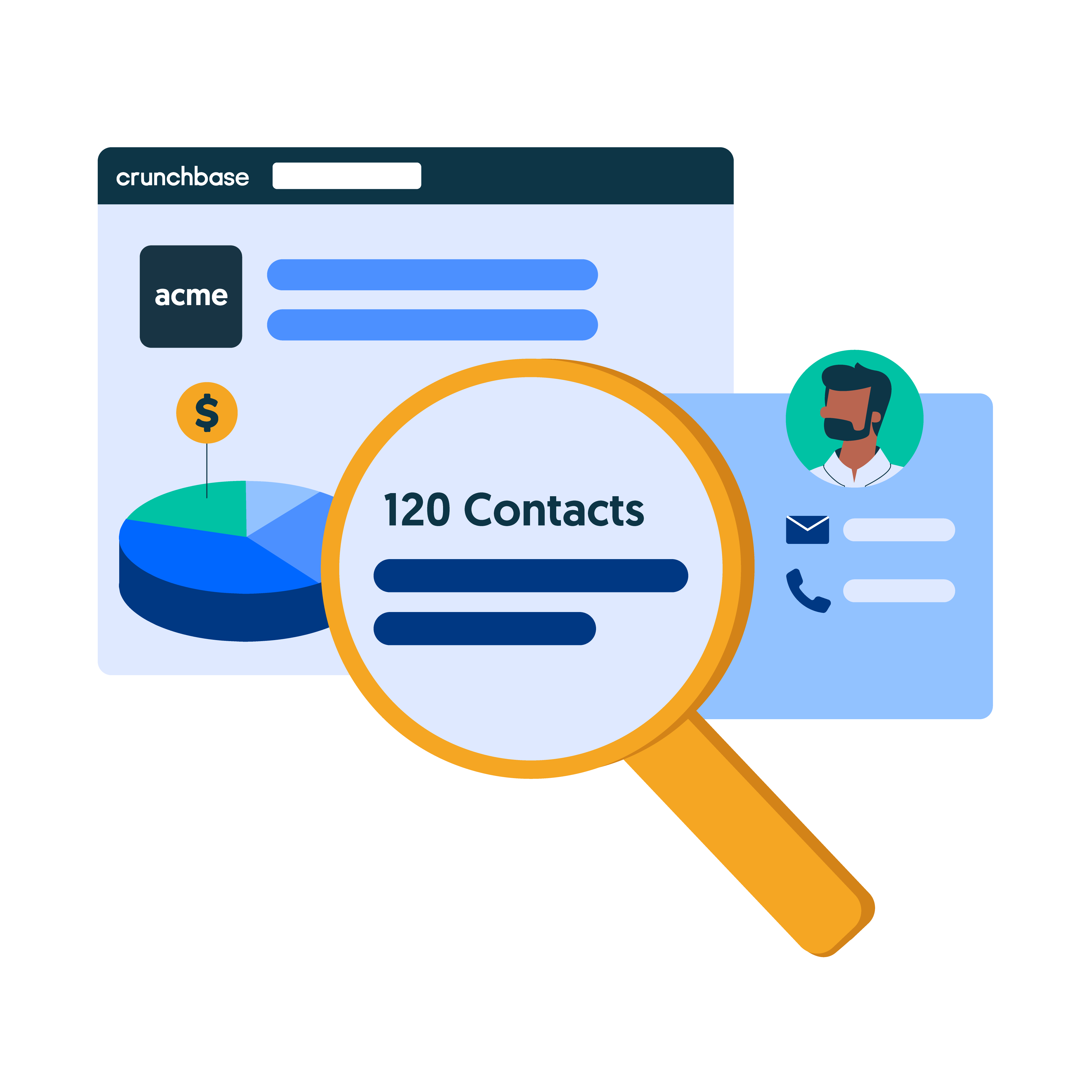

Close more with Crunchbase

Lead generation is a critical aspect of your strategy. Sales forecasting models enable you to determine whether your current system is successful or whether you need to make changes.

With Crunchbase’s intelligent prospecting software, it has never been easier to identify prospects that match your ideal customer profile. And, when it’s time to connect with those prospects, Crunchbase provides contact data for decision-makers, enabling you to go from research to outreach, all in one platform.