We recently closed our Series C funding round for $30 million and shared our vision for the future of Crunchbase. It’s a very exciting time for us, and we recognize that many of our users are in similar stages at their own companies. They’re raising capital to reach the next stage of business growth. We know, first hand, that the fundraising process is not always easy. How do you capture the essence of a business you’ve spent years working on in just a few slides? How do you help investors see not only your current achievements but the growth potential you have for the future?

In the spirit of our mission to help innovators find new opportunities, we wanted to share a version of our own Series C pitch deck, and three lessons we learned through this process. You can also see a list of several other successful pitch deck examples to help you find inspiration.

[DOWNLOAD THE CRUNCHBASE SERIES C PITCH DECK]

1. Set the Stage with Storytelling

When we first started pitching, we thought that leading with our awesome numbers was the way to nab a VC. “Look at our big traffic stats! Look at our awesome CAC! LTV! SaaS Magic Number!” Unfortunately, big numbers on their own, aren’t great conversation starters.

Imagine walking up to someone you don’t know at a networking event and saying “Hello, I have 14 years of work experience. I have been in my current job for 3 years. There are 15 people on my team. 130 people in my company. Would you like to be my new professional connection?” Not a great way to forge a connection.

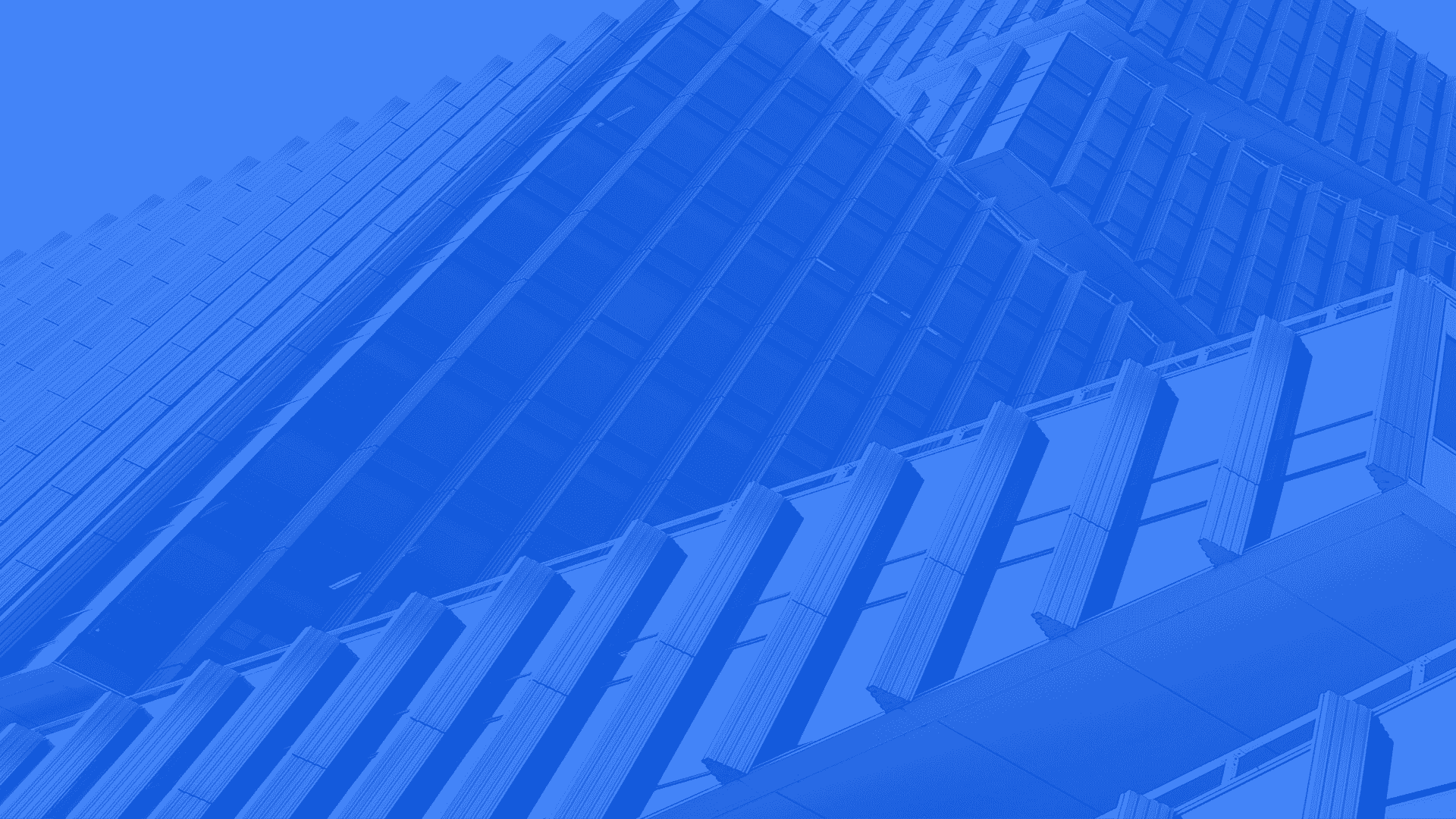

And, when you’re pitching to investors, you’re really trying to create a connection, in very short order. So, we changed things up. We led with a story that painted the picture of the opportunity that private company information represents and the challenges people face when trying to find trustworthy company data. This exposition quickly showed our investors that this is a business opportunity worth learning more about, and set the stage for us to be able to show how our numbers validated our strength in capitalizing on the opportunity.

2. Tap into a Shared Frame of Reference

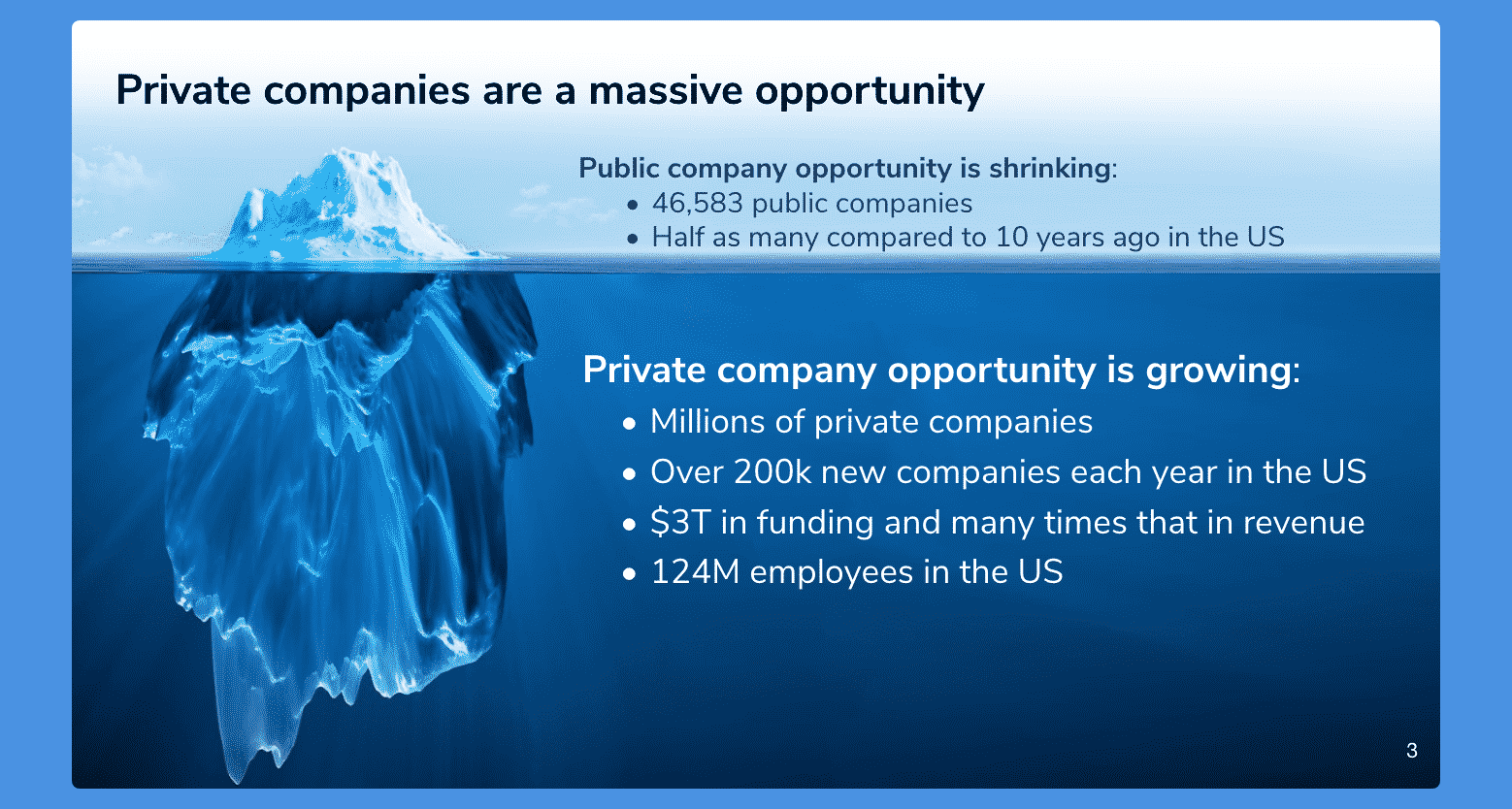

Investors are busy. They’re trying to understand your business in as short a time as possible. The fastest way to create shared understanding is by using metaphors and analogies. You’re essentially explaining the new thing, by saying that it is like or equivalent to something else that a listener is already familiar with. Or, in mathematical terms:

- How do you solve for x, where x = the new business concept you’re trying to convey?

- Well, if x = y, where y = the well-known business concept your VC is already familiar with, then you’ve solved for x!

The metaphor lets you skip several steps in a conversation, and guides your listener toward a common frame of reference. We did this by breaking down the four key ingredients to success, for a few well-known companies with similar business models to Crunchbase. We then showed how Crunchbase has those same ingredients and a similar business model. That helped our investors understand how well positioned Crunchbase is to continue growing and expanding in the future.

3. Highlight Your Competitive Edge

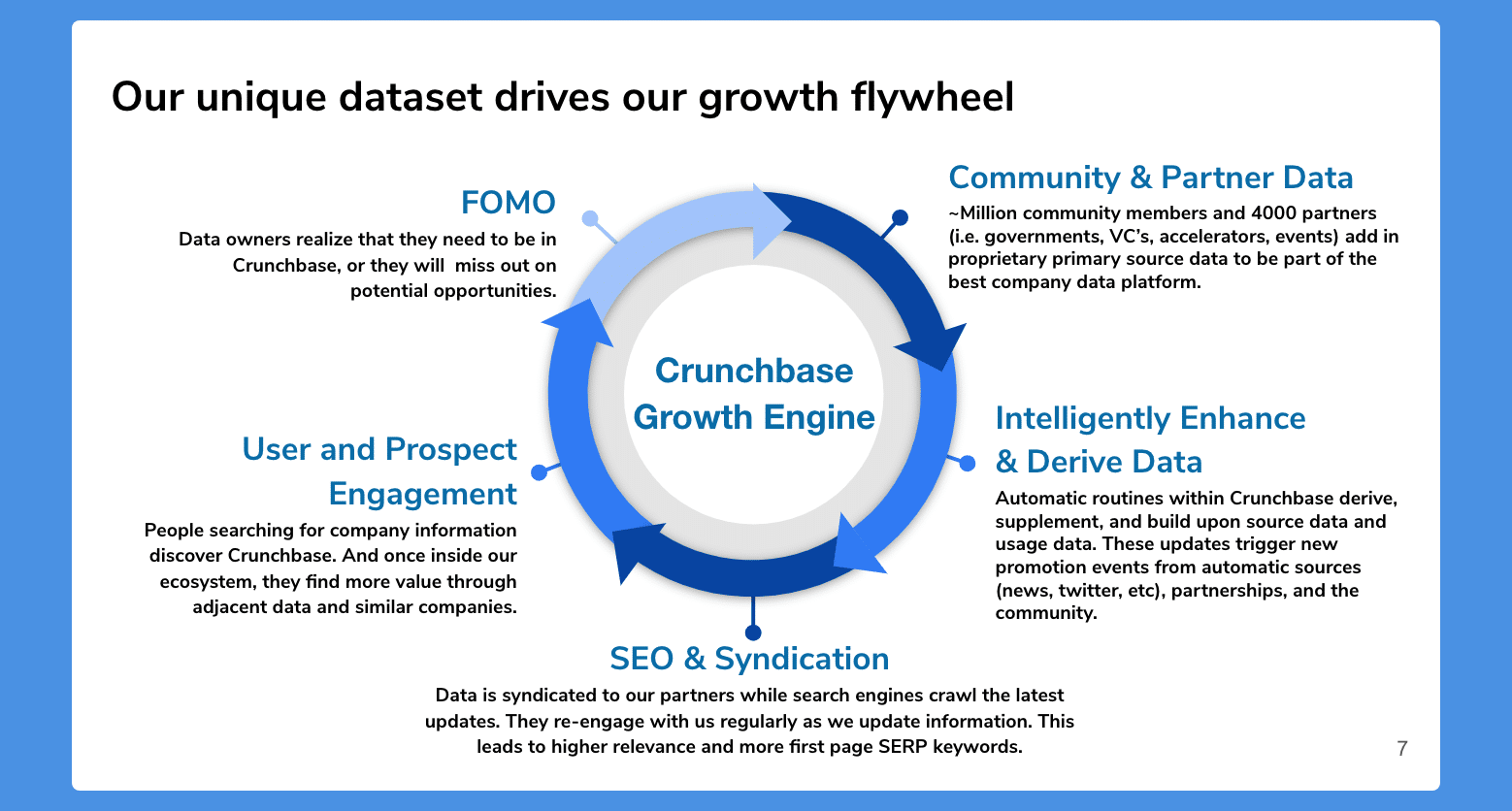

In the end, investors need to understand your unique differentiator. What makes your solution better than others? What will ensure your success within your field? What’s your secret sauce? This could be anything from proprietary technology and innovation strategy to operational efficiency and profit margins. Whatever it is, paint a clear picture for prospective investors to understand why you’re the horse to bet on.

We did this by showing our growth flywheel. A proprietary system that we’ve developed over the years that powers our audience, data, and engagement growth. It’s something that’s unique to Crunchbase, and a moat that separates us from competitors.

In the end, one of the most valuable things we learned through the process was to practice, refine, repeat. The pitch deck itself was a living document that evolved as we received feedback, and as we honed the key points of our story. Download the full Crunchbase pitch deck here, or check out additional pitch deck examples for even more ideas.