You probably don’t have the option to pitch your startup to a panel of investors on a national stage. After all, that’s an approach only open to a relatively small number of entrepreneurs. Fortunately, there’s another resource to find investors at your disposal — technology.

Here are six actionable strategies to use tech to find investors who are ready to support your startup.

1. Use the Gust Platform to Find Investors

Gust brings together entrepreneurs and investors from nearly 200 countries.

More specifically, it’s a software-as-a-service (SaaS) offering that allows applying for startup funding through the platform’s network of angel investors or aiming for acceptance into an accelerator program.

It’s usually best to seek startup funding through multiple methods. Gust provides a single platform that allows interacting with investors in more than one way.

Gust recently launched an evaluation engine component that gives investors feedback about how to improve their chances of future funding, too. That tool analyzes aspects such as fundraising history, revenue and personal investment using a unique algorithm.

2. Try the Pitch Investors Live App

Think of the Pitch Investors Live app as the next best thing to appearing on a traditionally televised reality show for entrepreneurs. Currently available for iOS with an Android app on the way, it lets you pitch ideas to an investor in real-time.

Even better, those sessions get transmitted via Facebook Live to an audience of hundreds of people or more. Plus, each pitch is stored as a video in a library inside the app, as well as on a YouTube channel. As such, you could get even more interest in your business venture than expected.

One thing that sets this app apart from others is that people use Pitch tokens — a type of cryptocurrency — when interacting with the platform in ways that go beyond merely watching pitches. You can learn more about the specifics by browsing the company’s FAQ page.

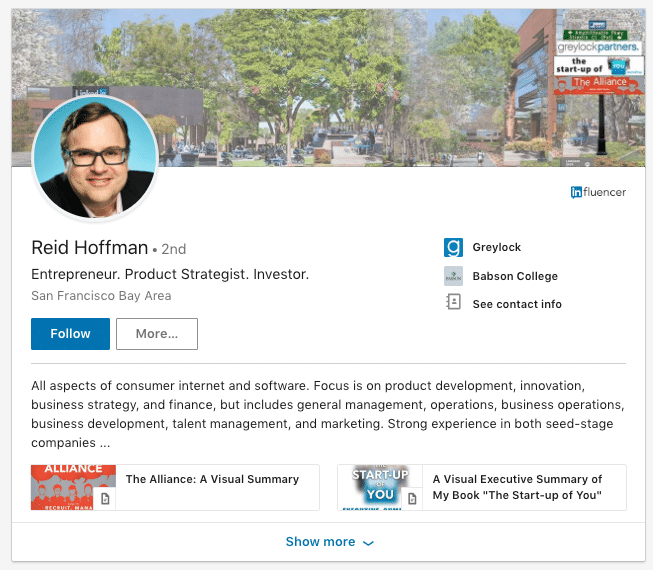

3. Turn to LinkedIn to Look for Investors

The startup industry changes with the times, although some similarities remain.

For example, one aspect that hasn’t gone away over the last few years is the fact that people still use LinkedIn to connect with their peers for business purposes.

Data from 2018 indicates the site boasts 250 million active monthly users. That substantial user base makes many companies incorporate the site into their social media campaigns.

As a startup founder, you can also depend on LinkedIn during your investor search.

Tap into the capabilities of the online platform by using it to improve your real-world interactions with potential investors and vet them. Use the advanced search features, and resist the urge to contact an investor that seems like a good fit immediately.

Instead, look for mutual contacts and reach out to those people to learn about the investors. If you still like what you hear after completing that step, see if a mutual connection will introduce you to the investor.

4. Register with Microventures

Microventures is a portal that gives interested individuals access to early and late-stage investment opportunities.

Because investors can contribute as little as $100 to projects that capture their attention, it’s a fantastic platform to find investors who are eager to support entrepreneurs they believe are involved in industry-changing efforts but want to do so without tremendous upfront investments.

It’s also open to accredited and non-accredited investors, potentially giving entrepreneurs access to a larger overall pool.

5. Become a User of WeFunder

WeFunder is similar to crowdfunding platforms like Kickstarter, but it’s exclusively for investments and lets you find investors own small stakes in your company.

The site connects investors with startup founders, helping those with the financial resources support the entrepreneurs aiming to make improvements and solve pressing problems in today’s world.

Hundreds of companies used WeFunder to raise millions of dollars collectively. Also, you don’t pay any fees unless your campaign succeeds. If it does, the required fees comprise 7 percent of the total investment amount.

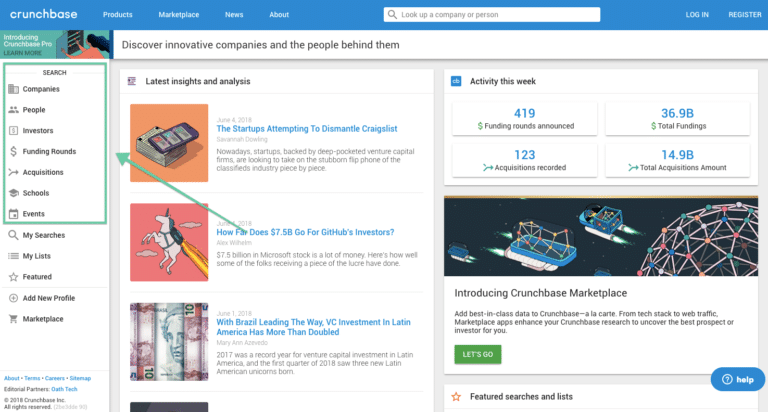

6. Sort Through the Data on Crunchbase Pro

With Crunchbase Pro you can find investors who invest in companies like yours, who have a certain amount of exits, in a certain region. The left side navigation features broad categories, such as Companies, Investments, and Acquisitions.

Add filters to further narrow down your search. Filter by investor type (angel investor, early stage, late stage VCs etc.) who have invested in a certain sector and round size.

Registered users can add up to two filters for free, while Crunchbase Pro subscribers can add as many as they’d like! Here are some example searches:

Technology Simplifies Acquiring Funding for Your Startup

Securing fundraising for your venture is arguably one of the most critical parts of the foundational process. After all, without financial resources, your efforts may fail before they ever get the chance to gain momentum.

This list gives pointers on how you could diversify your strategies by making sure they contain technology-centric options.

Kayla Matthews writes about tech startups, apps, and entrepreneurship. Her work has been featured on The Daily Muse, Digital Trends, VentureBeat, The Week and The Daily Dot, among others. To read more from Kayla, please visit her blog, Productivity Bytes.