This article is part of the Crunchbase Community Contributor Series. The author is an expert in their field and a Crunchbase user. We are honored to feature and promote their contribution on the Crunchbase blog.

Please note that the author is not employed by Crunchbase and the opinions expressed in this article do not necessarily reflect official views or opinions of Crunchbase, Inc.

Before reading, please note: I identify as female (pronouns: she/her) and therefore I’ve written this with that perspective. Any reference of “female” could also be attributed to other non-male genders, however, since I am mostly sharing personal experiences, I’ve chosen to reference only what is applicable to me.

Most, if not all, founders are trying their best to build a gender-diverse team. Not only does it create an inclusive workplace, but there’s been very clear data for years that shows gender diversity improves performance in areas like profitability.

But if founders truly want better outcomes for their companies, then why do women still make up only around 30 percent of the workforce in tech? Although the responsibility falls on founders to create a diverse workplace, I’ve come to realize that venture could indirectly be playing a role in this narrative. Let me explain.

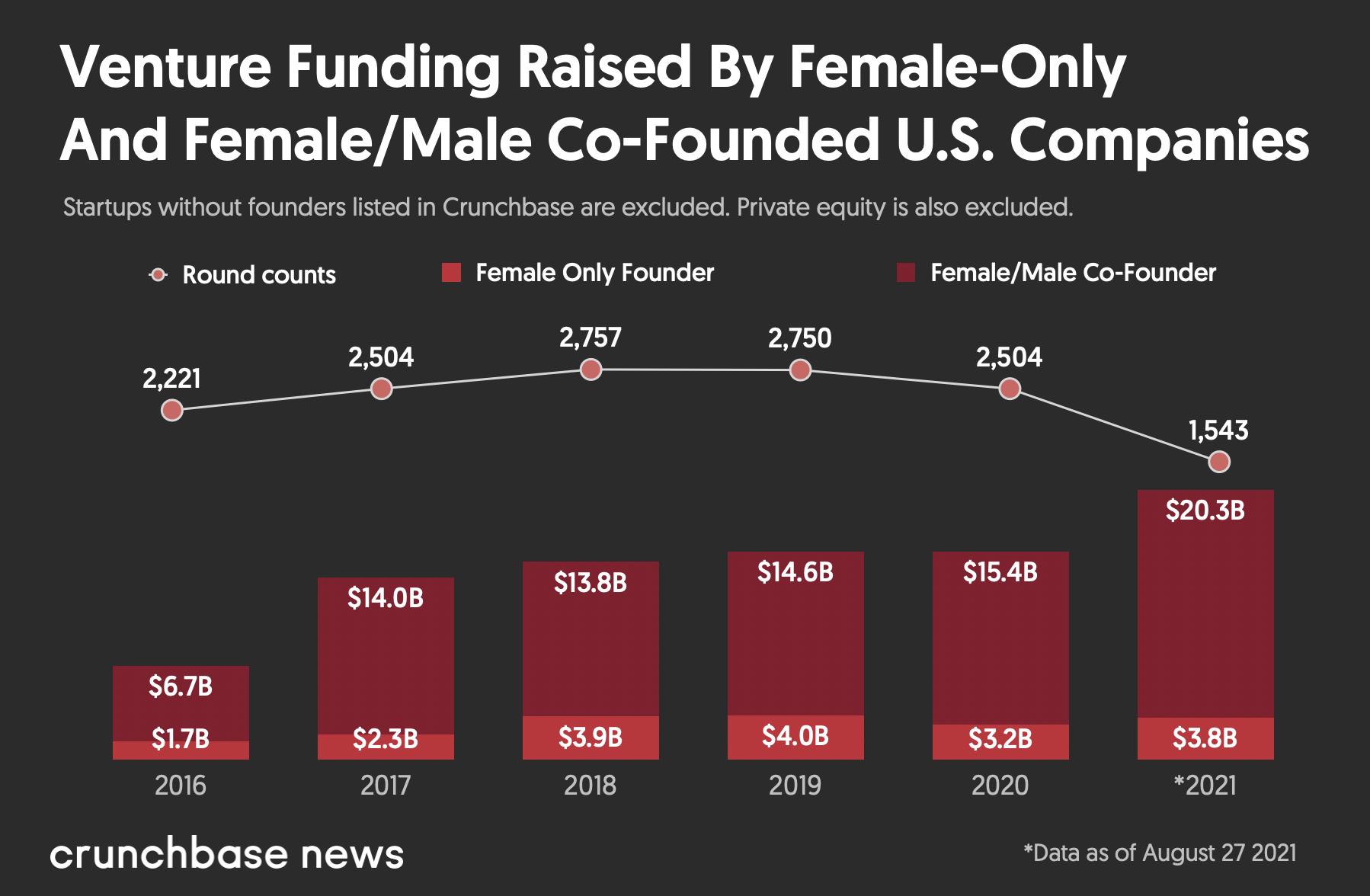

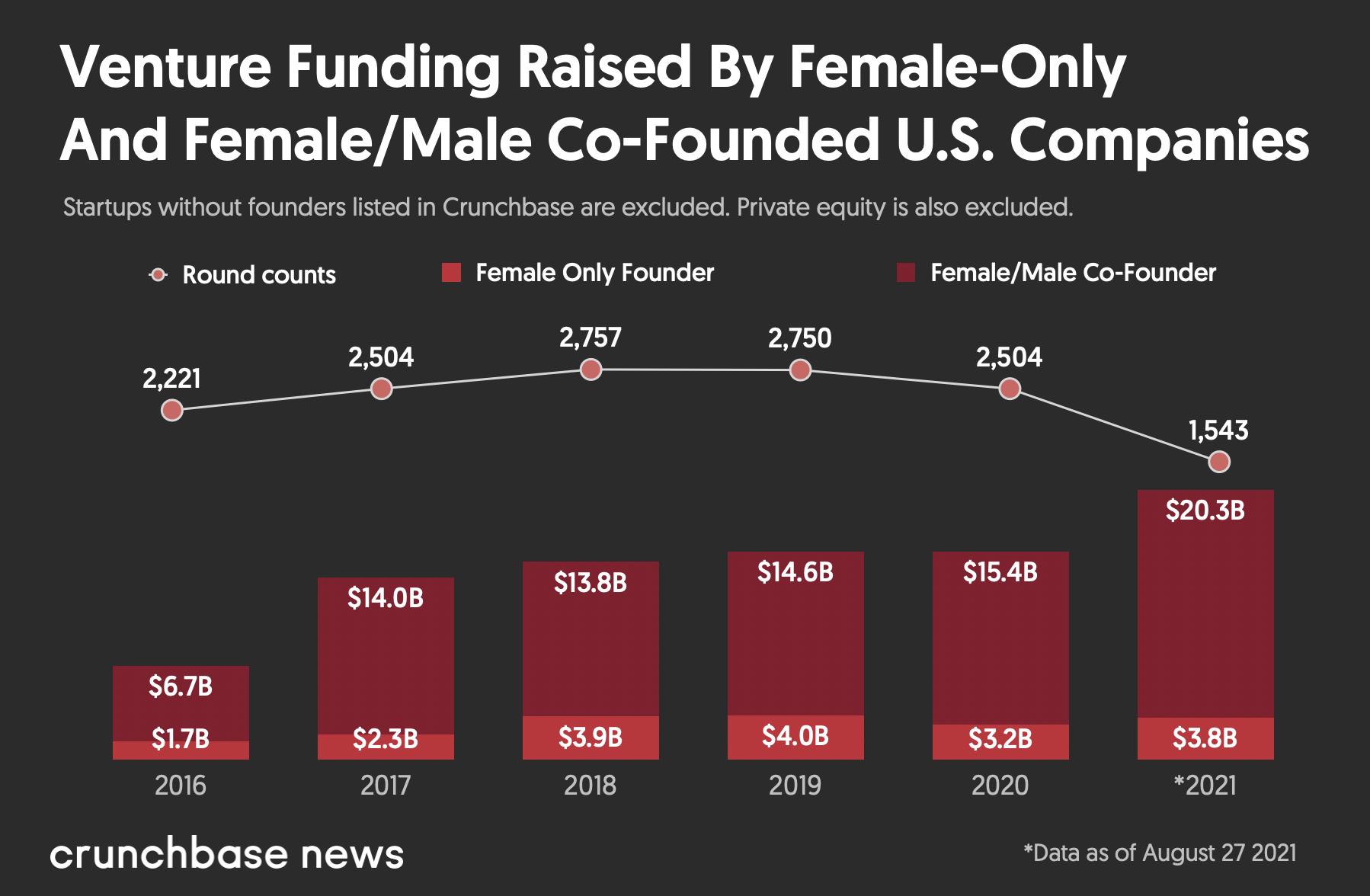

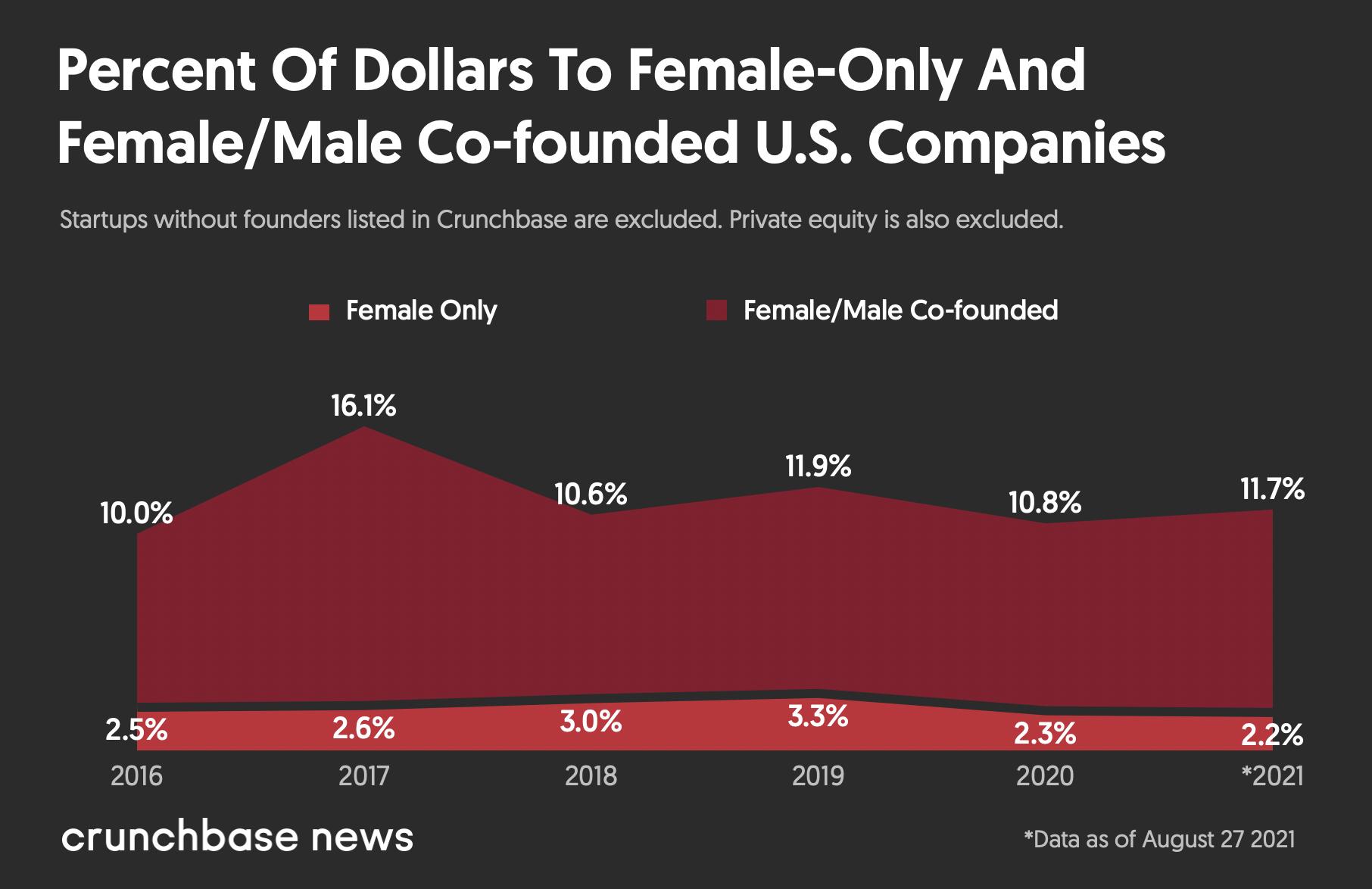

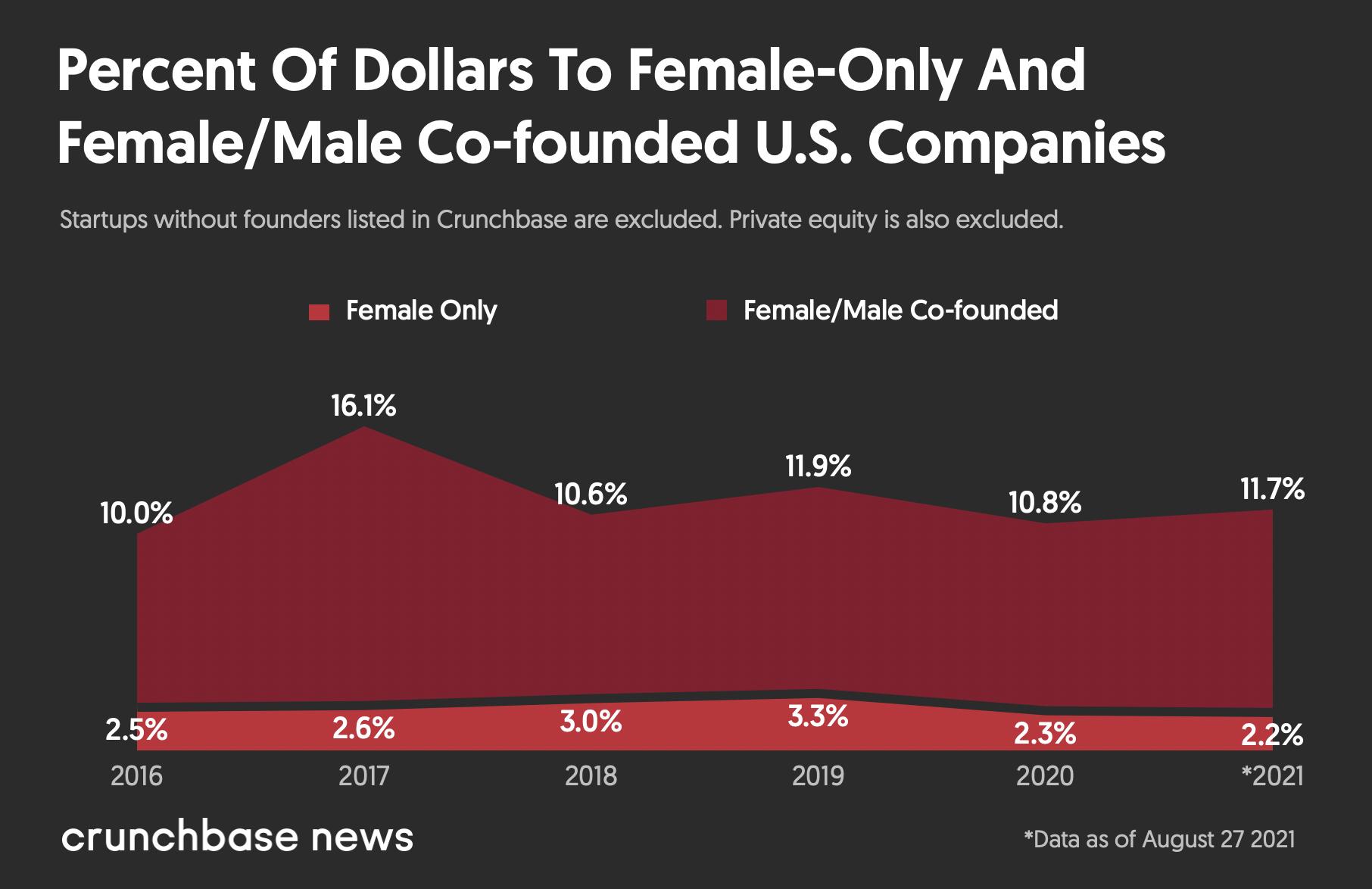

Funding distributed to all-female and mixed-gendered teams is lagging

On the surface it looks like the amount of funding going to women is rising.

However, the percent of deal volume has stayed stagnant, meaning the proportion of total funding distributed to women is declining. The record-breaking year in venture funding last year explains the increase in dollars, but taking this closer look at mixed gender and all female teams shows there’s still a very big problem at hand. Despite some growth for mixed-gender teams over the last year, it’s unclear in the graph below whether the male or female co-founder led the fundraise, while it’s very obvious that females in the driver’s seat of a raise have seen two steady years of decline.

I won’t spend time speculating as to why this is, but I will instead share a personal example that clearly shows, despite progress in total dollars distributed to women, there is still a very clear gender bias in venture.

A couple of weeks ago, we shared the news of our recent seed round. Typical of any fundraise announcement, inbound VC inquiries poured in. But despite being the one who led the fundraise, was quoted in the TechCrunch article, and who had over 200k views across my social posts on LinkedIn and Twitter, all of the inquiries were directed to my male co-founder. It was only after the tweet below that inbound inquiries started appearing in my inbox.

I led our recent fundraise, was heavily quoted in the TC article, and had 200k views on my social posts.

— Christine Simone (@chris_simone) February 1, 2022

And yet, all inbound VC interest went to my male cofounder’s inbox.

These VCs are going to miss out on incredible companies led by women (not just ours) with this mindset.

You’d think the story ends there, but it continues in the replies to the tweet. I got a number of comments from men trying to play “detective” as to why this had happened.

- “When you search your company on LinkedIn, he shows up first!” If their intention was to reach out to us, why would they search our company on LinkedIn when our names are very clearly published in the TC article?

- “His email is publicly available through LinkedIn, while yours isn’t!” Outreach to him came through his company email and through LinkedIn messaging. It’s his personal email attached to his LinkedIn account so those with premium accounts would have been emailing him there.

- “It isn’t clear which of you is the CEO!” This one is fair, as we both list our titles as Co-Founder on LinkedIn, but isn’t it funny how the default option is to assume he is?

A few days later, I was interviewed by a well-known research entity and they shared with me that in 2021, VC meetings with all-female teams actually exceeded mixed-gender and all-male team meetings. But, as demonstrated in the data shared earlier, funding given to all-female teams in the year was the lowest of the groups.

If VCs have a bias toward males being in charge of a company’s investment strategy—as seen in what happened to me—then it’s no surprise that they wouldn’t go any further than an introductory conversation with a female in charge of the process.

When presented with this data, it’s easy to point the finger at venture and tell them they’re the bad guys or gals (note: a good portion of the outreach to my co-founder came from female VCs, too). But I’ll play devil’s advocate first before I come back to why VCs are contributing to the diversity problem in tech.

My unpopular opinion on female-focused programs

I don’t believe that the funding disparity toward women is solely attributed to bias held by VCs. You aren’t taught in school how to fundraise, so most founders learn about venture capital through books, social media, blogs or accelerators. Most serve as a great way to learn the basics and build confidence, but the problem lies when women only seek programming/resources created or run only by other women.

Female-focused programs, accelerators, competitions, etc., provide benefits through increased exposure to things like pitch practice, access to great mentors, and connections with other founders, all of which are invaluable throughout the entirety of building your business and beyond. But I cringe when women expect their experience in the day-to-day of tech to mirror those environments. The truth is that in tech:

- Most women are outnumbered by men in business meetings by 2:1, while a good chunk (26 percent) report that ratio to be 5:1;

- Women only make up a quarter of leadership positions; and

- Women make up 36 percent of venture analysts, 13 percent of partners, and 9 percent of managing partners at venture capital firms in all of North America.

When competing for funding, customers, press or talent, you’re not going to be in a room full of women. When it comes to funding specifically, you’re looking to be, in most cases, one of 10 of the fund’s investments for the entire year. So unless you’re speaking to Artemis or Female Founders Fund (who are both lovely!) you’re going to be compared to companies run by men.

When I played competitive soccer, for example, our coach frequently had us scrimmage against the men’s team. We weren’t expected to win—and we rarely did—but we were expected to pick up on things that would help us have an edge against our next opponent. This doesn’t happen when you put women in isolated coaching environments, no matter whether it’s sports or startups.

For reasons like the above, I personally think it’s a little naive to believe that gender bias is the only factor impacting money raised across genders. Regardless of whether you’re with me or not, I hope you’ll at least see the impact that this distribution of venture capital has on gender diversity in the tech workplaces.

How the distribution of funding impacts gender diversity metrics

I’ve been spending time recently speaking with women in tech, particularly in software/engineering roles, asking them what they look for in companies they want to work for. Every single response has led with some variation of “women in leadership/a female-founded company.” Secondary responses included a challenging problem to solve and a collaborative culture.

What doesn’t impress women? A hot new round of funding led by top-tier investors.

When women see other women in leadership positions, they see it as an opportunity for themselves. They’ll work harder and want more ownership and responsibility to prove themselves. Women don’t look at an all-male executive team and think, “Wow now there’s an opportunity for me.” Instead, when in that situation, they’re unmotivated, stay stagnant and can sometimes be working with one foot out the door.

One engineer shared that she recently created a Slack channel with all the women at her company. Her description of the purpose of this channel was to create a place where they could come together to support one another in a workplace that skewed male-dominant. It took only a few days for management to shut it down. She then got called into a board meeting to discuss the issue. I asked her how many women were in that boardroom and she replied with, “Zero.” It’s no surprise that she’s only been there eight months and is already looking for her next opportunity.

So when VCs disproportionately distribute money to male-founded companies, they are not only decreasing the likelihood of an exit, but they are also indirectly fueling companies that women don’t want to work for.

If women can’t raise, or raise less money, it’s more likely that their companies will fail, leading to fewer later-stage companies with one or more female founders. If women want to work for companies started by other women, but these companies are predominantly earlier-stage companies that don’t get as much funding, wouldn’t it make sense that most women end up taking lower salaries, burn out from fewer resources and being stretched too thin, and/or leave or never work in tech due to limited options?

A diverse workplace excels best under diverse leadership. The leaders set the standard and hold the responsibility of being intentional about inclusivity. But until women founders hold an equal position to their male counterparts in terms of funding, I don’t think that we will reach gender equality in tech. The progress that founders are trying so hard to make is unfortunately being held back by the bias still very widely held in VC.

Christine Simone is a co-founder at Caribou, a healthcare cost prediction and optimization solution for the financial services industry.