In this article, we review venture capital trends in Europe. We take a closer look at growth in investment and fundraising. Despite Brexit, we find that the United Kingdom remains the top place for European venture capital. Lastly, we look at how successful entrepreneurs in Europe are increasingly beginning new ventures.

Europe is a minnow between the two giants: America and Asia

According to the latest full-year estimates from the international technology investment company Atomico, Europe invested around €23bn in venture capital (VC) in 2018. Comparable estimates for the US and Asia are around $130bn and $92bn respectively. This contrast is striking given that the population of Europe (EU28) is 500m, much greater than the US population of 364m and that the two have similar levels of GDP per capita.

In 2017 start-up investment in Europe was €19.2bn compared to $74bn in US/Canada and $72bn in Asia (mainly China).

Europe’s VC investment over GDP ratio suggests it has a great growth potential

Given its relatively low ratio of VC investment in start-ups to GDP, European VC investment could grow fourfold or fivefold before reaching the levels in the U.S.

European VC investment and fundraising has accelerated in the last three to five years

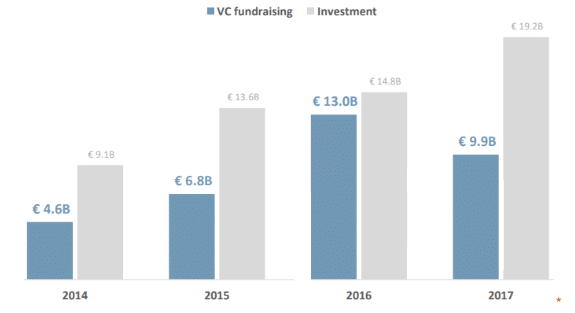

According to data from the European Investment Fund (EIF), there is clear evidence that Europe has seen tremendous growth in VC investment and fundraising. VC investment in start-ups has grown fourfold to €23bn in the last 5 years (2013 to 2018). Additionally, VC fundraising has doubled to €9.9bn in the last 3 years (2015 to 2017).

China will be the biggest VC market by 2023 (sooner than expect) if current growth rates in VC investment continue

It is expected that if China continues to grow at the current rate, it will be the biggest VC market in the world by 2023. According to TechNation, Asia is seeing a growing share in total VC investment in Europe. It is up from 3% in 2008 to 13% in 2017, compared to 17% from the US. With that, It is clear that VC investment from Asia will play a bigger role in the future in Europe.

Another trend globally and in Europe: Fewer but bigger deals

Since 2015 the number of deals has been falling but the volume has continued to rise. All sources confirm that volumes are growing with fewer deals.

European startups: Low valuations in a global context

GP Bullhound noted in one of their reports, that a unicorn in Europe is valued 18 times its revenue while in the U.S. a unicorn company is valued at 46 times their revenue. With this in mind, there is a scope for profitable arbitrage (buy in Europe and sell in the U.S.). For example, European companies can go to the U.S. or Asia and scale there. But today China is protecting its tech market from foreigners; however, I expect this could change. If a US-China trade truce makes progress, China may need to open its domestic market.

UK the first start-up market in Europe

The main start-up market in Europe is the UK, with a share of 37%, followed by France, Germany, Spain, and Sweden. Spain is also a major player to keep your on due to its rapid growth, a large number of tech workers, as well a low cost of labor and living. the country one to keep an eye on. According to Dealroom, the value of VC investment in Spain will increase from €900m in 2017 to €1.4bn€ investment in 2018.

London is the capital of the European Venture Capital market

The UK gets 37% of all the venture capital investment in Europe. This is due to 1) the UK being the financial center of Europe (despite Brexit) and 2) the size and quality of its start-up eco-system, including incubators, accelerators, business angels, bankers in tech, M&A advisors in tech, and the number and size of the VC funds too. As 3) UK Venture Capital managers have longer track records to show with returns above three times DPIs, they will continue to attract more capital than any other country in the coming years.

It is interesting to note that USA and UK investors (VC Funds) represent 48% of all VC investment in Europe, according to Dealroom reports. London will remain number 1 in Europe for VC. London in Europe is the go-to destination for startups looking to fundraise large rounds.

The exits in Europe are starting to make strong returns to VCs

Some European IPOs have done very well: Spotify (Northzone, Creandum), Adyen (Index), Farfetch (Advent, Index and Vitruvian), Avast (Summit Partners), Funding Circle (Index, Accel) and Elastic. And there were also two major M&A deals like iZettle by Paypal (very successfully closed by Anil!) and Zoopla acquired by PE Tech Silver Lake.

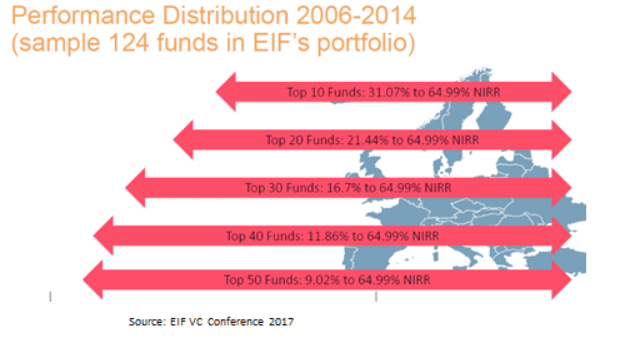

The top 30 VCs in Europe achieved a 10% annual return over the last 10 years

The top 30 VCs report more than a 10% IRR in the last 10 years. The EIF portfolio, which is compounded by all funds to promote VC in a hub where there is no VC at all, returned an annual return of 8.5%during the same period. Not bad for a public institution in Europe that has become the largest fund of funds in VC; in 2018 it invested €1.1bn in some 40-50 managers with tickets of €20-30m.

Roger Miralles has analyzed 400 VCs over the last 4 years, mainly in Europe. He has run a small fund of funds, Mastertech Capital SCR, with 8,9m€ in VC Europe. Data and sources: Atomico, Dealroom, EIF, Crunchbase, PWC, EY, PREQIN. Acknowledge support of Gabriel Suau, Gerard Walsh, Charles J. Brown, Manuel Jaffrin, Jordi Viñas (Nauta Capital), and Luis Cabiedes (Cabiedes&Partners). Please note: There are some differences in volumes, numbers, and percentages but the trends are in line are consistent among all sources.