Investing in a startup demands more than just financial acumen — it requires a deep exploration of the market and entrepreneurial landscape. While it’s a risky endeavor for some, it can also be thrilling and purposeful, offering high personal and financial rewards and putting you at the forefront of innovation.

Whether you’re a seasoned investor looking to diversify or a newcomer exploring the potential of startup investments, these insights and actionable steps will help you navigate the complexities of this high-potential, high-risk endeavor.

Ways to invest in startups

- Angel investing

- Crowdfunding

- Venture capital

- Startup accelerators and incubators

- IPOs

- Private equity trusts

- Direct investments

- Secondary markets

Let’s start by reviewing the various ways you can invest in startups. These include traditional avenues like angel investing and IPOs to contemporary options such as crowdfunding and private equity trusts. Each approach offers distinct considerations, letting you choose the strategy that best serves your needs and goals.

1. Angel investing

Angel investing is a form of early-stage investment where affluent individuals provide capital to startups in exchange for equity. Angel investors typically invest their own funds, and they play a crucial role in the startup ecosystem by supporting entrepreneurs during their initial stages of development. In addition to offering financial backing, they also provide valuable mentorship, industry connections, and strategic guidance to founders.

Angel investments are made in the seed or early stages of a company, when there’s both high risk and potential for significant returns. Successful angel investors possess a keen eye for promising ventures, a strong network within the entrepreneurial community, and the ability to navigate the uncertainties inherent in the startup landscape. Both AngelList and Angel Investment Network are popular platforms for connecting entrepreneurs with investors for startups.

2. Crowdfunding

Crowdfunding platforms allow a large number of investors to contribute small amounts of money to a project or small business. Platforms like Kickstarter and Indiegogo enable entrepreneurs to showcase their ideas and products to a global audience, attracting funding from backers who may receive rewards, early access or discounted products in return.

Equity crowdfunding platforms, such as SeedInvest and Crowdcube, take this concept a step further, allowing backers to invest in startups and receive equity shares. This democratization of investment provides an alternative to traditional funding models, empowering both startups and a diverse range of investors to participate in the early stages of innovative ventures.

3. Venture capital

Venture capital involves professional firms pooling funds from various investors to invest in startups with high growth potential. Venture capitalists play a pivotal role in the startup ecosystem by injecting substantial amounts of capital into companies poised for rapid expansion.

VCs typically engage in multiple rounds of funding and, in return, receive equity in the startups they invest in. Beyond the financial investment, venture capitalists often bring strategic insights, industry expertise, and a vast network that can significantly contribute to the growth of the startups in their portfolio.

While venture capital offers startups the resources needed to scale, it also comes with the expectation of substantial returns. This symbiotic relationship between investors and startups is a cornerstone of innovation and growth within the tech industry.

4. Startup accelerators and incubators

Startup accelerators and incubators are programs designed to support the growth and development of early-stage companies. In exchange for equity, these programs offer startups access to mentorship, resources, office space and sometimes initial funding.

Accelerators typically have a fixed-duration program that culminates in a demo day, where startups pitch their businesses to a room full of potential investors. Y Combinator and Techstars are well-known examples of such programs.

Incubators, on the other hand, provide more extended support and a collaborative environment for startups to mature. These initiatives not only offer financial assistance but also foster a culture of innovation and collaboration that is invaluable for startups navigating the challenges of building a sustainable business in competitive industries.

5. IPOs

Initial Public Offerings represent a critical milestone in the lifecycle of a startup, signaling its transition from a private to a public company. When a startup decides to go public, it offers shares to the general public through a regulated stock exchange for the first time.

Investors, including institutional funds, retail investors and even individual enthusiasts, can participate in the IPO process. This presents a unique opportunity to invest in a company during its early stages of being publicly traded, allowing investors to be part of the company’s growth story.

Pro Tip: Get the most up-to-date information on IPOs with a quick search on Crunchbase. You can also customize your search using filters for IPO date, valuation and more. Take a look at this list of recent IPOs.

6. Private equity trusts

Private equity trusts pool capital from multiple investors and deploy it across a range of private companies, often spanning various industries and stages of development. These trusts are managed by professional fund managers with expertise in selecting and managing investments in the private markets. Investing in private equity trusts is a way for individuals to gain exposure to a diversified portfolio of private companies, including startups.

7. Direct investments

Direct investments involve high-net-worth individuals, family offices or institutions making direct equity investments in startups without going through a formal venture capital fund. This approach enables investors to have a more hands-on role in their investment decisions and often involves a direct relationship with the startup founders. Direct investments can take place at various stages of a startup’s development, from the seed stage to later rounds of financing.

8. Secondary markets

Investors and shareholders interested in selling or buying shares in private companies can use dedicated platforms such as SharesPost, EquityZen and other private marketplaces. This offers liquidity to early investors, employees or other stakeholders who hold shares in startups, allowing them to sell their positions before a company goes public or is acquired. Additionally, this enables new investors to enter into established startups, offering an alternative investment avenue outside traditional fundraising rounds.

How to invest in startups

- Learn about the startup ecosystem

- Understand the risks and rewards of startup investing

- Assess your readiness

- Define your investment goals

- Know what to look for

- Research investment opportunities

- Connect with startups and founders

- Estimate the startup’s valuation

- Do your due diligence

- Choose an investment method

- Negotiate the deal

- Manage your investment

Now that you understand the different ways you can invest in startups, let’s go over the steps for investing, from start to finish. From understanding the fundamentals of the startup ecosystem to making informed investment decisions and actively managing your portfolio, these steps will equip you with the knowledge you need to get started as a startup investor.

1. Learn about the startup ecosystem

If the world of startup investing is new to you, start by learning the basics. This includes familiarizing yourself with both the startup ecosystem and industry trends.

First, you’ll need to know about the various stakeholders and their roles. This includes the founders, angel investors, venture capitalists, accelerators and incubators we discussed in the section above.

Next, learn about the startup lifecycle, from ideation and seed funding to Series A, B, and beyond. Each stage comes with its own set of challenges, opportunities and investment dynamics that you should be familiar with.

- Pre-seed funding is the initial capital injection a startup receives, typically from founders, friends or family, to validate a concept or develop a prototype.

- Seed funding represents the stage where startups secure external investment to scale operations, conduct market research and develop a minimum viable product (MVP).

- Series A is the first significant round of venture capital financing, enabling startups to expand their market reach, enhance product development and solidify their business model.

- Series B occurs when startups seek additional capital to scale their operations, expand market presence and prepare for further growth.

- Series C is a round where mature startups secure capital to accelerate growth, explore new markets and potentially prepare for an IPO.

- Series D and subsequent funding rounds involve further capital infusions to support large-scale expansion, potential acquisitions and solidify the startup’s position in the market.

In addition, don’t forget to keep tabs on industry trends – a must for any serious investor. This will help you understand which industries are up-and-coming, which are undergoing significant shifts, and which are and aren’t worth your money.

Pro Tip: Check out the Crunchbase Unicorn Board, which tracks the most valuable companies in the word, and the Crunchbase Emerging Unicorn Board, which tracks companies that are on the path to unicorn status. Both lists are updated real-time and provide invaluable data on market trends and hot companies.

2. Understand the risks and rewards of startup investing

We mentioned above that investing in startups is inherently risky, and it’s important to understand what those risks are before getting started. It’s also important to understand the potential rewards and how they stack up against those risks so that you can make the right investment decisions.

The risks of investing in startups include:

- High rate of startup failure: Startups face a considerable risk of failure, with a significant percentage not surviving beyond their early stages. Factors such as market competition, financial mismanagement or unforeseen challenges can contribute to this high failure rate.

- Market volatility: The startup ecosystem is susceptible to market fluctuations and economic downturns. Economic uncertainties can impact consumer spending, funding availability and overall market conditions, affecting the success of startups.

- Lack of liquidity: Unlike publicly traded stocks, startup investments often lack liquidity. Investors may face challenges in selling their stakes, especially if the startup is not acquired or does not go public.

- Operational challenges: Startups are inherently agile and innovative, but this flexibility can also lead to operational challenges. Rapid growth, shifting market dynamics and adapting to customer feedback pose risks that require effective management.

All that said, many people dedicate their careers to startup investing because they find it to be incredibly rewarding. These rewards include:

- Potential for high growth: Successful startups can experience exponential growth, offering investors the potential for substantial returns. Early investment in a company with a groundbreaking idea or disruptive technology can lead to significant financial rewards.

- Innovation and impact: Investing in startups provides the opportunity to support groundbreaking ideas and innovations. Beyond financial returns, investors can contribute to the development of solutions that address societal challenges and transform industries.

- Diversification: Including startups in an investment portfolio can enhance diversification. If well-managed, a diversified portfolio may mitigate risks associated with the broader market, providing a counterbalance to traditional investment assets.

- Early access: Investing in startups allows investors to access new and exciting opportunities before they become mainstream. This early entry can lead to advantageous terms and the possibility of being part of a company’s foundational success.

As an investor, understanding the potential pitfalls and benefits ensures a more nuanced approach to building and managing a startup-focused portfolio.

3. Assess your readiness

Once you familiarize yourself with how startup investing and funding work, you’ll need to take an inward look at your own readiness as an investor. This self-assessment involves evaluating various aspects of your financial standing, risk tolerance and time commitment. Ask yourself the following questions to decide whether startup investing is right for you.

Financial readiness

- Liquidity: Do I have the necessary liquid funds available for startup investments without jeopardizing my day-to-day financial needs?

- Diversification: Have I considered how startup investments fit into my overall investment portfolio, and does it align with my diversification strategy?

- Emergency fund: Is my emergency fund sufficiently established to handle unexpected financial challenges that may arise from startup investment volatility?

Risk tolerance

- Understanding risk: How comfortable am I with the higher risk associated with startup investments, and do I understand the potential for both rapid growth and failure?

- Long-term perspective: Can I maintain a long-term perspective, recognizing that startup investments may take time to mature and generate returns?

- Risk mitigation strategies: Can I play an active role in managing and mitigating risks, including staying informed about market trends and adapting my strategy as needed?

Time commitment

- Active or passive approach: Do I prefer a more active or passive investment approach, and how much time can I realistically allocate to research, due diligence and portfolio monitoring?

- Education and networking: Can I commit time to continuously educate myself about the startup ecosystem and build a network with founders, investors and others in the space?

- Management of investments: Do I have the capacity to actively manage my startup investments, attend meetings and engage with founders based on the level of involvement I choose?

Alignment with overall goals

- Financial objectives: How well do startup investments align with my broader financial objectives, including wealth accumulation, diversification and support for innovative ventures?

- Exit strategy: Have I considered my preferences for exit strategies, whether they involve short-term gains, long-term growth or a strategic exit?

- Impact on lifestyle: To what extent do startup investments align with my overall lifestyle and personal goals, and have I assessed their potential impact on my financial well-being?

Once you’ve thought through these questions and assessed your readiness, it’s time to move on to the next step: outlining your goals as an investor.

4. Define your investment goals

This stage is all about clarifying what, exactly, you hope to gain from investing in startups. Your investment objectives will dictate which startups you choose to invest in, how you want to invest, and how much risk you’re willing to take.

Are you primarily seeking to grow your wealth through potential high returns? This is one common reason to invest in startups. If this is your goal, set expectations around your desired level of risk and the timeline over which you expect to see returns.

Beyond financial gains, some startup investors are driven by the desire to support innovative ideas and contribute to the growth of groundbreaking ventures. This may be an attractive goal if you find fulfillment in driving cutting-edge development in tech, or if you want to contribute to social and environmental causes through impact investing.

Of course, you can also seek a combination of financial returns and supporting ideas that align with your values. You might look for ventures that not only have the potential for profitability but also contribute positively to our world. Whatever your goals, defining them clearly will help you make investment choices based on your broader vision for impact and financial growth.

5. Know what to look for

While no one can say for sure whether a startup will succeed or fail, you can gather information to ensure that your investment decision ultimately aligns with your objectives. Go into your research with the following factors in mind:

- Market size and dynamics: Familiarize yourself with the trends and dynamics of the industries and markets you’re interested in. Identify any shifts, emerging opportunities or potential challenges that might impact startups in those spaces. You should also assess the expansion potential of these markets, including their current size and capacity for growth.

- Product-market fit: Evaluate how well a startup’s product or service meets the needs of its target audience. Positive feedback, customer testimonials and early traction are indicators of a strong product-market fit. You should also assess the startup’s ability to iterate and adapt based on user feedback, which will be crucial for maintaining relevance and staying competitive.

- Differentiated idea: Identify what sets the startup apart from existing solutions in the market. Does it have a unique value proposition that differentiates it from its competitors? Research the competitive landscape, as well as the barriers to entry and potential challenges from both direct and indirect competitors.

- Quality of the team: Evaluate the experience and expertise of the founding team. Look for a diverse skill set that covers key areas such as technology, marketing and operations. This also includes investigating the team’s track record, including previous successes, failures or relevant industry experience.

- Good business model: Examine the startup’s business model and how it plans to generate revenue. Likewise, understand the cost and efficiency of customer acquisition, as a scalable and cost-effective customer acquisition model is crucial for profitability.

- Good pricing model: Assess whether the pricing model aligns with the perceived value of the product or service and is a reliable formula for sustainable profit. You should also consider whether it allows for flexibility to adapt to market changes, customer feedback and potential shifts in the competitive landscape. Some of the most common pricing models include advertising-based (making money off ads), transaction-based (providing a platform for transactions and receiving a cut) and subscription-based (making money from subscriptions rather than one-time transactions).

- Scalability: Understand whether the startup has a clear roadmap for growth. Founders must have a plan for how they’ll scale their operations, whether that involves expanding into new markets, launching new products, increasing production capacity or growing the customer base.

6. Research investment opportunities

Now that you know what to look for, it’s time to identify the companies you might want to invest in.

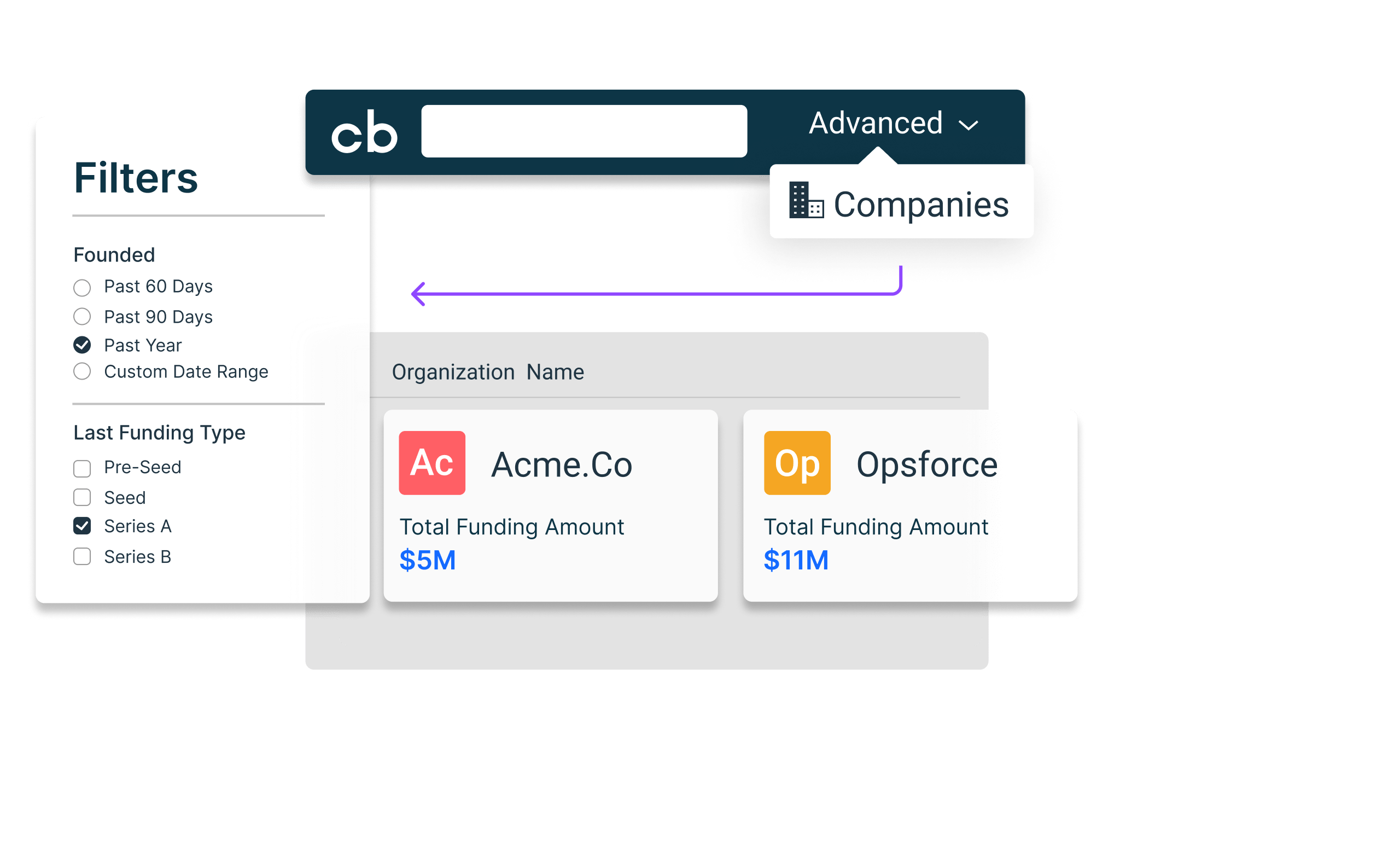

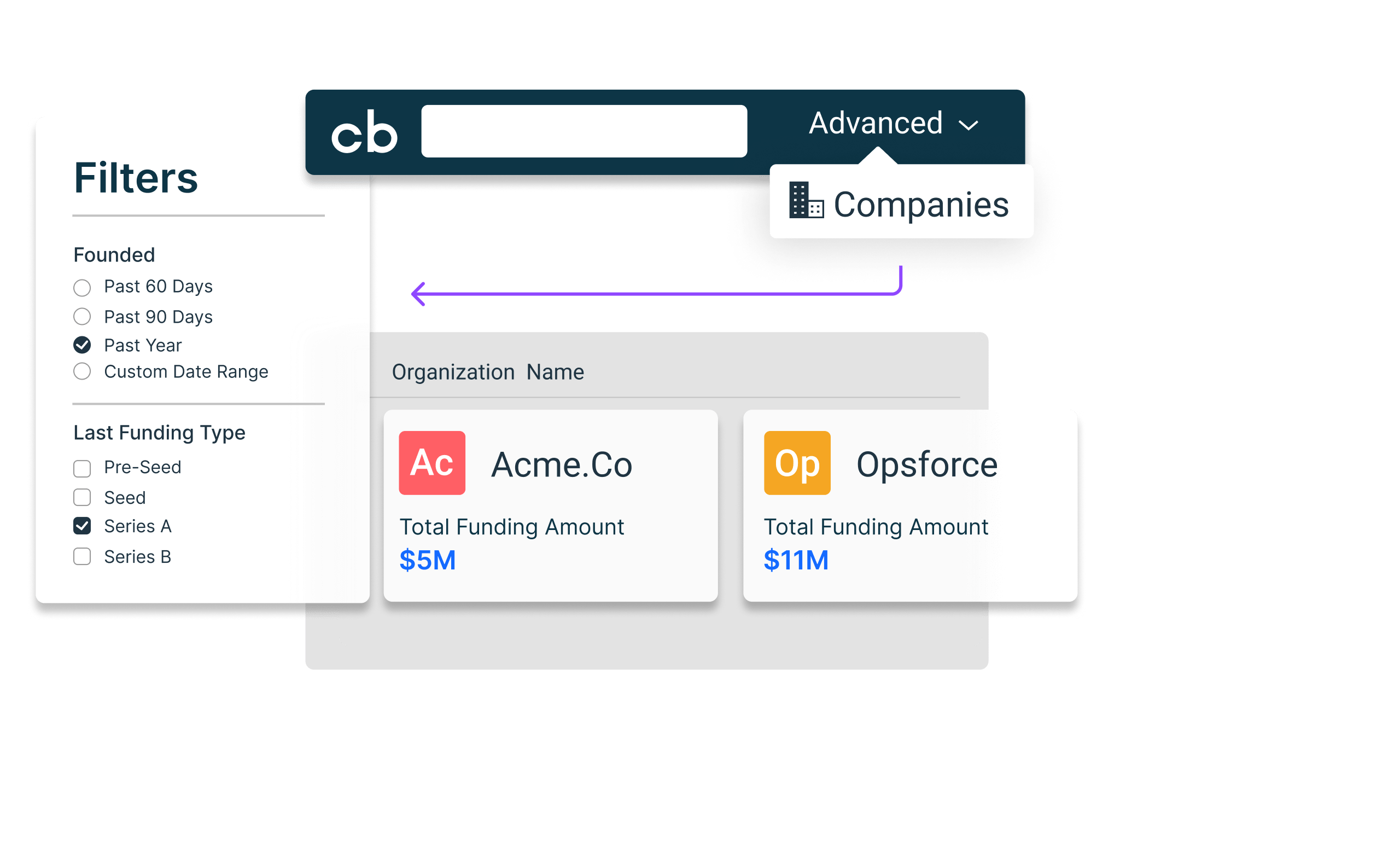

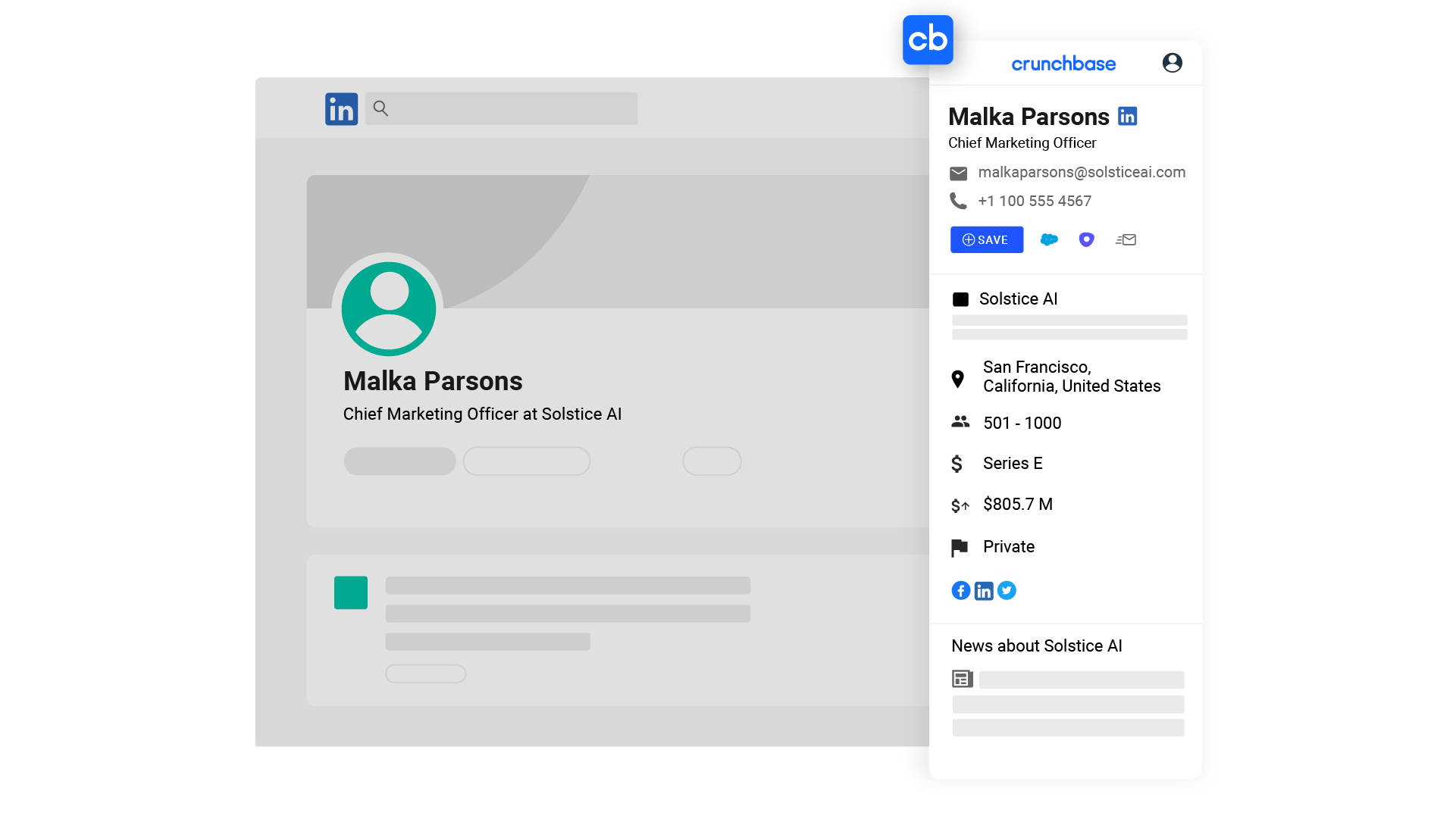

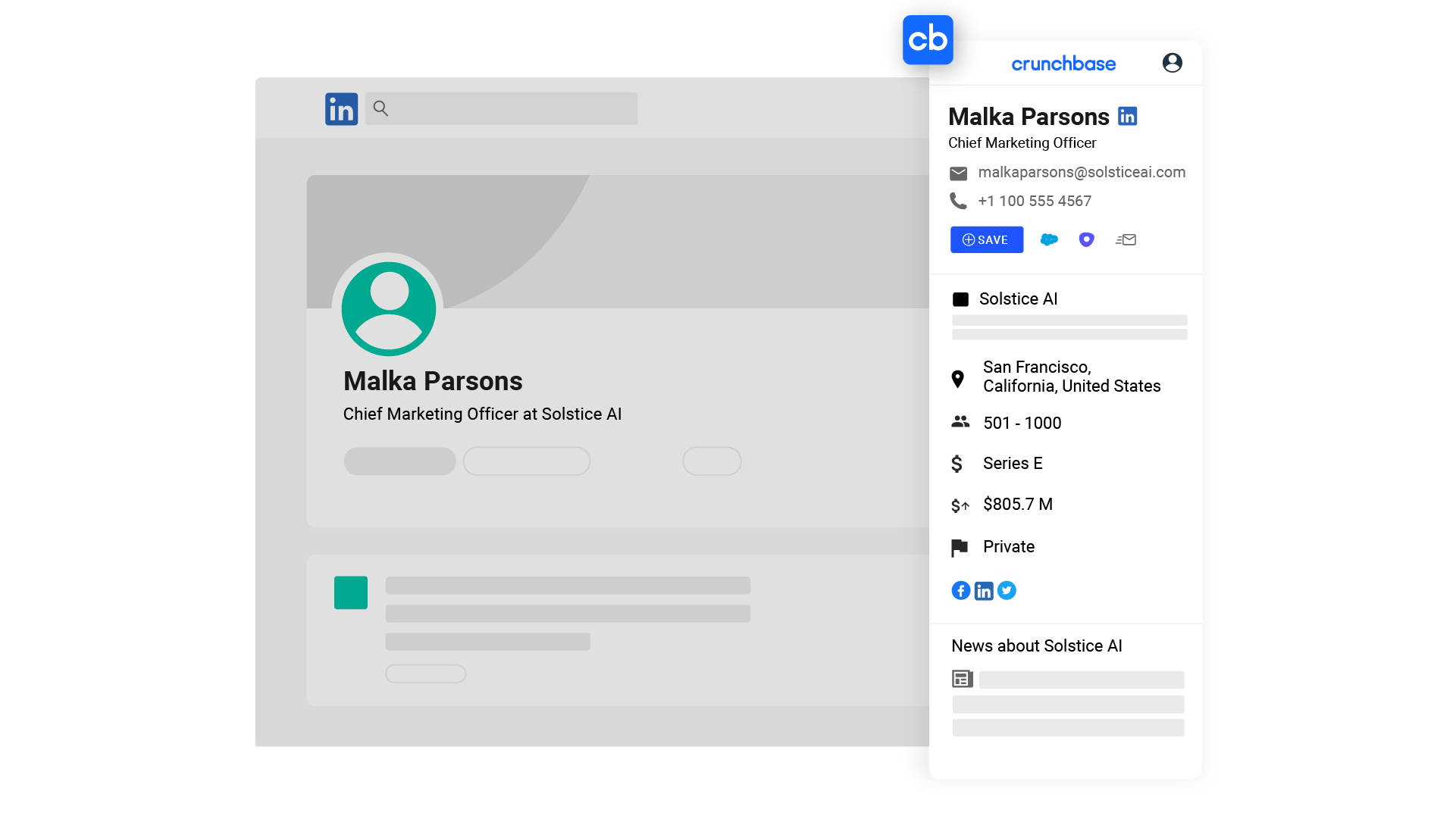

Start by going to Crunchbase, a comprehensive database that provides detailed information on startups, their funding rounds, their leadership team, other investors and industry trends. You can use the search filters to narrow down your focus based on location, industry, company size, funding stage, funding date and more. This will surface companies that match the criteria you’re looking for.

Importantly, this data also reveals key growth signals that indicate the health of a particular startup. Here are some tips for how to use these insights to inform your investment decision:

- Gather data on funding rounds, such as a startup’s total funding and its most recent funding stage and amount. Large amounts of recent funding are indicators that a startup is on a path toward growth.

- Check for the involvement of other investors. High-profile investors or those with a track record of successful exits can add credibility to a startup.

- Review the leadership team. Dig into the founders’ experience, industry expertise and any notable achievements that demonstrate their ability to lead the company. Additionally, check whether the leadership team is growing and attracting top talent, which is indicative of a company’s financial health and its ability to execute its vision.

- Gather employment and layoffs data. Active hiring patterns – or, on the flip side, layoffs – are both key indicators of how a startup is doing.

- Stay up-to-date on mergers and acquisitions. Information about whether a company has acquired another company, has been acquired themselves, or has merged with another company can give you a clearer picture of where that company is headed.

- Keep an eye out for IPOs. A company going public will change your investment strategy and is also a clear indicator of top players in the market.

You should monitor this data on an ongoing basis, while continually checking for new startups that match your preferred criteria. You can do this by setting automatic alerts on Crunchbase so that you get immediate updates when a company raises new funding, undergoes changes in leadership and more. These sample lists will help you get started:

- Series B Companies that Raised At Least $30M in the Past 3 Months

- Active Cybersecurity Companies that Raised a Series A in the Last Two Years

- Software Recently Funded in the Last 6 Months

Pro Tip: Build custom searches to find the types of companies you’re looking for, including recently funded companies and growing startups. For more details on how to use Crunchbase’s best-in-class company data to inform your investment strategy, learn how to find investments on Crunchbase.

7. Connect with startups and founders

In addition to conducting data-driven research, directly engaging with the people behind the company allows you to gain a more complete understanding of their mission and vision, culture and potential challenges. One effective way to initiate these connections is by attending industry events, conferences and networking meetups. These forums provide valuable opportunities to interact with founders, key team members and fellow investors.

Social media platforms, particularly LinkedIn and X (formerly Twitter), have also emerged as powerful tools for connecting with startups and their founders. Follow the profiles of startups you find intriguing, actively participate in relevant discussions and reach out via direct message. Many founders are receptive to engaging with potential investors who express genuine interest in their endeavors. Establishing these connections, either in person or online, will enrich your understanding of the startup landscape, position you as an engaged and proactive investor, and create a foundation for ongoing dialogue with key stakeholders.

8. Estimate the startup’s valuation

As you conduct research and build connections, you’ll identify startups you’re seriously considering investing in. You’ll need to estimate the valuation of these startups in order to ultimately make a smart investment decision.

While calculating an exact valuation can be challenging, especially for early-stage startups, investors often employ methods that provide a reasonable estimate. One commonly used approach is the comparable company analysis, where the startup’s key metrics, such as revenue, growth rate and market potential, are compared to those of similar companies that have undergone funding rounds. This method helps in establishing a valuation benchmark, offering insights into where the startup stands relative to its peers.

Another approach is the discounted cash flow analysis, which involves estimating the startup’s future cash flows and discounting them back to present value. While more complex, DCF allows for a more detailed exploration of the startup’s financial projections and potential return on investment.

9. Do your due diligence

You’ll also need to conduct a thorough and meticulous due diligence process to mitigate risks and make well-informed decisions. This phase involves a comprehensive examination of various aspects of the startup, ranging from its financial health and market positioning to the competency of its leadership team.

Financial due diligence is critical – it involves an in-depth analysis of the startup’s financial statements, revenue model, and historical and projected financial performance. Scrutinize the funding history, including the terms and conditions of previous rounds, to get insights into the startup’s capital structure and investor relations.

Equally important is operational due diligence, where investors delve into the day-to-day operations of the startup. Understanding the scalability of the business model, potential operational challenges and the efficiency of internal processes is crucial for predicting future success.

Finally, legal due diligence ensures compliance with regulations, assessment of intellectual property rights and identification of any potential legal liabilities. It’s a good idea to consult experts in these fields to guide you through the due diligence process.

10. Choose an investment method

We mentioned the different ways to invest in startups at the beginning of this article, and now it’s time to select your preferred investment method. This is a pivotal decision, as it involves a careful consideration of your risk tolerance, financial goals and level of involvement.

One common avenue is direct investments, where investors directly contribute capital to a startup in exchange for equity. This method provides a hands-on approach, allowing investors to actively participate in the growth and strategic decisions of the startup.

Angel investors, in particular, play a crucial role in this category, often providing not just capital but valuable mentorship and guidance to early-stage startups. Multiple angel investors may come together through angel investor networks, where they can leverage their combined expertise and resources for a more impactful support system.

For those seeking a more diversified and passive approach, investing through venture capital funds can be an attractive option. These platforms pool capital from multiple investors to fund a portfolio of startups, offering a broader exposure to different ventures.

Another method gaining popularity is crowdfunding, which democratizes the investment landscape by allowing individuals to contribute smaller amounts of capital to startups. Equity crowdfunding platforms provide access to a wide range of investment opportunities, making startup investing more accessible to a broader audience.

Additionally, for those looking to invest in startups that have already matured, IPOs offer the chance to buy shares of a startup as it goes public.

Each method comes with its own set of advantages and considerations, and the choice ultimately depends on factors such as risk appetite, investment horizon and the desire for direct involvement in the startup ecosystem. Take another look at the first section of this guide to review other ways to invest, and chat with a mentor to help you make the right investment decision for your goals.

11. Negotiate the deal

Let’s say you’ve chosen a startup to invest in and are ready to move forward. The negotiation stage is a critical juncture in the startup investment process, where terms are hammered out, and the foundation for the investor-founder relationship is established. Successful negotiation requires a delicate balance between securing favorable terms and fostering a collaborative partnership.

Start by understanding the key elements of the deal, including the valuation, equity stake and any additional preferences attached to the investment. This proposal often comes in the form of a term sheet, which covers essential aspects such as the valuation, investment amount, ownership stake and any protective provisions or rights the investor may seek. Review the term sheet prior to negotiations so that you have a clear framework for your discussion.

As negotiations unfold, clear communication is paramount. As an investor, you should express their expectations, whether it’s a seat on the board, information rights or involvement in strategic decisions. Founders, in turn, may present their vision for the company and their reasoning behind the proposed terms.

Negotiations may involve give-and-take, with both parties working towards a consensus that aligns with their respective goals. Consider consulting a skilled attorney specializing in startup investments to review term sheets, agreements and regulatory compliance and ensure that your interests are protected.

12. Manage your investment

Once the deal is sealed, your journey as a startup investor will enter a new phase — one that involves active management and strategic involvement. You’ll need to regularly engage with the startup’s leadership team and stay informed about its progress. Attend board meetings or investor updates to gain insights into the company’s strategic decisions, financial performance and any challenges it may be facing. Being an engaged investor allows you to offer support and guidance when needed while ensuring alignment with the startup’s trajectory.

Beyond active involvement, managing your investment also entails staying attuned to market dynamics and industry trends. The startup ecosystem is ever-changing, and factors such as evolving technology, regulatory changes or shifts in consumer behavior can impact a startup’s prospects. Regularly reassess your investment strategy and consider whether adjustments are needed based on the startup’s performance and changes in the external environment.

Finally, make sure to seek professional advice throughout the research, decision-making and management process. Engage with financial advisors, particularly those with expertise in venture capital and startup investments, as you explore potential opportunities, assess risks versus returns and manage your portfolio. Additionally, consider consulting with mentors or seasoned investors at various stages of your investment journey, as their firsthand experience can help you navigate challenges and make strategic decisions.

How much can you invest in startups?

Are you still wondering how much, exactly, you should be investing? It’s important to keep in mind that there’s not only the question of how much you should invest, but how much you can.

For accredited investors, who meet specific income and net worth requirements, the limits are often dictated by personal financial capacity and risk tolerance. Angel investors contribute an average of $25,000 to $100,000 per deal, with a 20-30% average return. That said, this number can vary greatly, and returns, of course, aren’t guaranteed.

If you’re a non-accredited investor going the crowdfunding route, regulations will dictate how much you can invest. Crowdfunding platforms impose certain restrictions on investment amounts within a specific timeframe. As of 2023, non-accredited investors with an annual income or net worth less than $124,000 can invest a maximum of 5% of those amounts (whichever is greater), while those with an annual income and net worth greater than $124,000 can invest up to 10%. Refer to the U.S. Securities and Exchange Commission for the most up-to-date information.

Not only should you strike a balance between ambitious investment goals and prudent risk management, but you should also familiarize yourself with the rules and regulations surrounding different investment strategies.

How to make money investing in startups

At this point, you’ve learned everything you need to know about how to invest in startups. Now comes the next question: how do you actually make money from your investments?

There are several ways to generate returns. One primary avenue is equity appreciation — as the startup progresses and achieves key milestones, the value of your equity stake can increase substantially. This appreciation is often realized during exit events, such as acquisitions by larger companies or when the startup goes public through an IPO. Successful exits can lead to significant financial gains for investors.

In addition to equity appreciation, some startups may distribute profits through dividends. However, it’s essential to note that this is less common, particularly in the early stages of a startup’s development when the focus is often on reinvesting profits for further growth. Investors should carefully assess a startup’s financial structure and policies regarding profit distribution.

Active involvement in the growth and strategic decisions of the startup is an indirect, but equally important, way to make more money off your investment. Providing strategic guidance, leveraging industry expertise and fostering valuable connections can contribute to the overall success of the startup and, consequently, generate greater returns.

Platforms and sites for startup investing

- Crunchbase

- AngelList

- SeedInvest

- Crowdcube

- Angel Capital Association

If you’re ready to start finding startups to invest in, take a look at these well-regarded platforms and websites. These sites can help you discover new companies, engage with key stakeholders and ultimately invest in startups of interest.

1. Crunchbase

Crunchbase is a comprehensive platform for investors seeking robust, best-in-class data on startups. It offers detailed profiles of companies, including funding history, information about the leadership team and industry trends, and is a critical tool for discovering and researching startups. As an investor, you can use Crunchbase to track funding rounds, identify key players in specific industries and gain insights into the competitive landscape. Crunchbase also delivers personalized recommendations and lets you set custom alerts to monitor companies of interest. Learn more about finding investments with Crunchbase.

2. AngelList

AngelList is a prominent platform connecting startups with investors, particularly angel investors. It offers a curated list of startups seeking funding and facilitates the investment process. Investors on AngelList can discover early-stage startups, review their pitches and connect directly with founders. The platform streamlines the investment process, making it accessible to a broader network of angel investors.

3. StartEngine

StartEngine is an equity crowdfunding platform that empowers both accredited and non-accredited investors to discover and invest in a diverse range of startups and emerging companies. Through StartEngine, individuals can access investment opportunities with relatively lower minimum investment requirements, fostering a more inclusive approach to startup investing.

4. Crowdcube

Crowdcube enables individuals to invest in small companies in return for equity or an annual return. It provides investors with access to a variety of startups, spanning different industries and geographical locations, and facilitates international investment opportunities for those looking to diversify their portfolios.

5. Angel Capital Association

The ACA is an organization that connects accredited angel investors. While not a platform in the traditional sense, it serves as a network that enables investors to discover opportunities and collaborate on investment deals. The ACA fosters a community of angel investors, providing opportunities for collaboration, knowledge-sharing and co-investment. It is a valuable resource for investors seeking to engage with like-minded individuals.

These platforms and sites serve as valuable tools for investors seeking to explore and engage with startup investment opportunities. Use these tools, along with your own network of entrepreneurs and investors, to stay well-informed about a startup’s progress, industry trends and market dynamics.