The demand for strategic investors lead us to ask: how important are Strategic Investors and are they critical to success? The answer in our view is ‘no.’

Entrepreneurs are always looking for “Strategic Investors” — corporate VC such as Intel Capital, Verizon Ventures, SAP, Microsoft, etc. The view is that these investors provide not only capital, but also guidance on the product roadmap, engineering and dev resources, and critical introductions. Meanwhile, they’re often customers themselves. For instance, Cloudera was 22% owned by Intel prior to the IPO.

The demand for strategic investors lead us to ask: how important are Strategic Investors and are they critical to success? The answer in our view is ‘no.’

Why Strategic Investors Aren’t Necessary for Success

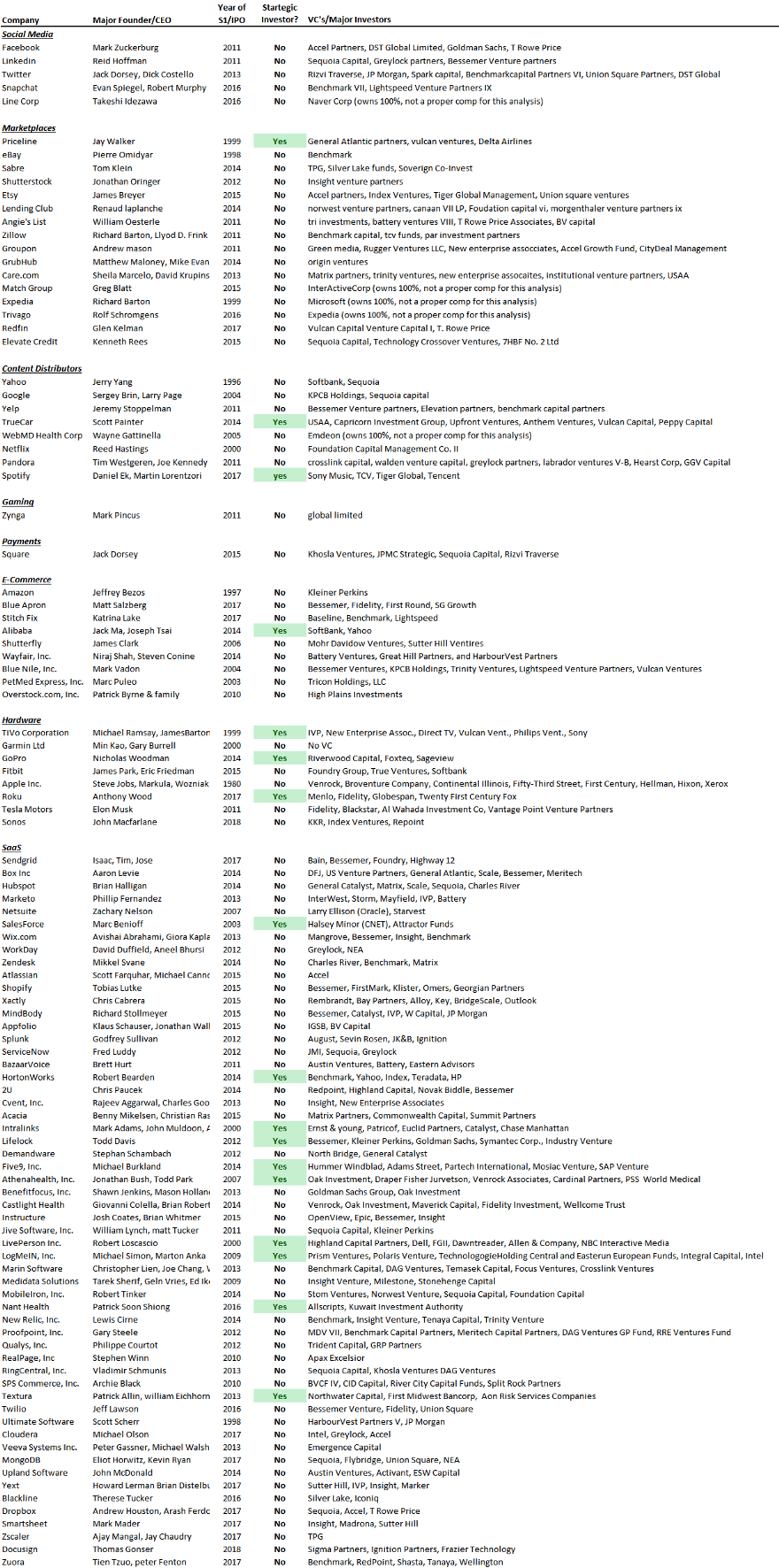

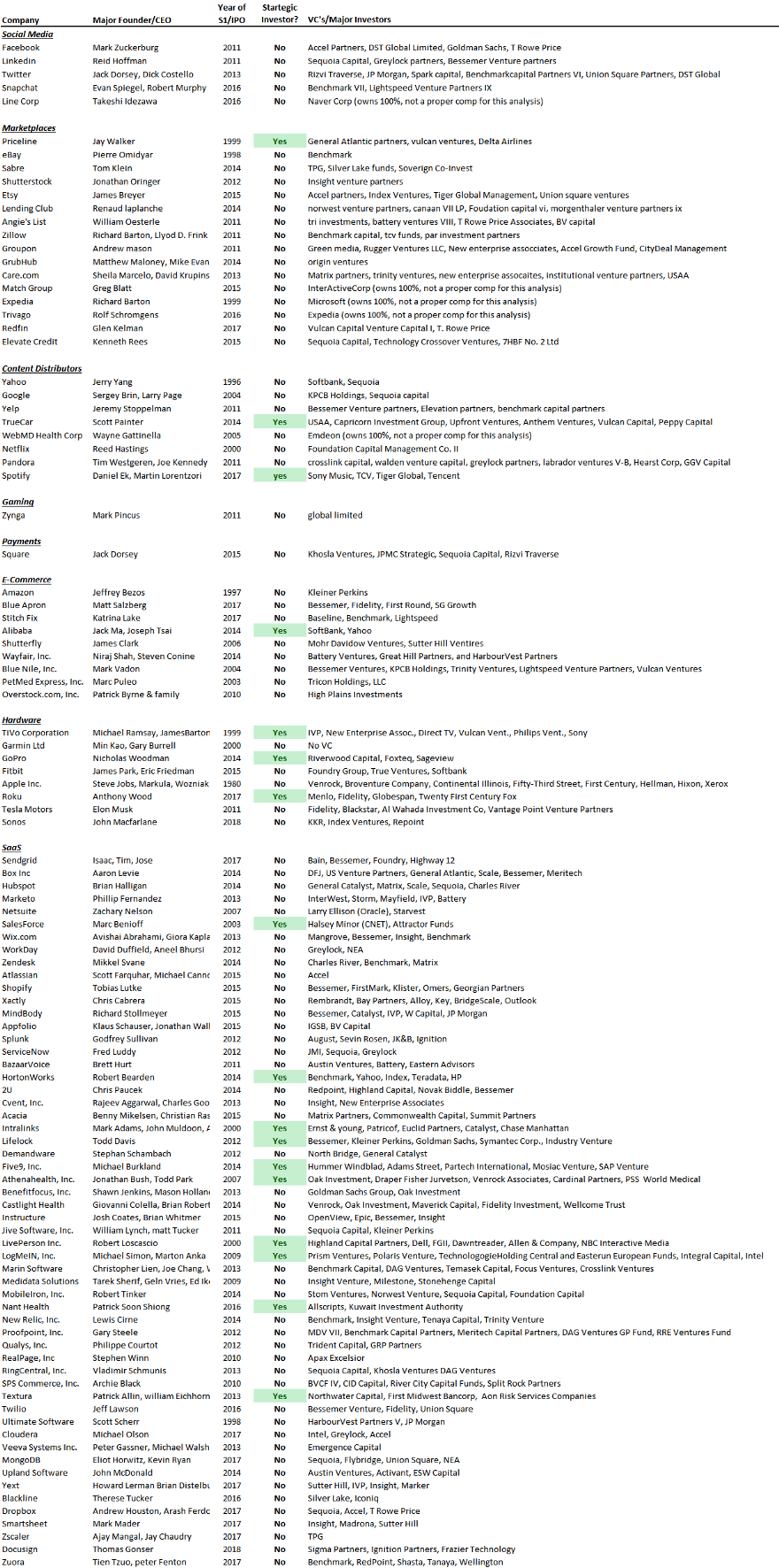

To arrive at that conclusion, we looked at the major investors in 104 tech companies prior to going public. We found that of the 104 companies, only 17 had a strategic investor. The remaining 87 companies had only traditional VC or financial institutions as investors, but no strategics. In other words, having a strategic investor was not critical to making it to IPO for 84% of the companies we looked at. The data is below.

While there is certainly value in having strategic investors they’re not critical to success, based on the low density of strategics invested in tech companies that have gone public.

What’s more important is to find investors that help when they can, are supportive of the business (both financially and emotionally), and know when to step out of the way and let you do your thing.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.