This article is part of the Crunchbase Community Contributor Series. The author is an expert in their field and a Crunchbase user. We are honored to feature and promote their contribution on the Crunchbase blog.

Please note that the author is not employed by Crunchbase and the opinions expressed in this article do not necessarily reflect official views or opinions of Crunchbase, Inc.

It might sound like an exaggeration to say that fintech is enabling the future. But there’s a growing body of evidence to suggest this may be true. A pandemic year that forced remote working and accelerated digitalization everywhere was a proof point for fintech globally. After a sharp contraction in fintech venture investment as the pandemic broke at the beginning of 2020 – the year ended as the third-highest on record by funding volume.

The 2021 Global Fintech Rankings powered by German unicorn Mambu and released today by findexable in partnership with Crunchbase offers more proof of the industry’s growing systemic importance.

First launched in 2020, this year’s second annual rankings of fintech cities and countries doesn’t show much movement at the top of the table but adds 50 new fintech city hubs in 20 new countries. More hubs but also more global. 19 of the 20 new countries added to this year’s rankings are in emerging markets.

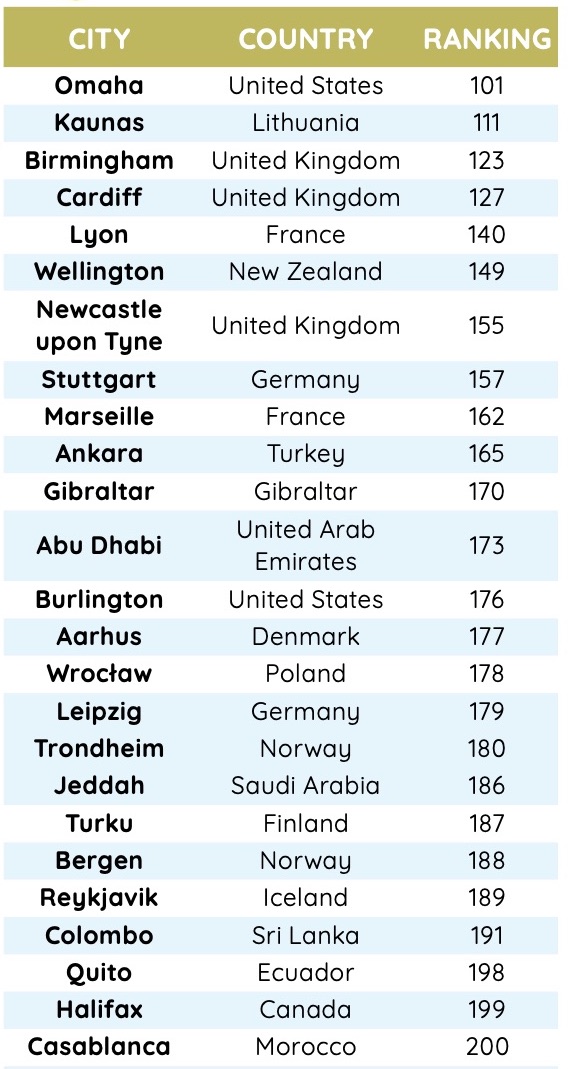

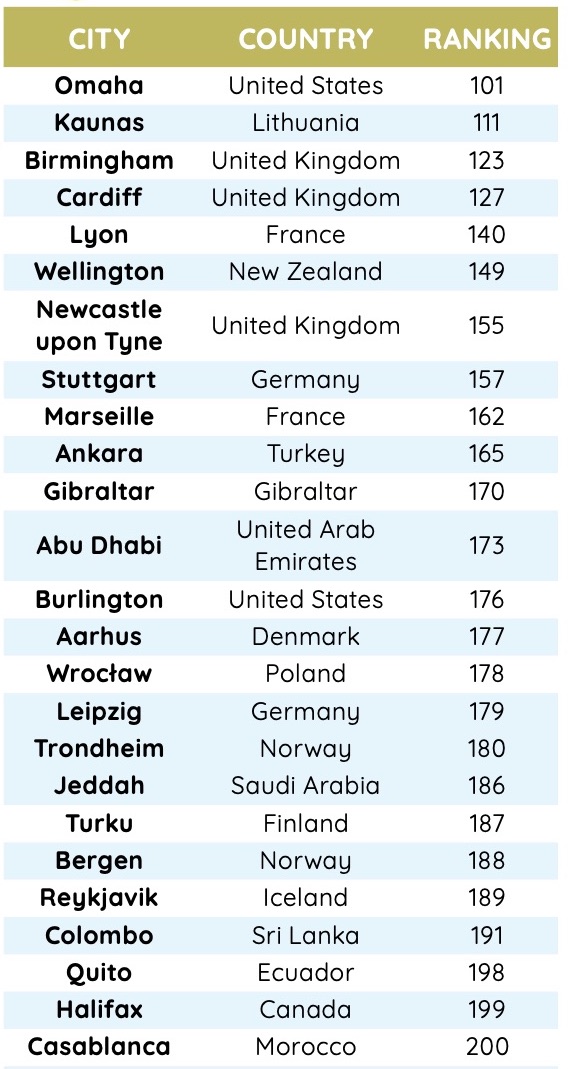

New Cities Make the Top 200 Fintech Hubs

The 2021 Global Fintech Rankings scores the ecosystems of 264 cities in more than 80 countries. A selection of new cities that make the top 200 fintech hubs is included below.

Global Fintech Rankings: New fintech hubs in 2021

Most interestingly, fintech is also becoming more local. Fintech has now spread innovation to the furthest reaches of the American and European economies as founders embraced remote working and chose to base themselves in smaller cities.

Take Scandinavia. Denmark and Finland added second hubs this year, Norway a third, while Sweden already had three countries in the rankings. While the US and the UK added the most new cities of all countries globally.

A Global Network for a Global Index

Different from other lists of fintech companies findexable uses an open directory to identify fintech businesses and rank ecosystems around the world – working with a network of over 60 ecosystem partners including fintech associations, investment promotion agencies and industry bodies to validate, qualify and improve the information available on fintech companies worldwide.

As this year’s Global Rankings show high speed broadband is not only helping the rise of previously little noticed cities in the rich world. The same is happening in developing countries. Ulaanbaatar, the remote Mongolian capital, with a population of just 1.5 million where investment in connectivity, including fourth-generation mobile networks has helped fuel a domestic fintech industry – and means the city joins the City Rankings for the first time this year. Fintech is the future – and it’s coming to a city near you!

About The Global Fintech Rankings

The 2021 Global Fintech Rankings powered by Mambu are published by findexable. The Rankings use proprietary data and data from Crunchbase to rank the fintech ecosystems of over 260 cities across more than 80 countries worldwide. Visit findexable.com for more information and to download this year’s Global Rankings report.

About The Global Fintech Index

The Global Fintech Index is an open directory of fintech companies – designed to improve awareness of fintech development globally, promote collaboration and reduce geographical barriers to fintech investment, scale and success – and works in partnership with Crunchbase as the data partner for the Index contributing data related to fintech companies.