Crunchbase and East-West Digital News are teaming up to cover key tech and venture trends from Russia and other countries of the former Soviet Union. This monthly column by EWDN chief editor Adrien Henni highlights the most notable industry facts and trends from Eastern Europe and Central Asia, as well as promising tech innovations. Below is the review for June.

Giant e-commerce JV deal in Russia

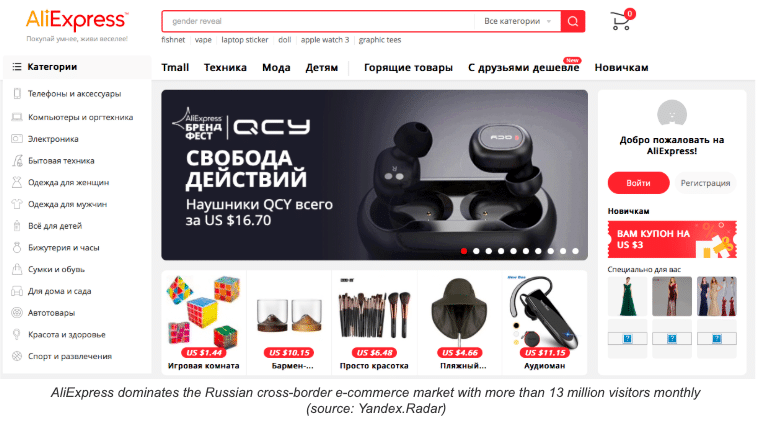

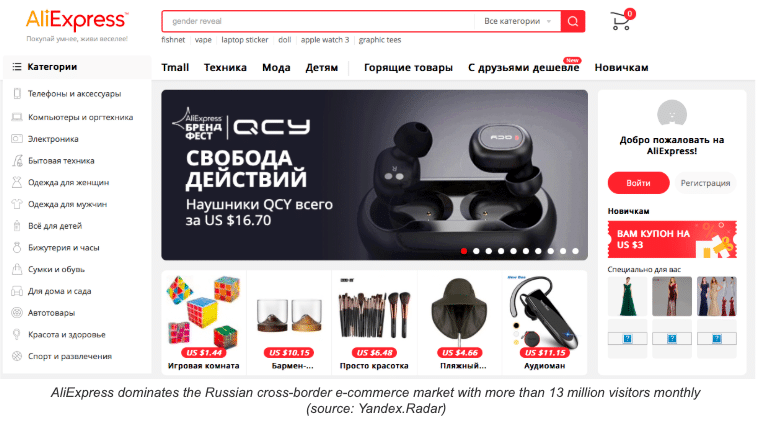

June 2019 was marked by the formalization of a giant e-commerce JV deal – pre-announced in September last year – involving Alibaba Group, Mail.Ru Group, Russian telco MegaFon and sovereign fund Russian Direct Investment Fund (RDIF).

The partners received approval from Russia’s antimonopoly authorities to complete their deal, which involves a $400 million investment. The JV will leverage on the existing businesses of AliExpress Russia, the B2C marketplace owned by Alibaba which controls a large part of the e-commerce flows between China and Russia.

Keeping the name of ‘AliExpress Russia,’ the JV will “operate across all e-commerce segments, including cross-border and local marketplaces and first-party retail.”

This is the second largest deal in the history of Russian e-commerce. In 2018, the financial giant Sberbank injected $500 million into a competing e-commerce JV with Yandex. In spring 2019, Ozon, a major multicategory platform, secured $154 million – also a considerable amount by Russian standards.

East-West Digital News and Crunchbase have just released a research report about VC and PE e-commerce investment in Russia. The report can be downloaded at no charge through this link.

Investment and M&A deals

The other deals of the month were more modest – but among them is a $40 million capital injection deal into ivi.ru, Russia’s largest online video platform in terms of revenue. The investors include Russia’s sovereign fund RDIF, Mubadala Investment Company (UAE), Baring Vostok Private Equity Fund IV, Flashpoint VC, RTP Global, and Winter Capital.

Other deals were under the $10 million mark:

- Golama, a leading e-grocery delivery service based in Moscow, agreed with Veb Ventures a $7.7 million capital injection after just one year of operations. Previously known as VEB Innovations, Veb Ventures is a subsidiary of state development agency VEB.RF (Vnesheconombank).

- Russian PE fund ExpoCapital and several foreign business angels jointly invested $2.5 million in SmartPrice, a Moscow-based online store that trades in used smartphones.

- Botkin.AI attracted more than $1.5 million in a Series A round to develop its cancer diagnosis technology. Part of the funding came from two Russian funds: RBC Capital, which was created in 2014 by Russian state fund-of-funds RVC and Russian high-tech pharmaceutical company R-Pharm; and Orbita, a fund launched last year by Russian state atomic energy corporation Rosatom.

- Tealsy, an online food products platform, attracted an undisclosed from Baring Vostok, a major Moscow-based international PE firm, in exchange for a 5% stake.

- Gazprom Media, Russia’s largest media holding and a subsidiary of Gazprom, invested an undisclosed amount in St Petersburg-based Happy Monday Family, a group of companies that operates in the fields of online advertising and influencer marketing.

Two notable acquisitions also took place. The Chinese electronics manufacturer Huawei bought the face recognition technology of Russian startup Vocord, with patents, equipment, and hiring most of the related team. The financial terms of the deal were not disclosed, but experts believe Huawei may have priced Vocord at $40-$50 million.

In a move to increase its share of the Russian e-ticketing market, Yandex, the NASDAQ-listed Russian Internet giant, acquired exclusive rights to an e-ticketing system called TicketSteam.

International deals

Substantial VC deals involved funds with Russian roots investing outside Russia. Two transactions concerned UK startups: Impulse VC led a $6 million round for GuestReady, a three-year-old service that lets hosts manage their business on Airbnb and other rental sites. This fund, which is reportedly affiliated to Russian billionaire and Chelsea FC owner Roman Abramovich, already invested in UK startups in the past, including adtech startups LoopMe and Locomizer.

Almost simultaneously Target Global, a VC firm with Russian roots operating internationally, led a $42 million round for London-based insurtech startup Zego.

RTP Global (previously known as Ru-Net), invested once again in India. This time, it took part in the pre-Series A round of Agara Labs, a Bengaluru startup that uses deep learning in speech and text to automate customer support.

In the US, Almaz Capital and Runa Capital, two other international VCs with Russian roots, exited from Acumatica. This provider of cloud-based ERP software systems has been fully acquired by EQT, a leading PE firm. Almaz was the first investor in the company as early as 2009; Runa joined in a new round in 2013. Acumatica’s other investors were Accel-KKR, Visma, and MYOBand.

Fund creations

Last month was rich in fund creations involving Russian state organizations. Thus, the defense conglomerate Rostec and Russian Railways pledged to create a joint R&D center for LPWAN XNB wireless network devices as well as IoT technologies to be used in transport. The parties announced they will launch a $100 million venture fund to support such activities.

Sovereign fund Russian Direct Investment Fund (RDIF) agreed with its Chinese counterpart China Investment Corporation (CIC) to set up a joint Russian-Chinese R&D fund for innovations. The funding – no less than $1 billion provided by the two partners equally – will be used to invest in the fields of AI, innovative materials, and space technologies.

Just weeks before, the RDIF received $2 billion from foreign investors to support Russian startups developing AI projects. The money came from sovereign funds and global corporations in the Middle East and Asia, including the UAE.

On its side, Veb Ventures confirmed its commitment to support Russia’s tech startups. The fund has pledged to invest more than $30 million in the second half of this year.

In other countries of the region

A few deals took place in June in Ukraine, including the following ones:

- PromoRepublic, a Ukrainian-Finnish startup, closed a late seed round of nearly €2 million. The funding was brought by venture capitalists Innovestor, Daal and Alfabeat, along with individual investors and government agencies in the UK, Germany, and Finland. PromoRepublic has developed a solution to help small companies grow their business leveraging social media in an affordable way. TechCrunch has called it the “WIX for a small business’s social presence.”

- A small deal involved Kira, a Ukrainian startup developing an analytics solution for small and medium-sized online businesses. This company was backed by the Finnish Venture Fund Icebreaker.vc.

- The Ukrainian venture firm AVentures Capital announced it invested an undisclosed amount in Viseven, a provider of multichannel content for life sciences.

No big VC news came from Belarus – but a European ranking of the most valuable facial recognition startups singled out three ones coming from this country. These companies, “which have given tough competition to Facebook and Google,” include AI Matter, now a property of Google; Masquerade, acquired by Facebook; and Banuba, funded by Belarusian VC Viktor Prokopenya. The ranking also features Looksery, a company with Ukrainian roots acquired by Snapchat in 2015.

An important deal by local standards took place in Kazakhstan: serial entrepreneur Timur Turlov put $520,000 in Arbuz.kz. Launched in 2012, this online supermarket generates around $100,000 in monthly turnover. The company hopes to reach or exceed the $200,000 mark by the end of 2019.

Previous reviews: