Crunchbase and East-West Digital News are teaming up to cover key tech and venture trends from Russia and neighboring countries in Eastern Europe and Central Asia. This monthly column by EWDN chief editor Adrien Henni highlights the most notable industry facts and trends from these regions, as well as promising tech innovations. Below is the review for April.

Deal of the month: $150 million for Russian e-commerce

In late April the Russian online retailer Ozon secured a $150 million convertible loan from the international PE firm Baring Vostok and the Russian conglomerate Sistema, two of its existing investors.

Ozon was founded in 1998, with an initial focus on books, CDs and DVDs. On the footsteps of Amazon, the site progressively enlarged its assortment: it sells now virtually anything from mobile phones, to fashion items, to medicine, to travel products.

With big capital injections in 2011 ($100 million), 2014 ($150 million) and 2018 (up to $92 million), Ozon is one of the most well-funded Russian e-commerce companies. Its valuation in the 2018 round amounted to $814.2 million, according to media reports.

Ozon needs financial means to develop its logistic capacities – with a plan to increase them tenfold by 2025 – and increase its market share amid harsh competition. The company is number one among multi-category online retailers in Russia, but only number four in Data Insight’s general e-commerce ranking. It has to measure itself against Wildberries, the current e-commerce leader, which is switching from its initial focus on fashion items to a more diversified assortment.

Other strong contenders for market leadership are LSE-listed Mail.Ru Group, which has made an alliance with Alibaba, and Yandex Market, into which Sberbank injected half a billion US dollars last year.

The Russian e-commerce market may look modest by US standards – it reached $18 billion last year (physical goods only) – but it is entering a promising development cycle with a potential to exceed $50 billion by 2023, according to Morgan Stanley.

Other startup investment and M&A deals in Russia

At a much smaller scale, the other notable deals of last month in Russia included:

- A $7.6 million investment in food delivery startup Instamart, a copycat of US unicorn Instacart, from Mail.Ru Group and top Russian businessmen;

- A $6 million investment in Prisma Labs, the company which made the news in 2016 with its art filter app inspired by neural networks;

- A $6 million capital injection into GetMobit – whose devices “merge phones with computers” in corporate offices – from the company’s founders.

Several acquisitions were made or announced:

- Sberbank, the giant state-controlled financial institution, fully acquired digital job search service group Rabota.ru;

- The bank also announced plans to acquire a 46.5% stake in Rambler Group, a major online media and entertainment group, in exchange for a capital injection of 11 billion rubles ($173 million), according to media reports;

- Steel magnate Alexey Mordashov bought GetLean, a Moscow startup that helps people adopt a healthier lifestyle.

April was rich in fund creations:

- Four state-controlled institutions – GazpromBank, GazpromNeft, RVC and VEB Innovation – announced a new venture fund called ‘New Industry Ventures;’

- Phystech Ventures and North Energy Ventures, two venture capital firms, created a $40 million fund focusing on artificial intelligence, machine learning, and robotics projects

- MTS, a major mobile carrier and retailer, launched a $15 million corporate fund to invest in startups.

Election and acquisitions in Ukraine

While the presidential campaign was in full swing – ending with the triumphant election of showman Volodymyr Zelensky, – a Ukrainian e-commerce marketplace, Jiji, agreed with Naspers the acquisition of OLX properties in several African countries. The amount of the deal was not disclosed, but local media estimated it between $1.5 million and $3.4 million.

April was also marked by the acquisition of a small Ukrainian startup, Captain Growth, by Israeli adtech company Perion. Another Ukrainian startup, AxDraft, raised $1.1 million in Silicon Valley to “commoditize legal services,” while smart blinds startup Solar Gaps received a €1 million grant from the European Commission.

Belarus invites Elon Musk and restores Notre Dame

As part of its strategy to integrate the global market, Belarus is inviting “the most clever and talented” IT professionals from across the globe to settle in this country stuck between Russia and Poland. President Alexander Lukashenko officially called “Ukrainians, Russians, Americans, West Europeans, Indians” to enjoy the “ideal conditions” which will be created for them to work and live in the country.

The ministry of foreign affairs went as far as to invite Elon Musk to “start testing [his] Robotaxi system in Minsk,” the Belarusian capital.

The country’s efforts to boost its international connections could be supported by the American government. At the Minsk Venture Day in early April, as reported by the local media, USAID Assistant Administrator for Europe and Asia Brock Bierman said his organization seeks to develop new ties between the two countries, including business ties in various fields.

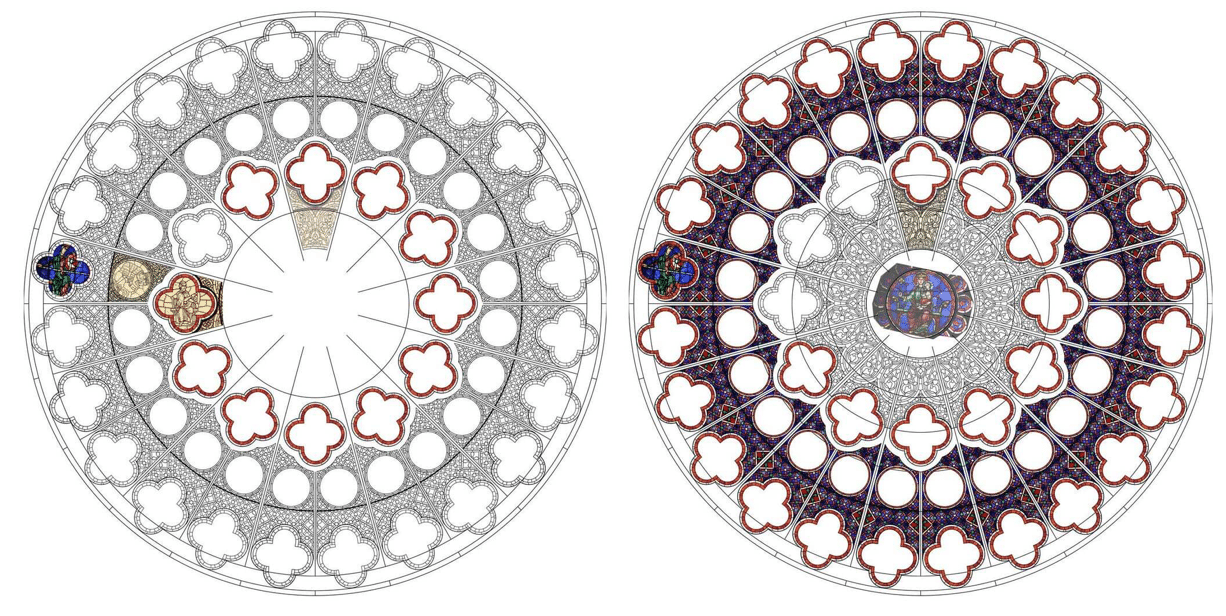

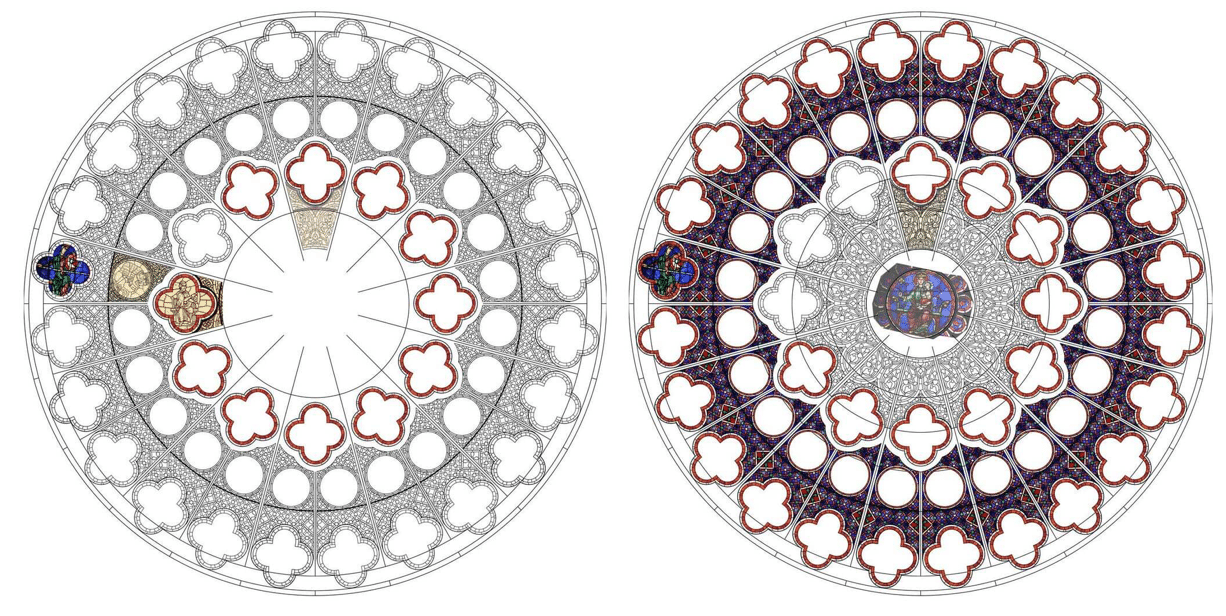

Meanwhile, 3D modeling, design and art studio PBRBN started restoring Notre-Dame’s stained glass windows in augmented reality. According to the local media, this creative team has all the talent and experience required to complete this praiseworthy task. However, the lack of financial means – the team could not afford paid versions of the cathedral’s best 3D models – has slowed down the works.

In Belarus, 3D modeling, design and art studio PBRBN is restoring Notre-Dame’s stained glass windows in augmented reality.

Burgeoning activity in Central Asia

Two noticeable deals took place in the innovation-friendly republic of Kazakhstan. Nommi, one of the country’s most successful tech startups, announced it raised $400,000 in total to date at a $3 million valuation. The money came from local investors, including the investment firm SkyBridge Invest and a few business angels.

Nommi touts its product as “the world’s first intelligent router for digital nomads:” it keeps you connected virtually anywhere in the world with virtual SIM and dual Wi-Fi.

Another Kazakhstani startup, HR Messenger, secured $100,000 from I2BF, a fund with Russian roots operating internationally, and Murat Adrakhmanov, a prominent local businessman.

In neighboring Uzbekistan, as reported by the local media, a bank from Georgia, TBC, spent $5.5 million to acquire a 51% stake in local payment service Payme.

The tech scene in these countries is just burgeoning, but local governments are have begun supporting it actively. In November last year, the reformer-president of Uzbekistan Shavkat Mirziyoyev liberalized investment activity, aiming to attract international investors, in particular in the field of innovation.

Meanwhile, Kazakhstan launched an internationally-oriented tech center, ‘Astana Hub,’ appointing US businessman Joseph Ziegler to head it.

Previous reviews:

Adrien Henni is the chief editor at East-West Digital News (EWDN.COM, UADN.NET), an international news and consulting agency dedicated to tech innovation in Eastern Europe. With nearly 20 years of experience in the high-tech and venture businesses, he advises a variety of startups, investors and other organizations. He is a regular contributor to industry publications and speaks at conferences in Western and Eastern Europe, Asia, and America. Contact Adrien at editor@ewdn.com