6 million inhabitants, 6 unicorns. That’s the Baltic startup scene in a nutshell.

This small-but-mighty region’s tech-savvy innovators have punched well above their weight, and the success stories of such giants as Skype, Pipedrive, and Vinted have laid the foundation for a healthy and thriving startup culture with global ambitions and the capacity to achieve them.

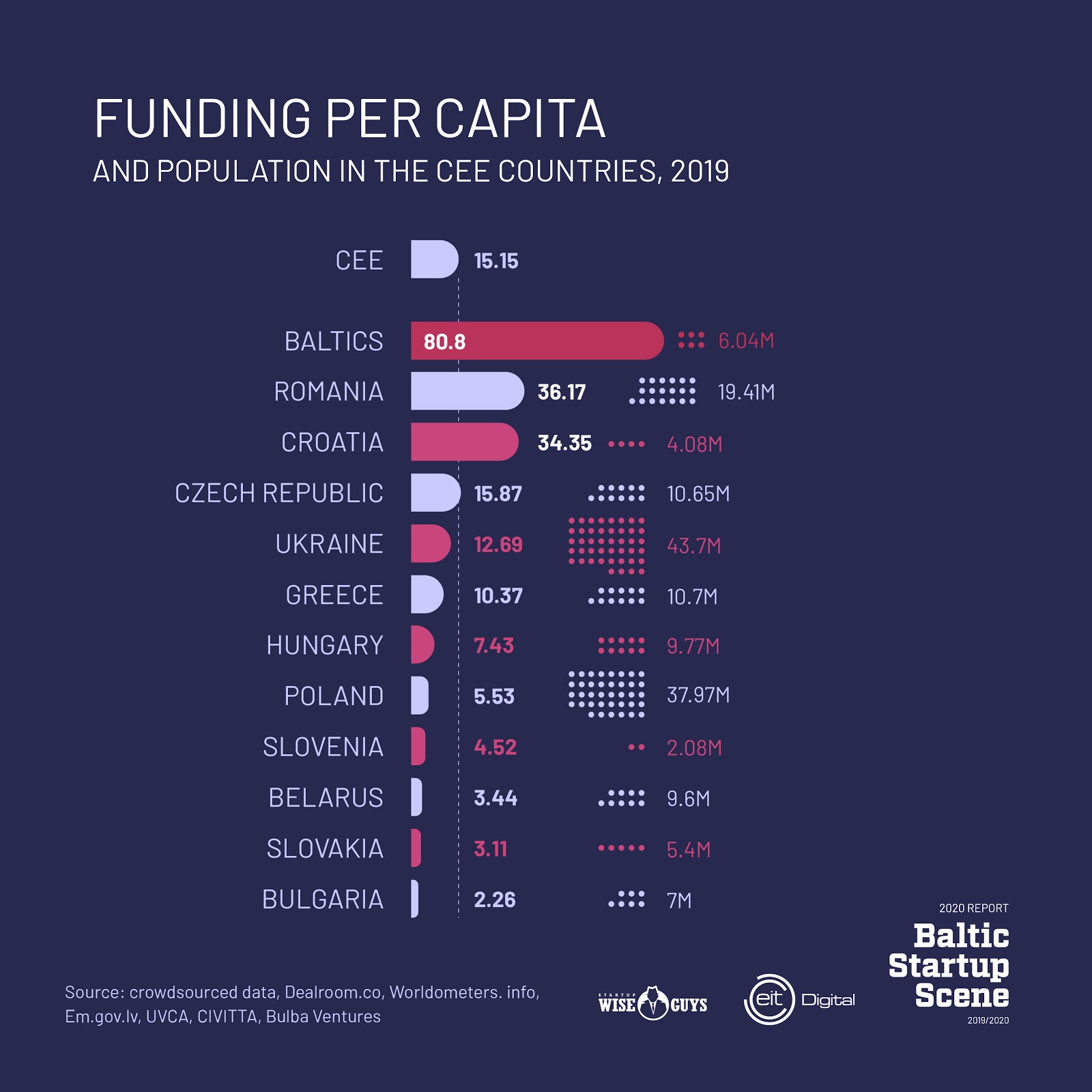

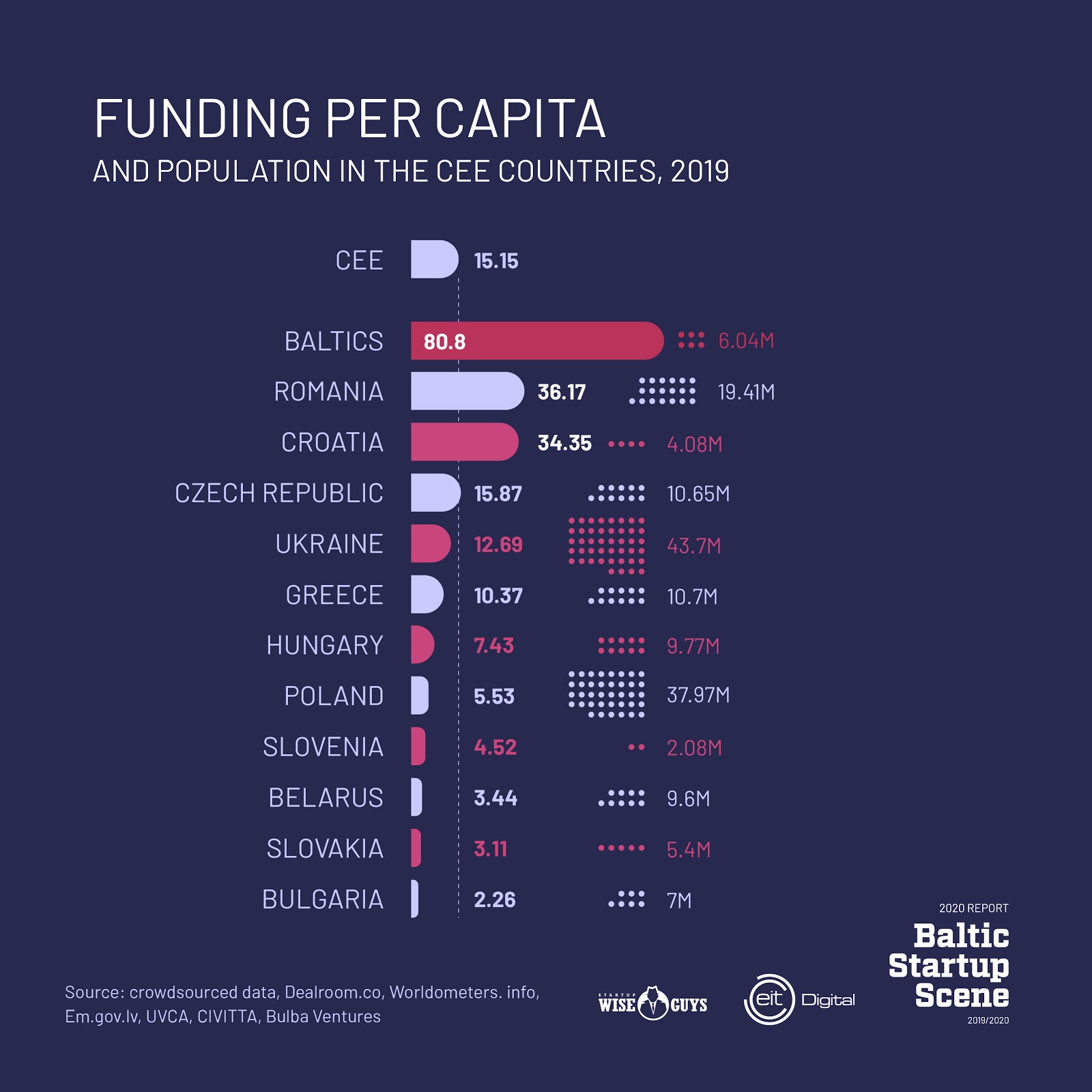

The three Baltic states of Estonia, Latvia, and Lithuania boast five times the amount of funding per capita compared to the whole Central and East Europe region.

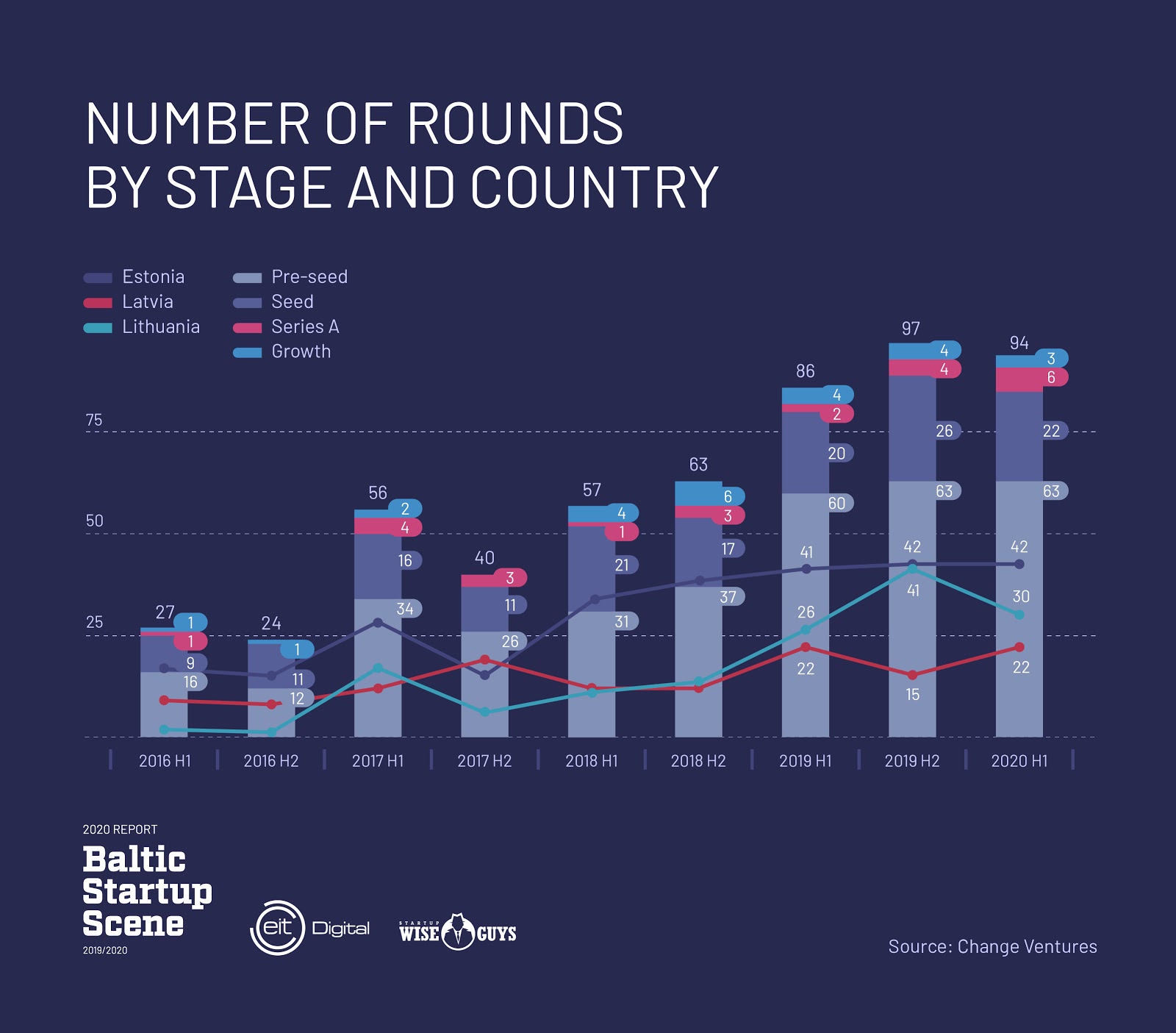

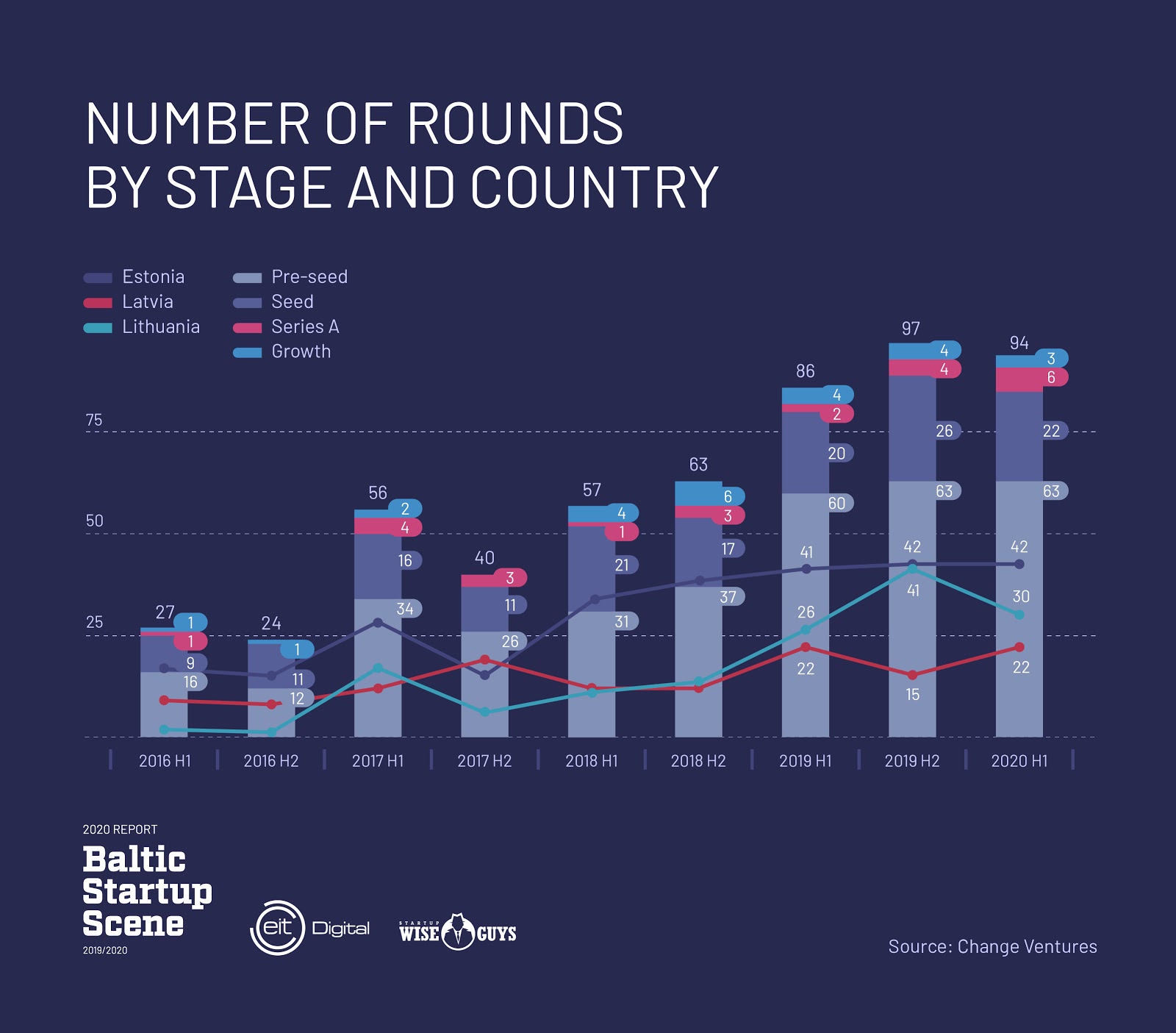

Despite a recent hiccup, with 2019 becoming the first year with a decline in funding, the region has experienced a strong rebound in 2020. According to survey insights and Crunchbase funding data for 2020, investor and startup optimism is growing, with 2020 H1 significantly outperforming 2019 H1 in terms of funding, even with the onset of a pandemic-induced economic downturn.

2019/2020 Baltic Startup Scene report

This year, Crunchbase partnered with Startup Wise Guys and EIT Digital for the third edition of the Baltic Startup Scene report, which offers a comprehensive overview of where the region’s vibrant startup scene is at and where it’s headed.

It consists of 5 main sections – highlighting investment data within the Baltics, benchmarking Baltic results with its surrounding regions, ecosystem insights, a curated list of 150 startups to watch, and deep dive analysis of what 2020 has been like for startups, investors, and the other ecosystem stakeholders and participants.

In this article, we’ll summarize brief insights from the report and share with you the key facts that have helped the Baltics thrive even in the face of a pandemic.

1. The Baltics in a nutshell

The Baltic region, tucked away in North-eastern Europe, consists of 3 countries – Estonia, Latvia, and Lithuania. It’s home to just over 6 million people and 2,577 startups (July 2020). All three countries are seeing sustained growth in startup numbers, with Estonia showing higher growth than usual, partly due to recent national startup database improvements.

For several years, growth in startup numbers went hand in hand with growth in funding, until the two went their separate ways in 2019, as the Baltic region saw its first fall in funding. Notably, however, 2020 H1 has outperformed 2019 H1, with the Baltics looking to close out 2020 on a better note than the previous year.

Of the three Baltic countries, Estonia continues to put up spectacular numbers year after year, attracting the lion’s share of funding, as Lithuania tries to hold its own, and with Latvia trailing far behind.

Many point to Estonia’s early success with Skype as the catalyst for the country’s bubbling and uniquely successful startup culture, which has borne five unicorns. Pipedrive was the latest to join the ranks in November 2020.

Estonia’s fifth unicorn comes almost exactly a year after Lithuania’s first- Vinted. Vinted secured it’s $1 billionB eur valuation after raising $128 millionM eur in 2019 H2.

In terms of funds raised, however, nobody can keep up with Bolt’s (formerly Taxify) yearly $100 millionM+ eur rounds.

While the big guns bask in the numbers spotlight, some of the smaller rounds are also making waves in their own way. For instance, Estonia’s Whatifi surprised everyone by scoring 8.8M eur from individual backers including Netflix CFO David Wells, Supercell CEO Ilkka Paananen, Paypal co-founder Max Levchin, and Zynga founder Marc Pincus.

Latvia’s Mintos also recently made headlines by closing out a $7.2 millionM eur round that was entirely crowdfunded, making it the largest round of its kind on continental Europe and the largest funding round in Latvia this year.

In a nutshell, the Baltics demand attention. The region is at an exciting stage and investors are becoming increasingly aware of this.

In this section of the report you’ll also find:

- Spotted Startups – in the previous edition of the report, many startups with potential were highlighted as Startups to Watch. In this section, we explore which of them succeeded.

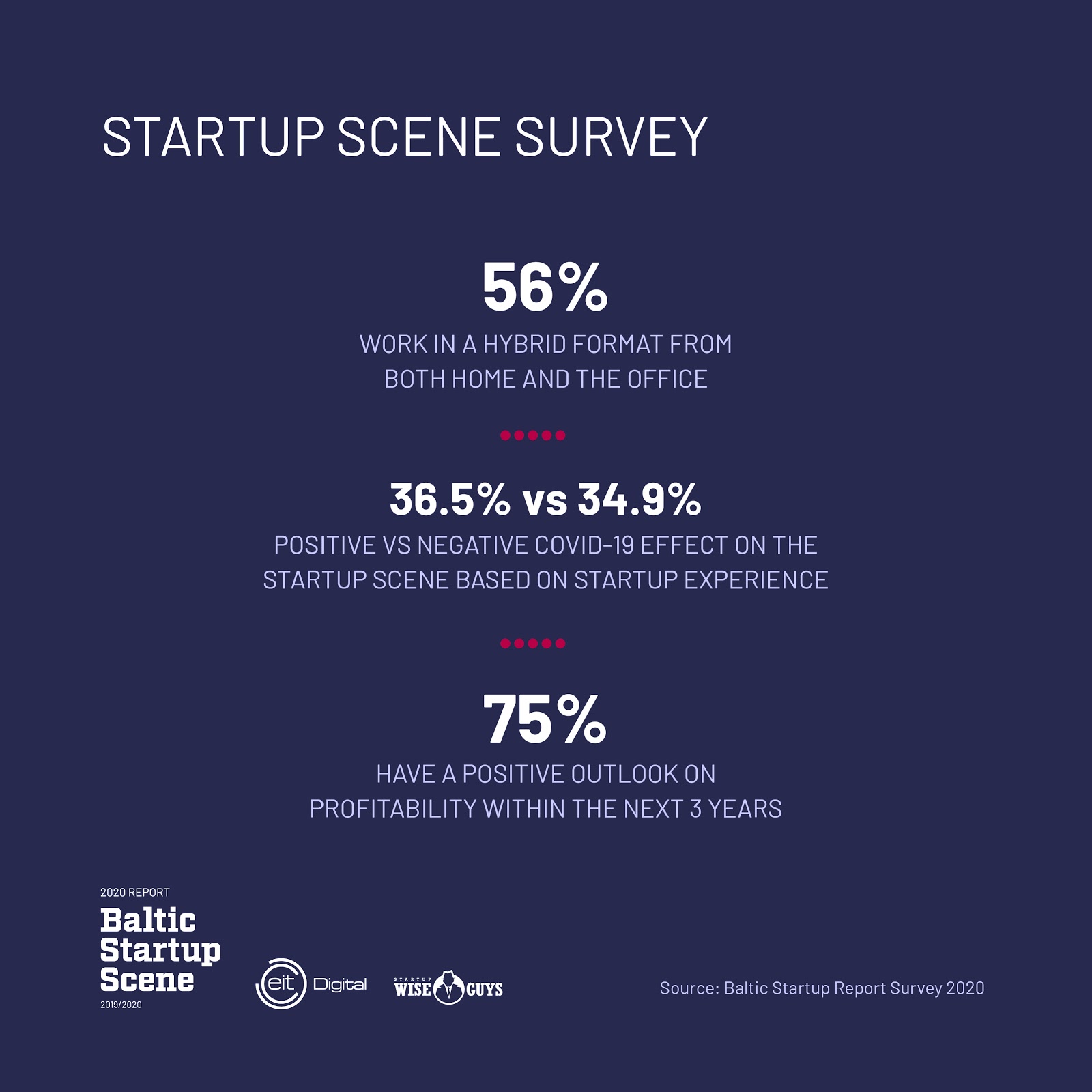

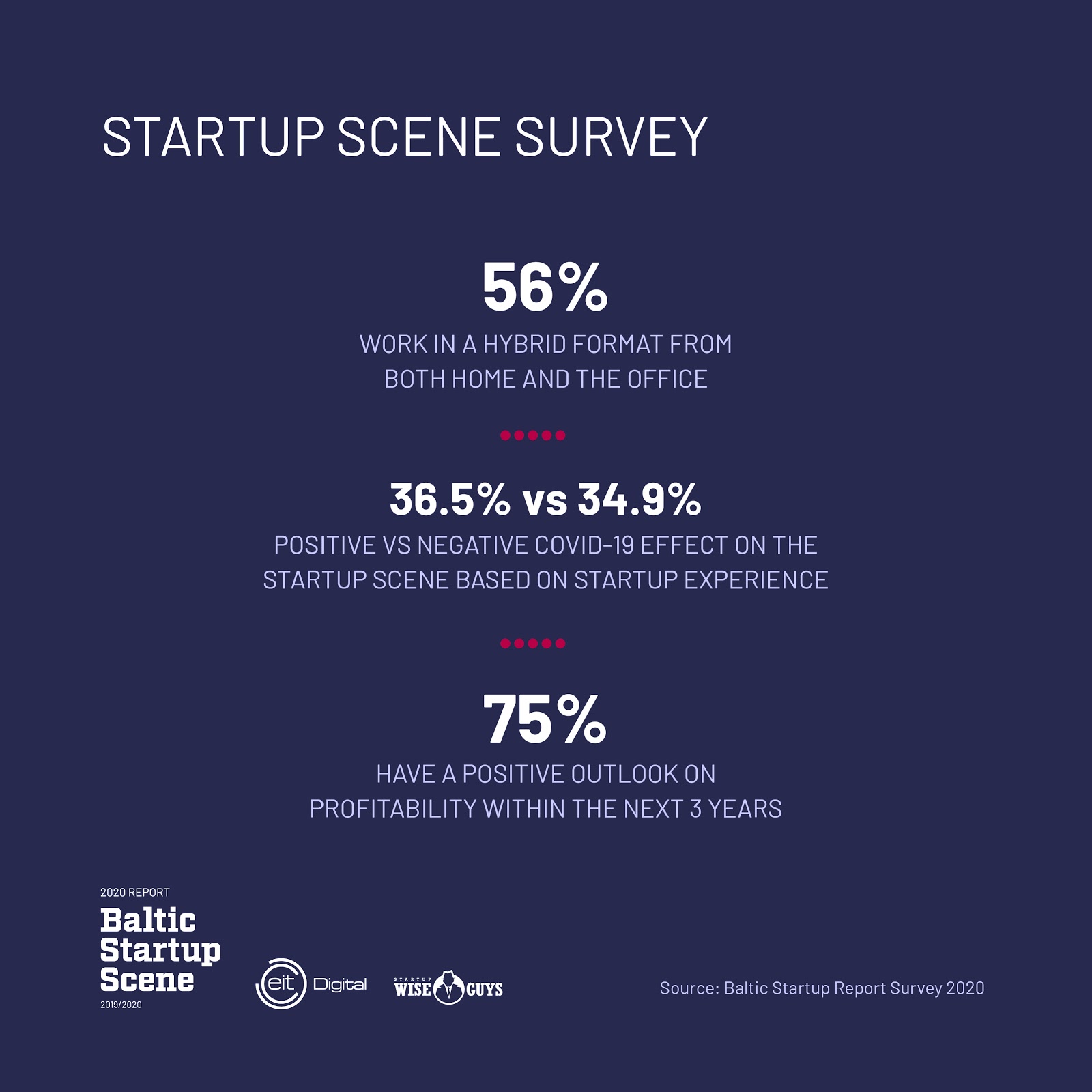

- Startup Scene Survey overview – a quick look at the main results from the startup survey which involved Baltic startups, investors, and other ecosystem participants. The results are explored in-depth throughout the report, particularly in the Deep Dive section.

- More investment statistics, insights, and expert commentary.

2. Baltics benchmarked against CEE & Nordics

Observing the Central Eastern Europe (CEE) region as a whole, Baltic startup funding accounts for almost 20% of total funding.

While Ukraine and Romania are also establishing themselves as major players in the region after closing some significant deals in 2019, the Baltics demonstrated 5x more funding per capita than the 14 countries in the CEE region, averaging 80.80 eur and 15.15 eur, respectively.

This is, however, eclipsed by the 166.91 eur per capita of the Nordic countries who had a standout year with startups such as Northvolt and Wolt landing gargantuan investments.

A strong plus for the Baltics is their moderately low cost of living compared to other startup hubs. Life in Vilnius, for example, is almost twice cheaper than in Stockholm. This results in high standards of living, happy founders, and a longer runway for investment received.

A low cost of living, paired with world-leading digital infrastructure, easy connectivity to all of Europe and beyond, high ease-of-doing-business scores, and spectacular nature are all major attractions of the Baltics, which are often marketed as key selling points to attract businesses and talent to the region.

More than that, the Baltics are actively working on developing welcoming visa regimes.

The newly-launched Estonian digital nomad visa is a bid to attract digital nomads, who often tend to be self-employed, to stay and work in Estonia with an appropriate permit. Meanwhile, both Latvia and Lithuania have developed fast-track visa application processes specifically for Belarusian businesses and their employees, in response to unrest in the region.

All in all, the Baltics are shining bright among their peers and holding their own against bigger players.

In this section of the report you’ll also find:

- How much does it actually cost to live in the Baltics according to startup founders.

- Further details, statistics, and input from startups about visas.

- Accessibility to the Baltics.

- More statistics, insights, and expert commentary.

3. Baltic ecosystem insights

Accelerators, VC funds, Angel investors… for most Baltic players it’s life as usual even as the pandemic rages on.

An influx of EU money into Baltic accelerator funds changed the game for early-stage investments significantly in 2018/2019, and, in a way, also served as a safety cushion for the financial implications that would arise from the pandemic in 2020.

From the surveyed accelerators, none reported a decrease in investments made due to Covid-19. Most maintained unchanged levels of investment, whereas some even increased theirs. Business Angel networks LitBAN and LatBAN reported a similar situation on their end.

One notable trend, however, is the slowly shifting focus of startups, as they increasingly eye corporate-startup collaboration. The majority of surveyed startups are operational – already generating revenue and employing people – and, in terms of fundraising, VCs (78.8%) and Business Angels (40.4%) remain the go-to investment targets. However, corporate partnerships (26.9%) come in third, outperforming both government funds (21.2%), as well as accelerators and incubators (19.2%).

This trend is particularly notable among younger (< 3 years old) startups, who might see this is a more stable and long term funding option.

Diversity in the Baltics

For the first time, the report sought to shine a light on the topic of diversity in Baltic startups. While the report considers several factors, such as education and founder background, the most striking insights relate to gender disbalance.

There’s a surprising scarcity of discussions and information relating to this topic in the Baltic startup scene, which the report looks to change. Uninspiring as the findings may be, you have to start somewhere.

Crunchbase’s database and insights were essential for making this section possible.

“In 2015, Crunchbase added gender-based parameters to its dataset, which made it possible to measure funding received by teams according to gender. Over the last decade, we have seen the percentage of newly-funded companies with at least one woman founder increase from 10% in 2009 to over 20% in 2020”, explains Gené Teare, Senior Data Journalist at Crunchbase.

Unfortunately, the Baltics, despite generally fairing rather well in terms of gender equality, are lagging behind when it comes to startups.

Looking at data from the past 2 years, the Baltics have the same 13% diversity ratio as for the past 20 years, indicating that little to no progress has been made in improving the gender-diversity of founding teams. A particularly worrying statistic, as the world increasingly views woman participation not only as an equality issue, but an acute necessity, particularly in the tech industry, where a talent drought is now one of the top issues.

That said, there is some notable individual progression, as well as some positive high-profile examples, with the Lithuanian unicorn Vinted being a particularly visible one for other women. But it’s certainly not enough.

Nevertheless, the scene has been called out by the report and it will be interesting to see what follows.

In this section of the report you’ll also find:

- Other diversity elements, such as founder background, education, and language proficiency.

- A look at Tech events in the Baltics: what happened during the pandemic and what the future holds.

- List of active VC funds investing in the Baltics.

- More statistics, insights, and expert commentary.

4. Baltic Startups to Watch

Every year the Baltic Startup Scene report compiles a list of Startups to Watch curated by experts and partners, and this year, it’s supplemented by additional data from Crunchbase.

18 startups from last year’s list went on to raise 1-5M eur in funding rounds in 2019/2020.

This edition features 150 startups and out of the 6 verticals featured in this report, B2B and SaaS dominate with 36 startups to watch. Estonian startups lead the B2B and SaaS and Cybersecurity verticals, Latvian startups are taking the lead in Hardware, IoT and Robotics, Medtech and Sustainability, whereas Lithuanian startups remain strong in the Extended Fintech vertical, with a solid foothold in the Transportation, Mobility, and Logistics vertical.

The list is a veritable who’s who of the Baltic startup scene’s hidden gems and serves as a comprehensive glimpse into what’s happening in the Baltics. It can be downloaded separately from the report here: https://mailchi.mp/startupwiseguys/startups-to-watch

5. Deep Dives: Covid-19 and future outlook

The Baltic startup scene has shown resilience in the face of the pandemic. As mentioned above, funding has increased when compared to 2019 and investors show no signs of slowing down.

The Baltic startups themselves are also powering full steam ahead with opinions about the impact of the pandemic on the scene split right down the middle. Surprisingly, it’s the other ecosystem participants who assume the worst.

Positivity in the Baltic scene, however, doesn’t mean business as usual. Far from it. 47.7% admitted to having done budget cuts. A remarkable 45.5% said they have launched new Covid-19-related business initiatives and 43.2% said they have generally pivoted their business model.

This adaptability is clearly paying off and is the by-product of a still blossoming scene for which being quick on your feet is a matter of startup survival, pandemic or not.

82% of all surveyed people now work remotely, of which 56.2% have a hybrid work set up and 25.8% work entirely from home. What’s more, people with a hybrid work setup rate their work-life balance higher than those who are working only from home.

From difficulties with new colleague onboarding to challenges with separating work and private life, these novel work models come with a fair share of issues, however, very few respondents bring up lower productivity as a problem.

Outlook ahead

3 out of 4 surveyed Baltic startups have a positive outlook on startup profitability for the next 3 years and 88.9% plan to raise money in this time period, which pairs well with investor willingness to invest in the region.

Investors have been particularly keen on SaaS and Fintech startups which the Baltics have aplenty, however, more and more investors are eyeing other verticals. All surveyed investors consider (re)investing in the region, being appreciative of the region’s reasonable valuations, highly competent founders and teams, and the “No BS” approach.

The main takeaway is, when it comes to Covid-19, the Baltics are unphased and ready to continue their upward path rain or shine.

Conclusion

We have scratched the surface. The Baltic Startup Scene report explores the topics covered in this article in much more depth and offers expert commentary on trends, highlights major shifts, and provides unique insights about the scene from the people that are shaping it.

This year’s report stands out thanks to partnerships with Accenture, Change Ventures, UK Trade & Investment, Crunchbase, and other organisations, all of whom have helped enrich the report with data and expert insight, culminating in the largest-ever and most comprehensive report about the Baltic startup scene.

The Baltic Startup Report is a joint effort between Startup Wise Guys and EIT Digital.

The report is free of charge and available for download at: http://startupwiseguys.com/report

Cover photo by Leo Roomets on Unsplash