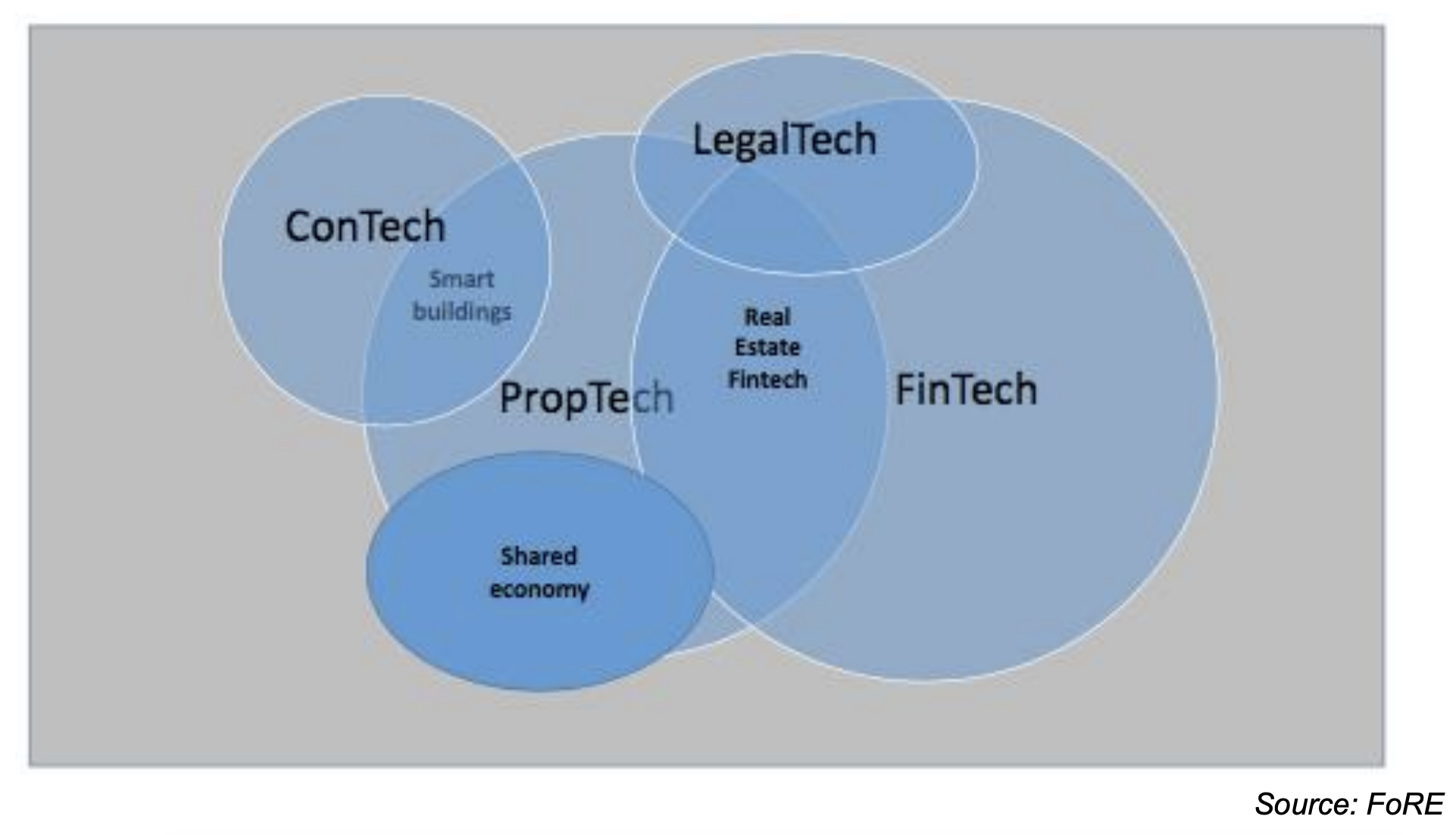

The real estate industry is traditionally a slow-moving asset class. The recent hype around real estate technology or ‘PropTech’ stands in stark contrast to this traditional view on real estate. PropTech entrepreneurs, tech evangelists and scholars predict a ‘digital disruption’ of the industry and a digitalised global real estate market.

In Proptech 2020: The future of real estate, the Oxford Future of Real Estate Initiative investigates these claims with the use of Crunchbase data, and theorises about the potential effects of PropTech on value generation, data, and competition in the real estate industry. Their analysis shows that users and owners of real estate need to become aware of the value of data they are generating in buying, renting, or managing real estate in order to benefit from the efficiencies gained through PropTech solutions.

The data

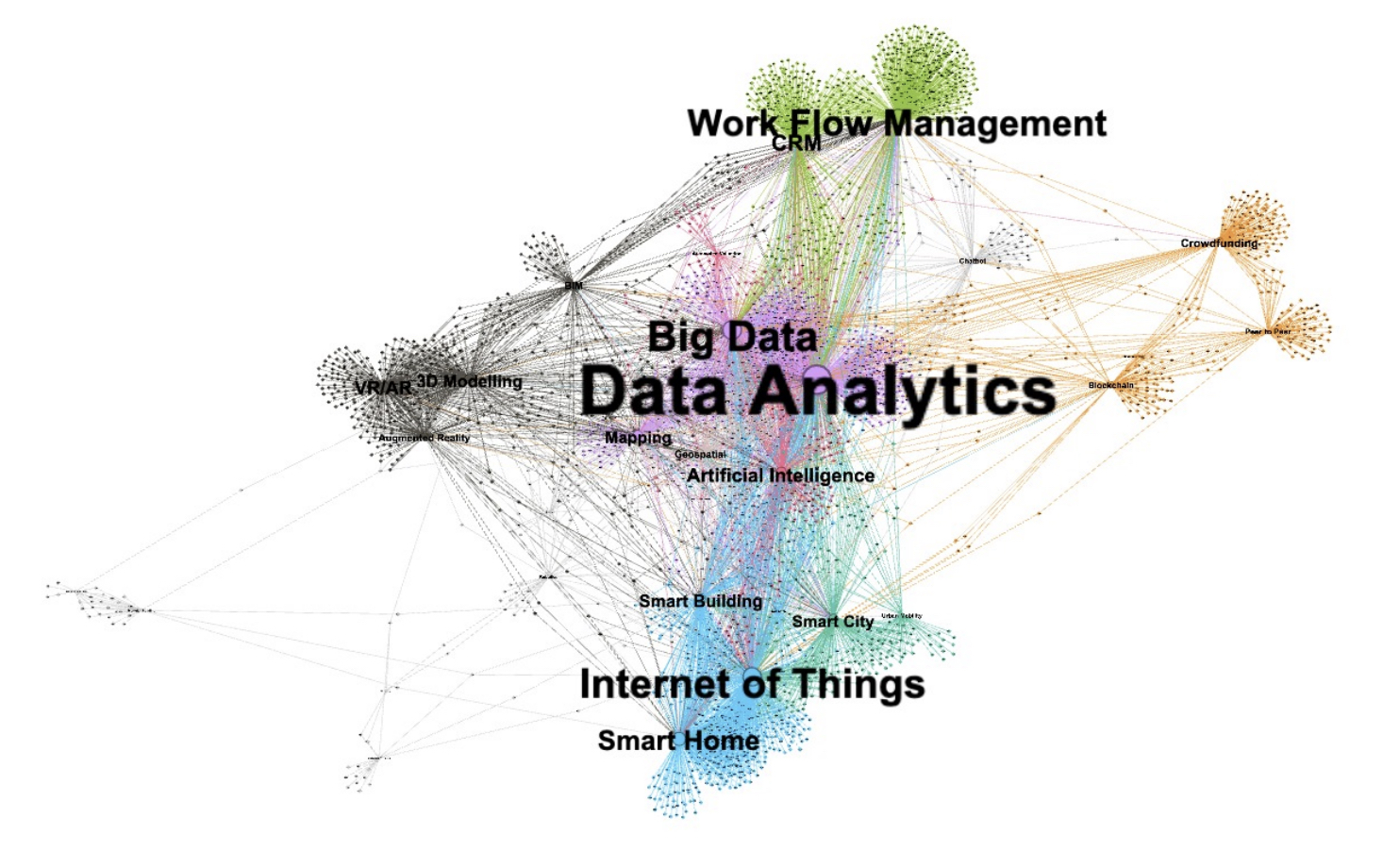

The authors of the report investigate data from more than 7,000 PropTech firms based on Crunchbase data. In order to investigate the specific role of technological trends that are at work in PropTech, they combine the Crunchbase data with additional information from Unissu, a PropTech data provider. In bringing together data from both platforms they generate the largest, most comprehensive dataset available to investigate the PropTech industry. The unique data set is the basis for the subsequent network analysis uncovering the importance of different technologies within the universe of PropTech companies and the growth of the PropTech market.

Data Analytics is at the core of the Property Technology network

The network analysis reveals that PropTech mainly consists of six tech clusters. Data Analytics forms a large cluster at the core of the network, connected with Smart Buildings and VR/AR technologies. ConTech (Modular Building) and Blockchain / Cryptocurrency technologies form rather small groups at the periphery of the network.

The network perspective shows that the most important technologies in the PropTech market are those that produce digital data (Smart Buildings, Smart Home, Sensors), and those that generate value from the data (Big Data and Data Analytics). Other hyped technologies like Blockchain or Cryptocurrency remain peripheral. A lot of money goes into data technologies in PropTech and they are ready for commercial application in real estate. Smart home devices offered by companies such as Google or Amazon are just the first examples of this rising trend.

Funding in PropTech is growing exponentially

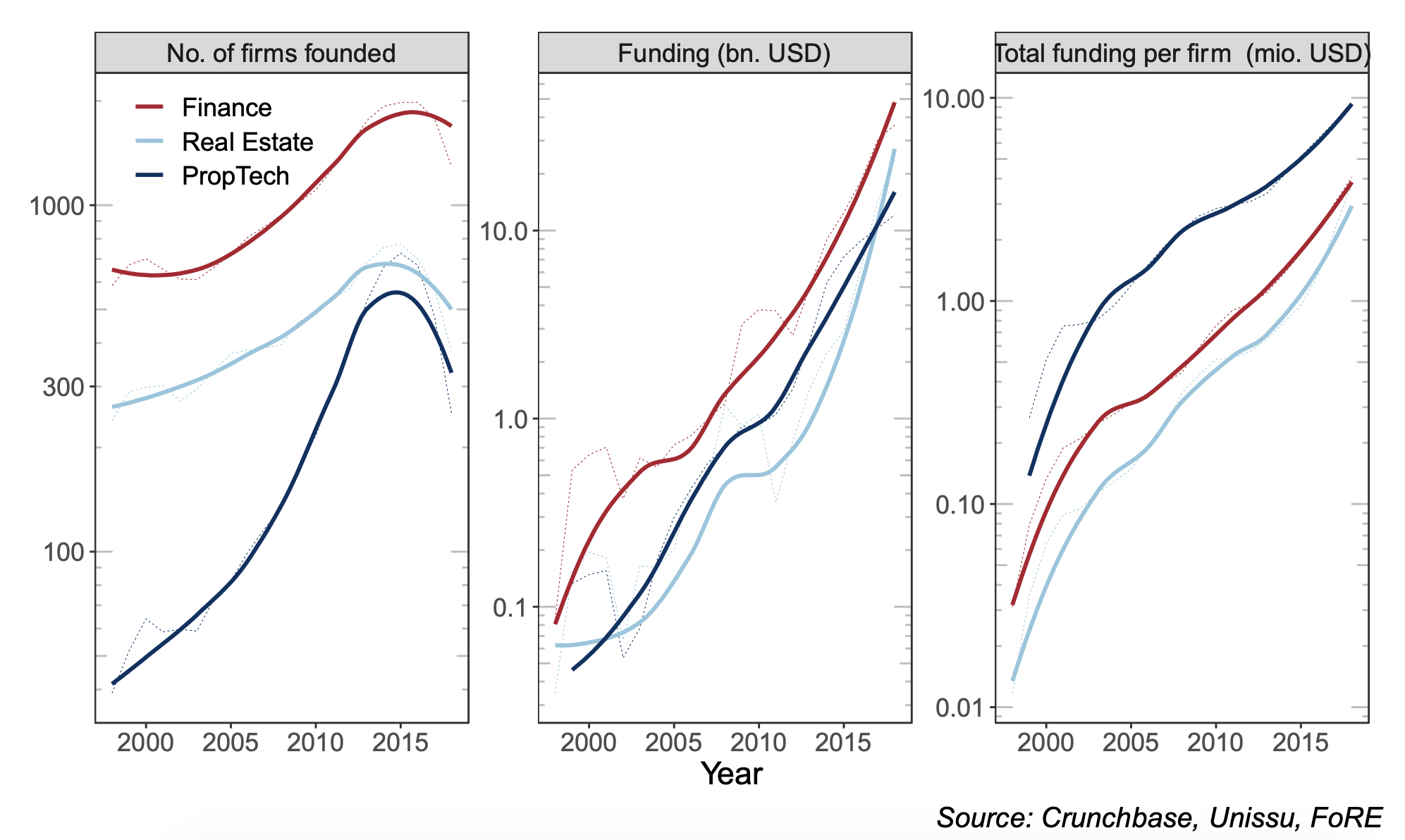

Thanks to the granular time resolution of the Crunchbase data, the researchers could compare the development of the PropTech industry over the past 20 years with two other related industries – real estate (i.e. non PropTech real estate firms) and finance.

The figure shows the number of firms founded, total funding, and funding per firm in (i) PropTech, (ii) other real estate firms, and (iii) firms active in finance from 1998 – 2018. The left panel compares the number of newly founded firms per year in the three sectors. It reveals the maturation of the PropTech industry: after a first phase of slight growth from 1998 to 2003/2004; the sector grew exponentially from 2005 to 2014, and saturation started in 2015. In contrast to the number of firms, the funding (central panel) grew exponentially in all three sectors for the last twenty years with rising growth rates for PropTech, leading to PropTech being the industry with the highest funding per company (right panel).

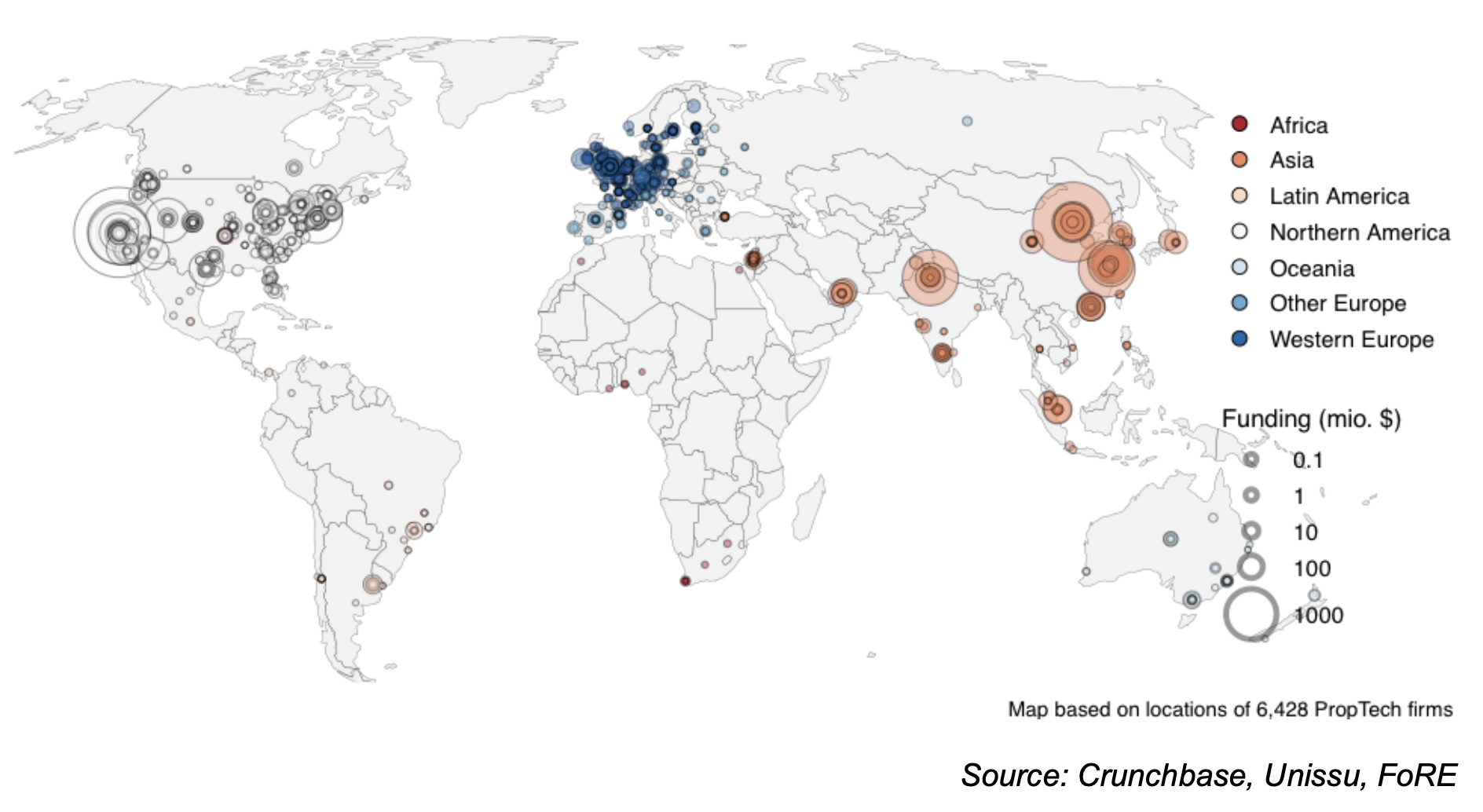

PropTech is a global phenomenon

PropTech start-ups are distributed all over the world. As shown in the map below, PropTech firms are based all over in North America, Europe, Asia, and Australia. Despite the global scope, most PropTech companies cluster geographically. Hotspots of the PropTech industry are California (Silicon Valley), the US east coast, Western Europe (in particular the London Region), and metropolitan areas in Asia (Delhi, Shanghai, Beijing, Seoul, Singapore). Compared to these places, most other regions of the world have much less developed PropTech sectors.

Conclusion

PropTech is challenging the real estate industry. Thanks to exponentially growing funding, it has become increasingly important in real estate and it is a global phenomenon. PropTech has been praised for introducing efficiency gains and innovation in a traditionally slow-moving industry. The analysis shows that it is data analytics technologies that are at the core of the PropTech trend, which has important implications for the real estate industry.

The core business of real estate might remain material and space-based, but the PropTech boom proves that essentially all information around using, managing, or owning real estate can be digitalised. Such a digitalised market might bring substantial efficiency gains, but it could also change the whole fabric of the real estate market. The real estate market has not yet turned into a data monopoly, but digital giants have made first steps into the market in designing smart home devices. In order to participate from the efficiency gains that come with innovation and digitalisation, users and owners of real estate need to become aware of the value of the data they are generating in renting, buying, or managing real estate. They need to more actively engage in the generation and collection of digital real estate data, which will become a valuable asset class in its own right.

Read the full report here