New York City-based think tank Center for an Urban Future (CUF) published a new report, titled New York’s New Jobs Engine, which finds that the tech sector has matured over the past decade to become the city’s single-most important economic engine and most reliable source of new middle- and high-wage jobs.

Published jointly with Tech:NYC, the report reveals that the tech sector has accounted for a remarkable 17% of New York City’s entire job growth since 2010, growing 7x as fast as the city’s overall economy. Tech’s share of all private sector jobs in the city has doubled since 2010, from 2.6% to 5.2%.

Utilizing data from Crunchbase, along with an analysis of state and federal labor market data, the study examines the growth rate of tech jobs compared to other industries, the sub-industries within tech poised to drive future growth, and the emerging core strengths and competitive advantages that set New York apart from other tech hubs.

A surge of startup growth

The report’s analysis of Crunchbase data reveals that New York City is now home to 25,451 homegrown tech startups, compared to 10,349 in 2011—a 145% increase.

New York City is now the U.S. city with the second-highest number of tech startups—only the San Francisco Bay Area, with 31,194, has more. New York has nearly double the number of tech startups as Los Angeles (14,959) and nearly 4x as many as the Boston-Cambridge Area (7,623). New York also lands well ahead of other growing metropolitan hubs like Chicago (6,995) and Miami-Fort Lauderdale (6,807), and has more tech startups than Seattle (5,011), Austin (5,335), Dallas-Fort Worth (5,664) and Denver-Boulder (5,830) combined.

Fast-growing subindustries

CUF’s report also used Crunchbase’s data to produce detailed insight into the fastest-growing subindustries in New York City’s tech sector. The city has experienced startup growth of at least 35% in 37 different tech fields since 2016—from blockchain to real estate tech, women’s and family tech, artificial intelligence, e-learning and augmented reality. For example, wellness startups have seen a 107% increase (from 205 firms in 2016 to 425 in 2021), personal health startups have grown 87% (from 89 to 166 firms), AI startups have expanded 85% (from 407 to 752 firms), and e-learning companies have grown 47% (from 120 to 176).

Notably, New York City is now home to 123 startups focused on providing products and services to women, a sharp uptick from the 83 firms that did so just five years ago. This list includes Maven Clinic, a woman-led telehealth company that, this year, became the first and only U.S. unicorn dedicated to women’s and family health.

Growing community of NYC-based investors

Using Crunchbase’s data, CUF found that the number of active New York City–based tech investors has grown exponentially over the past few years. In 2010, New York City was home to just 621 VC firms. Now, the city sits at 1,790–a 188% increase.

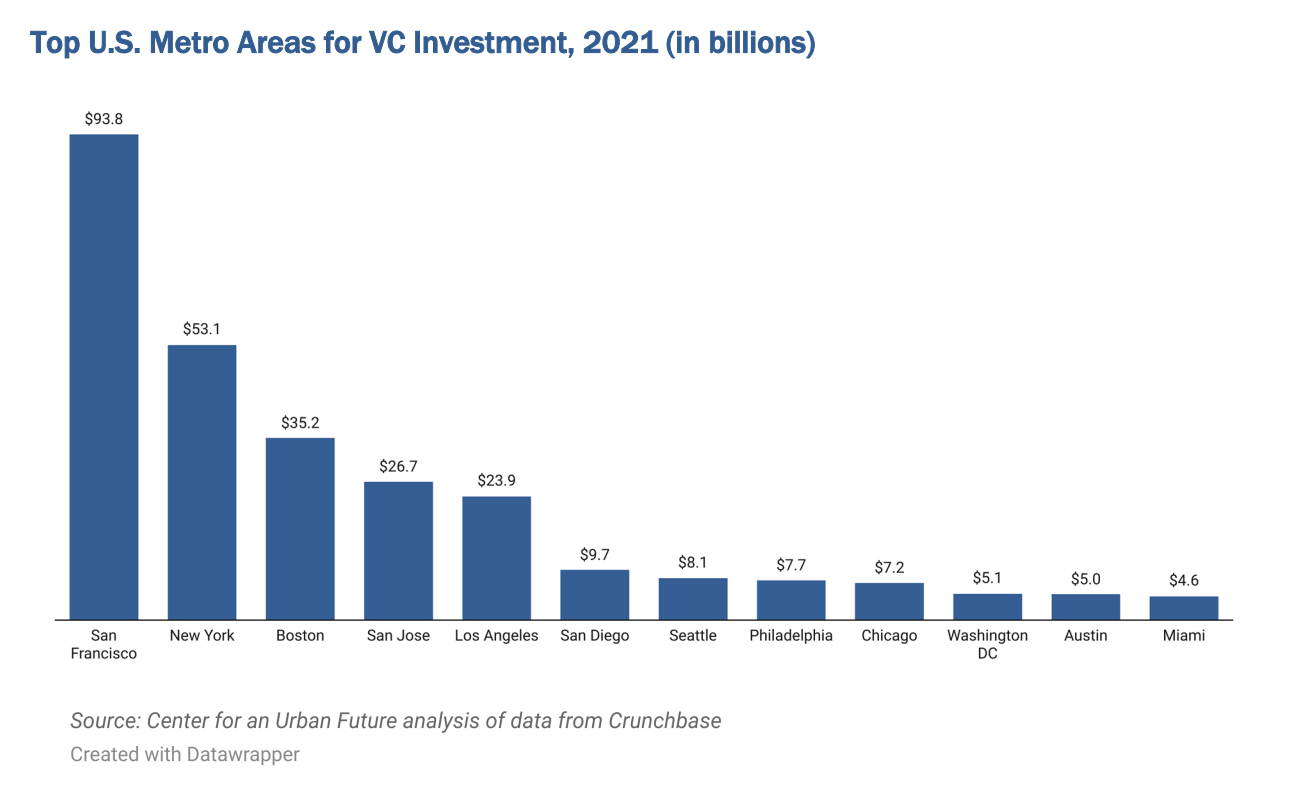

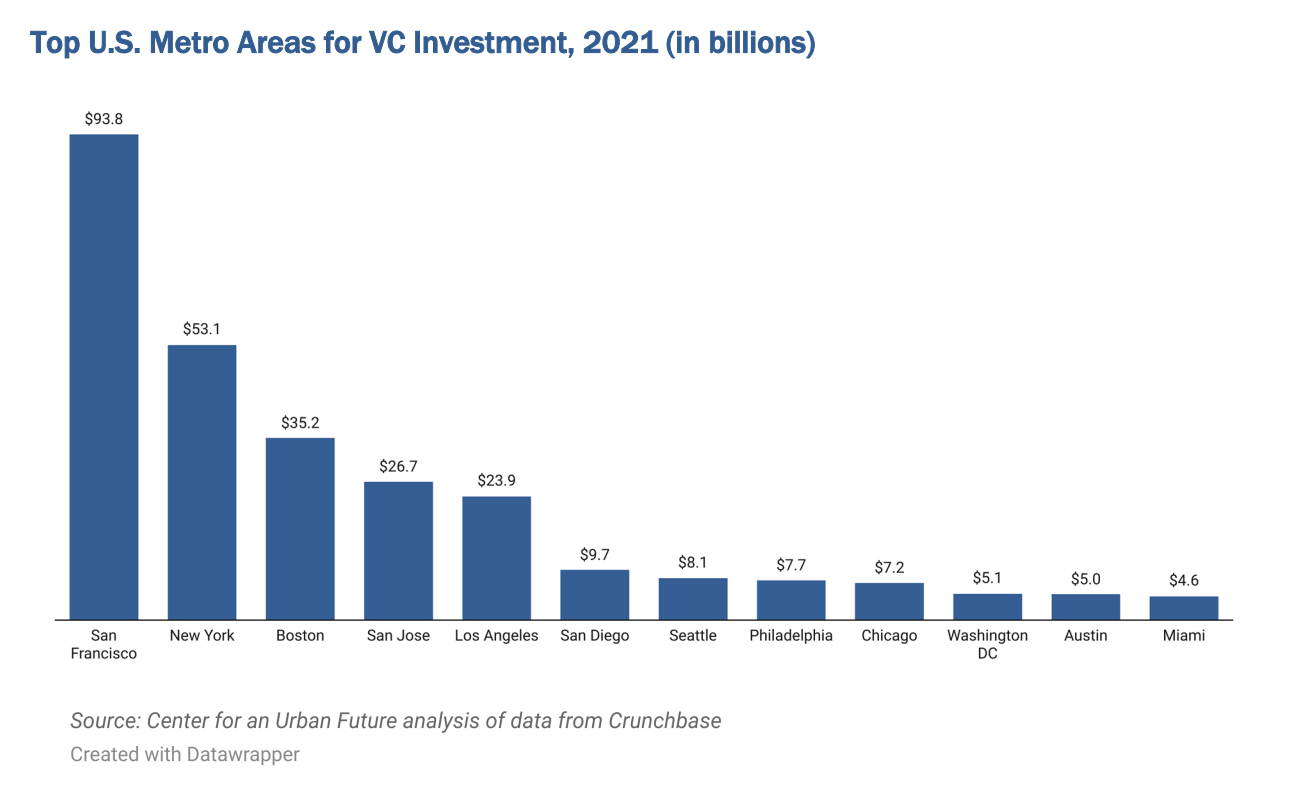

New York City’s expanding venture capital ecosystem has helped the city emerge as the second-strongest region for VC funding at $53.1 billion, across all U.S. metro areas in 2021, behind only the San Francisco Bay Area with$93.8 billion. New York also experienced the largest increase in venture capital investment of any U.S. metro area between 2012 and 2021.

“The script has totally flipped,” said Isaac Oates, the founder of Justworks, a Lower Manhattan-based payroll and employee-benefit software startup, who spoke with CUF for this report. “When we tried to raise money for our last startup in early 2009, I don’t think we even talked to a VC firm in New York.”

As much as New York City needs this tech growth to continue—the city still has 173,000 fewer jobs than it did before the pandemic—the report concludes it is by no means a given. Indeed, CUF’s research found that New York is facing new challenges that emerged during the pandemic which could dampen the industry’s growth in New York. This includes the rise of remote work, which has made talent more mobile than ever; a shortage of affordable housing; and growing competition from several other cities that—unlike 10 years ago—now boast dynamic tech ecosystems of their own.

The report includes more than a dozen policy recommendations that would help New York keep this job growth going and greatly expand access to tech careers. While the ideas include everything from targeting international technology companies to set up offices to making it easier for New York-based startups to compete for city procurement opportunities, the most important recommendations involve people, including:

- Prioritize investments in parks, transit, safety, culture and affordability—all of which are key to retaining and attracting talent, which is key to New York’s continued strength as a tech hub.

- Ramp up investments that will greatly expand access to tech careers for New Yorkers—from computing education in K-12 and scaling up the most effective tech training programs to harnessing City University of New York as a springboard into tech roles.

Read the full report here and explore all the data findings. Coverage of the report includes:

- There are now more tech jobs than Wall Street Jobs in NYC, Crain’s New York Business

- Tech Put NYC’s Job Market on its Shoulders During the Pandemic, Commercial Observer

- Mayor Adams talks tech with new report from the Center for an Urban Future, PoliticsNY

The Center for an Urban Future is a leading think tank focused on building a stronger and more equitable economy in New York City, and expanding economic opportunity for all New Yorkers.

This article is part of the Crunchbase Community Contributor Series. The author is an expert in their field and we are honored to feature and promote their contribution on the Crunchbase blog.

Please note that the author is not employed by Crunchbase and the opinions expressed in this article do not necessarily reflect official views or opinions of Crunchbase, Inc.