Howdy!

I’ll bet you an Impossible Burger you’ll have at least 30 new accounts to outbound once you finish this article.

Still have your Google Sheet bookmarked from Part I? If not, you’ll want to reread Part 1, as this is a successive series. You’ll be using this sheet to help you build your own Outbound Growth Index.

Bonus: Think of a clever codename like “Operation: Pipeline” or something that will mean something to your team (versus the 90th report buried in your CRM). You can also take credit for this in your next internal meeting. You’re welcome.

But first, a pulse check. If you had to sell 1,000 Cutco knife sets as fast as possible, which option would you choose?

- Option A: Go door to door, 10-plus hours a day. Grind it out. Charm the Mrs. Joneses of the neighborhood and outwork everyone else. “I’m a people person, just give me a chance to sell them and I will.”

- Option B: Sit outside of Williams-Sonoma during peak hours (10 a.m.-2 p.m.) with a small stand. You can assume everyone in that store has an intent to shop for kitchen supplies, which may include knives. Look for the people who walk out empty-handed. Maybe pose a question to them, like “Hey there, did you find what you were looking for? Oh, it’s too expensive? Interesting. My knives have similar quality, but half the price. The only difference is the small logo in the bottom right.”

There’s no right or wrong answer, but if you can’t already tell, this article is designed for the Option B crowd. I want to help get you outside Williams-Sonoma to catch the right peopleat the right time.

OK, enough of the fluff. Let’s jump in.

Here at Crunchbase, we’re big believers in account-based selling (ABS). Check outNeal Patel’s article on this if you need a refresher. That said, all of the strategies you’ll see below are in line with an ABS mindset. Why, you ask? Well, you can have a kick a$$ demo with a lead, but if the organization is not in a position to move forwardwith your product, the only thing you’re getting out of it is a new LinkedIn connection.

Here are the four campaigns you can begin running to formulate your Outbound Growth Index. You can use one or a combination of these strategies:

First, a few key assumptions:

- The highly scored customers (from Part 1) you recently signed on are solving a business critical need. There’s a good chance their competitors are trying to achieve similar goals or at a minimum would care to learn more about what their competitors are doing right now. “But Shamus … we’ve already run this campaign in the past.” Oh, really? Unless you’ve run this campaign in the past 60 days, or have signed on every single look-alike competitor to your top clients, run it again. 🙂

- (Qualified) Inbound leads are your north star for outbound targeting. When someone submits a “talk to sales” form, they know they’re about to get bombarded with calls/emails, similar to walking by the perfume section of Macy’s. Despite that inevitability, they still want to learn more from you. Prospects are not taking demos for fun right now and the request is likely stemming from a departmental OKR or executive-level goal they are tasked with researching.

- Everyone is trying to cut costs and retain customers. Take those questions out of your BANT (Budget, Authority, Need, Timing) sheet, it’s a given.

- Cadences should:

- Be mobile-friendly;

- Have a personalized intro;

- Mention cost savings and/or retention; and

- Have a call to action for a 15-minute consultation (not a demo).

If you’re looking for more in-depth strategies, there’s a ton of great content out there for step-by-step processes and what to think about. These two stick out to me:

- How to Adapt Your Sales Process During COVID-19 by John Barrows and Doug Landis

- Flip the Script: Personalization at Scale by Becc Holland

With these assumptions in mind, let’s dive into each strategy.

1. Look-alikes for top-scored (recently signed) customers

This should be the first campaign you run because it has the highest likelihood of landing a similar Total Contract Value (TCV). Whale hunting, some call it.

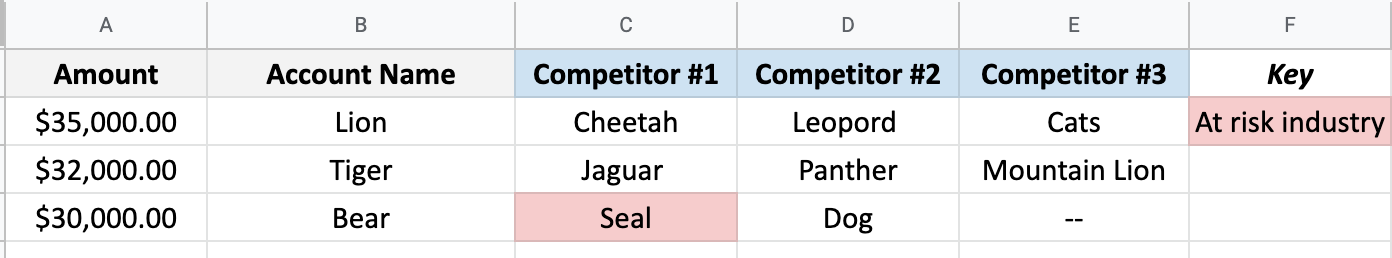

- Start a new tab in your Google Sheet with your top-tier, recently signed customers (remember that these are the highest TCVs). Create 3 new columns titled “Competitor 1, Competitor 2 and Competitor 3.” Whether they truly compete against each other or simply have a similar product, it doesn’t matter. All you need to do is find companies with the strongest correlation to your top-tier customers.

- Google all of your top-tier customers and see who is running paid ads against them. You’d be surprised to see how often this changes. You can also use free resources like Owler and G2 to see who they compete against and all of the relevant players in their space.

- If you have 15 highly scored customers (from Part 1), you should be adding 1-3 competitors to reach out to. If we go off this example, you’ll have 15-45 new accounts to go after.

- Take this list and cross-reference it against any at-risk industries to eliminate them from your list (you shouldn’t be calling into a corporate business travel platform).

Action items:

- Assign these accounts to AEs based on existing territories or ownership. If you have any greenfield accounts, assign it to a challenger rep.

- Cadences should becentered around FOMO (fear of missing out) and a free trial. More to come in Part 3 on that.

2. Inbound spider web

Let’s keep expanding on the look-alike model. It works, trust me.

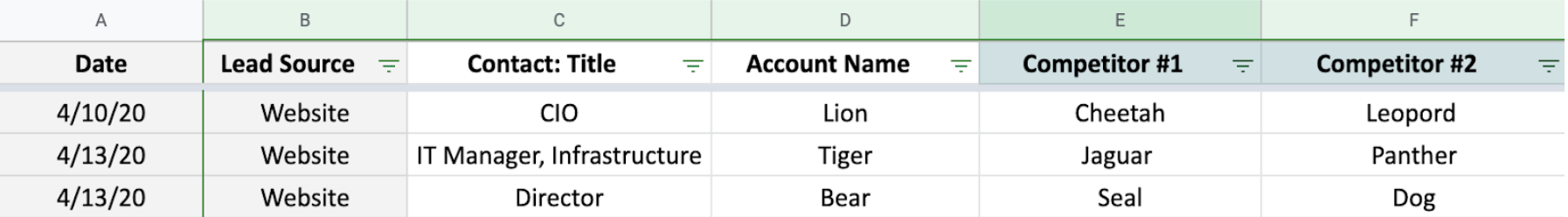

- Pull a list of all of your qualified inbound leads from the last 60 days and drop them into a new tab.

- Run the same exercise as above, but for finding their competitors or look-alikes. Again, this shouldn’t be a massive list. Maybe you only have 20-30 solid inbound inquiries over the past month. IT’S OK: quality > quantity.

Action items:

- Run a report every Friday morning to pull all of your inbound (qualified) leads for the week.

- Research 1-3 competitors and add them to your Google Sheet. Review with sales leaders to ensure it’s a fit. If it’s deemed a “yes,” add them to your CRM (it’s not as black and white as the look-alikes for your top customers, so go through this with a fresh set of eyes).

- Option A: put them into a marketing drip campaign

- Option B: assign them to outbound SDR’s to go after the following week

You have to be nimble and quick, so choose wisely.

3. Going after incumbent providers (cough.. competitors)

You said you were willing to roll your sleeves up, right? This cadence is not for the faint of heart. But I want to be very clear about this tactic. Do not sling mud. Save the soapbox speech about how you’re better than your competitor for happy hour. There’s a fine line between insulting and thoughtfully presenting facts, and here’s how you can walk the tightrope and survive. Before telling you how to find companies using your competitors’ solutions, it’s important to know how to approach this.

Golden Rule: Always speak in the third person, and ROI >opinions.

Bad: “I know a customer who ripped and replaced Acme and went with us and they love it!”

Good: “One of our customers noted that after replacing Acme with our solution, they noticed a 22 percent decrease in cost savings in the first 30 days.”

All of your cadences should mention (in order): estimated cost savings, incremental and/or new value, and ease of implementation. Also, don’t add any case study attachments or links–quotes or bullet points only.

Important: They need to know if it’s a rip and replace or a complementary service.

If rip and replace, you need to be upfront about the resources they need to do this (2 weeks or 2 months?). This is what prospects want to see:

- “Acme noted that it took a few weeks to replace an incumbent provider they had been working with for five years and finally pulled the plug. They needed a technical lead, business champion and a marketing associate to execute this successfully. Expected time: 2-4 weeks.”

If it’s complementary, what’s the incremental value add?

- “Most of our customers use us in tandem with Acme. We help fill gaps around mobile security and encryption, which leads to 0 percent downtime across all platforms. Otherwise, we’ve heard customers note a 15 percent to 20 percent downtime”

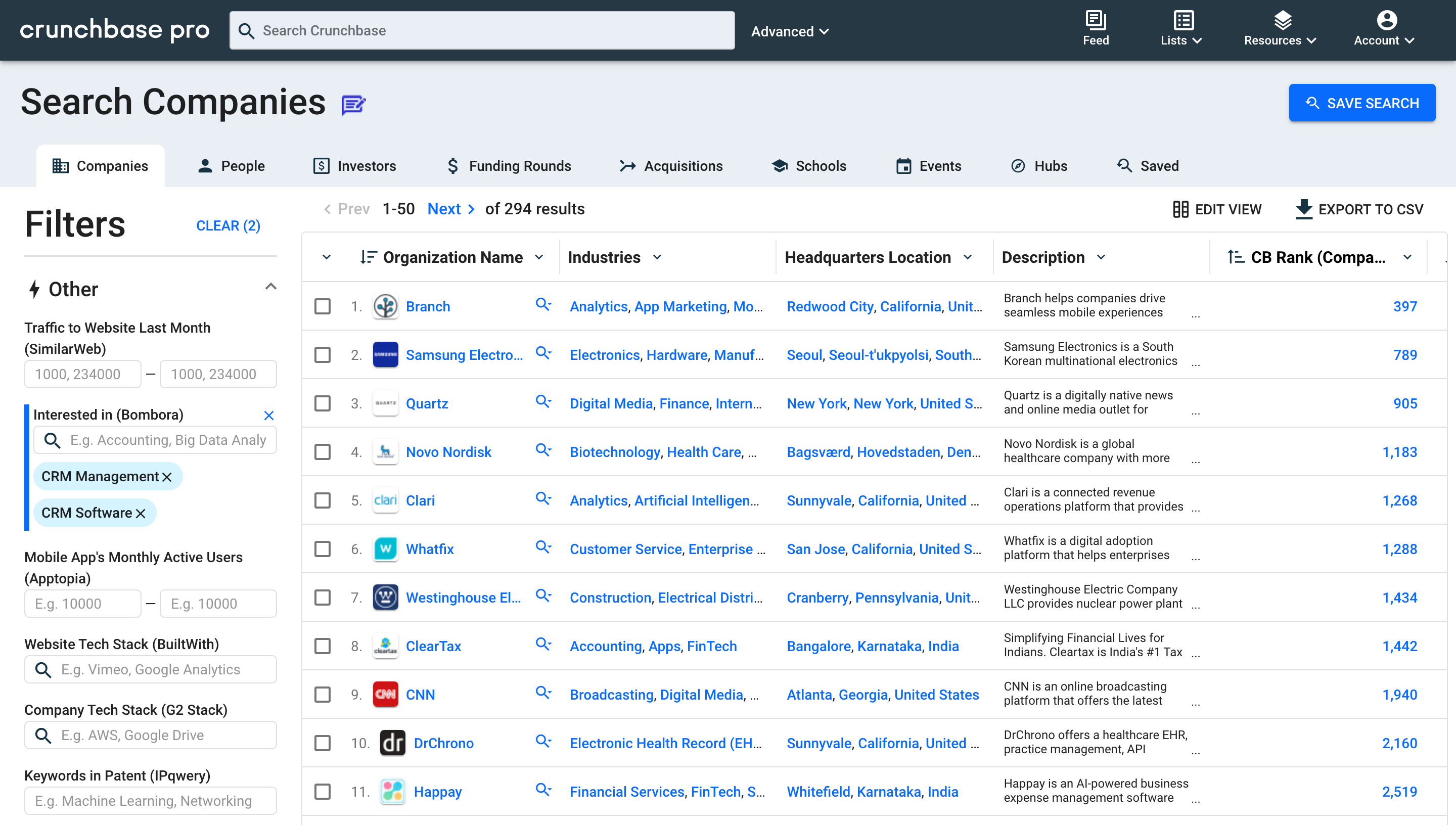

OK, it’s time to find those accounts. Here are a few ways to do this for free (for a longer-term solution for finding current installs, check out G2).

Go to your competitors’ websites and see who they’ve done a case study with. Go and prospect into their competitors, knowing they likely are using the same products. I’ll repeat that: If Acme is your competitor, look on Acme’s website for any case studies. If “Mountain Lion” is one of their case studies, go after Mountain Lion’s competitors. Are you following the spider web? Good.

A few other ideas to monitor what your competition is doing (assume the same logic and process as above):

- What events are they sponsoring (webinars, newsletters, etc.)? See who the end users of these webinars and newsletters are being pushed out to.

- Monitor their Twitter feed to see who engages with their content. Who follows their organization? Who is liking and engaging with it (outside of their own employees)?

- Find blogs or articles that talk about pain points your company solves. Check Quora, Twitter, Medium, etc. Who’s commenting or liking?

OK, now you should have a solid list of accounts to add into your outbound cadences. Hopefully that’s another 15-30 accounts.

4. Intent Rules Everything Around Me (I.R.E.A.M)

Hopefully this campaign helps you live the C.R.E.A.M lifestyle.

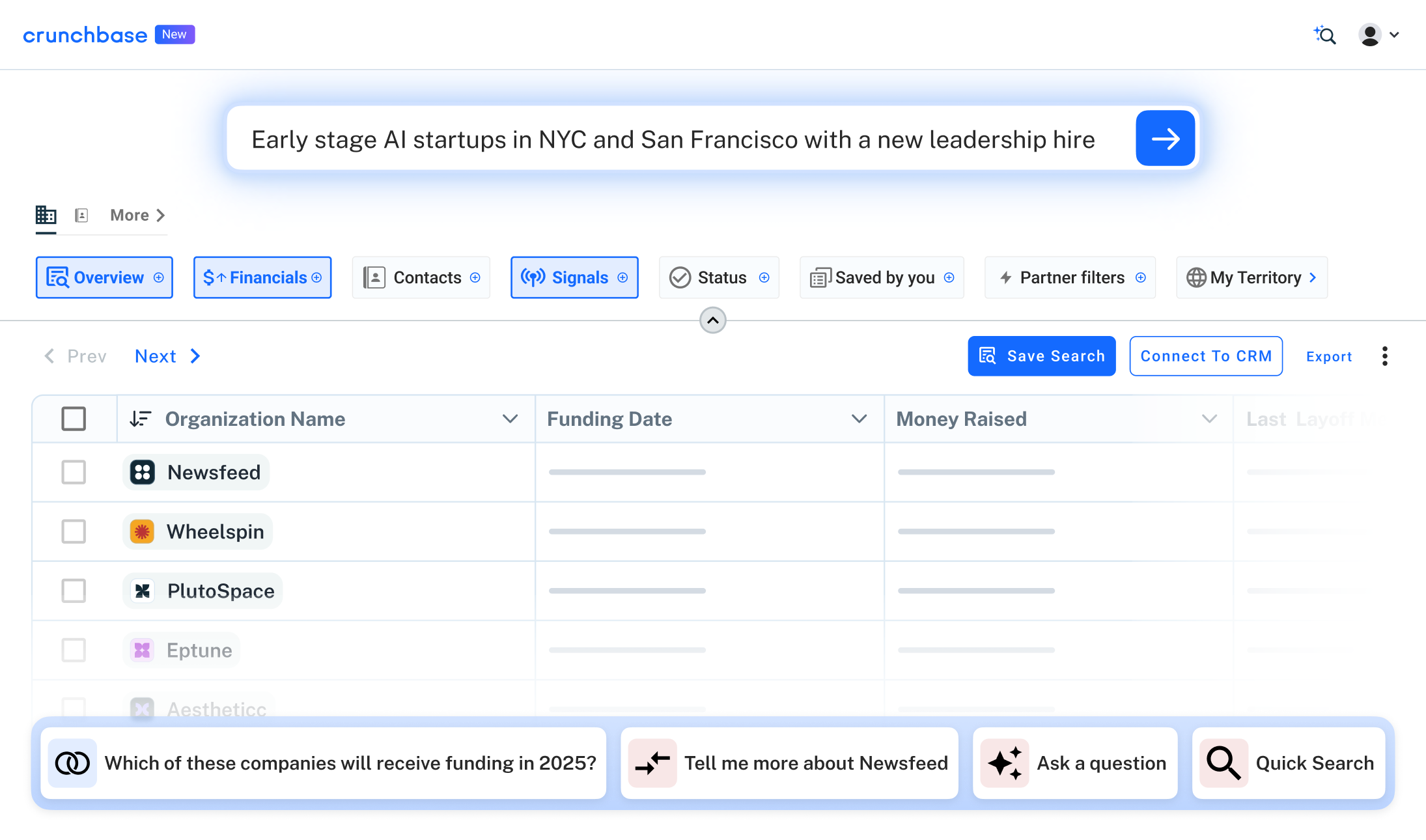

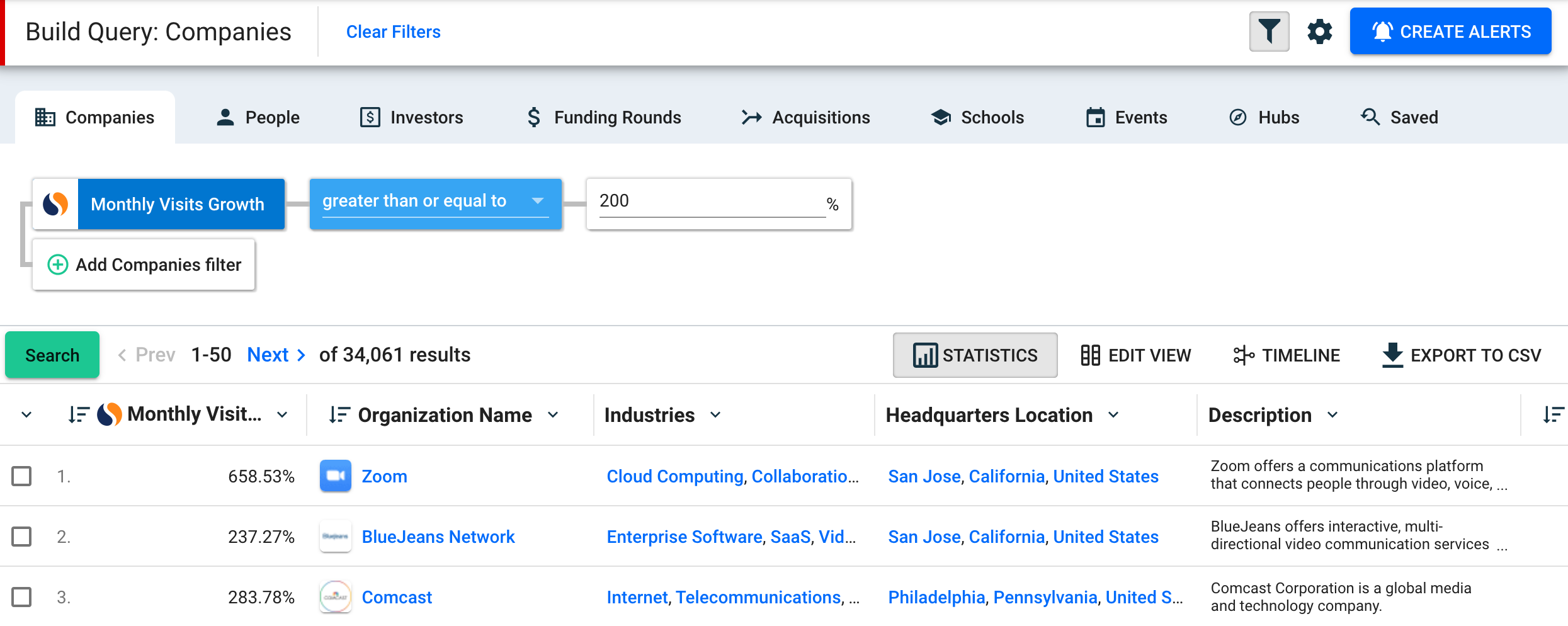

My last recommendation is around monitoring company-level triggers and events. There’s no free hack to this (outside of wiretapping internal meetings) to know when people are in the market for a solution or have a department-level goal they are trying to achieve. But there are ways to find alpha and increase your odds of finding more needles in the haystack. Here’s a few ways we (Crunchbase) use our own platform to uncover this.

Funding is typically the leading indicator that companies are scaling. As a refresher, private companies raise money because they need more money to accelerate growth. Plain and simple. The new investors wrote them a check and said: “Let’s see the chart go up and to the right next time we talk.” Every department will have higher goals than before. You need to be able to see how you can help them deliver on their promise to the new investors. Do your research and see how your company could play a part in their growth strategy.

Funding + industry search (Source: Crunchbase): Look for the up-and-comers in the industry you sell into. They are on a mission to become a Unicorn and wipe out the big players. Help them get there.

Intent data (Source: Bombora): Multiple people from their organization are researching a specific product or service.

Website traffic (Source: G2 Stack): People are going to their website. This is usually a leading indicator that the market wants to know more about them and their product(s).

Side note: This is the type of data I usually look at for “The Monthly Rundown: Startups to Watch.” It’s a nice blend of data and human intuition. You’ll find this in the Crunchbase Daily newsletter.

A reminder that these lists are not silver bullets and shoe-in’s for wanting your product or service. We’re getting you outside Williams-Sonoma, but now are telling you who wants to buy knives. So use this as a starting point for your conversations.

Bad: “Congrats on growing your monthly website traffic by 300 percent!”

Good: “Noticed a surge in IT Staff trying to solve how to remotely manage their employees’ work devices. Here’s an interesting article I read on Quora about this. Here at [COMPANY], we geek out over this stuff and that’s why we’re on a mission to make it easier to solve in an efficient and easy way.”

Cadences: These accounts should be dropped into a marketing drip campaign until they reach a score or interact with your website or content.

Boom! There’s your Growth Index (notice it’s not a fancy formula but old fashioned homework and research compiled into a Google Sheet). If you can’t find 30 accounts, shoot me a note on LinkedIn and I’ll buy you that Impossible Burger (post-quarantine).

In Part 3, we’ll be talking about how to turn these meetings into a pipeline (spoiler alert: it’s through a freemium model).

✌🏻

– Shamus (the sales guy)

Find this article helpful? Check out the rest of this series!

.svg)

.png)

.png)