Israeli data company IVC Research Center has released a study analyzing the time between funding rounds as it relates to different geographies and the volume of capital raised. Through partnership with Crunchbase, IVC Research reviewed proprietary and Crunchbase’s own data for activity in the US/Canada, Europe, and Israel.

Time between rounds: Israel, US, and Euro-region

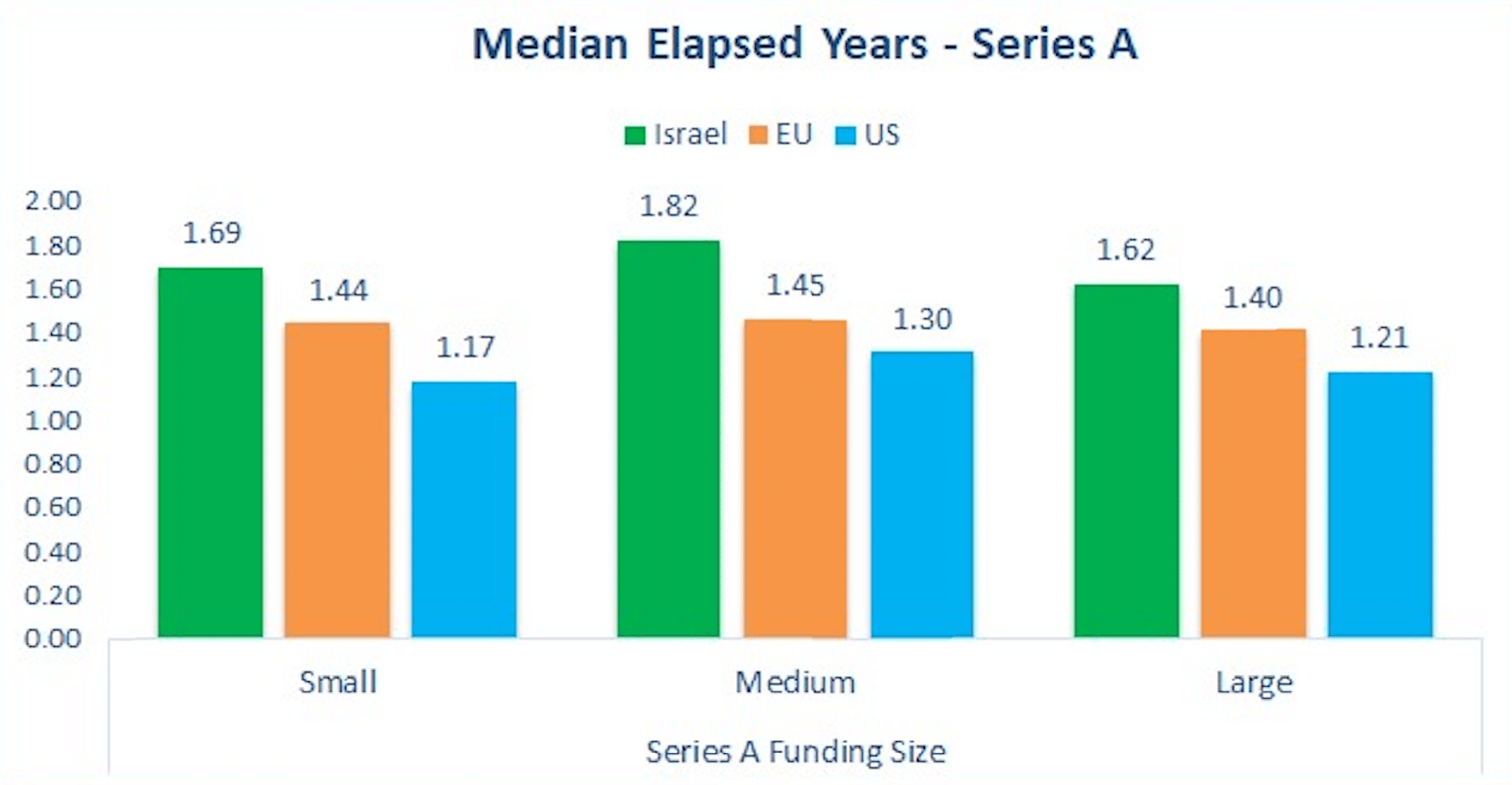

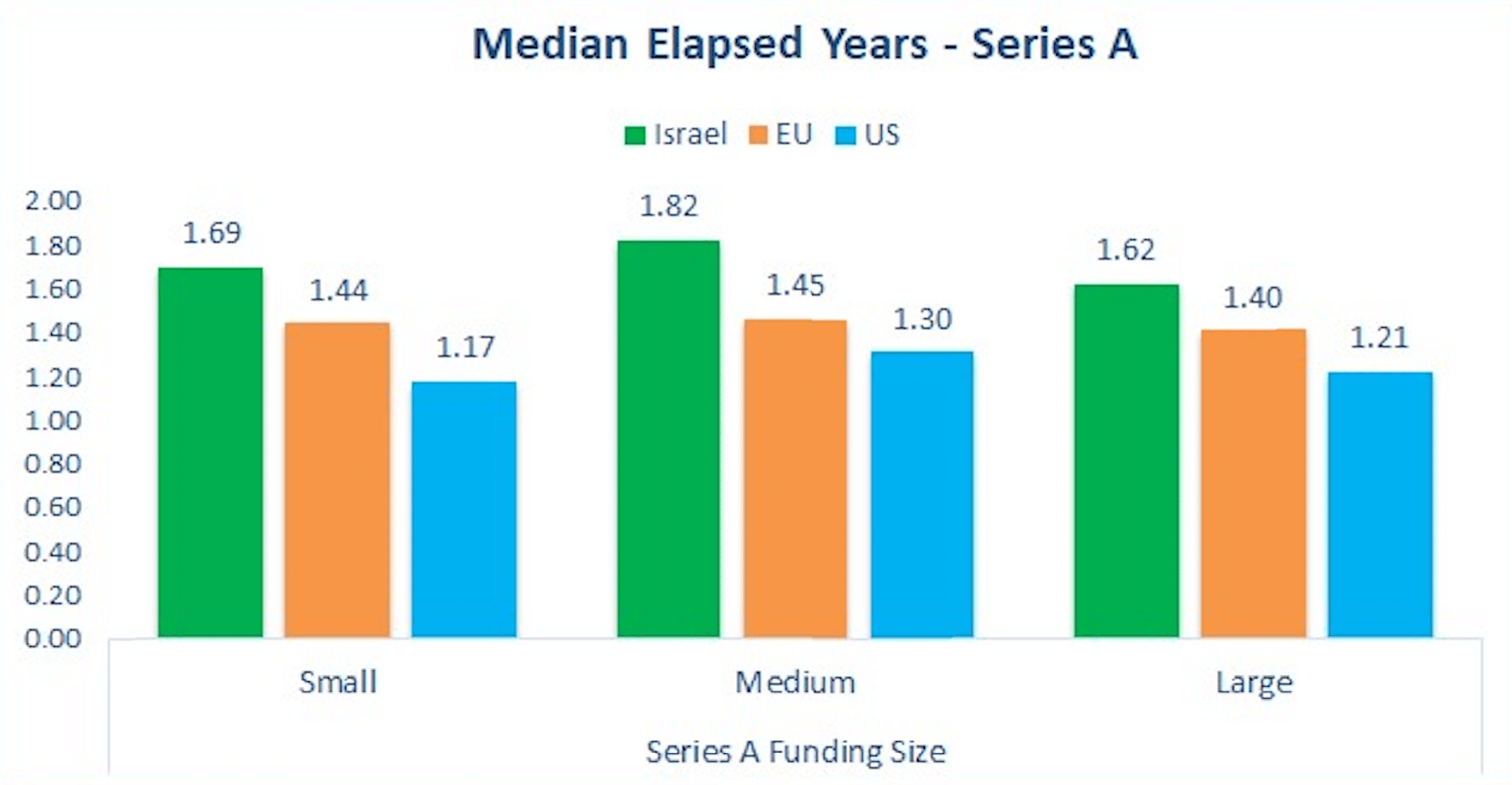

After analyzing Crunchbase and IVC funding data from 2010 – Sept. 2019, IVC determined that U.S. companies typically raise a Series A round the fastest compared to Israel and the Euro-region. The median time for U.S. companies is about a year and three months. Comparatively, it takes about a year and nine months in Israel and a year and five months in the Euro-region.

Source: Crunchbase and IVC Research

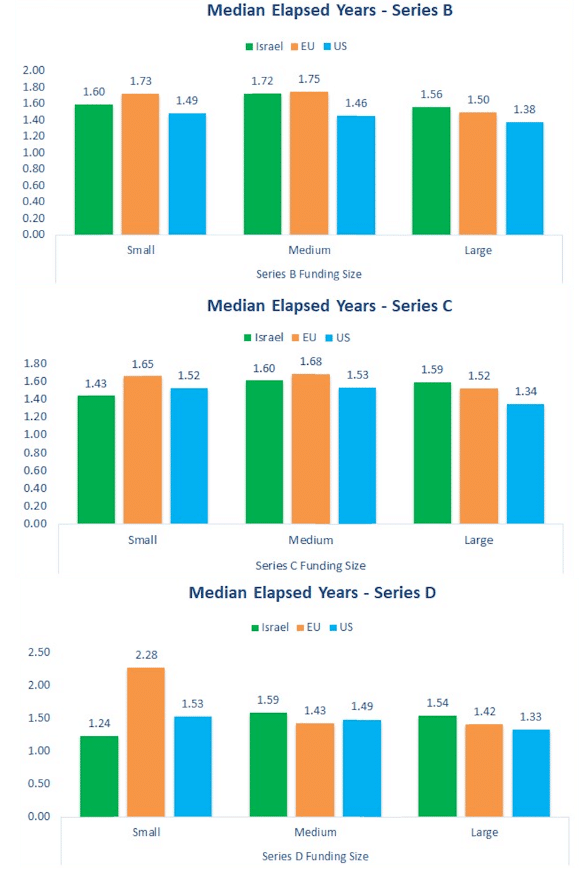

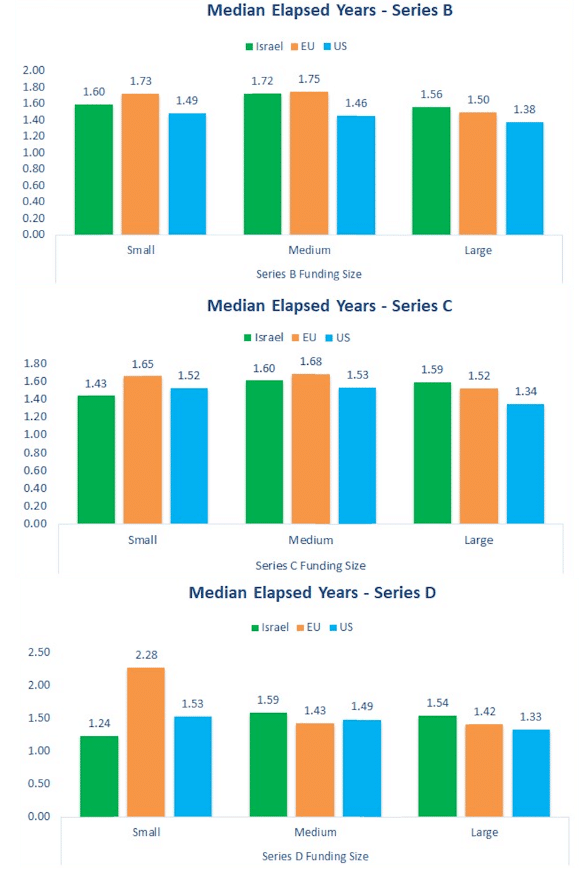

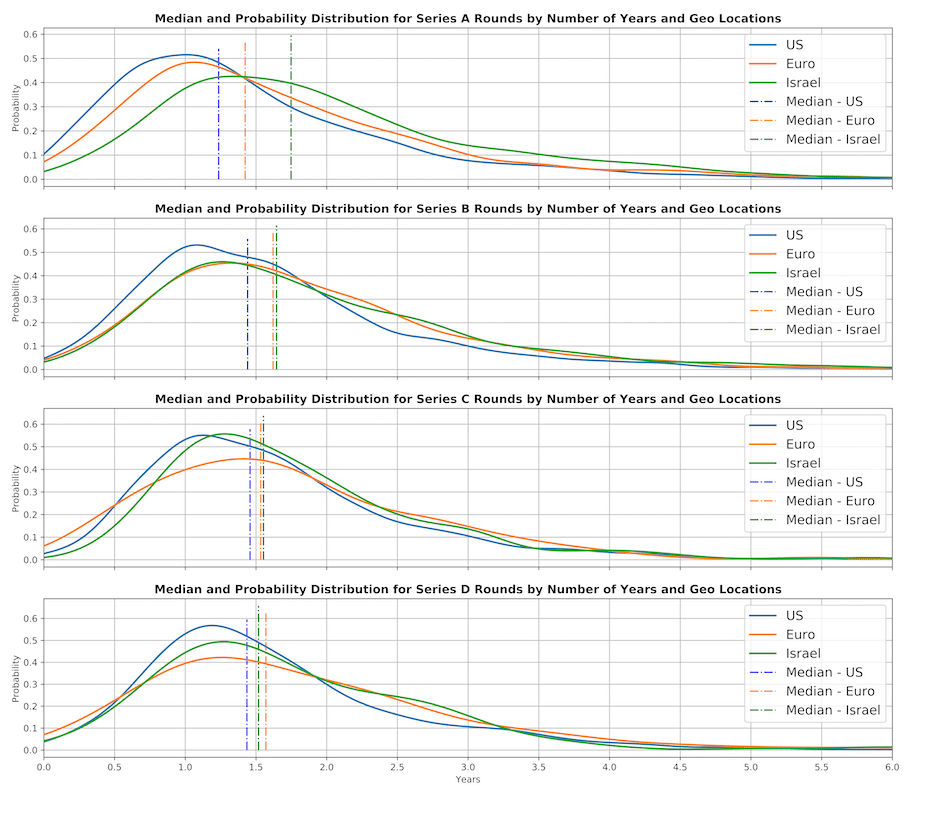

On the other hand, things seem to reverse as later rounds continue. As evidenced in the charts below, as Israeli companies continue in the funding lifecycle, it takes less and less time to receive each additional round. Conversely, U.S. companies take slightly longer to raise later rounds versus Series A rounds.

Source: Crunchbase and IVC Research

Faster to raise more capital

Interestingly, the study also concludes that raising large rounds can actually take less time than small or medium sized deals. This behavior can be partly explained by the fact that larger rounds tend to be for more mature companies. These companies already have a plethora of financial data and results to share with investors, leading to quicker investor decisions. Additionally, as companies become more well known and media starts to follow their successes (or failures), there tends to be an urgency around funding.

Find late-stage funding rounds for Israeli companies in this Crunchbase search.

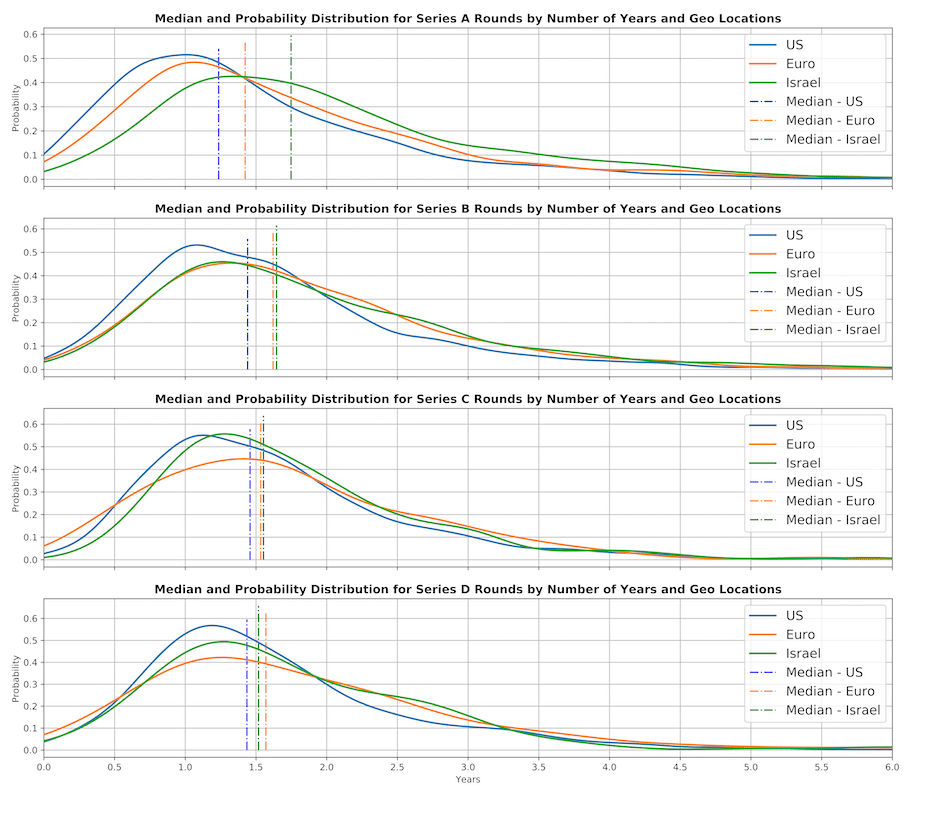

Furthermore, IVC Research has charted the median and probability distribution spread by number of years and location. This shows that the median numbers for these three locations become much more similar in later (and typically larger) rounds.

Source: Crunchbase and IVC Research

Crunchbase and IVC Research have partnered to increase the collection of information on the growing Israel tech ecosystem. “With well over 8500 operating start-up companies, nearly $8 Billion of investments per year, the entrance of more than 600 global investors and corporations, and 25 years of a vibrant ecosystem, Israel’s importance in the global Technological and Innovation biosphere is growing rapidly. IVC, the leading source for a digital enhance local tech ecosystem, is excited for this mutually beneficial relationship with Crunchbase. In this partnership IVC would gain ground in the US market, and Crunchbase will be exposed to intricate knowledge of the Israeli high-tech ecosystem.” – Guy Holtzman, Co-Founder and CEO, IVC Research

About IVC Research

Founded in 1997, IVC Research Center is the leading data source and business information company in Israel’s high-tech industry. We help our clients understand the market, make connections and identify opportunities with access to the latest news, trends and developments. From venture capital and private equity funds to industry leading companies and emerging startups across Israel’s varied high-tech sectors, we cater to the varied business information needs that make up the Israeli high-tech ecosystem.