The European Investment Bank, Nesta, and Crunchbase have partnered to publish From Starting to Scaling: How to foster startup growth in Europe. High growth startups are widely recognized as key sources of employment, productivity growth and innovation. However, while the long-term impact of the COVID-19 crisis on startups remains to be seen, many now face greater constraints than before. Continued policy support therefore is crucial.

In order to guide European policymakers, it is important to understand the key characteristics of high growth startups and gain insights into what sets them apart from other startups. In addition, it is helpful to examine the persistent gap between Europe and the United States (US) in terms of startup activity. While the data reported below (based upon the EIBIS startup and scaleup survey 2019, with firms sampled from Crunchbase) were collected prior to the COVID-19 crisis, the findings underscore the role of high growth startups for innovation ecosystems in Europe. We also highlight some ways governments can continue to support startups by encouraging collaborations with startups as an active innovation partner.

Why we care about high growth startups and what is holding them back

High growth startups stand out in terms of innovative activity and expected job creation compared to other startups, substantiating their key role in entrepreneurship ecosystems.

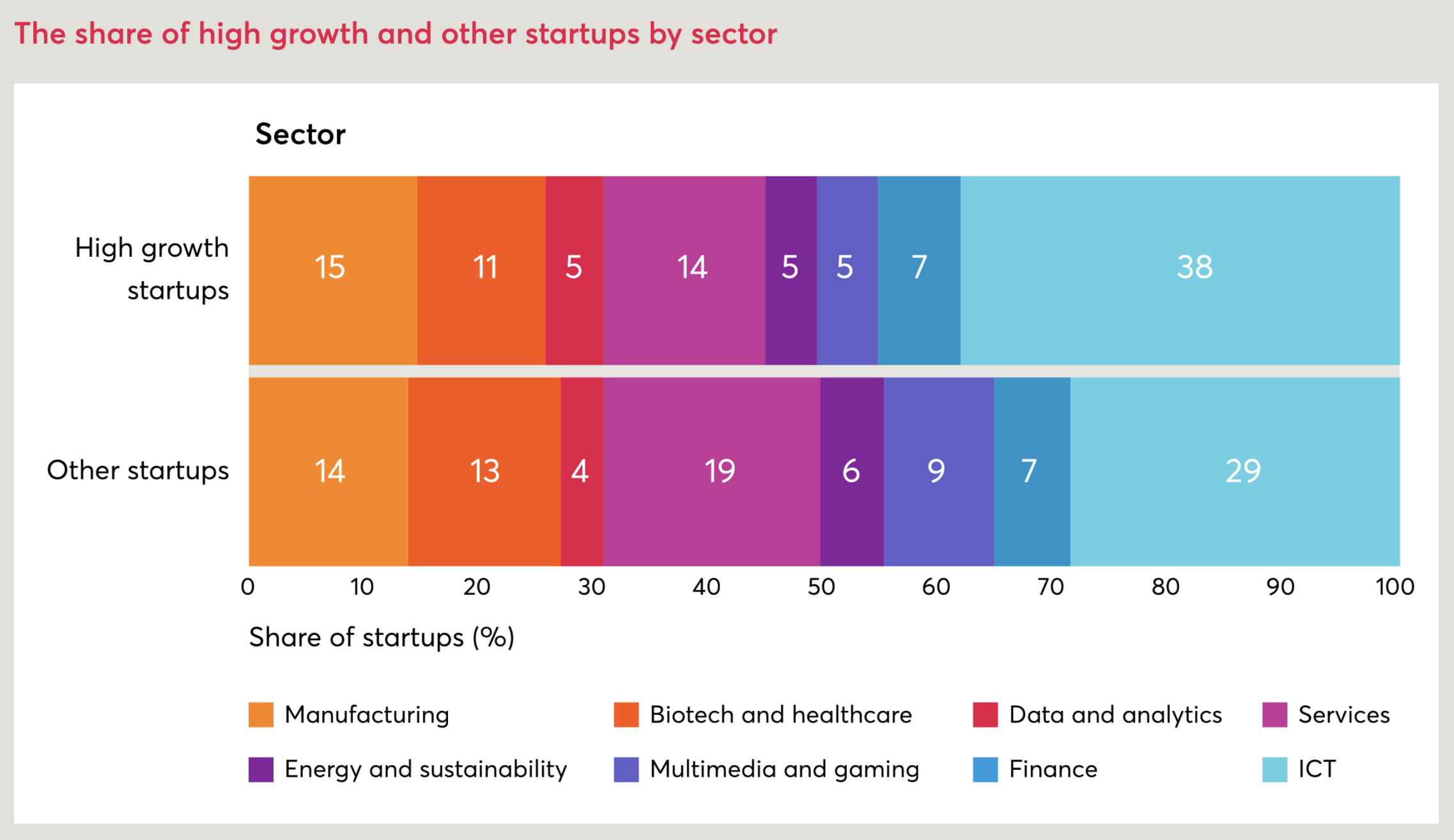

High growth startups seem to excel in terms of innovation and many high growth startups (65 percent) report that the most innovative aspect of their business is a new-to-the-world innovation (compared to 58 percent of startups with lower growth). The highly innovative activity of high growth startups seems supported both by their business models and the innovative business practices they adopt. High growth startups are also more likely to be active in sectors that enable innovations to scale quickly, most notably the ICT sector and the data and analytics sector.

Source: Crunchbase, authors’ calculation. Baseline: Firms founded between 2008 – 2018 that are still active, present in EIBIS Start-up and Scale-up Survey 2019 in EU27+UK.

High growth startups also hold the promise of economic growth and job creation. Before COVID-19 was hitting the world, a large share of high growth startups expected to increase the demand for high skilled workers and aspired growth rather than short term profits.

However, even before the COVID-19 crisis, high growth startups were disproportionately hindered by the availability of finance. Nevertheless, high growth startups were more likely than other startups to mention the use of more than one form of public support and particularly seemed to benefit from startup grants/investments. This suggests that while public financial support is important for growth, it does not seem to fully address the financing barriers high growth startups face. What could we learn from the ecosystem in the US?

EU versus US

Europe lags the US in terms of the amount of startups by a factor of three, a recent EIB report shows. By contrasting the data on European versus US startups, we highlight three key factors that may have contributed to this gap: a lack of private funding, difficulty in attracting talent and a lack of entrepreneurial recycling. Most notably is the private funding gap between Europe and the US: US startups are able to attract more private funding than their European counterparts. In contrast, European high growth startups are more likely to use public support compared to startups in the US. However, these higher public support rates in Europe do not seem to compensate for the private funding gap.

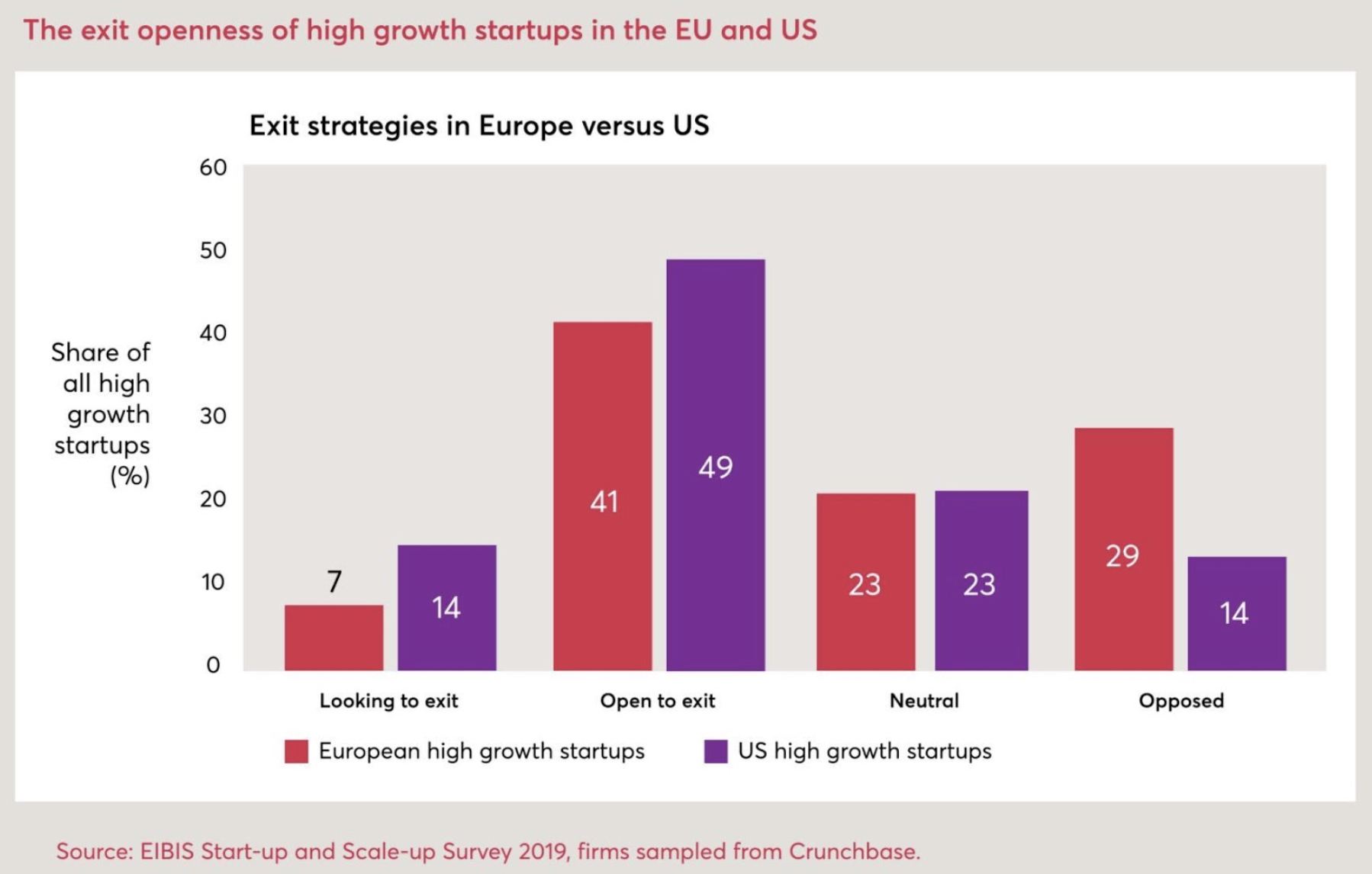

Next to the finding that European high growth startups perceive relatively more barriers that may undermine the success of their business compared to their US counterparts, our data also reveals that European high growth startups are more opposed to exit than their US counterparts. However, this is not always negative: in some cases, there is an overemphasis on exiting, causing startups to exit prematurely often due to investor pressures to “cash out”. However, in other cases, there may be a missed opportunity for “entrepreneurial recycling” when the involved individuals could use their experience to further strengthen the European startup ecosystem, by starting new ventures or becoming business angels or mentors.

What can policy do?

In times when there is enormous pressure on small businesses with high growth potential, we highlight some ways in which governments can continue to support them.

Our data reveals that European policymakers could complement existing policy initiatives to increase public support for startups with policies that increase the availability of private funding. One way to boost private investment is to encourage corporate-startup collaboration. Initiatives such as the Startup Europe Partnership aimed at supporting established corporates to collaborate with startups, are consistent with this goal.

Moreover, government can also act as a collaborative partner for startups. To build stronger startup ecosystems, governments not only need to encourage other actors to participate (for example through promoting corporate-startup collaboration as described above), but they must also take a more active role themselves. Governments typically act as conveners, funders and facilitators in the startup ecosystem, but they rarely engage directly with startups, for example through co-development or innovative procurement. Only a minority of European startups currently collaborate with or sell into the public sector, despite the potential mutual benefits. To unlock these benefits, governments are advised to design more startup-friendly public procurement processes and experiment with new forms of startup engagement.

Read the full report here and explore all the findings on high growth startups.