With contribution from Crunchbase, Dsight has published their Venture Russia 2018 Report, analyzing Russian venture trends and investment activity.

Compared to 2017, Russia saw significant growth in the overall amount of money invested in the market, raising the total by 51.6% to $714.4m. The three largest deals in 2018 included:

- $80m for Gett, a ride-hailing service

- $80m for WayRay, an augmented reality solutions developer

- $61m for Ozon.ru, a Russian online hypermarket

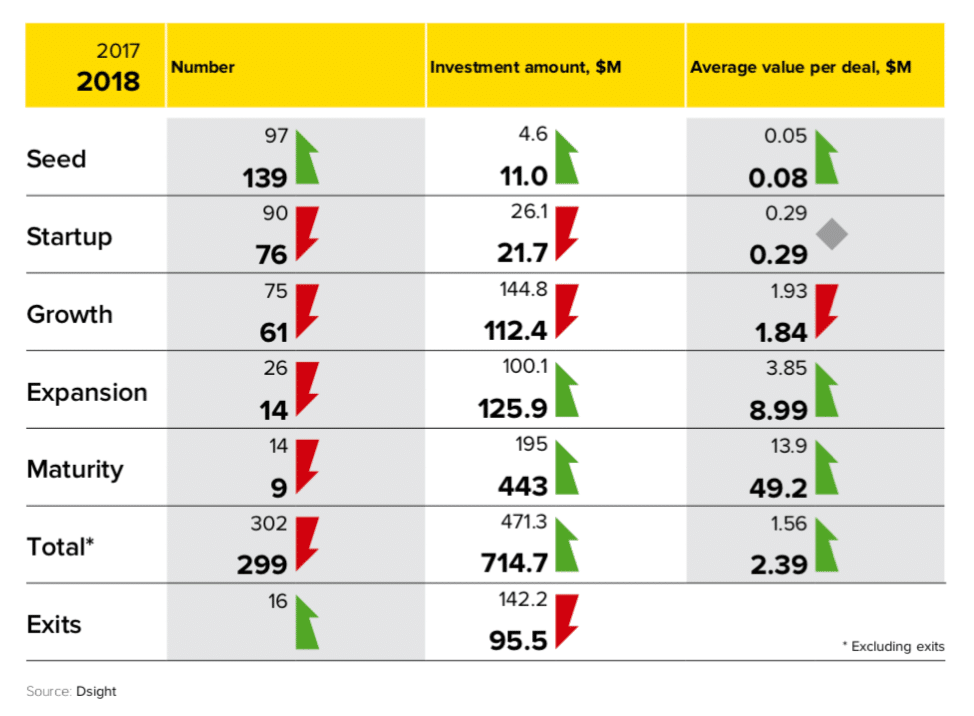

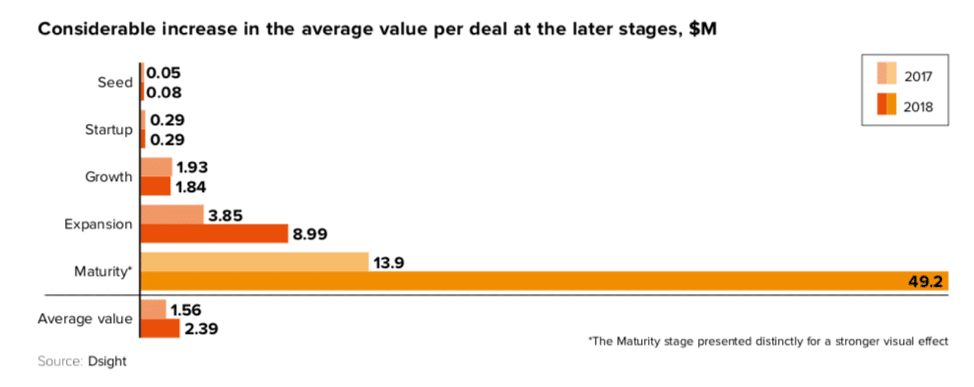

Russian investments: average value per deal

The overall number of investments held relatively constant (decreasing from 302 to 299); however, the average value per deal in late stage investments increased drastically. Additionally, the average value per deal for companies considered to be at the “maturity” level (including the 3 largest deals mentioned above) increased from $13.9m in 2017 to a whopping $49.2m in 2018.

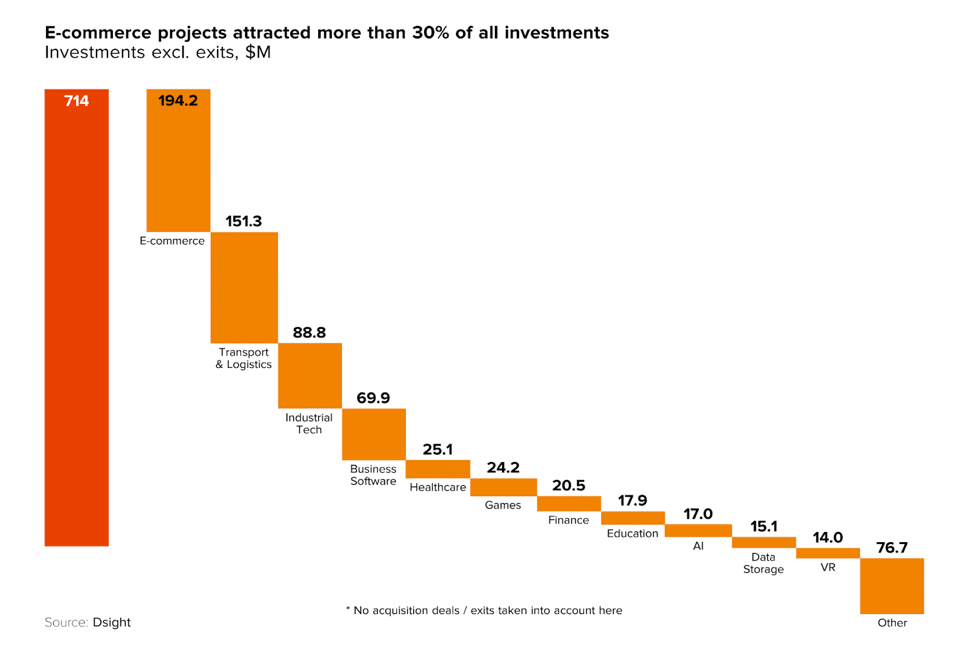

Increase in e-commerce investments

E-commerce deals accounted for more than 30% of all investments in Russia in 2018, with $194.2m worth of funding. Two joint ventures contributed to the growth in e-commerce. In early 2018, Yandex and Sberbank (the biggest lender in Russia) launched a joint marketplace called Beru. A few months later, Mail.ru, Megafon, the Russian Direct Investment Fund, and Alibaba Group announced AliExpress Russia. Multiple news sites have been referring to these ventures as “the Russian Amazon.” Check out Crunchbase’s Hub listing all of the Russian Federation Internet companies.

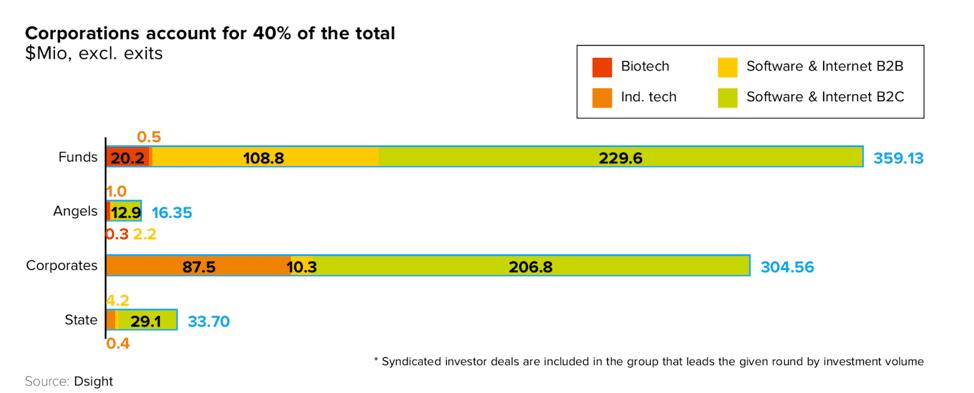

Funds and corporations led the way

PE funds and corporate VCs contributed the majority of investment money in 2018, with PE funds in particular accelerating the growth of late stage companies. The number of deals that involved PE funds quadrupled from 2016, reaching 12 deals in 2018. A few of the PE deals included Rusnano Sistema SICAR and Skolkovo Ventures investing $8m in Ivideo, a video surveillance systems company, and Vostok New Ventures and Baring Vostok leading a $9m round in Doc+, a medical service company.

Corporations accounted for 40% of all deals, much of this due to the fact that as many as 20 corporate accelerations programs launched in 2017. Additionally, a new law on private-public partnerships passed last year, allowing for easier creation of new venture funds. For instance, Skolkovo Venture Fund – Industrial I was set up in late 2017 and already received contributions from Russian Railways and Russian Helicopters totaling $9.2m.

Arseniy Dabbakh

Founder of Dsight. Investor & board member of several tech startups. Board member and Head of VC Committee of National Alternative Investments Managers Association (www.naima-russia.org). Education: RUDN University, MBA California State University, Skolkovo PE/VC.

About Dsight

Dsight is a database of deals focused entirely on Russia’s venture market. The company publishes Venture Russia reports twice a year and issues sectoral studies on the most attractive VC markets. Dsight also carries out contract-based research for customers on markets, companies, and investors.