Editor’s note: This is a repost of a TechCrunch article written by Billy Gallagher.

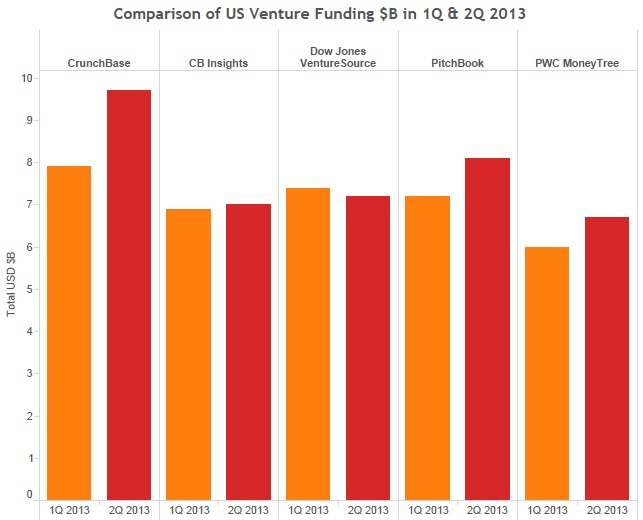

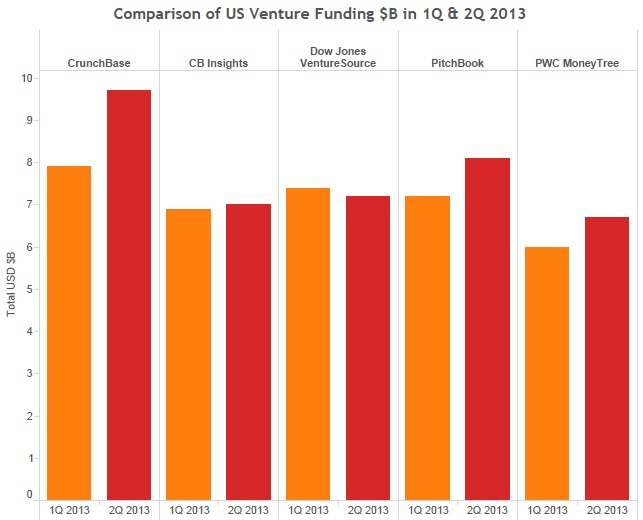

Now that the CrunchBase team has spent some quality time improving our data sets, we thought it’d be interesting to see how our free database of companies stacks up against other industry sources on a key measure of the startup ecosystem: quarterly venture funding totals.

Here’s a quick breakdown.

Crunchbase data shows that 2,674 venture deals were completed in the first half 0f 2013, with a total of $17,629,528,289 in venture capital invested. These figures are higher than for similar databases including CB Insights, Dow Jones VentureSource, PitchBook and PWC MoneyTree. Why? We suspect it’s because we have more early stage deals in there, given that the difference between total money raised is proportionally smaller than the number of deals listed.

Starting now, we’ll be regularly comparing CrunchBase data to other industry sources over on the CrunchBase blog. We’ll display information on how many deals are done, how much capital is invested, in what regions and categories this capital is invested, what types of rounds receive how many deals and dollars, and more. We’ll also make the source data available for download if you want to take a look for yourself.

And, when this data shows interesting trends, like U.S. venture capital investments doubling in a quarter, how much the average “successful” startup raised, or the largest seed and angel fundings of the last month, we’ll write about it here on TechCrunch.

You can check out a spreadsheet comparing data across these sources for the first half of 2013 on CrunchBase. You can see CrunchBase’s monthly reports and download full data sets here.

Graphs via Crunchbase’s Eddy Kim.