“This is the right momentum to build a long-lasting legacy that will stay with our children and our children’s children. Along this path, the thousands of young and not-so-young entrepreneurs, the sons and daughters of Meucci, Leonardo, Marconi, Colombo who fight every day to turn their ideas into business and their business into legacy, who faces overwhelming odds, rejections, delusions, who cry over joy and smile over dissatisfaction, just to be able to say: I made it.”

– Andrea Orlando, managing partner of Startup Wise Guys Italia

This is how Andrea Orlando, managing partner of Startup Wise Guys Italia, describes what is happening in the digital ecosystem of Italian startups.

If on one hand the pandemic underlined the resilience of innovative activities compared to traditional sectors, on the other Italy is seeing the proliferation of SaaS and PaaS platforms to support small and medium-sized enterprises, essential foundations of the Italian economy. Moreover, Italy seems to be the most underdeveloped market, full of human capital and cities with unique contributions to innovation across industries.

The sizable economy, limited barriers to entry, excellent national talent pool, and growing international ambitions have put Italy in the spotlight. Over time, these factors may lead to a reduction in the gap between Italian startups compared to other European countries and the U.S.

B2B Italian Startup Scene Report

This year, Crunchbase partnered with Startup Wise Guys, Dealroom and VC Hub Italia for the first edition of the B2B Italian Startup Scene Report, which offers a comprehensive overview of where the region’s vibrant startup scene is at and where it’s headed.

The report consists of five main sections:

- The force of a digital ecosystem

- The digital B2B startup scene in Italy

- Understanding digital B2B space through VCs & ecosystem influencers’ observation

- A survey among founders in Italy

- Focus and role models

In this article, we’ll summarize brief insights from the report and share the key facts that are characterizing, and will characterize, the Italian B2B digital ecosystem.

The digital B2B startup scene in Italy

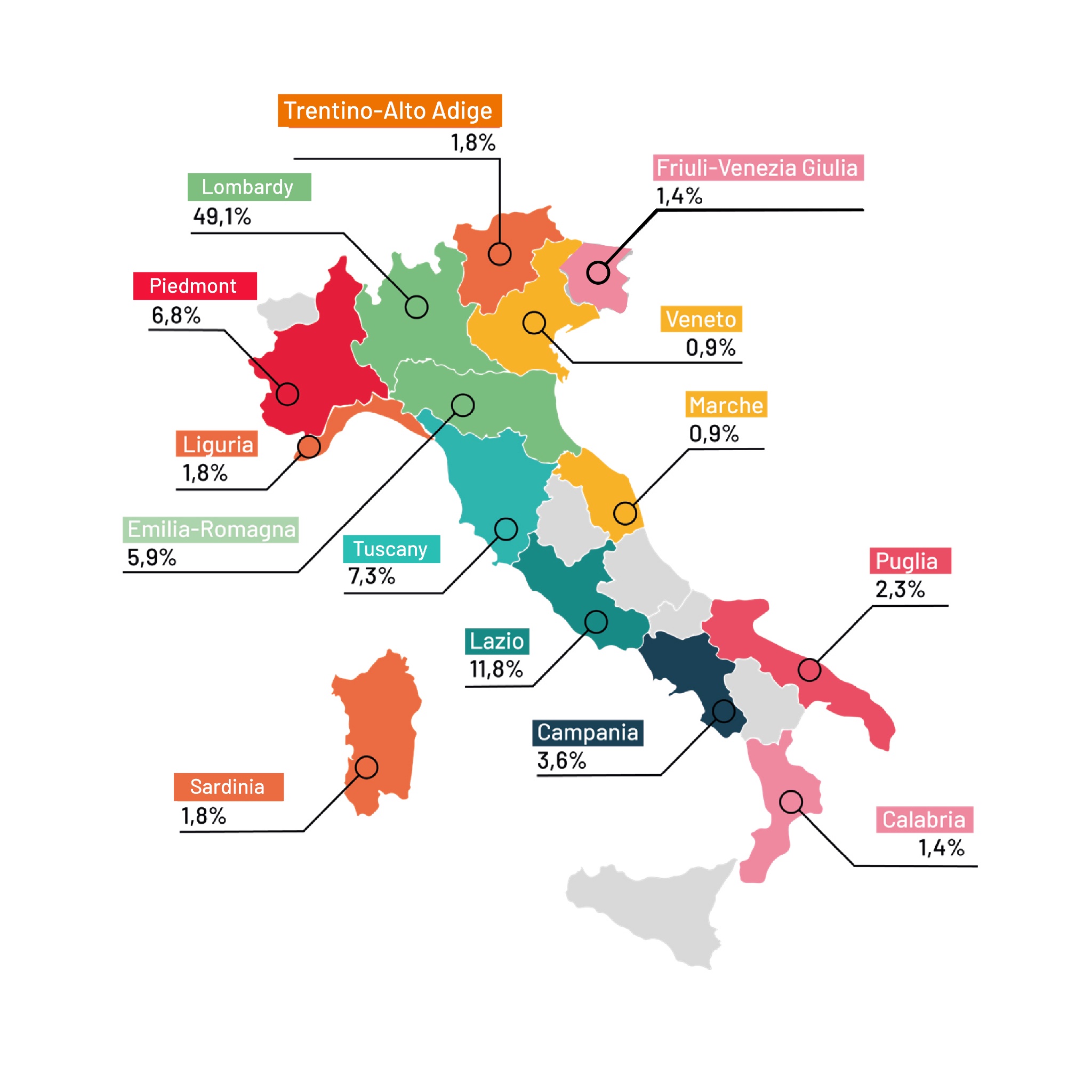

Initial analysis of the data available examines the geographic location of B2B startups in Italy. Lombardy is home to 49.1 percent of all Italian B2B startups, followed by Lazio with 11.8 percent, Tuscany with 7.3 percent, Piedmont with 6.8 percent, and Emilia Romagna with 5.9 percent.

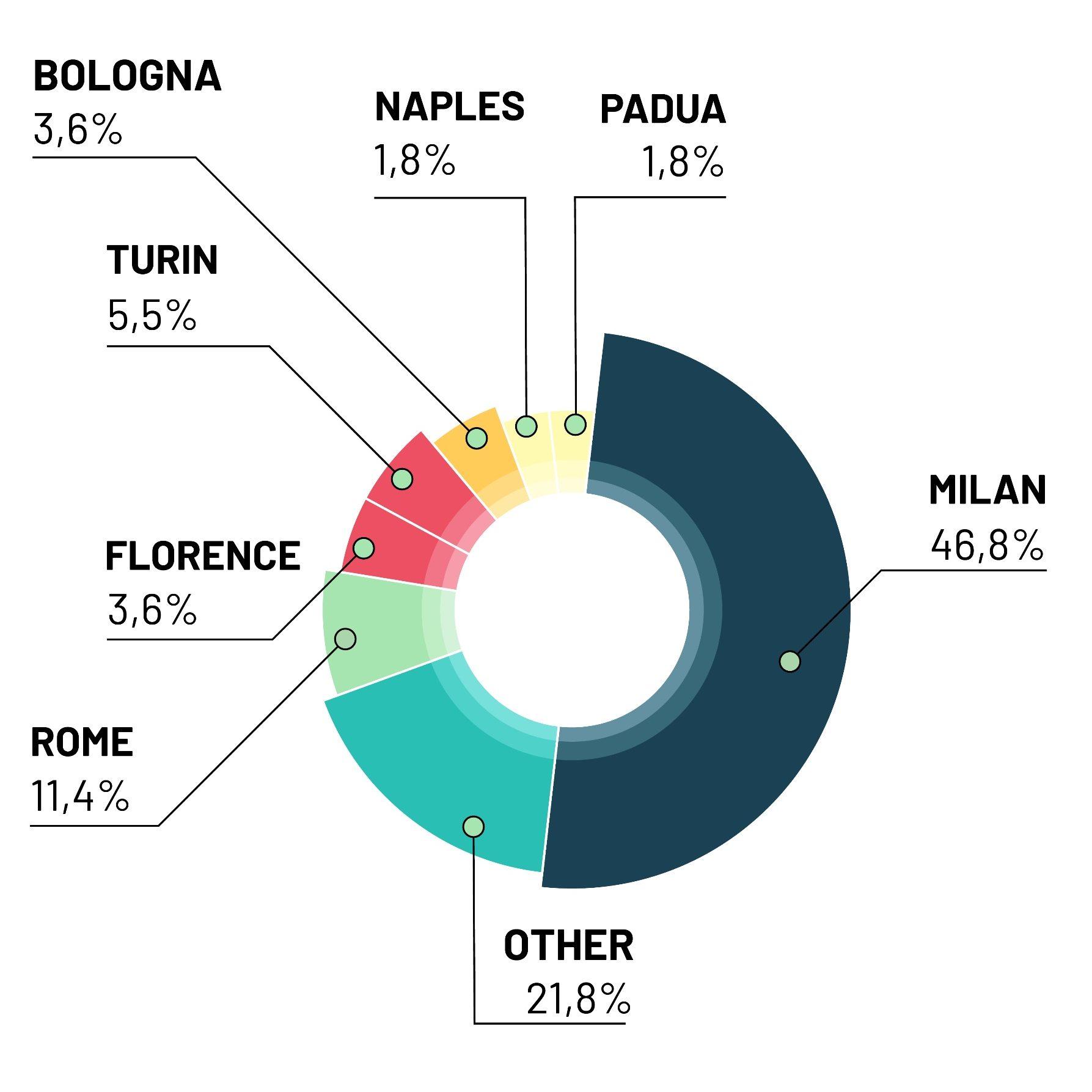

In Italian cities, the percentages remain similar; Milan is home to 46.8 percent of B2B startups, Rome 11.4 percent, Florence and Turin 5.5 percent each, and Bologna 3.6 percent.

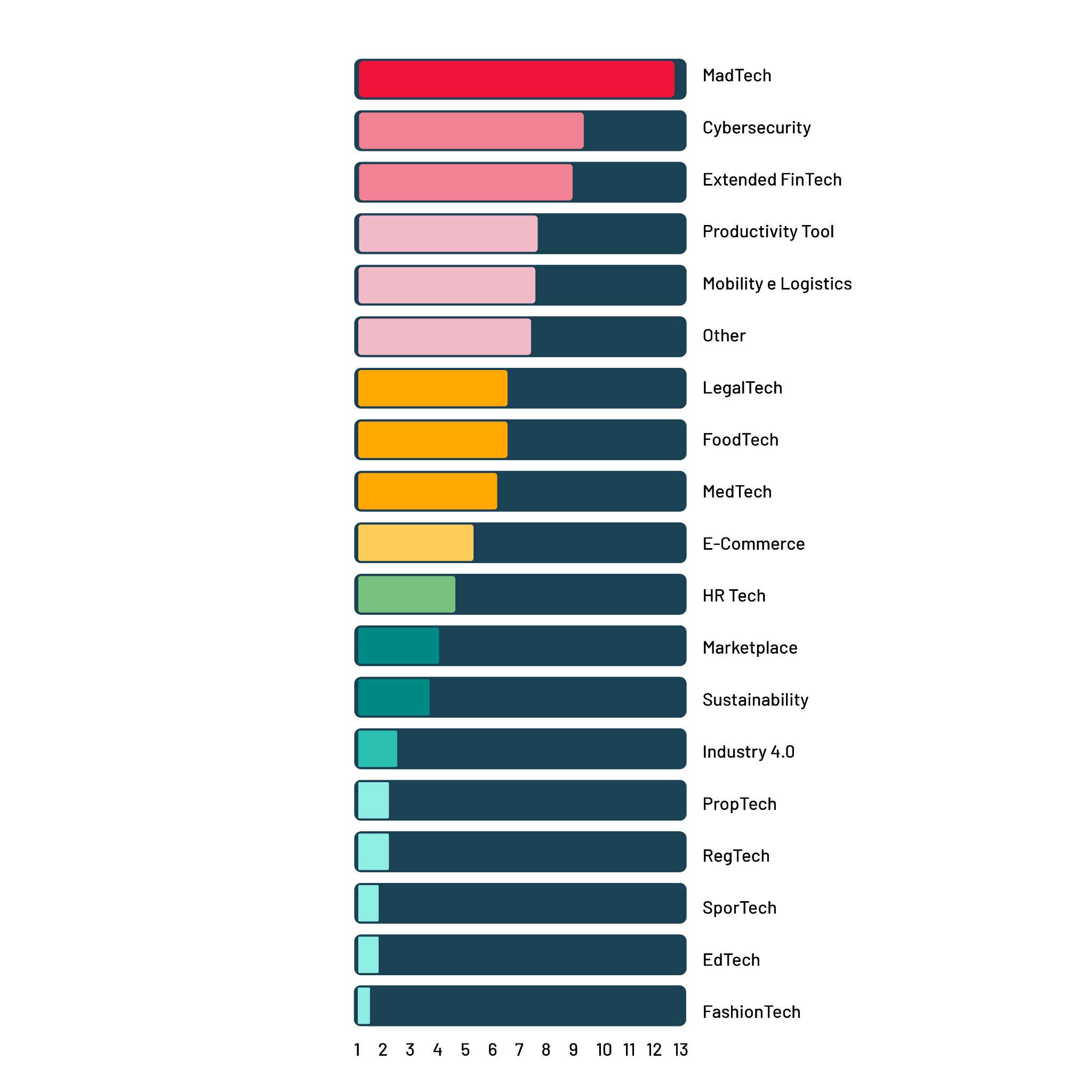

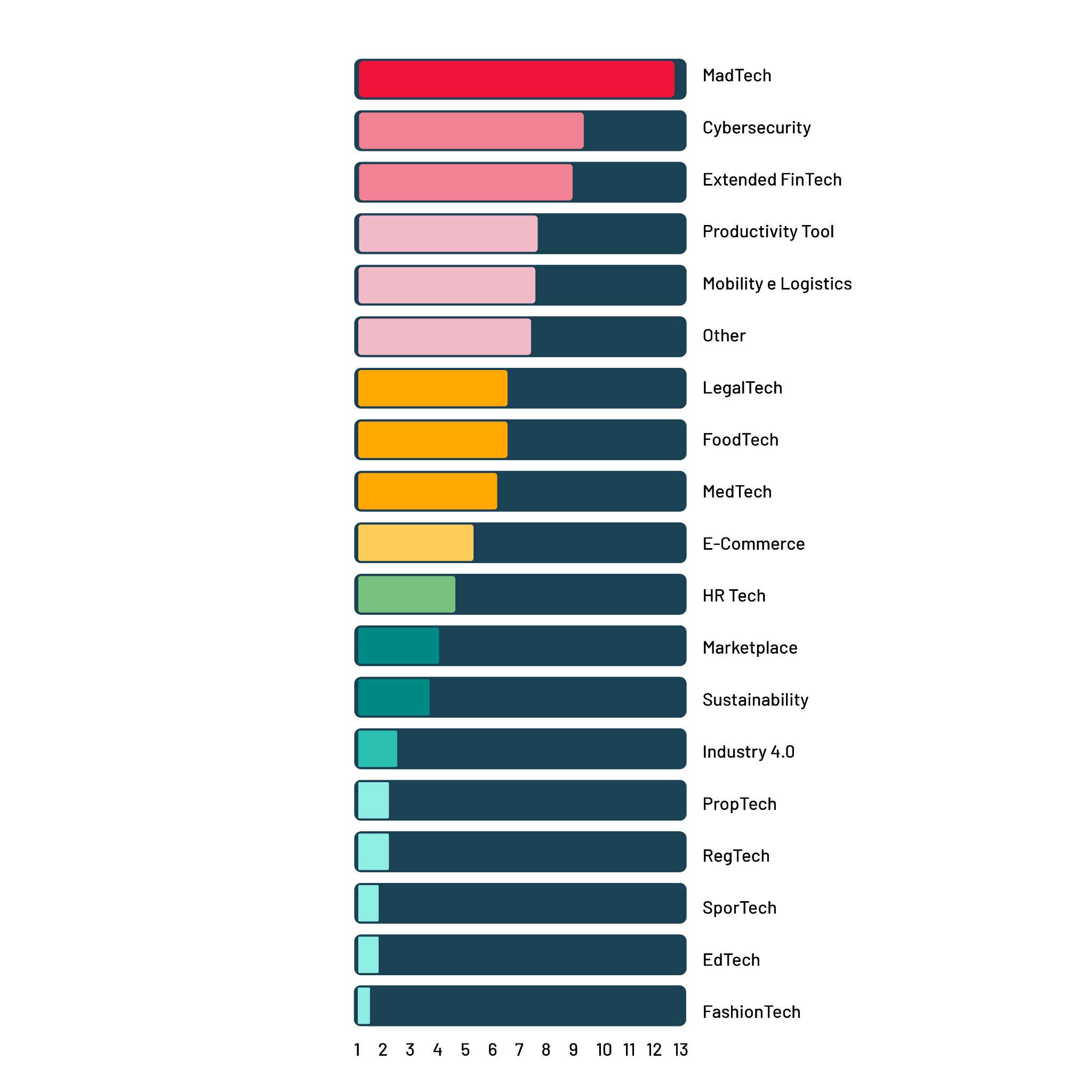

The analysis is much more granular when it comes to considering the sectors in which the B2B startups in the sample operate. The sector with the highest percentage of Italian B2B startups is madtech (digital services and products for marketing and advertising) at 13 percent. Next in terms of percentage size is the cybersecurity sector with 9.6 percent, followed by intech (in its broadest sense, therefore including areas such as InsurTech), standing at 9.1 percent. The mobility and logistics and productivity tool sectors are tied for fourth place with 7.8 percent of B2B startups in both fields, while foodtech and legaltech are tied for fifth place at 6.5 percent.

The availability of English, in addition to Italian, on the websites of the startups and scaleups in the sample indicates that the majority, 65.7 percent, have a business oriented toward internationalization, another critical phase of growth. This also means that 34.3 percent look exclusively at the domestic market, due to both a market choice and regulatory issues. It is more difficult for startups in the fields of legaltech, regtech, proptech and to some extent fintech, to implement international expansion strategies because they are linked to specific regulatory frameworks that vary from country to country, even within the European Union.

A survey among founders in Italy

A questionnaire designed to better understand the current dynamics and trends in this particular sector of business innovation was sent to a sample of entrepreneurs.

How digital B2B startups and scaleups are financed in Italy is a fundamental question not only to understand where entrepreneurs in this field find the financial resources needed to grow, make investments, improve their product or service, and to hire, but also to understand investors’ interests.

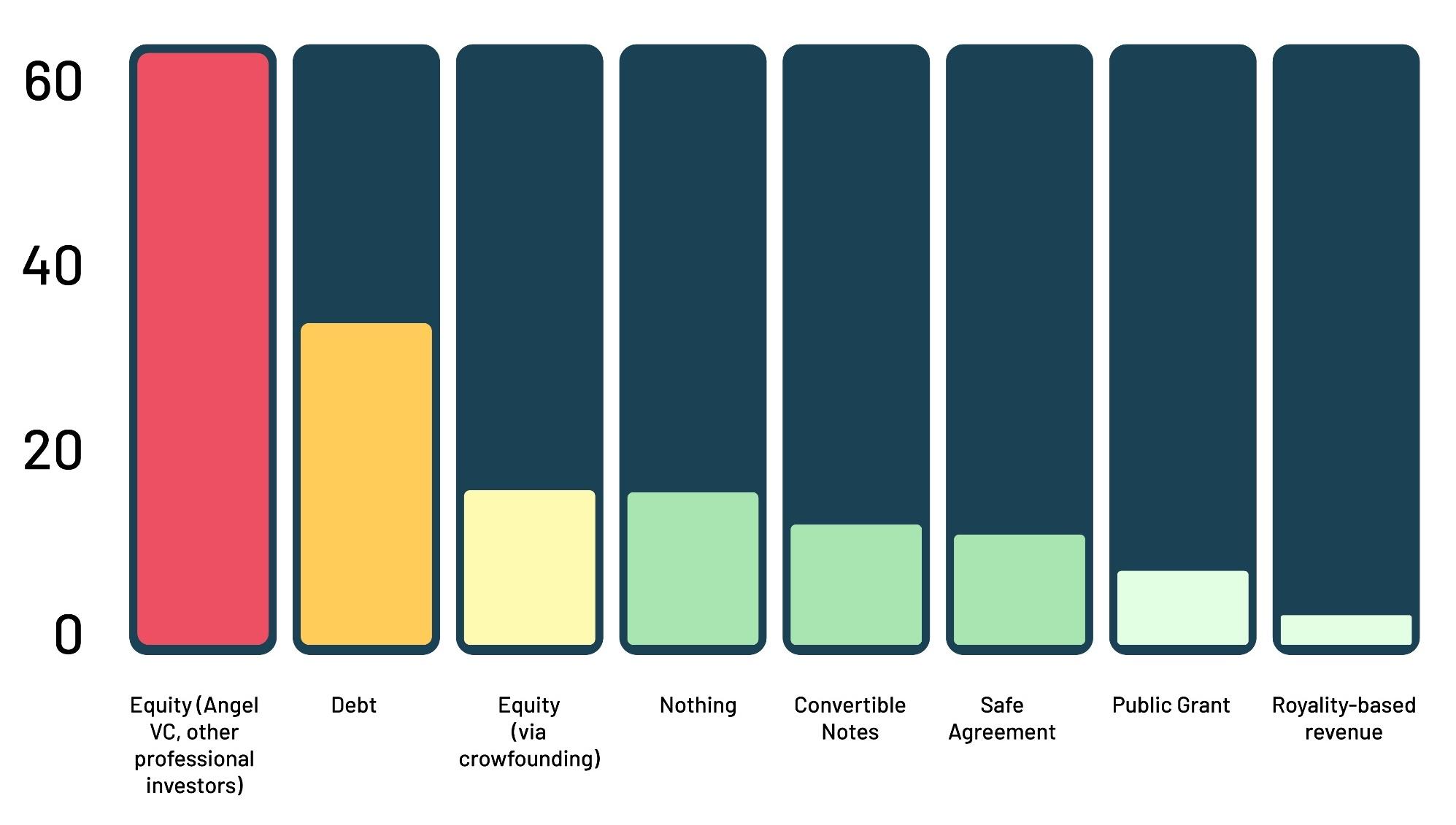

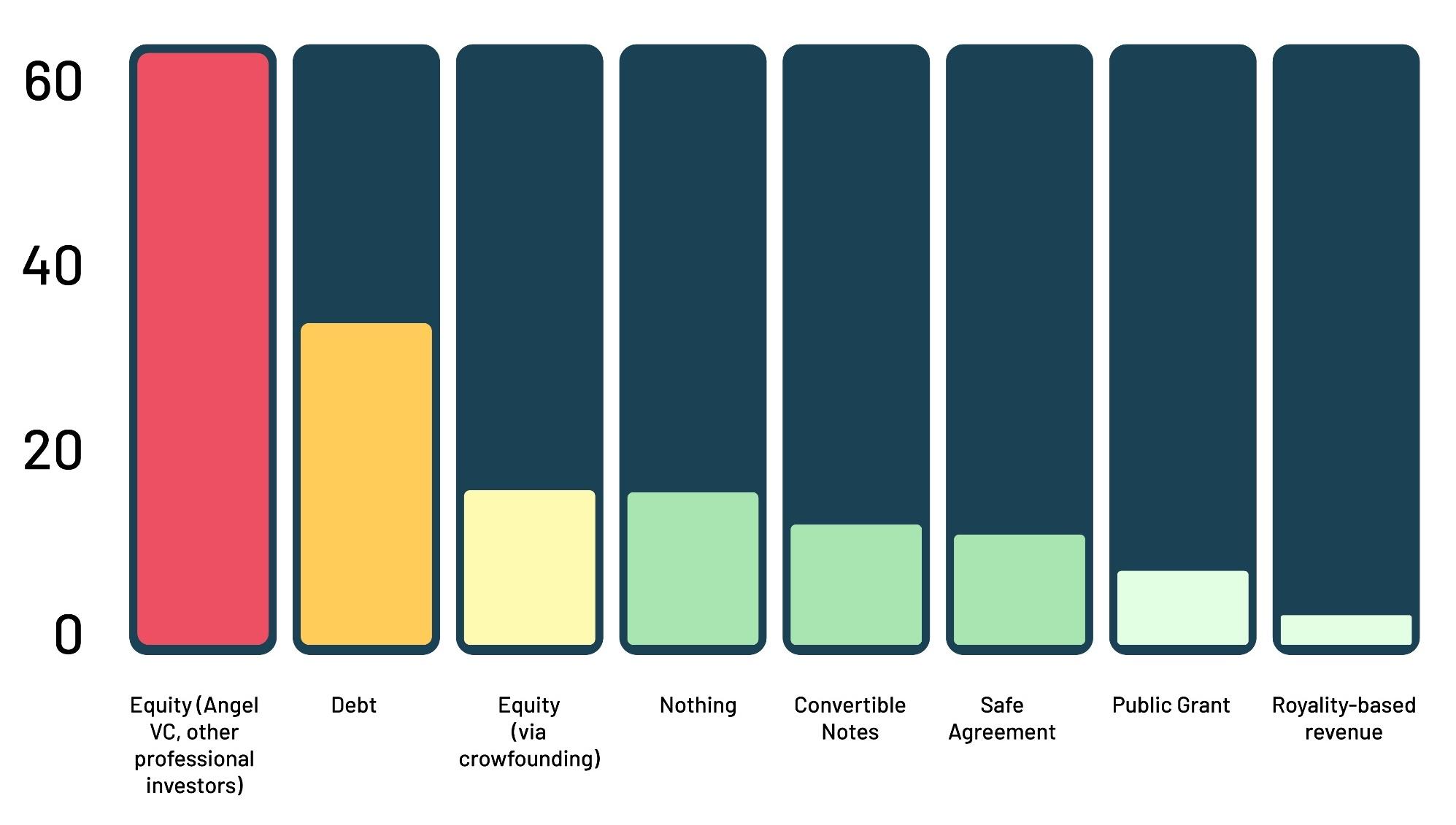

Sixty percent of startups have received funding in the form of equity from business angels, venture capital and other professional investors. This percentage indicates investor attention to B2B startups is high and that this particular sector is a harbinger of promising evolution in the medium and long term.

Looking at other funding channels, debt financing accounts for about 35 percent of startups, equity crowdfunding for just over 15 percent, and other funding sources such as convertible notes, safes, public grants and royalty-based revenues account for less than 15 percent. It should be kept in mind that these percentages are not exclusive–a single startup may have used more than one funding instrument and therefore the sum will give a number higher than 100 percent.

A further theme touched on in the survey is two aspects that are increasingly important in understanding the dynamics of innovative companies: the social and the environmental. The first piece of data analyzed is the gender gap within the founders’ teams; male-only teams are still predominant at 57.3 percent, but the percentage of mixed teams is anything but negligible at 40.2 percent. The percentage of female-only teams is still marginal at 2.4 percent. The B2B digital solutions sector, precisely because it caters to customers which are often still traditional companies–albeit eager to innovate–contributes to a slower process of alignment of the gender gap between the founders of this type of startup, but it is extremely significant that over 40 percent is made up of mixed teams.

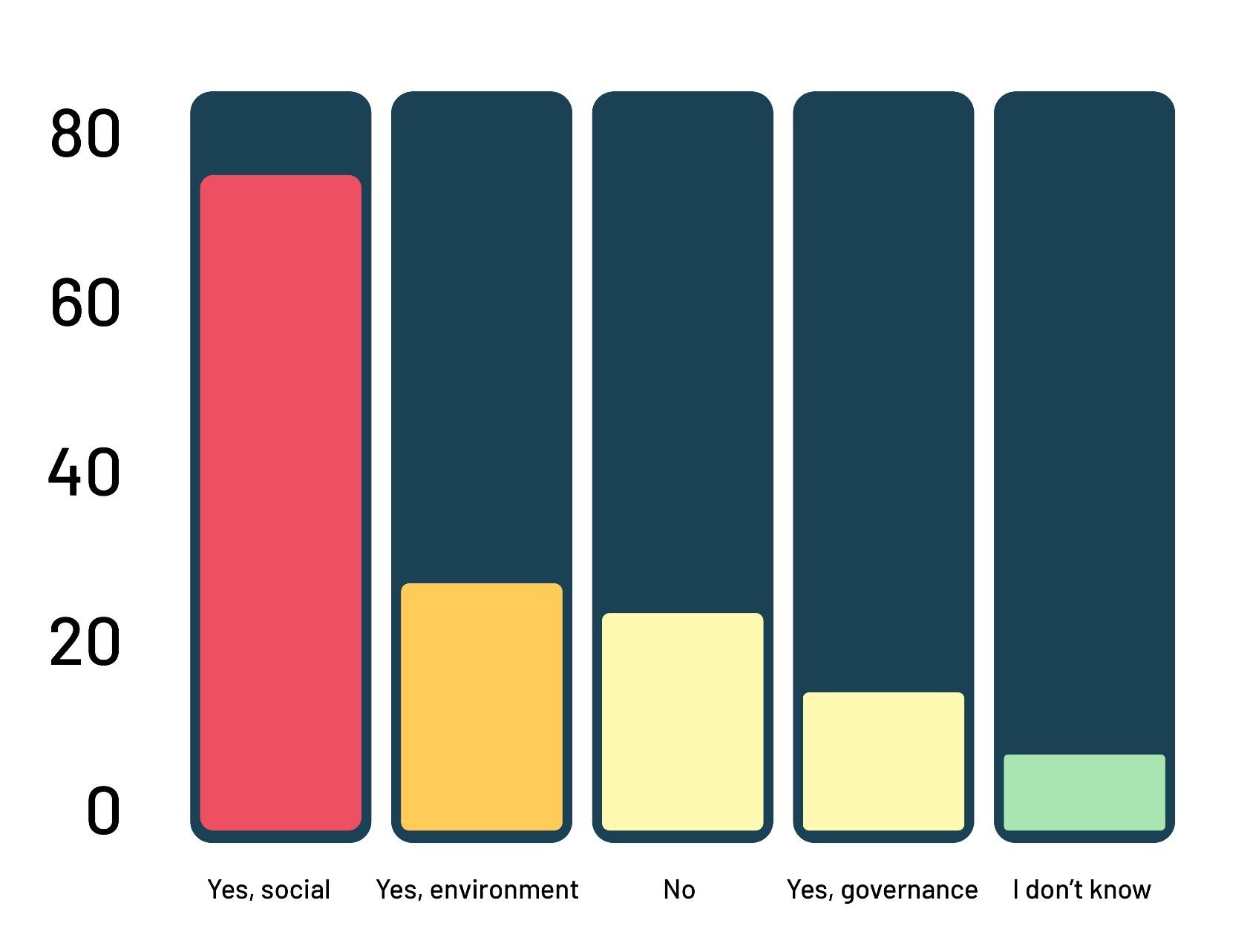

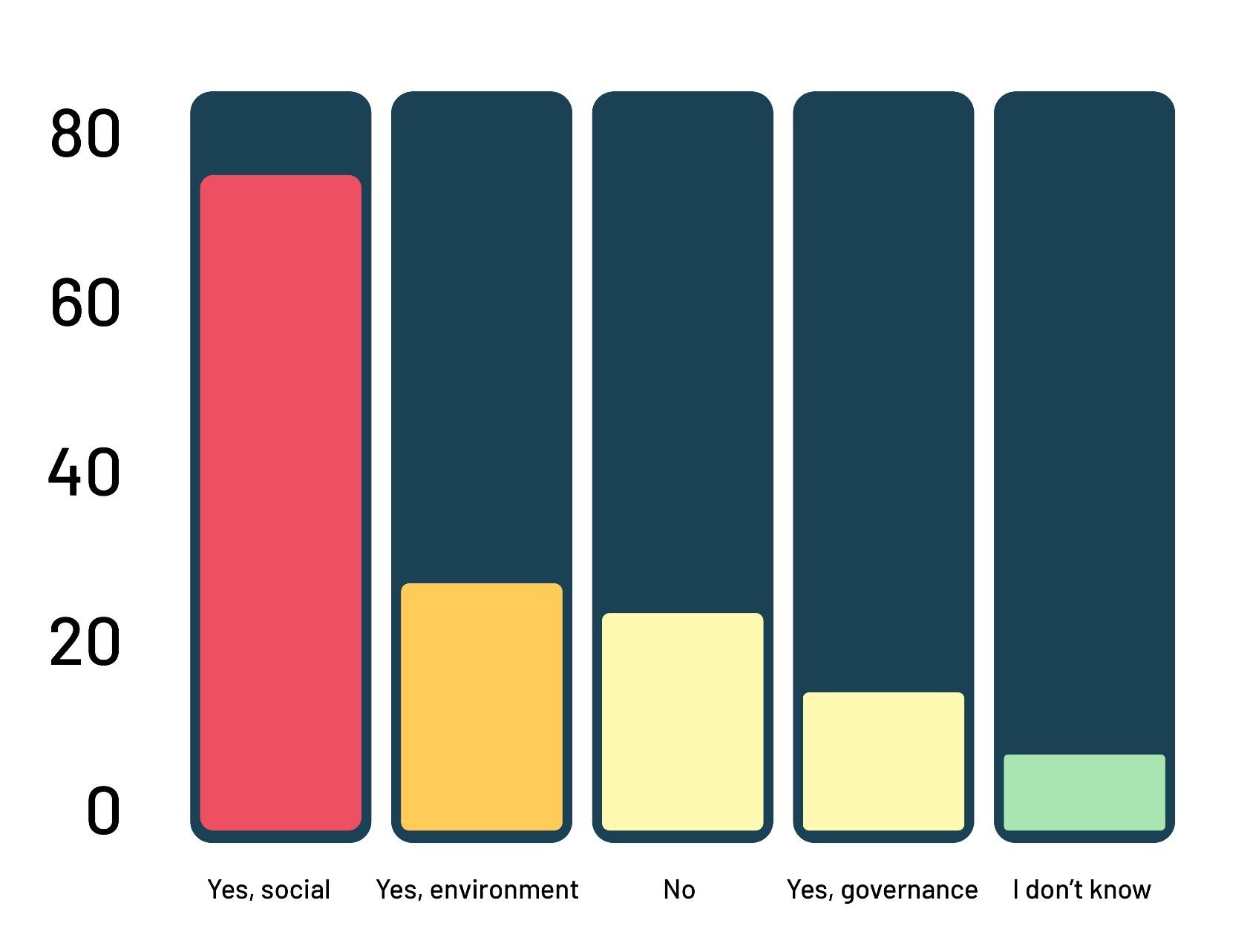

In relation to the ability of the solutions developed by Italian B2B startups to contribute to the achievement of the ESG (environmental, social, governance) objectives, almost 80 percent say they are attentive to social aspects, but just over 25 percent define themselves as being compatible with environmental issues, while 20 percent say they have no adherence to these aspects.

Clearly, there is a lot of work to be done. We certainly start from a favorable assumption that says the use of digital tools is on average more ecological and inclusive than other types of tools. But it also tells us that the simple adoption of an innovative tool, although motivated above all by the search for efficiency, is not sufficient on its own to have a significant impact. A change of mentality, an adaptation of processes, and a focus on resources such as energy resources is necessary to support the ESG objectives.

Startups to watch

The Startups Highlights section is a curated, nonexhaustive list of the startups we believe to be promising from the region, at a variety of stages in their development. It has been compiled by the Startup Wise Guys team, investors, experts, partners and ecosystem collaborators, which consider factors ranging from objective data such as funding, team size, startup age and founding team composition, to subjective factors such as innovation, visibility and potential to disrupt. With data provided by Crunchbase and individual research, we’ve added various indicators to each startup:team size, startup age, diversity of the founding team.

The Startup Highlights list is meant to give insight into the most exciting startups in the Italiano ecosystem. Startups were only compared within their respective industries and categorized into three verticals and three categories: usual suspects, on the radar and hidden treasures.

Madtech, extended fintech and cybersecurity worked as good samples for highlighting startups according to the above three categories. This section is complemented with a specific focus on three startups which, for different reasons, are meant to provide good role models for the entire ecosystem.

Cybersecurity

Booming cybersecurity is the best-kept secret in Italy. A governmental agency was also recently created to coordinate national efforts on the topic, which is not surprising. With countries actively rolling out 5G and bringing about Industry 4.0ì, IoT poses novel challenges due to distributed, software-defined digital routing and an exponentially higher attack surface. In short, there are many new challenges for cybersecurity. Privacy compliance, remote working and cyber training companies are emerging all across Italy.

Hidden treasures

On the radar

Usual suspects

Extended fintech

Not many may know that the oldest bank in the world is Italian. That may say a lot about the long tradition and also the general conservative attitude of an industry that has been difficult to disrupt. In Italy, up until some time ago, it could take anywhere from one week to one month to open a business account. Not anymore!

Thanks to improvements in regulation, entrepreneurial mindset, and a massive market to serve, fintech became as hot as ever and VCs have an appetite for investing large amounts of money in fintech. From credito solutions to KYC, from insurtech to lending for SMEs, Italy is catching up gradually and claiming its place where it should be: at the top!

Hidden treasures

On the radar

Usual suspects

Madtech

It should not be surprising that a country like Italy, known for fashion, design and luxury, has such a thriving madtech scene. Overall, Italy is a good testing ground for madtech SaaS companies, in light of the manufacturing ecosystem and the attention to topics like fashion, design and advertising.

Madtech has been growing through the years, with increasingly more large companies in this category, especially in B2B SaaS which is becoming mainstream. Most of these companies started as agencies or service providers until they managed to automate and digitalize some of their processes to better serve their clients and focus on scalability.

Through the pandemic, market activity in Italy has slowed down, but madtech startups have continued thriving. Customer-centric mindsets are becoming more prevalent and there’s been an increase in focus on CX (customer experience) in the madtech sector. We wouldn’t be surprised if the next big wave of exits comes from this sector. Women-led startups (i.e., InTribe, Roundabout and Transactionale just to name a few) are particularly prevalent in madtech.

Hidden treasures

On the radar

Usual suspects

Conclusion

The Italian Startup Scene report explores the topics covered in this article in more depth and offers expert commentary on trends, highlights major shifts and provides unique insights about the scene from the people shaping it.

This year’s report is an initiative of Startup Wise Guys. The efforts have been supplemented by ecosystem and content partners, which were essential in the report’s research and creation. The report also could not have been completed without the help of various organizations and individuals who provided their insight, knowledge and perspectives.

The report is available for download for free at: https://startupwiseguys.com/italy-report/