With the help of Crunchbase data, AgFunder has released the AgriFood Tech Investing Report for 2018, providing a review of funding trends in food and agriculture technology startups. AgriFood Tech had a record-breaking year in terms of funding, with $16.9 billion in funding in 2018. The three biggest deals of the year included:

- $1bn for Swiggy, India’s leading online restaurant marketplace

- $600m for Instacart, a US-based grocery delivery service

- $590m for iFood, a restaurant marketplace based in Brazil

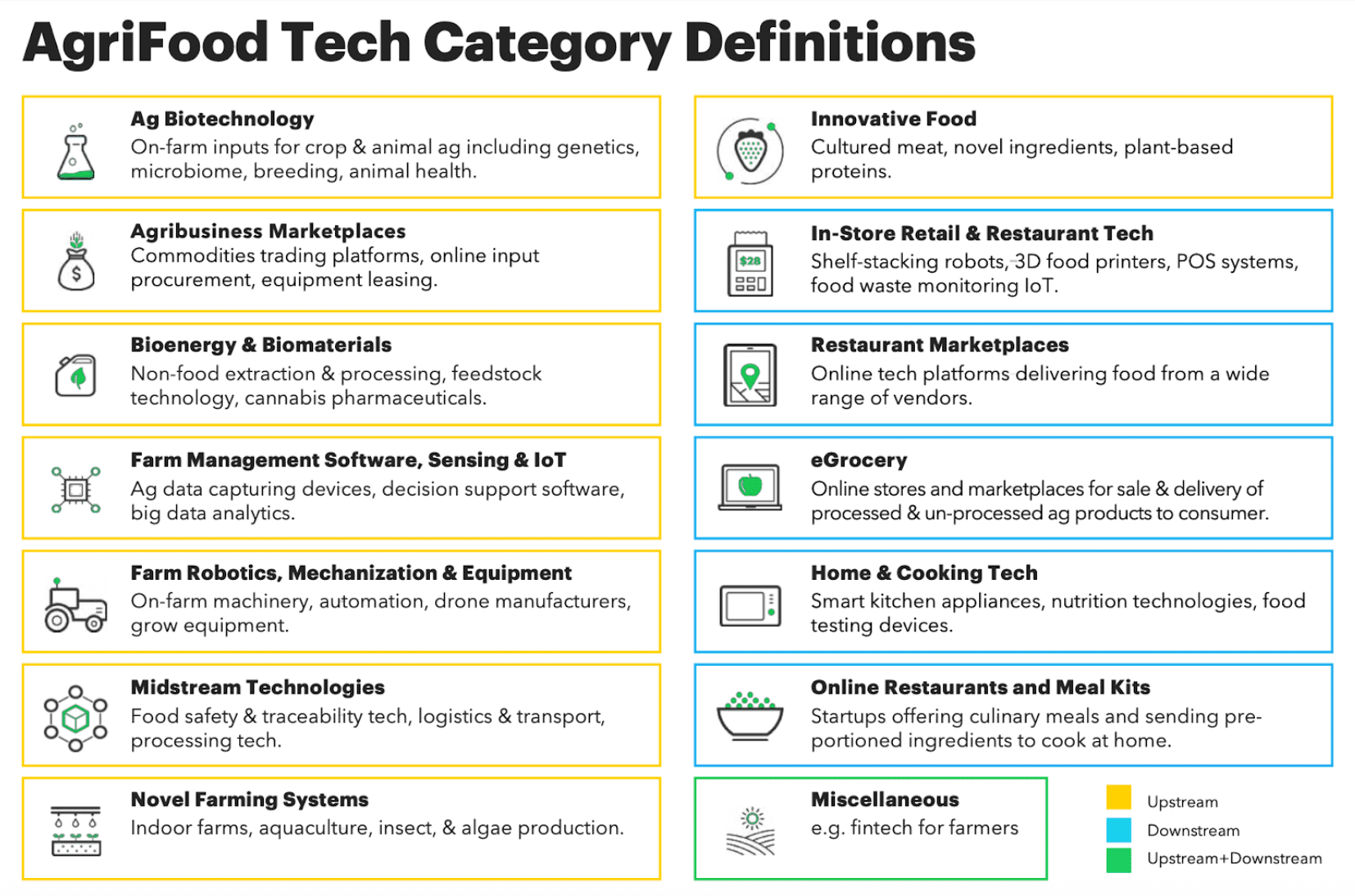

Food and agriculture technology startups: industry definitions

While it looks as though online marketplaces and delivery services dominated the funding this year (unsurprising given the trend of on-demand), AgriFood Tech actually covers a variety of industries Upstream and Downstream in the food supply chain, from Innovative Food (like Impossible Foods) to Ag Biotechnology (like Indigo and Pivot Bio).

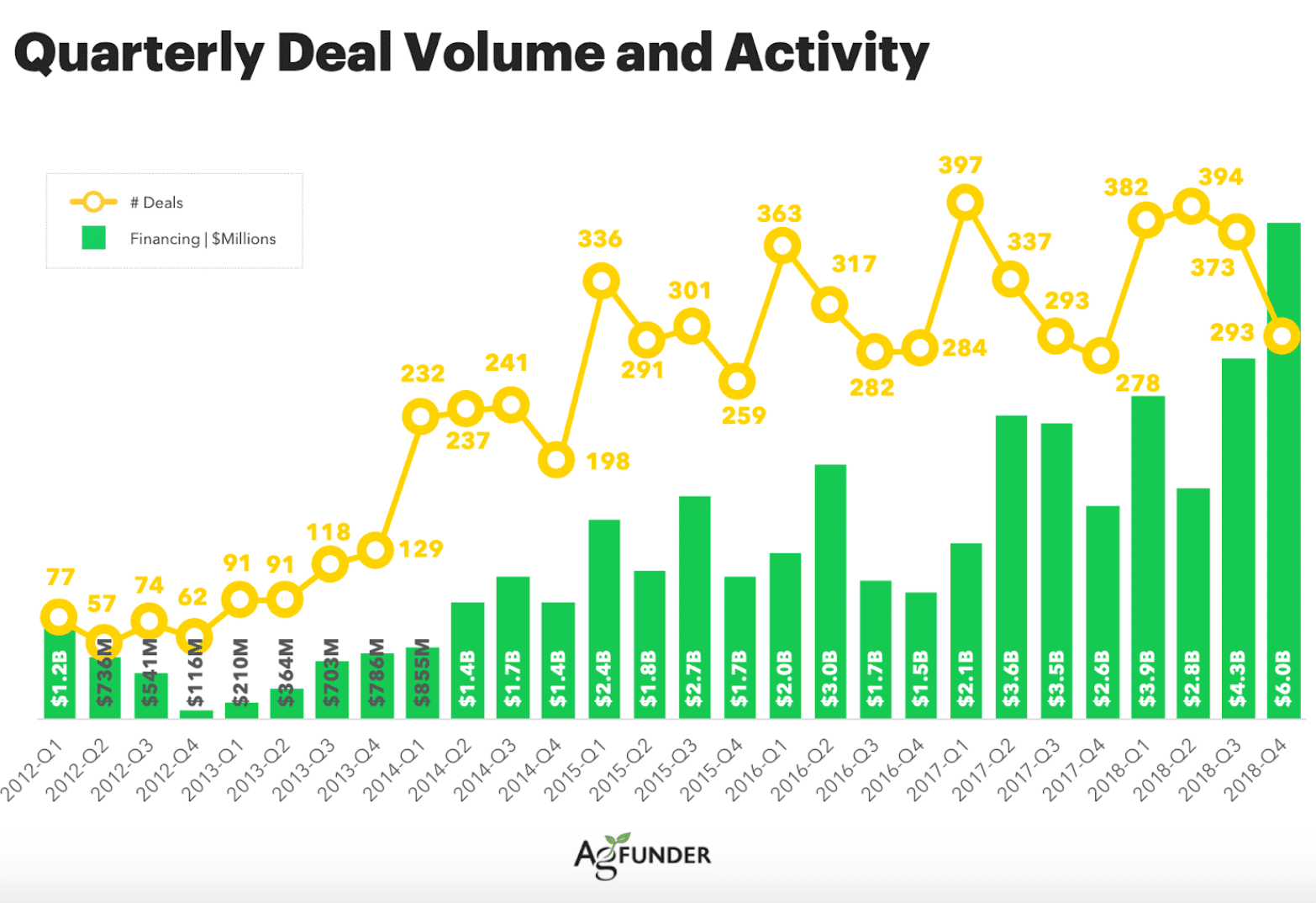

A major trend outlined in the report is that AgriFood Tech deals are getting bigger. From 2016 to 2017, and again from 2017 to 2018, we saw 43% year-over-year growth in terms of annual financing. However, from 2017 to 2018 we only saw an 11% increase in the number of deals, leaving more money on the table for each of those deals.

Deal volume and activity for agriculture and food technology startups

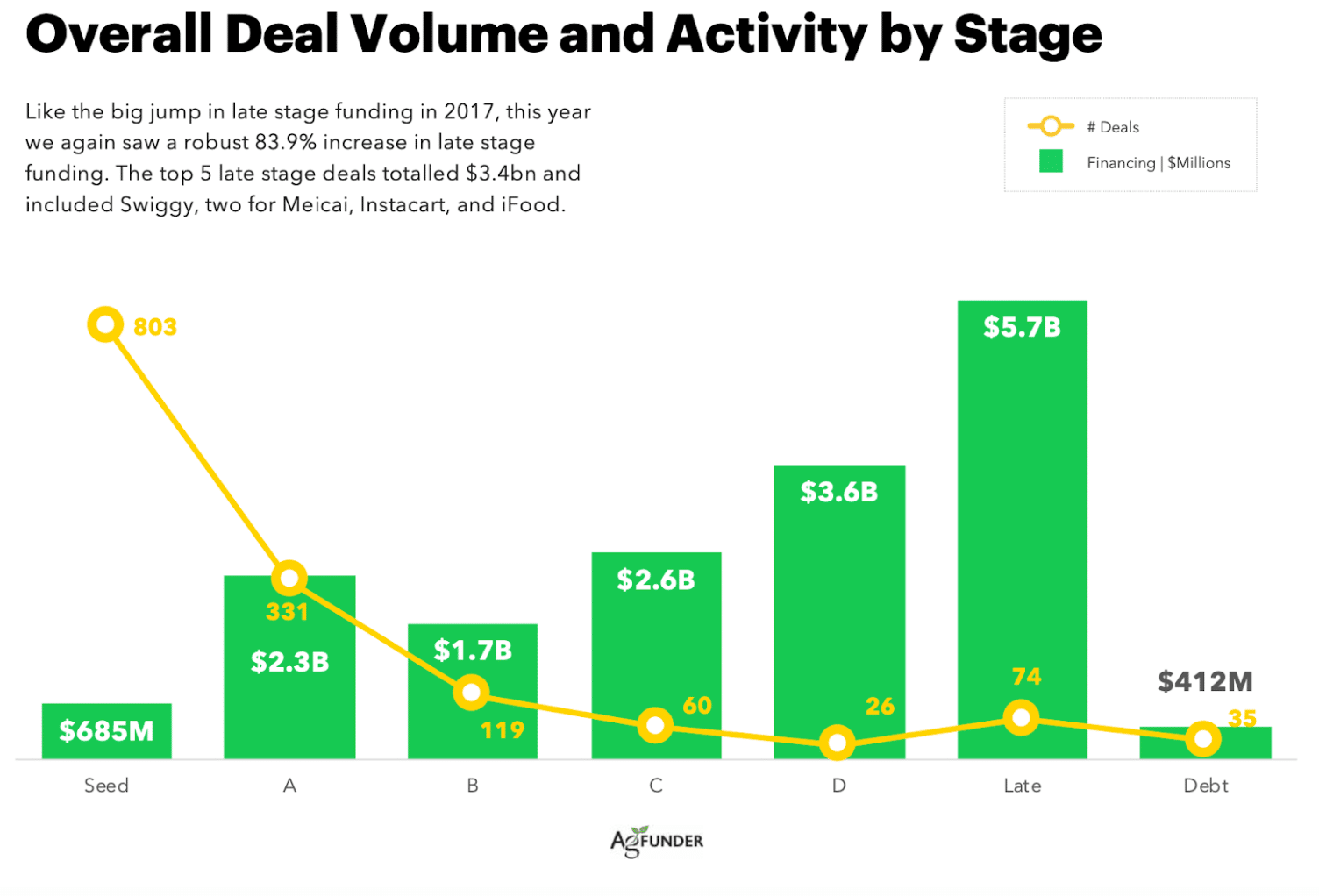

When we look at how this 43% increase in financing was spread across each stage in 2018. We see there was growth at every stage except for Series A. In particular, late-stage deals alone accounted for $5.7bn of the total $16.9bn. While the amount of funding for early-stage deals was particularly lower than the late stage rounds, it was still an increase from 2017, with $685m for Seed and $2.3bn for Series A. The largest Seed investment in 2018 was $25m for Starship Technologies and the largest Series A was $108m for Xiaoqule.

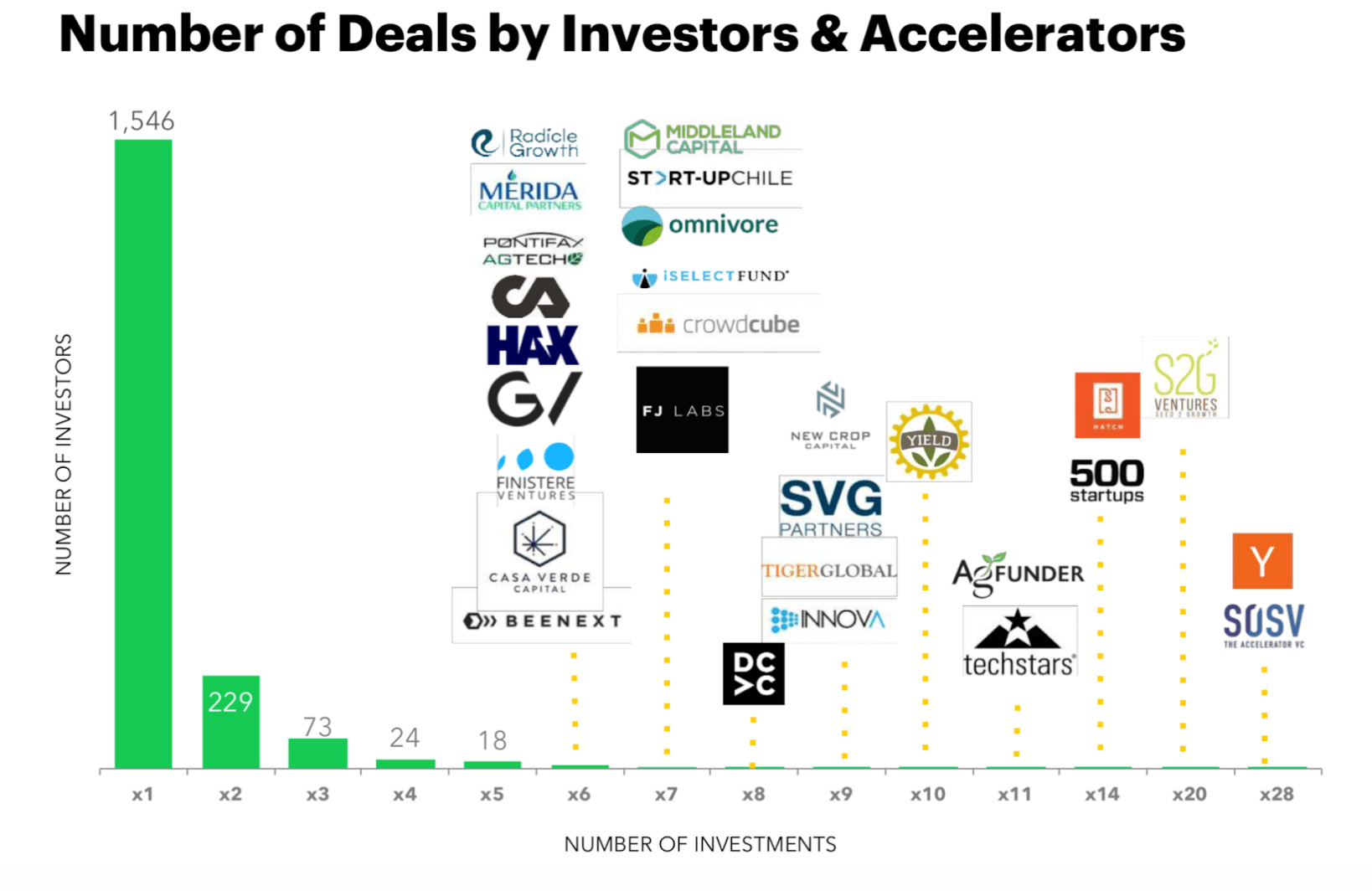

In addition to the increase in funding, the number of investors in the market increased to 1,776 firms in 2018. The leaders were SOSV and Y Combinator, both of which made 28 investments, and AgFunder themselves also made 11 investments into startups over the year. Particularly noteworthy is the number of firms that only had an investment in one AgriFood Tech company – 1,546 firms.

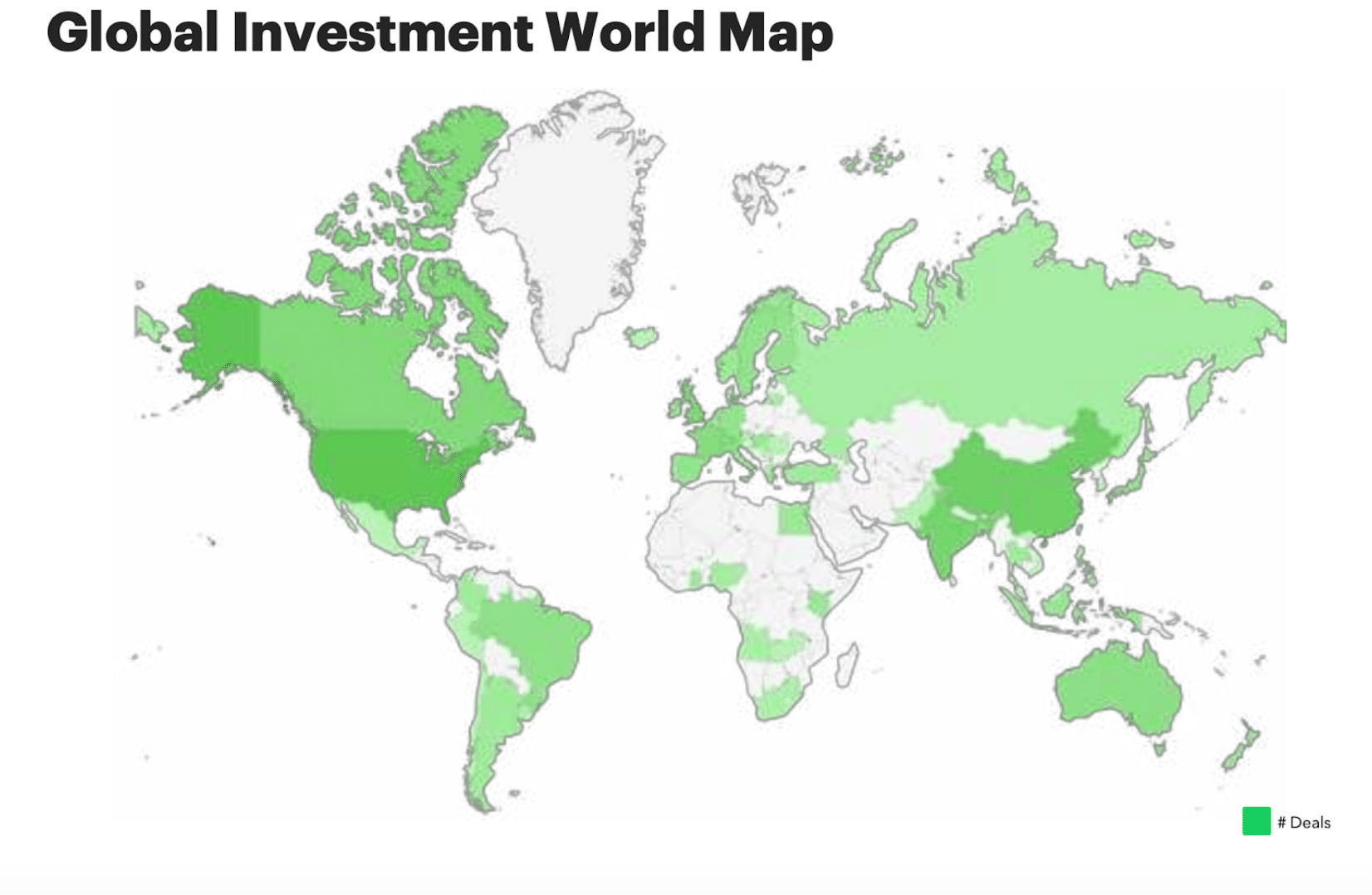

AgTech’s investment map

The US continues to be at the forefront of the global AgriTech Food landscape, with 567 investments totaling $7.9bn. China and India came in second and third, with $3.5bn and $2.4bn, respectively. Interestingly, while the $3.5bn from China is only a 5% improvement from 2017, the number of deals they made increased by 500%. Also worth noting is that Brazil had its highest ever investment total at over $700m.

Click here to download the full report from AgFunder.

Louisa Burwood-Taylor, Head of Media and Research

Louisa is Head of Media & Research for AgFunder and chief editor of AgFunderNews, bringing over 10 years of financial journalism experience to the team. She has covered a range of financial products and markets during her career, from equity capital markets in Asia to structured bonds in Europe, before turning her attention to agriculture five years ago. She’s also been responsible for launching two publications. She’s launched an institutional investment intelligence service for the Financial Times and the first-ever title focused on agriculture investment, Agri Investor, for PEI Media.

About AgFunder

AgFunder is an online Venture Capital Platform based in Silicon Valley. AgFunder invests in exceptional and bold entrepreneurs who are aiming to build the next generation of great agriculture and food technology companies. As a Platform-VC, they have leveraged technology, media, and research to build a global ecosystem of over 60,000 members and subscribers