StartupBlink, a global startup ecosystem map and research center, has launched its 2023 Global Startup Ecosystem Index, which tracks the momentum of 1,000 cities and 100 countries. Since 2017, the GSEI has provided policymakers and startup ecosystem stakeholders with practical insights into their local startup economies. Additionally, founders and investors use the GSEI to make informed decisions and to discover the most promising startup ecosystems in the world.

While choosing the right location to base and scale a startup is often overlooked, StartupBlink believes it can greatly impact the chances of success. Startups are chaotic in nature, but the right ecosystem allows founders to connect with high-quality opportunities and stakeholders on a daily basis.

StartupBlink collaborates with more than 100 governments and global data partners — including Crunchbase — to ensure the delivery of highly credible results. Through its partnership with Crunchbase, StartupBlink analyzes data about thousands of startups, providing valuable insights into the quality, frequency and trends of innovation across various ecosystems worldwide. Additionally, StartupBlink leverages Crunchbase’s funding data to continuously update and enhance its database, offering valuable insights on startup exits.

Click here to download the full Global Startup Ecosystem Index 2023

Our startup ecosystem ranking criteria

The GSEI rankings are based on the sum of three subscores that measure the quantity, quality and business environment for startups.

- The quantity score measures the activity level of an ecosystem, evaluating the engagement of stakeholders and other important players.

- The quality score leverages integrations with partners like Crunchbase to assess the overall quality of each startup ecosystem.

- The startup business environment score, also known as the business score, takes country-level parameters into account. These have a significant impact on all cities within a country, and include factors like national infrastructure, policies and legislation.

Top insights: countries

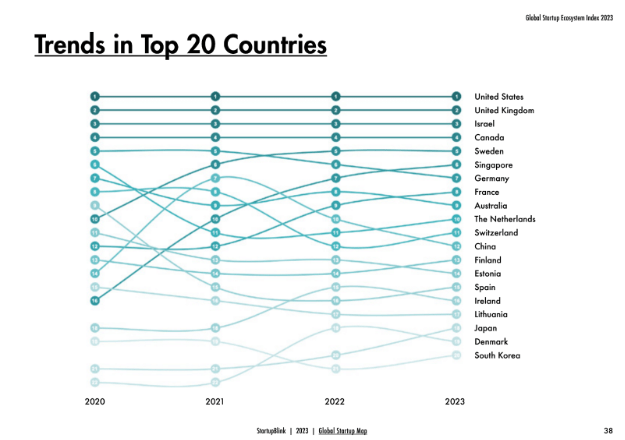

- The top 5 countries in the global startup ecosystem demonstrated relative stability throughout the year, with no significant shifts in their rankings.

- Countries ranked between 6-10 experienced minor changes, with some moving up or down by one position.

- In previous years, there had been a gradual decrease in the gap between the total scores of countries. Surprisingly, this year, the gap between the United States and the second-ranked country remained nearly unchanged.

- The United States maintains its leadership position, exhibiting the highest number of cities ranked in the global top 1,000.

- The United Kingdom retains its second position and continues to lead over Israel, the third-ranked country. Although the U.K. maintains its lead, the total score gap between these two countries has slightly narrowed. Notably, the U.K. is the only country — apart from the U.S. — with more than 50 cities represented in the GSEI.

- Israel, which came close to surpassing the U.K. in 2021, now faces a larger gap between the two countries.

- Canada made significant strides in narrowing the gap with Israel last year, joining the exclusive “Big 4” club alongside the U.S., the U.K. and Israel. As Canada seeks to solidify its global impact, it faces the challenge of justifying its membership in the prestigious club or being grouped with its competitors from below.

- Sweden maintains its position as the top-ranked EU country for the second consecutive year, showcasing consistent success in the startup ecosystem and overtaking Germany globally.

- Singapore has experienced a noteworthy rise to the sixth position, surpassing Germany and displaying substantial improvement since 2020.

- The Netherlands made a notable return to the top 10, displacing China and contributing to the representation of five European countries within the list.

Top insights: cities

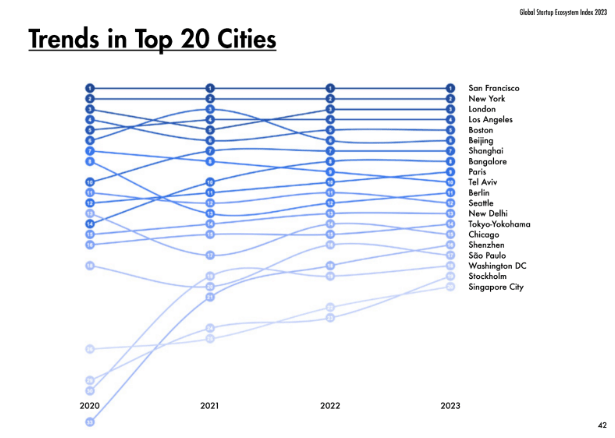

- San Francisco remains the dominant leader in the global startup ecosystem for another year.

- The relative power of San Francisco has stabilized, indicating its continued stronghold as the top global ecosystem.

- The competition between cities ranked third to sixth is intense, with small gaps in their total scores.

- The rankings and score gaps between these cities remained relatively unchanged in 2023.

- Shanghai, the second-ranked Chinese startup ecosystem, maintains its seventh global position but is closer in score to lower-ranked ecosystems.

- Bangalore, the top-ranked Indian ecosystem, holds its eighth position and is closing in on Shanghai.

- Tel Aviv has experienced a gradual decline, dropping one spot each year since 2020 and is now ranking 10th.

- Paris, on the other hand, has consistently improved, moving up one spot every year since 2021 and is now securing the ninth position.

Top insights: funding

Crunchbase played a pivotal role in providing us with comprehensive funding data, which enabled us to collect valuable insights. Thanks to Crunchbase’s extensive funding database, we compiled the following funding trends in the GSEI:

- After a record-breaking year in 2021, global startup funding experienced a decline of more than 30% in 2022, but still remained higher than in 2020 and 2019.

- The number of startup funding deals only saw a slight decrease of around 3%, from 32,058 deals in 2021 to 31,067 in 2022, indicating a significant decrease in the average funding amount.

- Late-stage startups were the most impacted by the global funding decrease, experiencing both the largest decline in volume and a year-over-year fall of 43%.

- North American startups continue to dominate the global startup ecosystem, capturing 49.9% of global funding, slightly lower than the previous year’s 52%.

- Startup funding in the Asia-Pacific region saw a small increase, rising to 24.5% compared to last year’s 24%. The majority of regional investment — more than 60% — is concentrated in India and China.

- Europe witnessed a modest increase in its funding share, rising from last year’s 18.3% to 19.7%.

- Despite the presence of numerous active and successful ecosystems in Europe (41% of the top 1,000 cities are European), investors perceive greater potential in North America and the Asia-Pacific region, resulting in only 19.7% of startup funding flowing to Europe.

For more insights, download the full report.

*Sengul Enginsey, content writer at StartupBlink, also contributed to this piece