Editor’s note: This is a repost of a story written on TechCrunch by Jon Shieber.

The U.S. healthcare system is sick, but increasingly early stage investors are spending money on new technology companies they believe can help provide a cure.

Earlier this week, Greylock Partners, one of the investors behind Facebook and LinkedIn, and the Russian billionaire technology investor Yuri Milner put together a $1.2 million round alongside a group of co-investors to back First Opinion – a consumer facing service selling a way to text message doctors anytime of day or night.

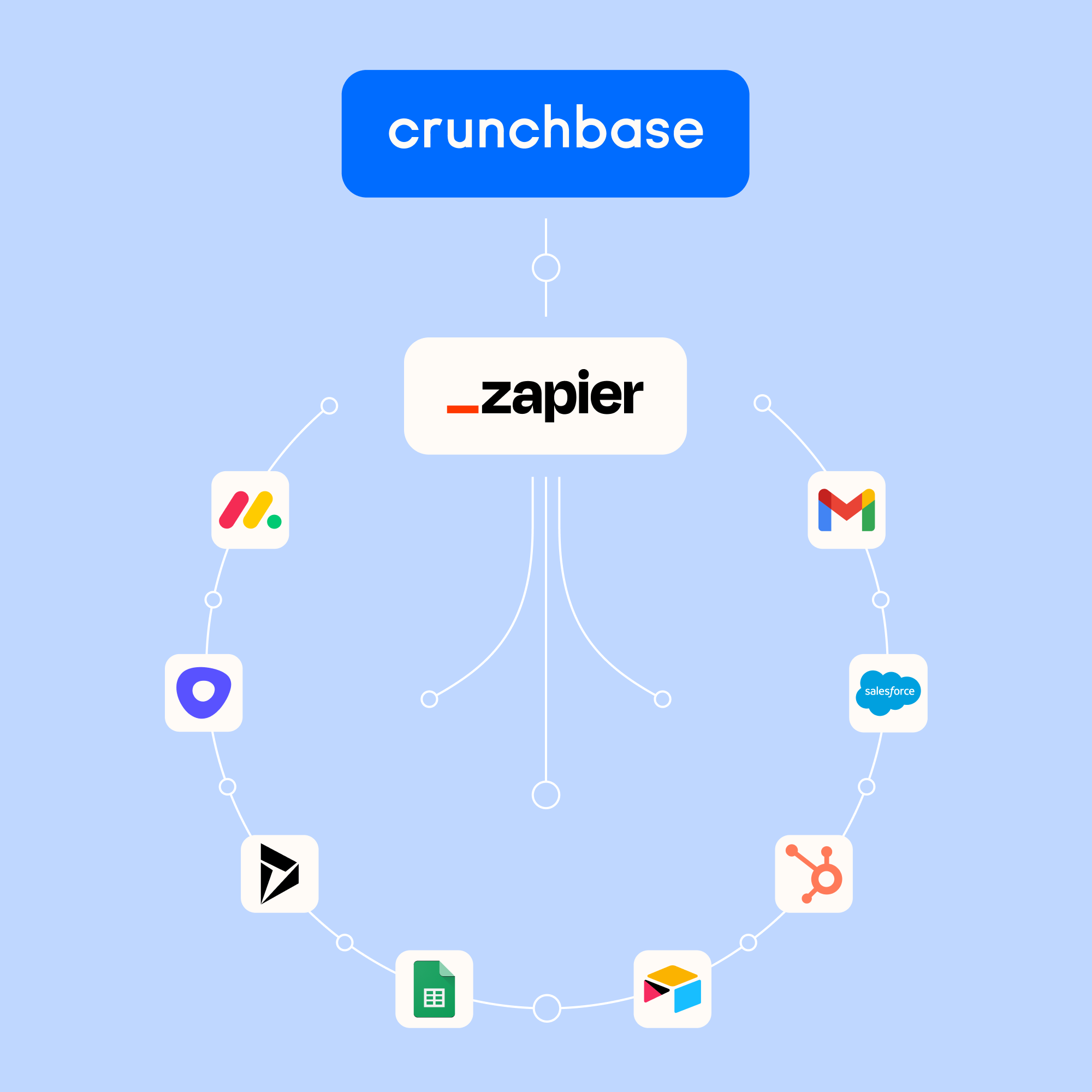

Greylock and Milner join a growing roster of technology investors focused on healthcare in recent years. The number of companies raising money from investors for the first or second time has skyrocketed since the passage of the Affordable Care Act, according to data from CrunchBase.

In 2010, the year in which President Obama signed the ACA into law, there were only 17 seed- and Series A-stage healthcare-focused software and application development companies which had raised money from investors. By the end of last year, that number jumped to 89 companies tackling problems specifically related to the healthcare industry, according to CrunchBase metrics.

Across all categories, investors spent over $1.9 billion in 195 deals with commitments over $2 million, according to a report from early stage investment firm Rock Health. Funding was up 39% from 2012 and 119% from 2011, the Rock Health report said.

And there’s plenty of room for the market to grow, according to Google Ventures’ general partner Dr. Krishna Yeshwant. “We’re still at the very beginning of what this is going to look like,” said Dr. Yeshwant.

Google Ventures is addressing the nation’s healthcare dilemma with investments in companies like the physicians’ office and network One Medical Group, which raised a later stage $30 million last March. At the opposite end of the spectrum in December 2013 Google invested in the $3 million seed financing of Doctor on Demand, which sells a service enabling users to video chat with doctors.

Unsurprisingly, the explosion in healthcare investments tracks directly back to the passage of the Affordable Care Act, investors said. “The incentives brought forward by the ACA shift what makes sense,” in healthcare, Dr. Yeshwant said.

“At the highest level there’s now a forcing function to take advantage of the efficiency technology provides,” said Bill Ericson, a general partner with Mohr Davidow Ventures, who led the firm’s investment in HealthTap, a service for consumers to message doctors with healthcare questions.

Overwhelmingly, Silicon Valley is leading the charge in these innovations, according to CrunchBase.

This flood of capital has pushed some investors like Founders Fund to re-think their strategy, and de-emphasize healthcare software in search of other, larger opportunities.

““The reason we have somewhat shifted focus away from healthcare IT is because there is so much investment going into that space. So we think the problems there are being sufficiently addressed by the full market.” said Brian Singerman, a partner at Founders Fund.

The firm’s most recent investment was in Oscar, a new, New York-based insurance company. Yes… an insurance company.

“In healthcare there is a tech stack around genomics, digitization, biometrics, analytics, and actual cures; one of the things that ties that all together is insurance,” said Singerman.

“Launching a new insurance company is not something that happens very often. While you could launch a new insurance company without the Affordable Care Act, the catalyst it gives you by being on the same page as the big incumbents is unprecedented.”

At Google Ventures, Dr. Yeshwant thinks there will be more opportunities for tech-enabled companies like Oscar and One Medical to compete in these broad industrial categories rather than offering point solutions. “Instead of being a piece of the system, it’s being the entire entity,” he said.

“The thing to keep in mind… with the healthcare industry is that it is far bigger than tech. As an entity it is where we’re spending 17% to 18% of GDP, so any one segment is tens of billions of dollars,” Dr. Yeshwant said. “Increasingly you’re seeing IT investors who have a fine sense of disruptive opportunities enter the market.”

Photo via Flickr user BrickDisplayCase