What will Japanese startups be like in 2025? In this article, we will describe the funding situation, investor activity, trends, and companies to watch.

Funding situation for startups in Japan

In November 2022, the Japanese government announced its Five-Year Startup Development Plan. The goals are to “invest 10 trillion yen in startups” and “create 100,000 startups.” The five-year plan, which aims to make Japan one of the world’s leading startup clusters, was 18 months old by the first half of 2024. As of H1, preliminary figures show that the amount of funds raised is only 372.5 billion yen, falling short of the annual goal of 1 trillion yen. The number of startups, at approximately 24,000, falls short of the “create 100,000 startups” goal set forth in the five-year plan, leaving a gap between the ideal and the reality.

Investment money in Japanese startups has been declining rapidly since 2023. This is because of monetary easing in response to the outbreak of the COVID-19 and the destabilization of the global economy, including interest rate hikes by global central banks, particularly in the United States. The figures for the first half of 2024 represent these trends.

On the other hand, since the first half of 2023, there has been no wild fluctuation in the amount of funding and it has remained at a constant level. This could be seen as a continuation of the adjustment phase in the funding environment.

The number of companies raising funds has also increased slightly since 2023. This is due to the fact that “seed” and “early” startups, which are those that have just started up and have just released their services, are raising more funds. While the amount of each procurement is relatively low for these early-stage companies, by investing in and accompanying them in their early stages of business, they can expect a large return when they achieve growth. One of the reasons for the increase in the number of seed and early stage companies is the growing pool of human resources in Japan who are interested in starting their own businesses. This is the feeling of many investors who are paying attention to startups.

Japan’s fundraising situation compared to the U.S.

Is Japan the only country affected by the cooling of the investment environment after 2023? Let us take a look at the situation in the U.S., which has the largest amount of funds raised and the largest number of companies in the world.

In the U.S. startup market, funding in the first half of 2024 reached $89.8 billion, up from the previous year but less than half the peak.

Although the first half of 2024 shows a rebound, investment money is concentrated in the area of generated AI, and it remains to be seen whether the market as a whole is on the road to recovery. The graph clearly shows that the investment environment in the U.S. was seriously affected by rising interest rates, suggesting that fluctuations in Japan were relatively minor.

Another difference between the two countries is in the investment industry. In the U.S., funds have been flowing steadily into the medical and healthcare sectors, which have attracted more attention since COVID-19. In Japan, on the other hand, startups engaged in energy and environmental businesses are attracting attention.

University-launched ventures are also gaining momentum in Japan; since FY 2014, the number of university-launched ventures has increased for eight consecutive years, reaching a total of 4,288 companies as of 2023. Most recently, a particularly large number of research-based ventures have been launched, followed by IT-related companies, and then the biotech, healthcare, and medical device industries. The university with the largest number of university-launched ventures is the University of Tokyo, followed by Keio University, Kyoto University, and Osaka University.

Number of investments by foreign investors

Let’s also look at the number of investments in domestic startups by foreign investors. In the first half of 2024, the pace was 49 cases, about the same as the previous year. Although the weak yen was expected to be a strong tailwind, the number of cases has not shown rapid growth. On the other hand, in the past few years, there has been a trend among foreign investors to investigate Japanese startups as investment targets, which may be reflected in the number of cases and the amount of investment in stages. For example, Sakana AI, established in Japan by prominent AI researchers from Google, has attracted significant attention from foreign investors. According to multiple reports, including the Nikkei (June 15), the company plans to raise an additional $125 million in funding, with participation from high-profile foreign VCs such as New Enterprise Associates (NEA), Khosla Ventures, and Lux Capital.

Germany’s Heraeus (Heraeus Beteiligungsverwaltungsgesellschaft mbH) participated in the Series C round of procurement (5.3 billion yen in total) for Tsubame BHB, which is engaged in ammonia production based on research by Hideo Hosono of the Tokyo Institute of Technology.

In this way, there are more and more examples of Japanese startups raising funds from foreign investors and VC firms.

Attractive areas for investment

In the first half of 2024, the number of startups in Japan and the number of people investing in these companies are increasing, with a particular concentration in the Tokyo area. There are three main reasons for this concentration: the easy gathering of startup talent, the location of an international business hub that facilitates the creation of global networks, and the environment that facilitates the convergence of diverse industries.

Outside of Tokyo, the Kansai area, which includes Osaka and Kyoto, is attracting a great deal of attention as an investment target.

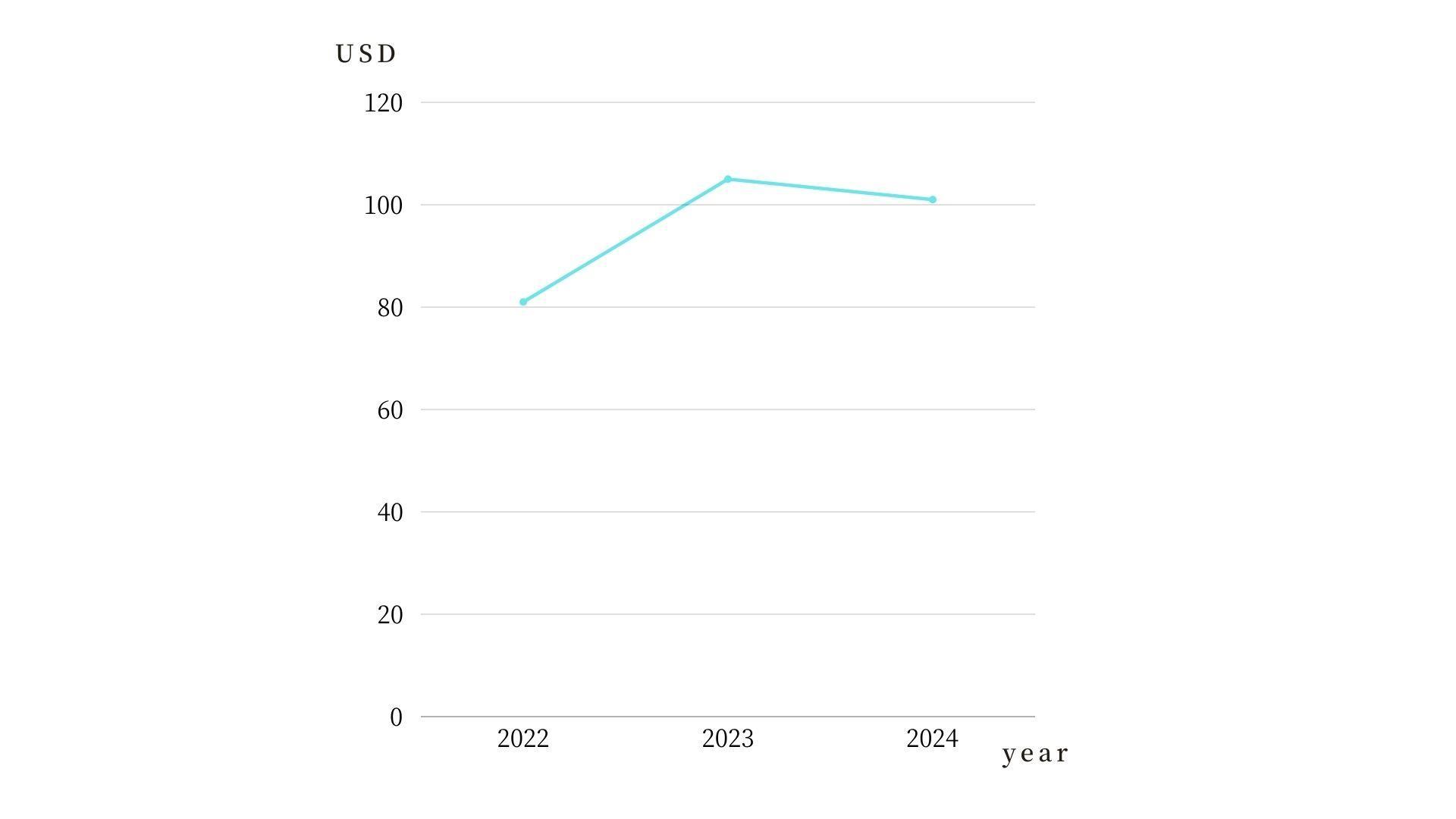

According to the results of “The Global Startup Ecosystem Report” published annually by Startup Genome, within the “Emerging Ecosystems Ranking” that ranks the growth of startup communities, the Kansai region is gradually moving up the rankings from unranked in 2022, to 91-100 in 2023, and then to 81-90 in 2024.

One of the reasons for the increase in the evaluation ranking is that the number of companies eligible for investment has been increasing, with several companies raising more than 1 billion yen, the average number of seed startups raising more than 4 companies, and the average amount raised rising to approximately 500 million yen after 2022.

Total amount of funds raised each year:

Companies with over 1 billion yen in funding:

Kansai ecosystem

Kansai is originally an area with many startups originating from university laboratories. There are many excellent research institutions in Kansai, including Kyoto University, Osaka University, and Kobe University. In many cases, R&D startups based on basic research in laboratories have taken up residence in university-related incubation facilities, and the companies that have grown out of these incubation facilities have created additional employment. In recent years, universities have been focusing on supporting these companies, and there have been moves to establish and scale up investment capitals on campus.

The Kansai area is also seeing an upsurge in support from government agencies. The Kansai region will host the Science Expo in 2025, and Global Startup Expo 2025 will be held during the event. The Global Startup Expo 2025 is an international conference event where investors and startups from around the world will participate to explore how they can approach global issues and find solutions through business exchanges and dialogues. Organized by Japan’s Ministry of Economy, Trade and Industry (METI), one of the goals of the event is to promote the attractiveness of startups in the Kansai region and elsewhere in Japan through collaboration with the Osaka-Kansai Expo 2025.

In Osaka, the redevelopment of the Umekita district, the largest terminal area in western Japan, has been underway since 2013, and in September 2024, a preliminary groundbreaking was held to create a mixed-use complex called Grand Green Osaka. The Grand Green Osaka is a complex that includes offices, a hotel, core facilities, commercial facilities, an urban park, and residences. The core facility, Jam Base, is a new center for innovation in Osaka, where a diverse range of people can gather and interact to generate ideas and innovations.

Jam Base aims to be a center for innovation activities by supporting companies, universities and research institutes, startups, venture capitalists, and other players to work together to give shape to new ideas and take on the challenges of social implementation and commercialization, and by promoting and supporting a variety of activities through the concerted efforts of the private sector, government, and economic organizations. The center aims to be a hub for innovation activities.

In the government, there has been a move by Osaka Prefecture, the city, and the Bureau of Industry to conclude a partnership agreement on startup support through the Osaka-Kansai Expo Revitalization Fund. Thus, in Kansai, there is a concerted effort by the government and economic organizations to promote and support startups, which is a major tailwind.

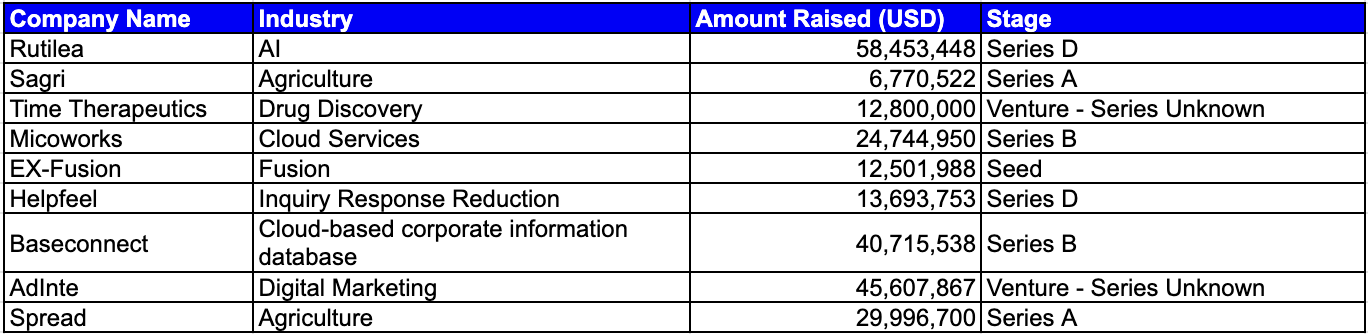

Startups to watch in Kansai

Here are three startups in the Kansai region that have attracted particular attention:

Toregem BioPharma

Toregem BioPharma Co., Ltd. has been attracting attention from investors in recent years. This Kyoto University laboratory-based company is developing and commercializing an autologous tooth regeneration drug (so-called “tooth growth medicine”) for tooth defects.

The company’s regenerative medicine, which was developed after more than 30 years of research and demonstration experiments at Kyoto University’s Graduate School of Medicine, will function as a special medicine for people with congenitally erupted permanent teeth. Worldwide, there are more than 2.4 million people with congenitally missing permanent teeth, and the market is estimated to be worth 3.6 trillion yen. If this drug could be applied to people with acquired missing teeth, the market would be worth more than 20 trillion yen.

The company has been collaborating with the Japan Agency for Medical Research and Development since 2015, and has already completed animal testing and will begin clinical trials in October 2024. The company has already raised 2,390 million yen, indicating high expectations from investors. It is a company with high expectations that could become a special medicine in the field of dentistry, which has a large global market.

QioN

In the same Kansai area, QioN is attracting attention in a different field. The company, which originated from alumni of the University of Tokyo and is currently based in Osaka, is exploring applications for high-performance ion-conductive membranes and developing devices. The company is developing synthesis technology for ion-conductive membranes that are tough and have high conductivity, and is designing a process that utilizes this technology.

The devices developed by QioN are attracting attention as a solution to the major environmental problem of reducing CO2 emissions.The company was selected as a promising company in “ki-do,” a program launched in the Kansai region to support startups in growing fields that are becoming a global trend.

The company is also attracting attention from the market, as evidenced by its confirmed participation in the 2025 Osaka-Kansai Expo, and is expected to be used in a wide range of applications, such as reducing the cost and improving the performance of fuel cells.

Godot

Lastly, we will introduce Godot, a company that develops products using machine learning and behavioral science. The company, located in Kobe, Hyogo Prefecture, offers a behavioral intelligence platform that simulates target populations, identifies behavioral barriers, and generates interventions, including messages and videos, to promote action.

The platform revolutionizes the application of behavioral science, which traditionally required costly and time-consuming expert input. By leveraging machine learning, it empowers anyone to utilize academic, evidence-based methods. Beyond one-size-fits-all interventions, it allows for personalized approaches tailored to individual behavioral traits, and it stands out by enabling data collection for iterative, adaptive interventions.

In Japan, Godot’s services are already being utilized by both municipalities and private companies. Notably, the City of Osaka leveraged Godot’s platform to encourage citizens who hadn’t undergone cancer screening in the past five years, resulting in a remarkable 46% increase in colorectal cancer screening rates.

Godot has already established an R&D hub in Vienna, Austria, and is steering towards global expansion, with preparations underway to enter the U.S. and Southeast Asian markets. Additionally, one of its flagship products, NudgeAI, was recognized with the WHO WPRO Innovation Award for its contribution to addressing vaccine hesitancy.

In this way, Kansai has produced a large number of deep tech companies, taking advantage of the unique characteristics of the region’s concentration of excellent universities and research institutes. While much of Japan’s ecosystem is concentrated in Tokyo, we will keep a close eye on trends in the Kansai area, where significant growth can be expected based on highly original research.

.svg)