In the era of COVID-19 and global lockdowns, most of us have been forced to adapt to living our lives remotely. All the essentials in our day-to-day lives such as school, work and doctors appointments have entered the digital sphere. Financial services are also experiencing this trend, as noted by a spike in fintech use. In Europe, for example, fintech platforms have seen a 72 percent increase in use — according to research by deVere Group.

According to James Green, deVere Group’s divisional manager of Europe: “The massive 72 percent bounce in fintech app usage is part of a fundamental adaptation to life in lockdown… The world has changed in the last few weeks.”

Despite the fact that most industries are falling at the feet of a crumbling global economy and with a potential recession looming, the fintech industry is being re-energized by the uptake in use. This is yet another sign that the long-term effects of the coronavirus will propel us into an increasingly digital age.

Our increased usage in fintech platforms has now expanded beyond the necessities–services such as mobile banking–and has quickly taken over other, less essential, areas such as trading stocks.

Fintech usage has stretched beyond the everyday

Why is this the case? Because fintech brings something to the table that has never been present in finance: accessibility.

For decades, the language used and the fees charged by brokers and financial institutions made investing an elusive concept for many. More recently, newcomers like Robinhood emerged to disrupt the industry by offering commission-free, effortless stock trading through an easy-to-use app. This opened the door to millions of new and younger traders, starting an industry seachange as more brokers followed suit.

Throughout COVID-19, millions of people have been stuck at home due to lockdown measures. Increased unemployment has caused pervasive financial uncertainty and rocky financial markets. This combination has resulted in another upsurge in people trying to take advantage of the market.

Online brokerage E*Trade Financial Corp., for example, opened around 260,500 retail accounts in March, more than any previous full-year recorded. Robinhood reported a record 3 million new accounts in Q1 2020. Even the forex market is speculated to have been saved by COVID-19 — an industry now composed of approximately 10 million traders.

This spike in fintech adoption and fintech users points towards a continued growth in this trend. All that’s left is the creation of apps and processes that people love. Easy, right?

Data Is Fueling Self-driving Money

The path to self-driving money has so far been rocky and windy, drizzled with near break-throughs and rained on by failed attempts.

The earliest personal finance management (PFM) apps took a lot of time to set up. In addition, banks initially attempted to predict customers’ future cash flows without considering data from other institutions that would help refine the results.

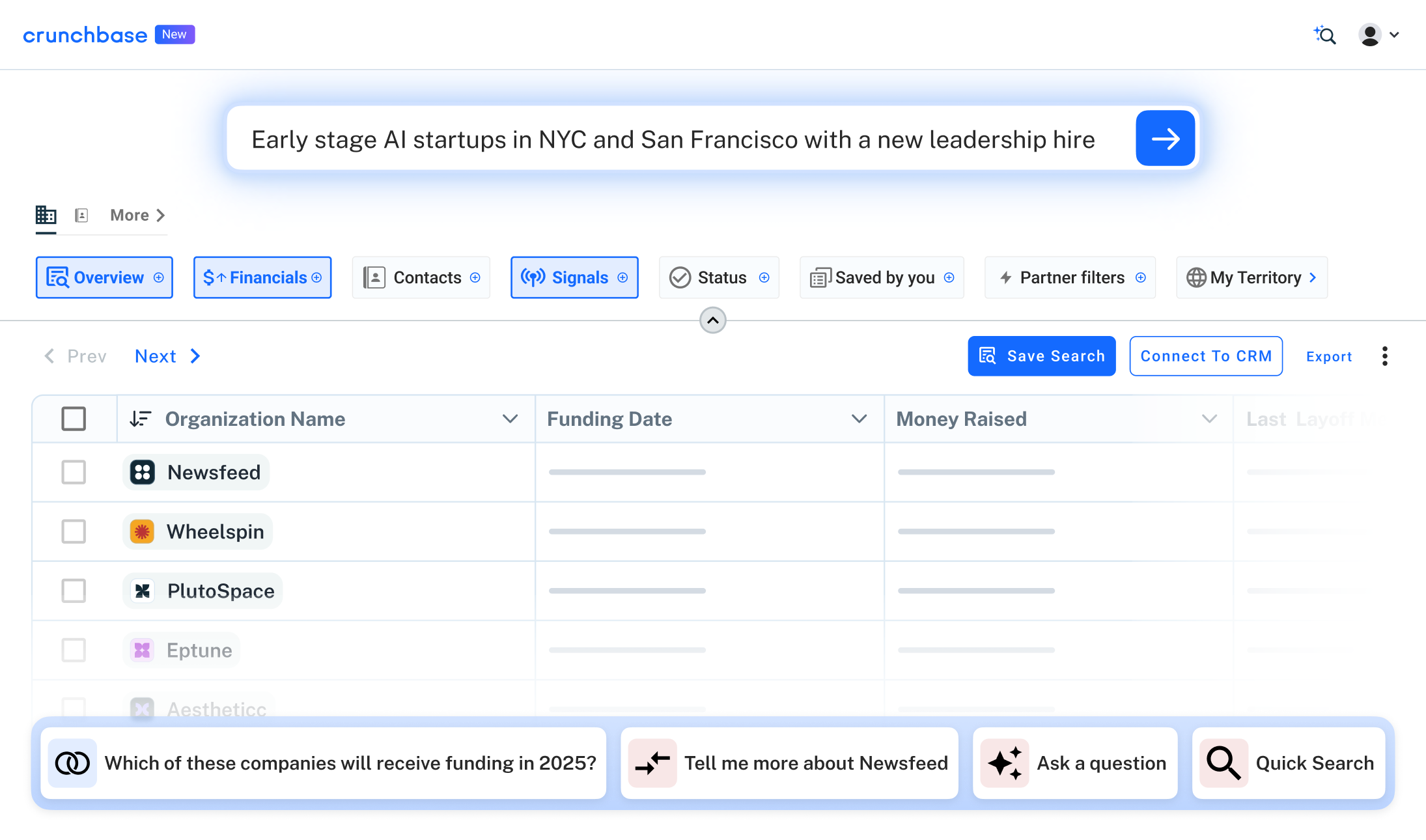

Although still in its infancy with 68 percent of data professionals working with data for five years or less, data is fueling the future of self-driving money. Newer companies are now utilizing data aggregation services and bringing more personalized, quality financial data to the table.

The significance of data in a digital age helped propel aggregation service Plaid to a $2.65 billion valuation. Its first major acquisition of Quovo, a company that tracks large amounts of investment data, helps paint a more intricate, colorful image of the issues customers are facing in their financial lives.

Originally, this data was used for one purpose: to keep users informed about their finances. Almost a decade ago, BBVA-owned neobank Simple created a Safe-to-Spend feature that let customers know exactly how much was in their account. This inspired a swarm of new innovations that aimed to not just inform users, but to take it a step further by offering solutions to financial issues, including saving, faced by many.

Millennials and Gen Z are taking these beloved niche functions and knitting them into a unified experience. Doing this successfully requires a large web of data that encompasses both the complexity and the variety of our individual personal finances.

Combining the building blocks of self-driving money

Entrepreneurs are marrying these building blocks to create a more in-depth understanding of people, with their sights set on self-driving personal finance tools and services. For example, Brightside, a financial health platform that provides personalized solutions to improve the financial health of working-class families, integrates data with a myriad of other human aspects like nuance and empathy.

Brightside automates people’s day-to-day personal finance tasks. It helps to work out which bills to pay first, or how to create a savings budget (that we stick to), while its assistants work on providing support and building trust.

In September, robo-advisor Wealthfrontlaunched Autopilot, a service that automates customers’ savings plans, removing the stress out of manually checking accounts. This was a huge step toward its goal of delivering a fully automated financial service.

Wealthfront co-founder Dan Carroll shared his optimism about the leap toward self-driving money. He said, “The system we’re building has the potential to be one of the biggest wealth creation engines of our generation, automatically optimizing your money in the background while saving you time and stress.”

A Future Of Stress-free Money Management

How will all of this culminate into a future of self-driving money? The future of our personal finances will look something like this: We will know how to budget better, monitor our spending more accurately, and learn from our financial history.

A deeper understanding of our finances will enable us to map out a schedule for paying debt, saving for emergencies, and planning for bigger finances in our lives, like mortgages and retirement.

Our finances will be perpetually monitored, allowing apps to notify us of things including cheaper or more niche financial products. Sirens will be set off as we approach risky financial terrain, encouraging us to manage, and even avoid, the fall.

Self-driving money will offer advice on how to manage liquidation, such as suggesting ways to sell an old item like a computer if you’ve just bought a new one. It will be especially welcome as a tax saving tool, by highlighting ways we could qualify for tax benefits.

All signs point to self-driving money becoming the new norm of the digital era. With the pandemic causing upheaval on our finances, self-driving money can help us stay afloat—so we can worry about the important things in life, knowing our finances are secure.

Kiara Taylor is an expert on the integration of finance and technology. She writes about the impact of both micro and macro trends on global finance.

.svg)

.png)