Through partnership with Crunchbase, Finnish Venture Capital Association (FVCA) released a new study covering Impact Investing in Private Equity. The study defines impact investing as investing that focuses on financial as well as social and/or environmental impact. The results reveal that European impact investors are not looking to compromise financial results in order to create impact.

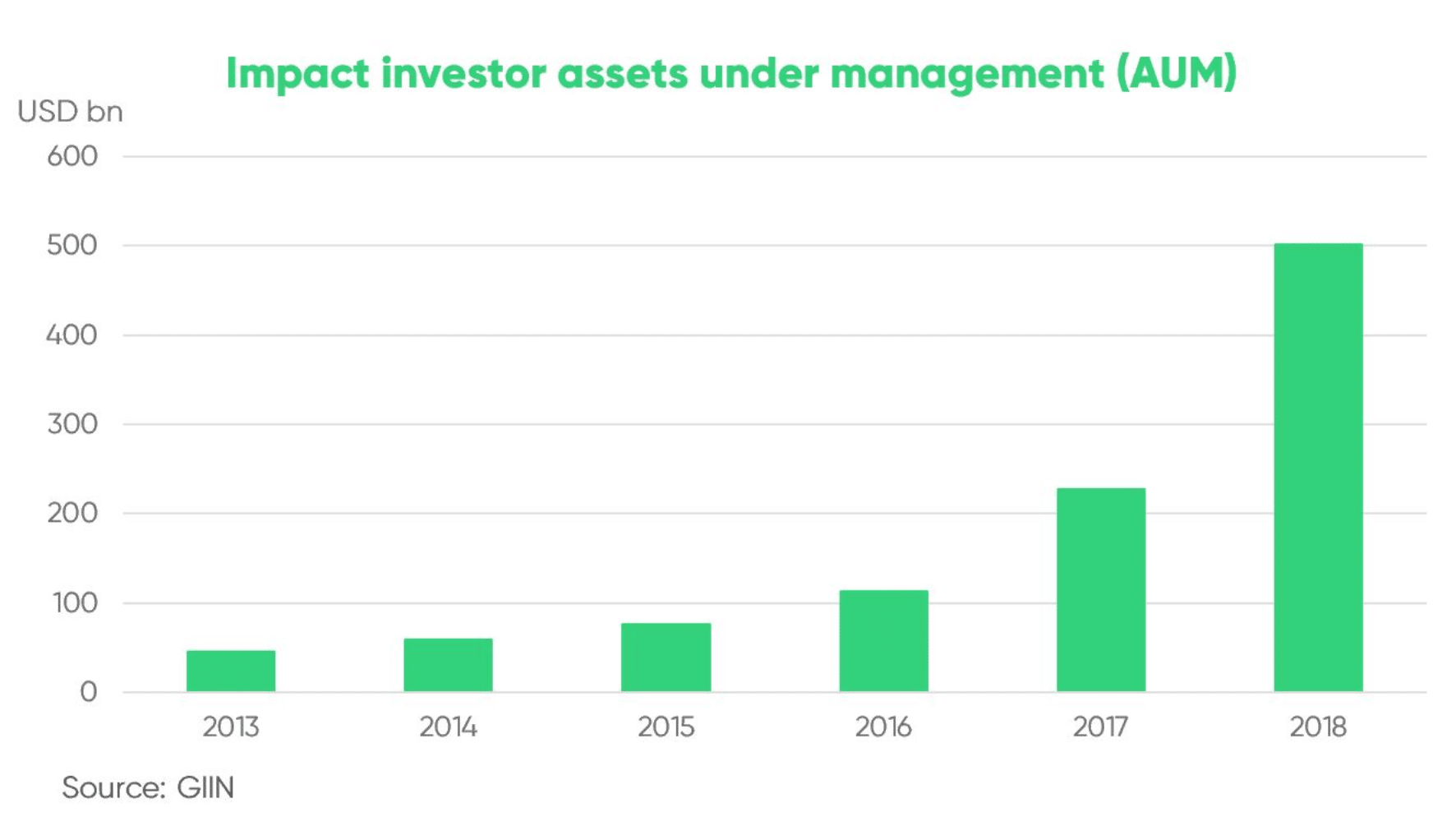

Growth in recent years

Impact investing has seen significant growth over the last few years. In fact, impact investing AUM more than doubled from 2017 to 2018, and hit a record of $502 billion in 2019.

FVCA’s study highlights financial and impact targets of European investors, as well as the achieved results of different methods. In order to collect impact investing practices, FVCA surveyed 22 European private equity impact investing firms. These 22 firms have a total of 415 portfolio companies through their impact funds. Crunchbase contributed data related to the portfolio companies, allowing for the analysis of method versus achieved impact.

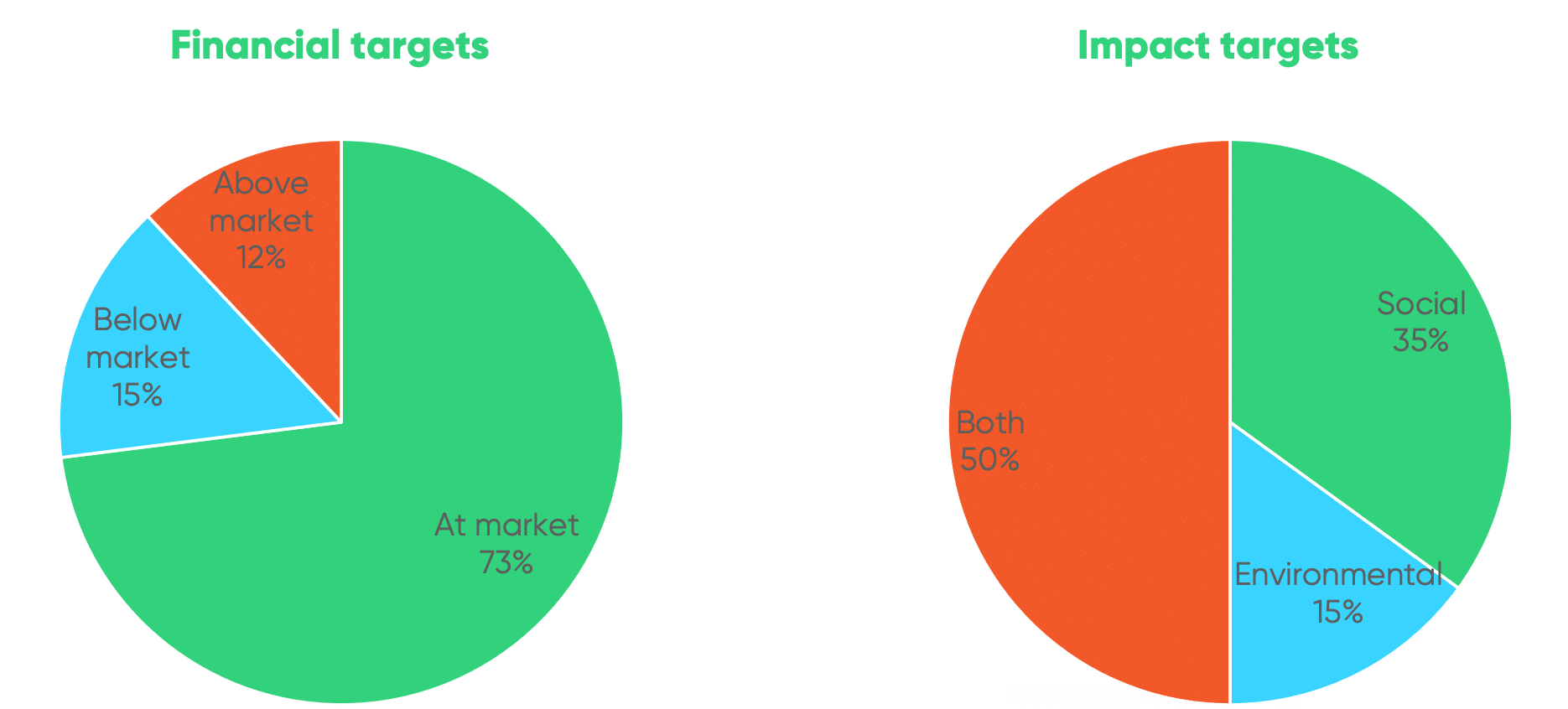

Financial and impact targets

The study concluded that 73% of European investors surveyed are not looking to compromise financial success for impact. Furthermore, 12% are even looking for above market financial opportunities. Additionally, half of investors seek investments that have a social and environmental impact.

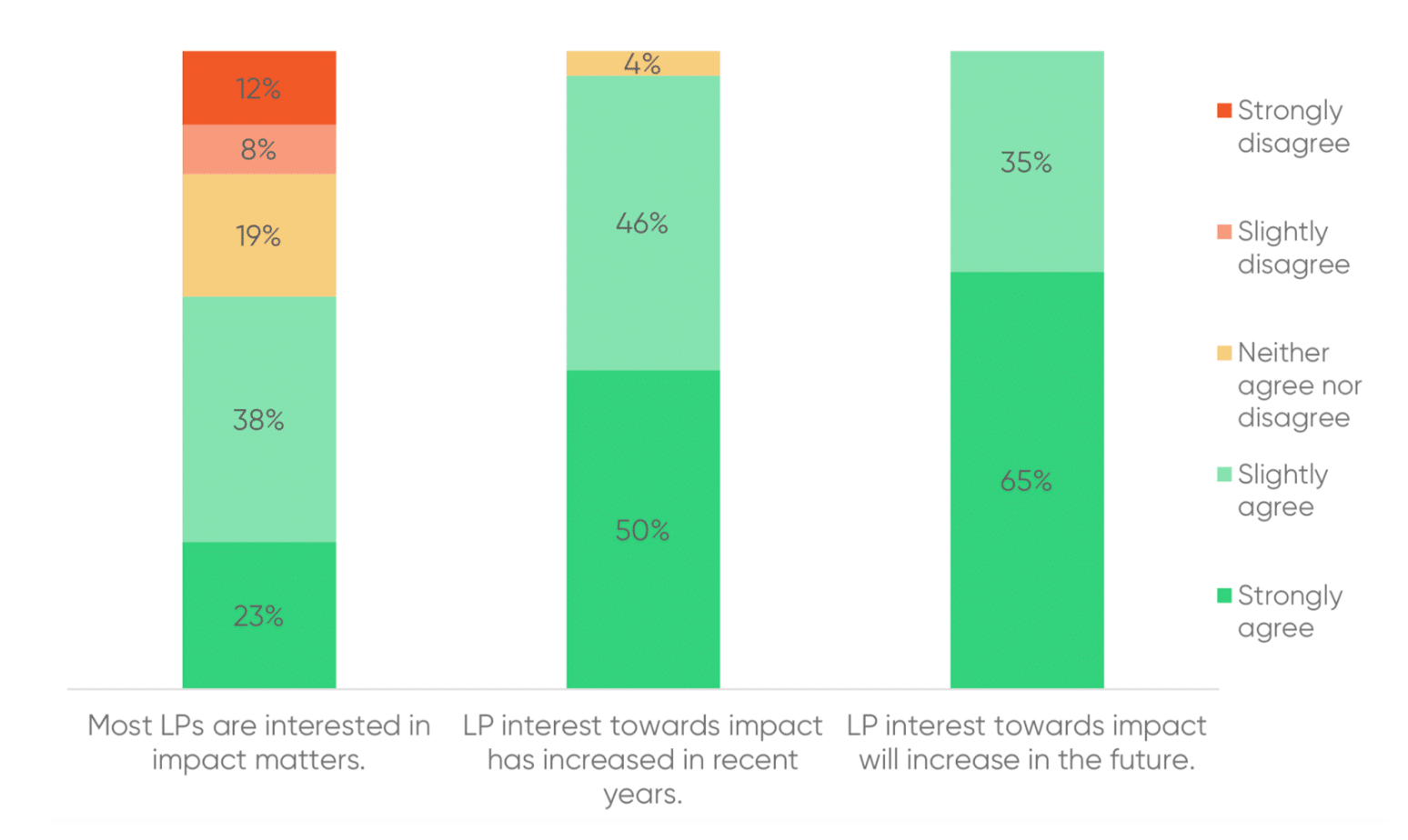

The future of impact investing

Along with investment stats, FVCA also surveyed these private equity firms for their outlook on the future of impact investing. All 22 firms agreed that interest in impact investing will increase from limited partners (institutional investors and family offices) in the future. The study attributes some of this increased interest to the worry over climate change, the planet’s limited resources, and social inequality.

How investing methods correlate to performance

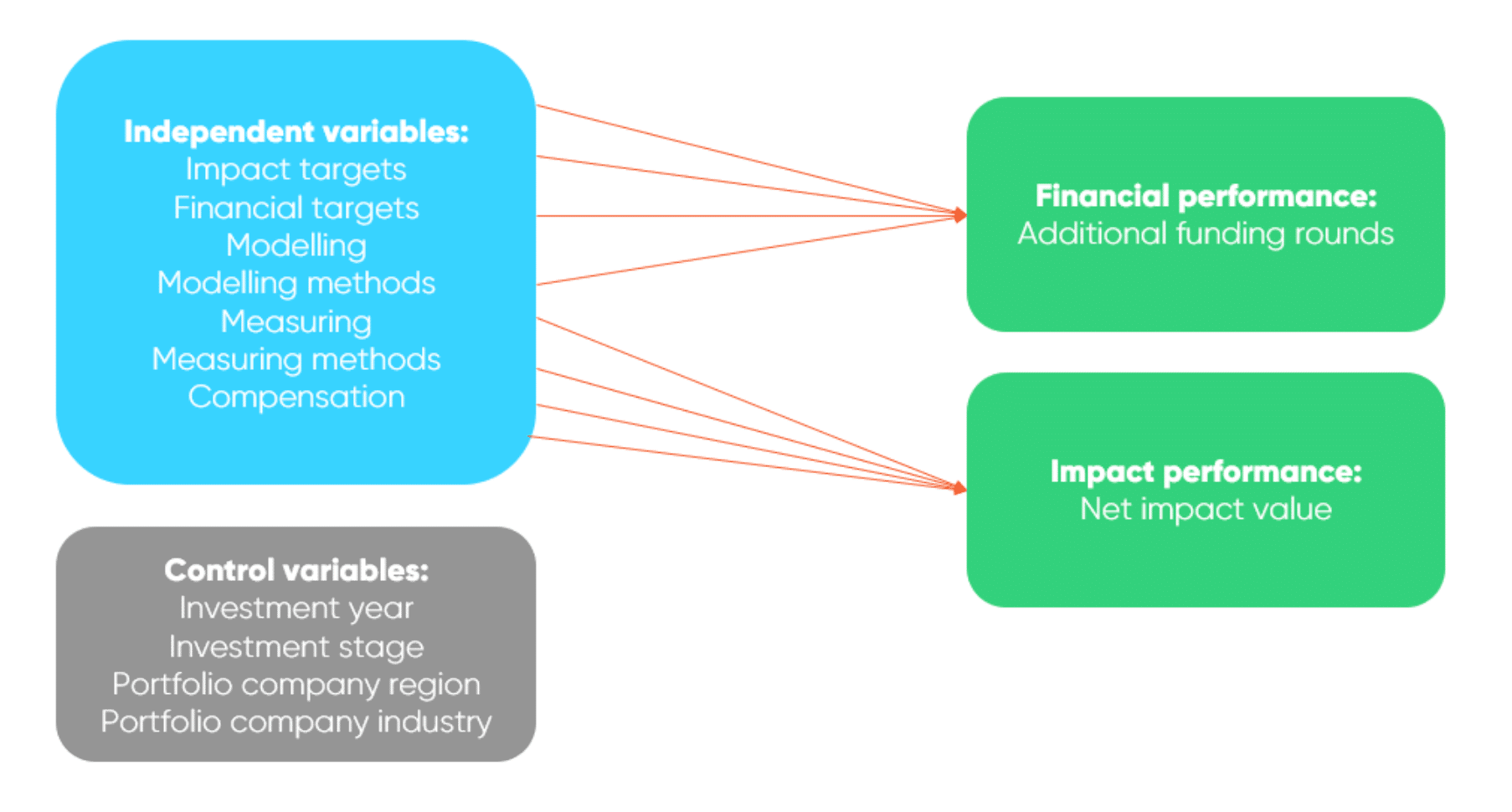

In order to study the effects that the different methods and practices have on the investments’ financial and impact performance, a regression analysis was conducted using the portfolio company data and linking it to their investors’ survey answers.

The portfolio company data (provided by Crunchbase) included information about the companies’ geographical location, the industries they operate in, the development stage of the company, and the number of funding rounds they have received. The number of funding rounds was used as the main indicator of financial success of the investments.

The results of the statistical analysis of the portfolio companies give indications of the effectiveness of the methods and practices deployed by the investors.

- Firstly, modelling the impacts before investing, especially using customized methods, seems to improve the financial performance of investments.

- Secondly, some impact measuring methods that are used in tracking the portfolio companies’ impacts appear to increase the achieved impacts, whereas some might decrease the investments’ financial performance. (However, the measuring methods are constantly evolving, so defining best practices is still too early at this stage.)

- Finally, the results also indicate that focusing only on social impacts and linking the general partner’s compensation to impact might decrease the financial performance of investments.