The EdTechX Global Research Report, created in collaboration with IBIS Capital and Cairneagle Associates, explores the growth in EdTech adoption during COVID-19 lockdown and long-term prospects. It takes a holistic view of the market drivers segmented across education phases, product types, geographies and more to highlight where the opportunities and challenges lie.

In the ‘Where’s the Money’ chapter, we take a closer look at transactions in the Education & Training industry over time. IBIS Capital’s proprietary data and Crunchbase’s own dataset is used to analyse trends in startups, mergers and acquisitions, fundraising, and IPOs.

Education and EdTech Company Launches

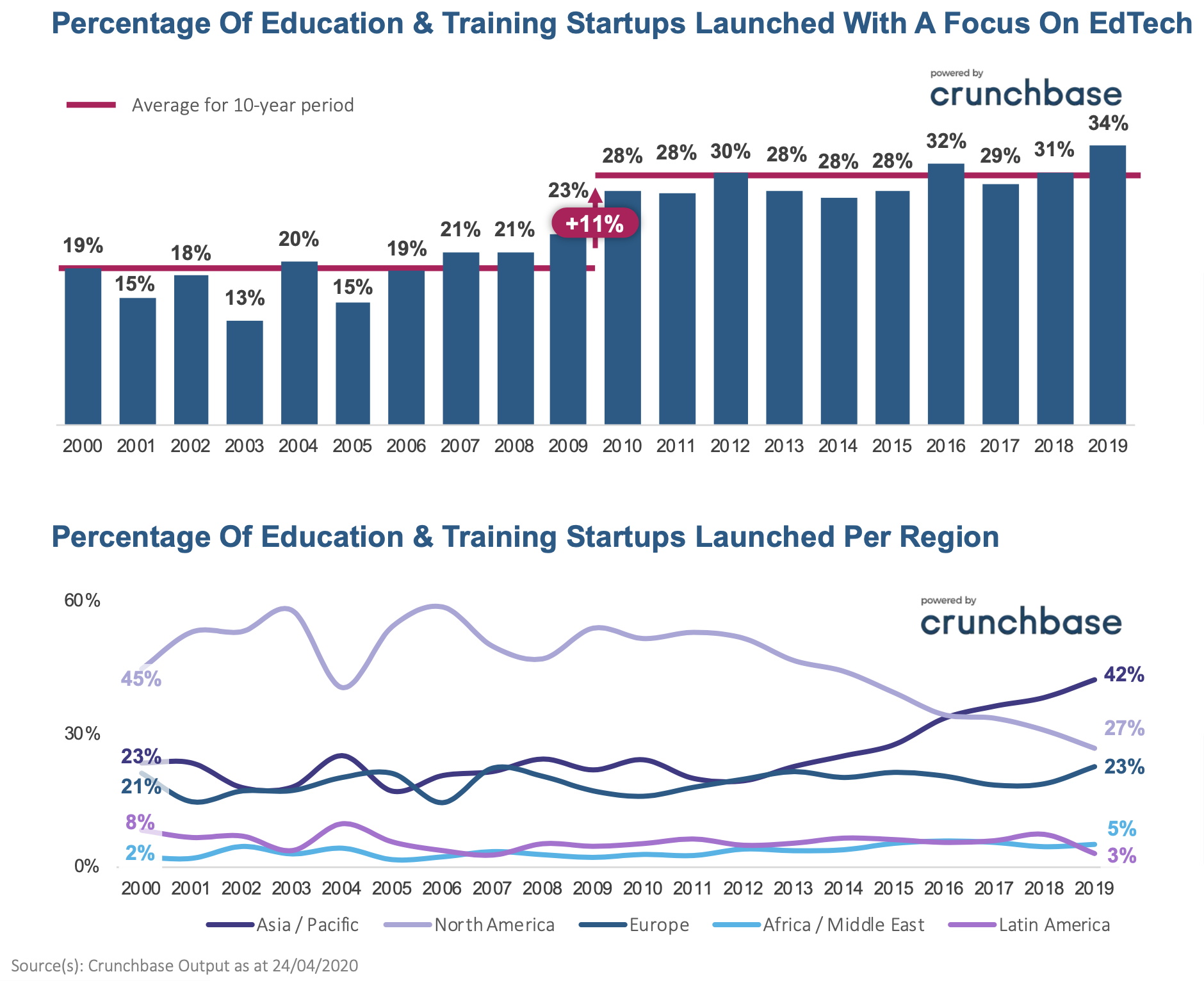

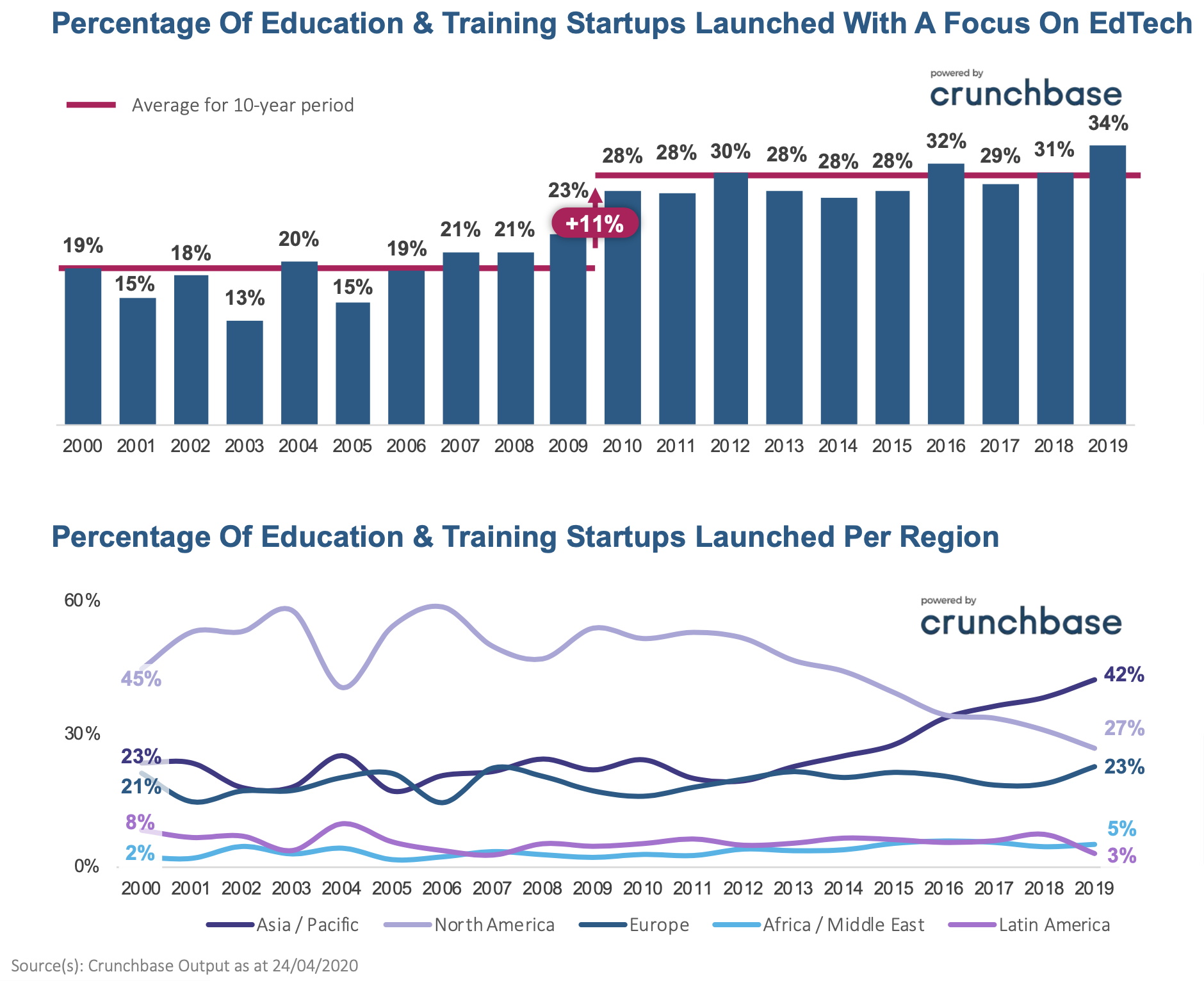

While EdTech has historically only accounted for 3% of total Education & Training spend, the fast-growing and innovative nature of the sector is encouraging the launch of growing numbers of EdTech startups. According to Crunchbase, almost 2,000 new EdTech companies were founded globally since 2010. This equates to an increase in EdTech-focused startups of 11% in the last decade. North America was home to the most startups historically, but the Asia / Pacific region has recently overtaken and contributed over 42% of the new startups in 2019.

Trends have included e-learning and e-books providers, and more recently, more advanced technologies such as AI, AR, analytics and gamification. The current pandemic is driving an increased uptake of technology in order to replace, supplement and enhance learning in the context of social distancing. In the short term, EdTech companies will be focused on gaining market share and therefore often giving their products away for free. In the medium term, incremental revenues are expected to grow, and by 2025, it is expected that this step change in usage will result in around $40-$80bn additional annual revenue in EdTech.

Education and EdTech IPOs

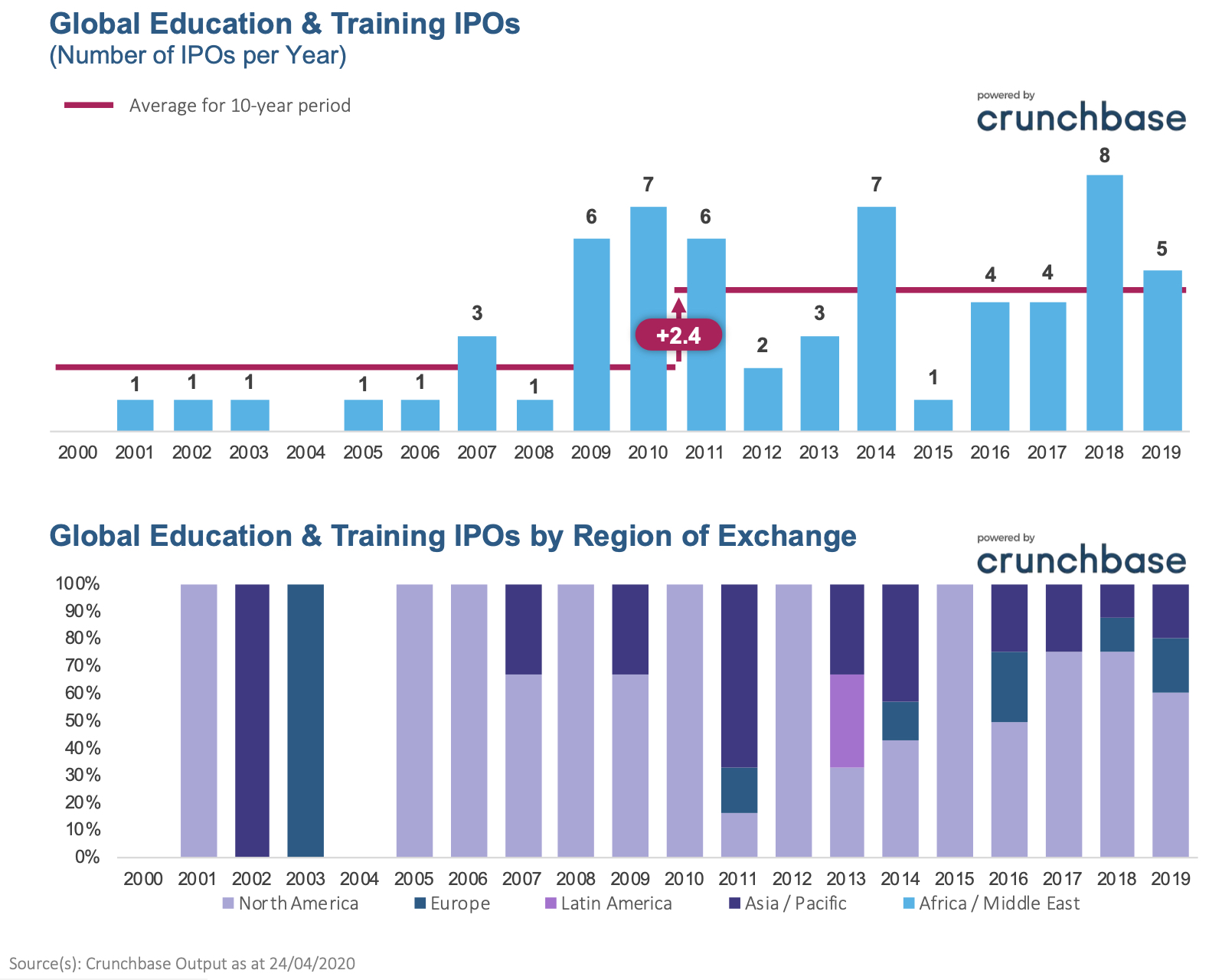

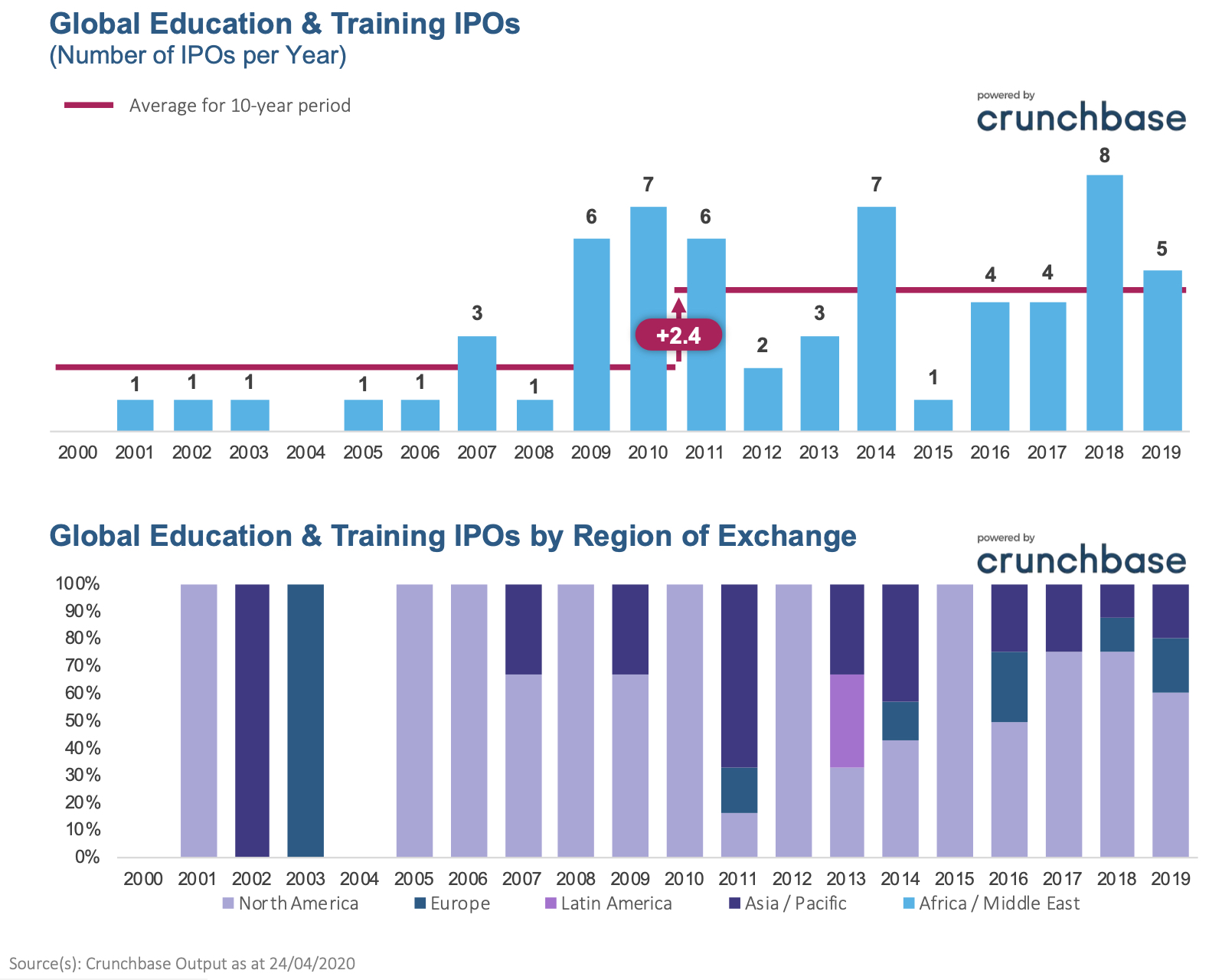

The Education & Training sector has also seen growth in listings, with the average number of IPOs more than doubling over the last decade. Crunchbase recorded a total of 8 Education & Training companies being listed in 2018, making it the busiest year for Education & Training IPO activity. The more recent listings have included several EdTech companies, with almost 30% of the Education providers listed in the last 5 years being EdTech-focused. North America has remained the preferred destination for IPOs, with just under 70% of Education IPOs in the last 5 years being listed on North American exchanges such as the NASDAQ and NYSE. Interestingly, 80% of new listings on the NASDAQ and NYSE in the past 3 years were Chinese Education services and EdTech companies.

In October 2018, EdTechX Holdings, the world’s first Special Purpose Acquisition Company (SPAC) with a focus on investing in Education & Training Technology, listed on the NASDAQ with an initial capital raise of $63.5m. In December 2019, the company announced its $535m landmark EdTech deal with Meten International Education Group – a leading English language training provider in China.

For detailed analysis of activity in the Education & Training industry, as well as insight into key trends and opportunities in the world of Education and EdTech, access your copy of the 2020 EdTechX Global EdTech Report here [link].

IBIS Capital

IBIS Capital is a specialist investment and corporate finance advisory business specialising in digital disruption across the media, education and healthcare sectors. We work with businesses globally to provide advice and capital throughout the corporate life-cycle, from Series A capital raises through to large and complex cross-border M&A transactions.

IBIS Capital is also one of the founders of EdTechX, the global thought leadership platform that brings together investors, strategic players and entrepreneurs that share a passion for the developments in the education and the human capital sector.

Contact: Rory Henson, rh@ibiscap.com

Cairneagle

Cairneagle is a boutique strategy consultancy focused on education, media and technology that has built a strong reputation for delivering rigorous, data-driven analysis and excellent value for money since our establishment in 2001.

Our strategy of building an education practice alongside our media & technology capability was rewarded as we were recognised at the 2015 and 2016 Educational Investor Awards with the award for best consultant to the private sector against stiff competition from the incumbent and the accounting firms.

We work on growth strategy and performance improvement in the UK and internationally for a wide variety of educational institutions, companies providing services to them and private equity firms.

Contact: Rupert Barclay, rupert.barclay@cairneagle.com