Jamaur Bronner is an advisor to Slush Singapore. He served as Project Manager on the 2018 State of Southeast Asia Tech report, published by Slush Singapore and Monk’s Hill Ventures. Previously, Jamaur worked globally on projects in the Technology, Media, and Telecommunications space as a consultant with The Boston Consulting Group (BCG).

Southeast Asian tech is on a roll. With Grab and Go-Jek entering the upper echelons of ride-share royalty with multi-billion dollar valuations, and hundred million dollar funds becoming the ‘new normal’ among leading VCs in-region, it’s hard to argue against Southeast Asia making the shortlist of the world’s hottest hubs for startups and innovation. Strategically nestled between the major markets of India and China, Southeast Asian countries benefit from easy access to nearly 60% of the world’s population.1

Yet just because the region hosts troves of potential customers doesn’t mean it’s an easy place to become a successful entrepreneur; Southeast Asia’s cultural diversity spans races, languages, and religions, making it difficult to force-fit a one-size-fits-all solution to market entry. To wit, some of the most dominant global companies have found it difficult to gain traction here, choosing instead to acquire, invest in, or form a joint venture with a local player — or even just exit the market entirely.

To many inside and outside of the region, the Southeast Asian2 tech ecosystem remains a mystery. Which is why Slush Singapore, in partnership with Monk’s Hill Ventures, endeavored to publish the region’s first comprehensive report on the tech and startup landscape. The 2018 State of Southeast Asian Tech report shares similarities with its sister report The State of European Tech, and explores key themes underpinning the region’s dynamic startup environment.

The report was the product of hundreds of hours of research, analysis, surveys, and interviews, and includes insights and perspectives from the industry’s leading voices. Special thanks to our data partners Crunchbase, Craft, and Funderbeam for helping to provide key data needed to uncover these trends.

Here are 3 highlights from the report:

1. Growth stage investments are on the horizon

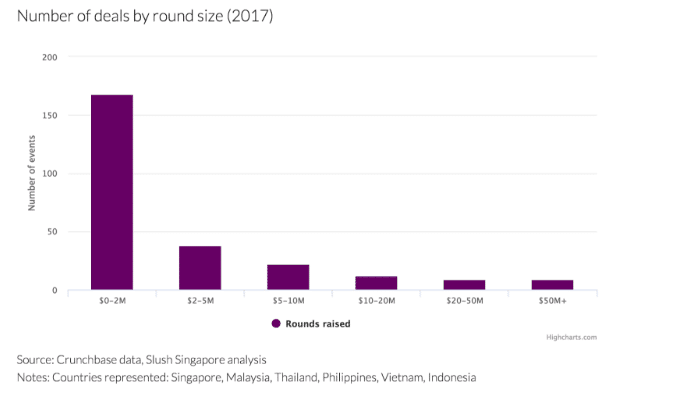

One common indicator of ecosystem maturity is the increases in growth stage capital, when funding is used for scaling the business rather than validating an idea or determining product-market fit. As VC investment dollars shift from seed funding to later rounds, this trend suggests that companies are successfully winning in the market and are positioned to become sustainable enterprises.

The data show that Southeast Asia is early in this journey, as an outsized number of deals in-region are still at the angel and seed stages and under $2M in check size.

However, the region has seen massive deals over the last 18 months such as Grab’s $2B Series G and Tokopedia’s $1.1B Series F, and now boasts 8 tech unicorns.3 Indonesia’s Minister of Communication and Information has even predicted that his country will yield its fifth unicorn by 2019. With Southeast Asia being on track to realize a $200 billion internet economy by 2025, it is likely that more and more companies will be able to achieve scale and secure investment at later rounds of funding.

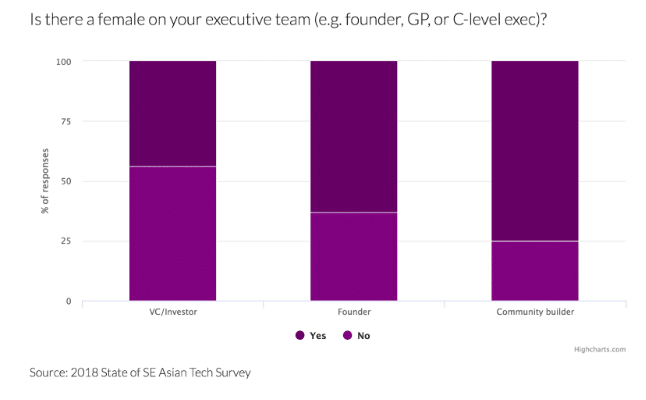

2. Gender diversity still an important issue

As a topic of discussion also noted in Silicon Valley, gender diversity in tech is an issue with room for improvement across the globe. In Southeast Asia, our survey found that 40 percent of respondents worked in businesses with all-male senior management.

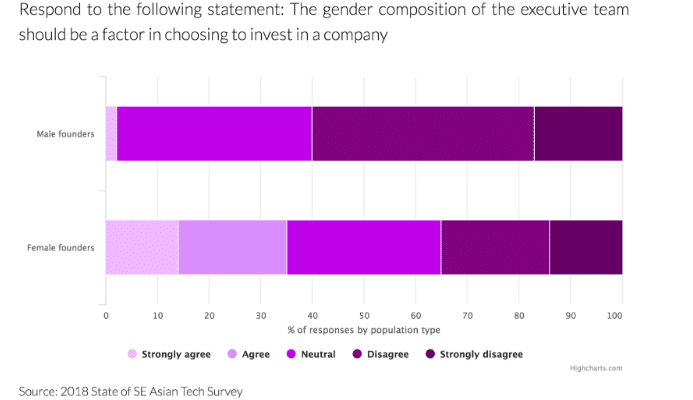

In addition, when asked whether gender should be considered when choosing to invest in a startup, the response was surprisingly negative. Founders had the strongest reaction to this idea — though taking a closer look, responses themselves were split by gender lines; thirty-five percent of female founders supported considering the gender of founders as an investment criterion, compared to only 2 percent of male founders.

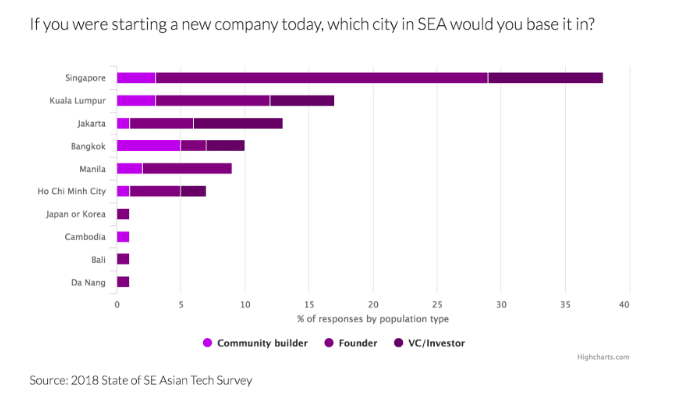

3. Singapore is the hottest place to start a startup

With its strong public infrastructure and high quality of life, it is of little surprise that Singapore is listed as a favorite among ecosystem members thinking of starting their own startup.

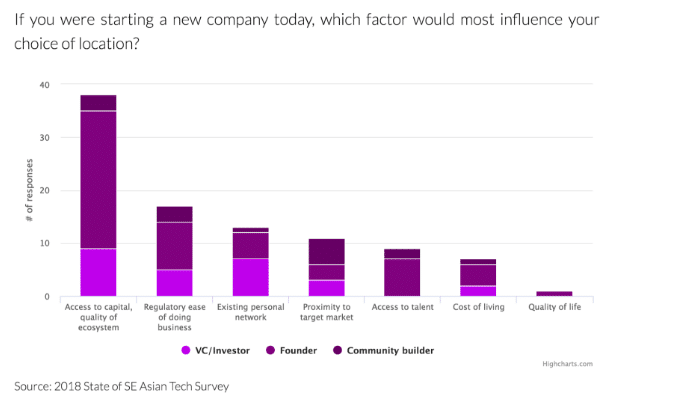

What is more surprising though is the fact that lifestyle is not the leading driver making Singapore such an attractive tech hub. According to the survey, access to capital and regulatory ease of doing business are the primary factors considered when choosing to set a headquarters, and Singapore is home to dozens of VCs and has a government that invests considerable resources in nurturing small businesses.

While Singapore is seen as a great place to start a business, it’s worth noting that its population of only 6 million people means that startups often have to expand to other countries in order to be successful. In fact, Indonesia, a population of over 260 million, has half of the region’s unicorns — suggesting that close proximity to a large customer base may also be a key factor for company success.

For those of us living and working in Southeast Asia, the recent rise of the tech scene here is ever apparent. The region has caught the startup fever, and as the ecosystem matures, there will be more opportunities for it to further coalesce through industry conferences and other events. The future of tech in SE Asia is a bright one, and the region’s next chapter might very well make it a beacon to the rest of the world.

1. Asia represents roughly 60% of the world’s population with over 4.5 billion inhabitants

2. Specifically: Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam

3. SE Asia’s tech unicorns include Bukalapak, Go-Jek, Grab, Lazada, Razer, Sea, Tokopedia, and Traveloka. The list excludes Revolution Precrafted, the only startup in the Philippines to pass the billion-dollar valuation mark, as it is not a tech-centric business.

More insights from the report will be shared at the Slush Singapore conference on Friday, September 14, 2018. To read the report in full, please check out www.thesoutheastasia.com