Pitching to investors is probably one of the most nerve-wracking parts of being an entrepreneur. This is true whether you’re raising your first angel round or you’re a seasoned pro looking for series A or venture capital.

For approximately 45 minutes, you put yourself and your business out there to be scrutinized from every angle and appraised for monetary value. And those 45 minutes can mean the difference between a successful startup launch and a business idea that never gets off the ground.

With so much on the line, it’s crucial for founders to get their investor pitch right. So, we’ve compiled a list of tips to help you plan, prepare and deliver the perfect pitch.

Find investors.

Find your next investor with Crunchbase.

#1 Find the Right Investor

For a lot of founders, a pitch starts the moment you shake hands with an investor and begin your 15-slide pitch deck presentation. But the truth is: you can win or lose an investment long before you even walk through the door. The outcome is often decided when you pick an investor.

But why is that? Well, chemistry. Not every investor is going to be interested in funding your company. You could be the next unicorn, but if your business idea doesn’t resonate with the person or group you’re pitching to, they won’t write you a check.

So, how do you make sure you’re pitching to the right investor?

Simple. Before scheduling the meeting—before even deciding to reach out, do your due diligence. Dig in and learn everything you can about a potential investor, including their career to date, their interests, their network, their availability, and their temperament.

And as you do, forecast. Think about whether or not they’ll resonate with your idea and your business model. Decide whether you’re more likely to click or clash on vision and timeline—and learn what you can about their response to setbacks. Along the way, be honest with yourself about whether or not you want them as a partner.

One great way to do your due diligence is with Crunchbase Pro. Using the investor search function, you can look up investors headquartered in a specific location, with a specific number of exits, or with active investments in your industry. You can even create shortlists and get notified when an investor makes the news, to stay on top of the best investment opportunities for your business.

Find investors with Crunchbase Pro — try it free today

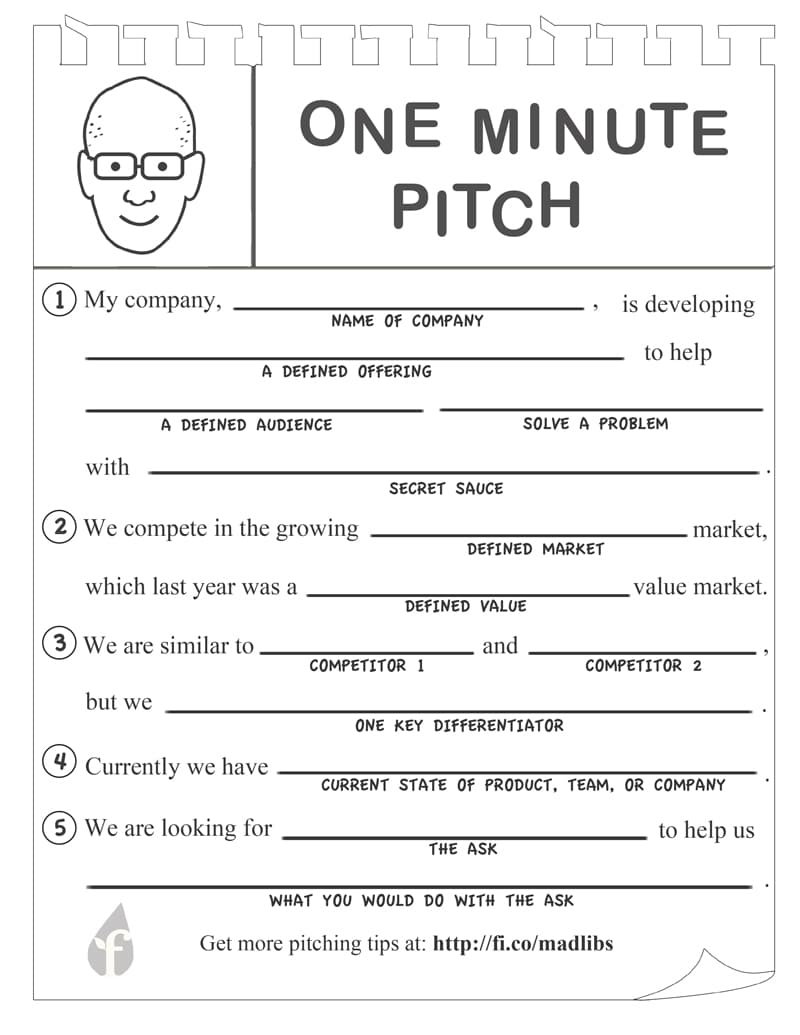

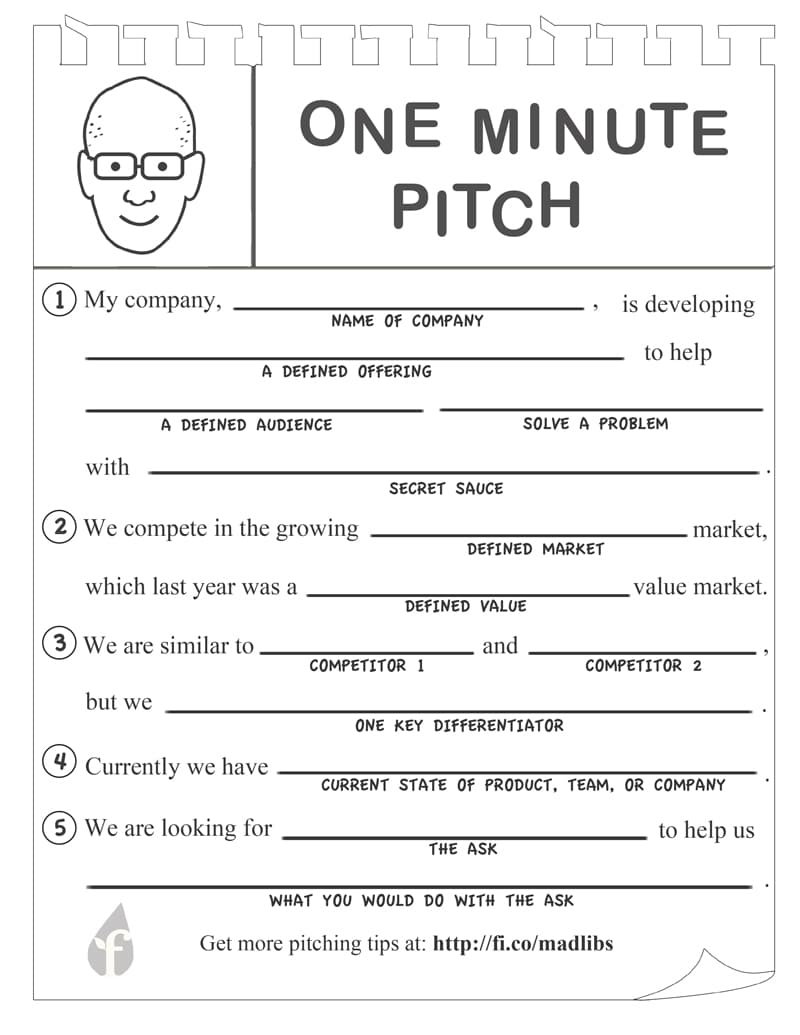

#2 Prepare Your Pitch Deck

Once you’ve found the right investor, it’s time to start preparing. The best way to do this is by creating a 15 to 20 slide pitch deck, detailing:

- The problem you want to solve

- Your proposed solution

- The ins and outs of your product

- Your target audience

- Your business strategy

- Your financials

- Your exit plan

Creating a phenomenal pitch deck takes more than just slapping this information on a PowerPoint with a few colorful graphics, financial charts and bullet points, though. It demands strategic planning, thoughtful word choice, and purposeful design.

But done properly, your pitch deck can act as a great visual complement to your presentation—helping the investor visualize your market data, understand your business model, and engage in your pitch.

#3 Tell Your Story

The point of a pitch is to inspire and excite, not put people to sleep. But that can be difficult to do when so much of a pitch focuses on numerical data, trends, and forecasting.

That’s why it’s important to periodically step away from the data and focus on the bigger story you’re trying to tell.

Think about your journey. What problems inspired you to create your business in the first place? What successes have you had since then? What setbacks have defined or changed your company? Most importantly: where are you headed now?

Share these things in your pitch and show them off in your pitch deck. Not only will it pique your investor’s interest and keep them engaged during your presentation, but it will also create a logical sequence to the pitch, itself.

#4 Nail Down the Details

Arguably, the most important thing you can do in a pitch meeting is to talk about your business model, your team, your financials, and your future projections. After all, investors don’t just hand out money for big ideas. They want to know that there is a viable plan in place to make money.

So naturally, you should let the data underpin your pitch. It should be openly shared throughout your presentation and visually represented in your pitch deck. It should be referenced during Q&A sessions and discussed in future conversations with the investor.

The more clearly and more frequently you can present this data, the more confident the investor will be in a decision to partner with your business and finance its operations.

#5 Be Specific with Your Investment Needs

One mistake founders often make is being vague when it’s time to talk money. Without question, it can be intimidating to ask for a specific amount of money, because there’s always a chance that the investment could come up short.

But it’s important to be confident and specific with your request. Not only do investors want to know exactly what their investment will look like, but they also want to see that you’ve thought through your financial needs. At the same time, it’s important to show them where you anticipate to be after spending their money—as this builds trust.

While this level of specificity may not guarantee funding, it will ease concerns and instill greater confidence in your business model and strategy—which can lead to greater fundraising success.

#6 Prepare for a Q&A

Last, but not least, prepare for a Q&A. Your investors will have questions no matter how flawless your pitch is. Anticipating those questions and having clear answers will not only increase your credibility but will also give you a chance to address concerns before you leave the boardroom.

How do you go about anticipating the questions you’ll be asked? There are a few different ways.

First, think about your pitch presentation. Did you gloss over any details that are important to understanding the viability of your business? Is there anything you said that may need more clarification? Jot those things down and figure out how you can fill in the gaps.

Look at your pitch from your investor’s point of view, as well. Are there specific concerns they may have about your market? Are they likely to have any issues with your business model? Will they have questions about your product? Keep a list of any potential questions and concerns and decide how you can best address them.

Ultimately, pitching to an investor is an important step in the lifecycle of any startup company. But knowing how to do it right is what sets successful companies apart. The key is to choose your investors wisely, and then prepare and pitch accordingly. Check out these pitch deck examples for inspiration.