The modern world of dating apps, social media and instant communications has destroyed the art of courting. But there is one place where you will still find it going strong. Finding an investor for your startup has often, rightly, been compared to courting a potential lover. My experience definitely bears that out and I want to share some tips with you, particularly when raising your Series A in startup funding.

What is a Series A funding round?

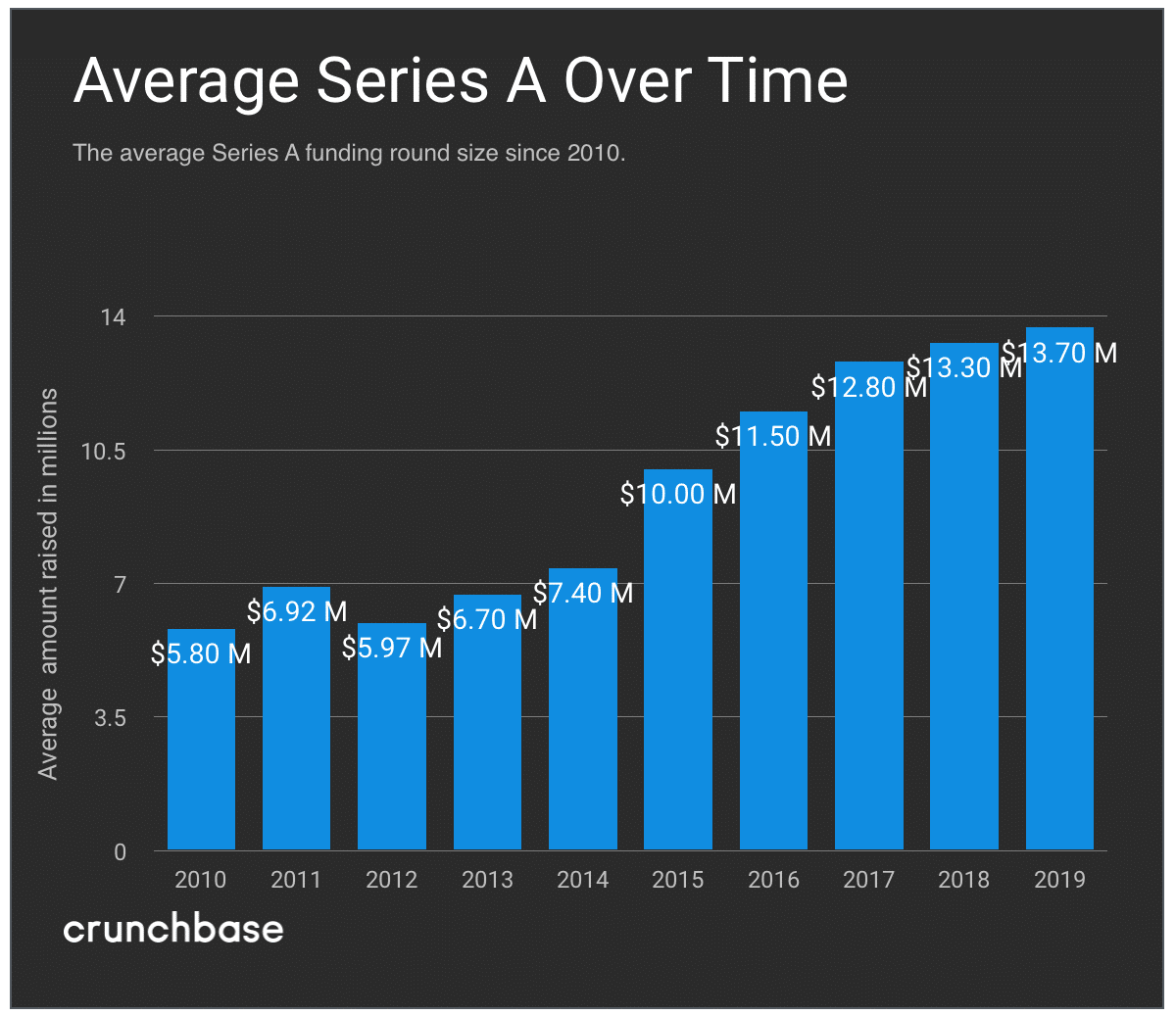

Series A funding rounds are early-stage, private companies and range on average between $1 million to $30 million. They follow angel, pre-seed, and/or seed investments. You can see the glossary of funding types here.

5 Tips and Tricks When Raising a Series A

You need to choose the VC wisely.

Places like Silicon Valley are home to thousands of VCs, making finding an investor and narrowing your search that much more difficult. Some of these are solo investors who have made it big. Others are professional VC companies with large teams to do due diligence and handle all the day-to-day dealings with your company. So, given this choice, who should you approach? Who is going to be the best fit for you so your fledgling company can soar?

Find your next investor with Crunchbase Pro — try it free for seven days.

There are a couple of key things you need to consider. Firstly, do they have any domain knowledge? It can be tempting to think “The VC doesn’t understand this, so we can pull the wool over their eyes.” But that is a very short-sighted view. If they have little or no knowledge, they may give you poor advice. Secondly, you will hopefully be working really closely with your VC for years to come. So, choose someone you can actually talk to and get along with.

Photo source: Lighter Capital, How to Raise a Series A Round from Venture Capital Investors

It’s not (just) about the money.

Many founders fall into the trap of thinking the more money they can raise, the better. Clearly, money is one of the main things a VC brings to your business. But they also bring so much more. In particular, VCs have a wealth of experience of companies that have done well, but also the mistakes other companies have made. Very few founders have this knowledge, although some are arrogant enough to think they do.

Remember, most VCs invest in multiple startups. If you start your relationship with them on a bad foot, don’t be surprised when you struggle and the board is not very gracious! So, if you are going to push for more investment, make sure you have a compelling story why, and get the VC to help you spend the money wisely!

You need to do your research.

Before you approach a VC, try to find information about them. Search Crunchbase for their past portfolio companies and speak to some successful founders who have been backed by the same VC. Get some insights into them as a person. Are they hot on formal titles or are they laid back, first-name users? Are they detail orientated, or big-picture people?

Also, try to speak to founders who had less than spectacular results after being funded. Find out how the VC behaved as a board member when a startup didn’t become the next unicorn. The more you know about your potential VC as a person, the easier it will be for you.

Will they have time for you?

Most VCs are serial backers. But this is a double-edged sword. On the one hand, investing widely is often a sign of success (though not invariably). It will also mean they have broad experience and will be able to help you more. On the other hand, it may mean they only have limited time for you. As I said above, a VC’s business experience is one of the most valuable things they bring to your company. So, you need them to have time for you and to want to spend time with you.

How will you work with them after raising your Series A?

If you are successful, you will have a long and ongoing relationship with your VC partner. This means you need to give some thought to how you will work together. What will be the company structure after the investment? How will you incentivize them to keep working with you long after the honeymoon?

Typically, VCs will want a place on your board. For many founders, this means giving someone else control over their baby. And as any parent will tell you, that’s hard to do. So, you need to make sure that you and the VC are aligned with your joint vision for the company. The worst thing you could do would be to end up fighting in the boardroom.

Overall, finding a VC and raising your first major investment is an exhilarating feeling. After courting dozens of VC’s, Functionize was fortunate to find Gary at Canvas Ventures. But if you get it wrong, that euphoria can be short-lived. Hopefully, my simple tips above will help you make the right choice for your company. Court wisely.

.svg)

.png)

.png)