Report: The Rise Of Global Cybersecurity Venture Funding

Discover how the cybersecurity venture capital scene has grown over the last decade and its outlook for 2021 and beyond.

TABLE OF CONTENTS

Key Report Insights

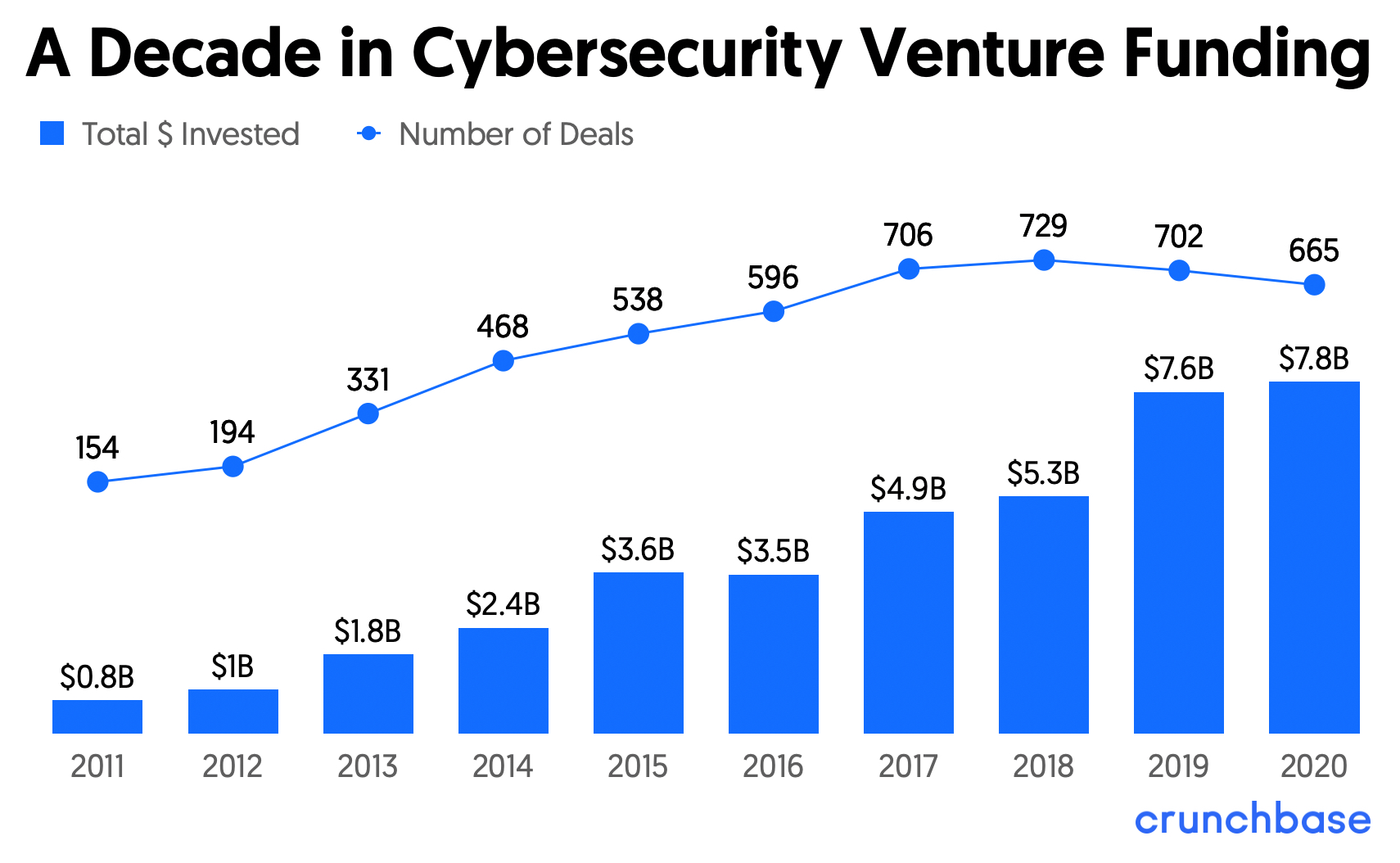

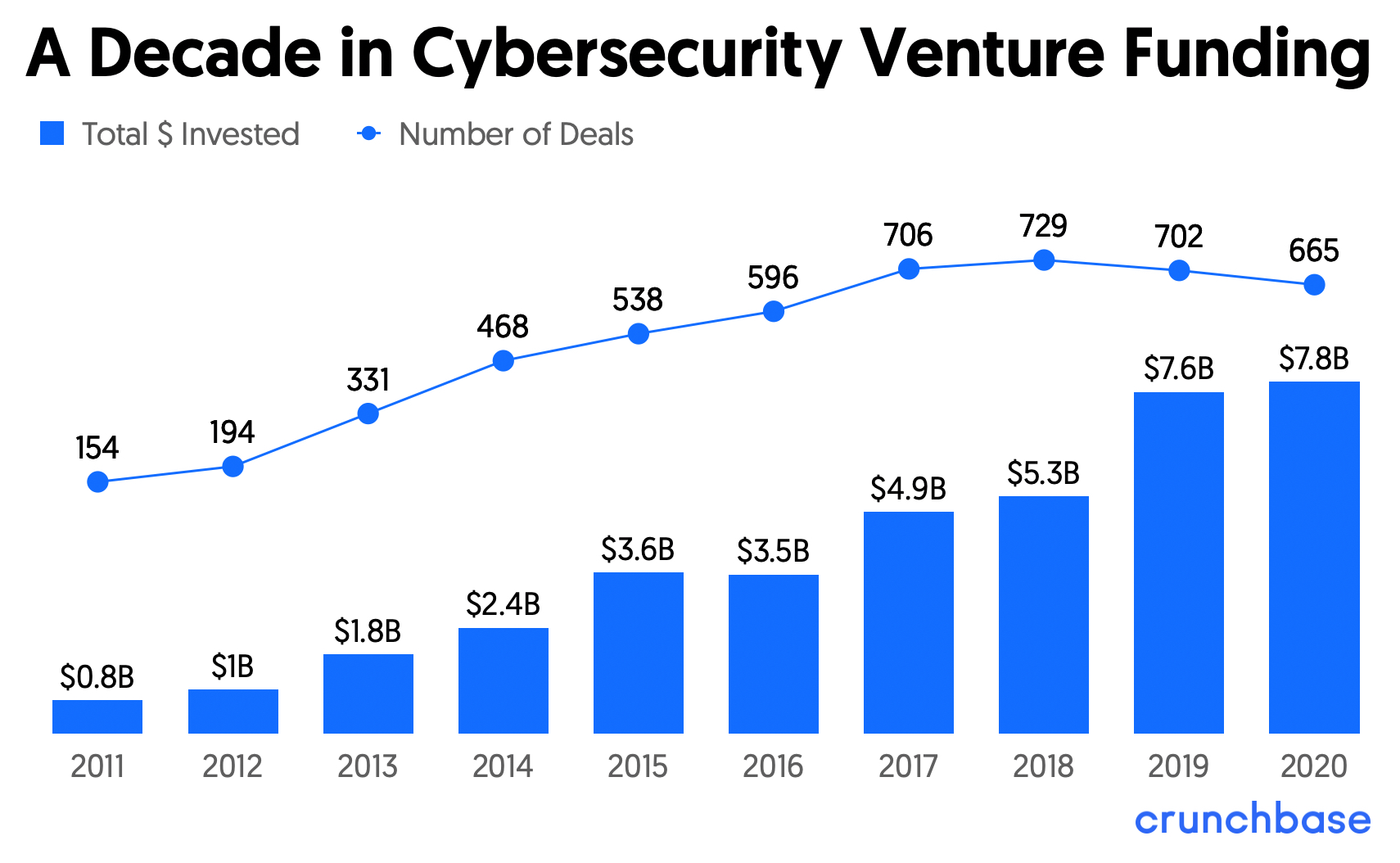

- Despite the global pandemic, 2020 was a record year for cybersecurity investments with over $7.8 billion invested in the industry globally.

- Investment in cybersecurity companies has increased more than ninefold since 2011.

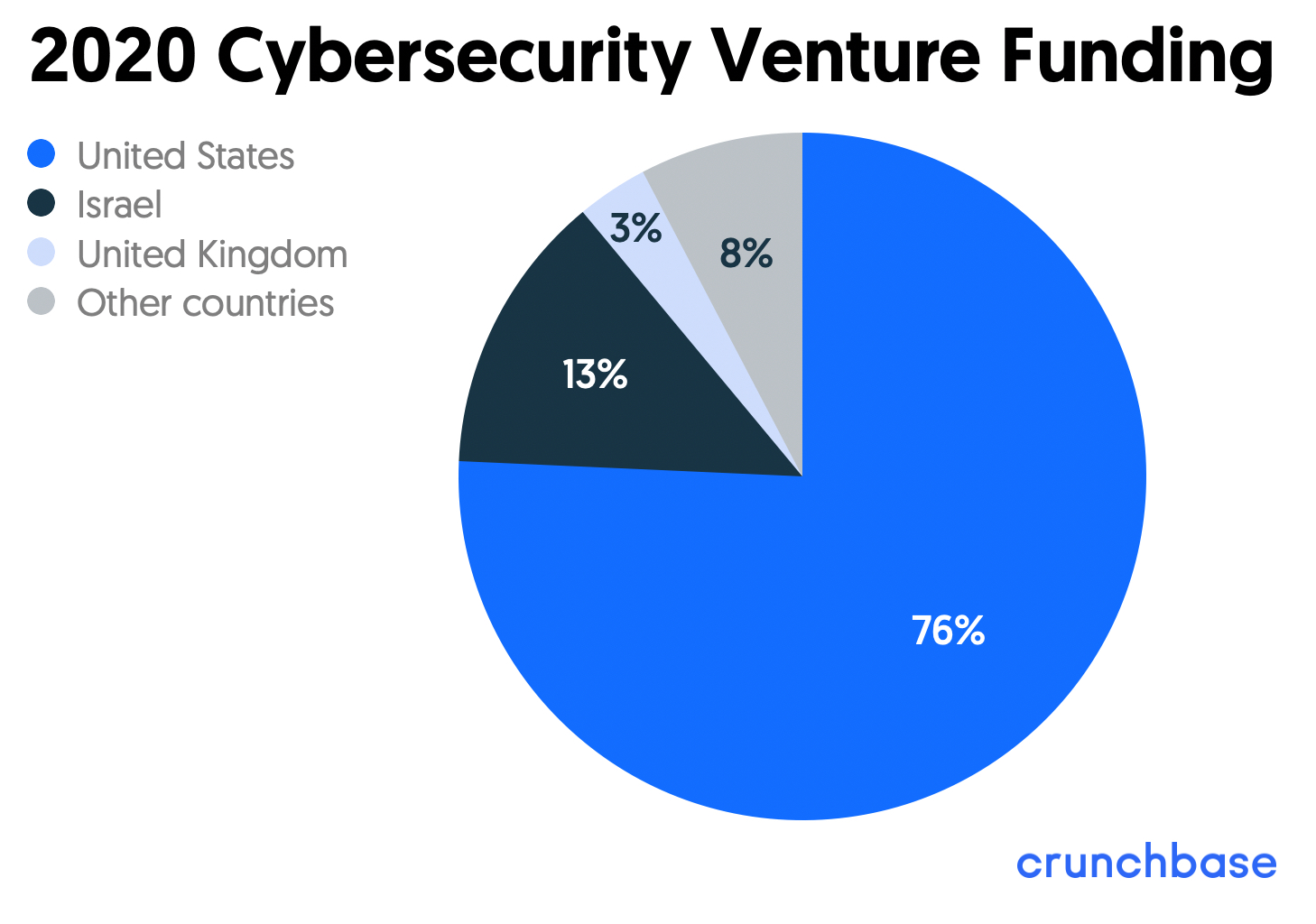

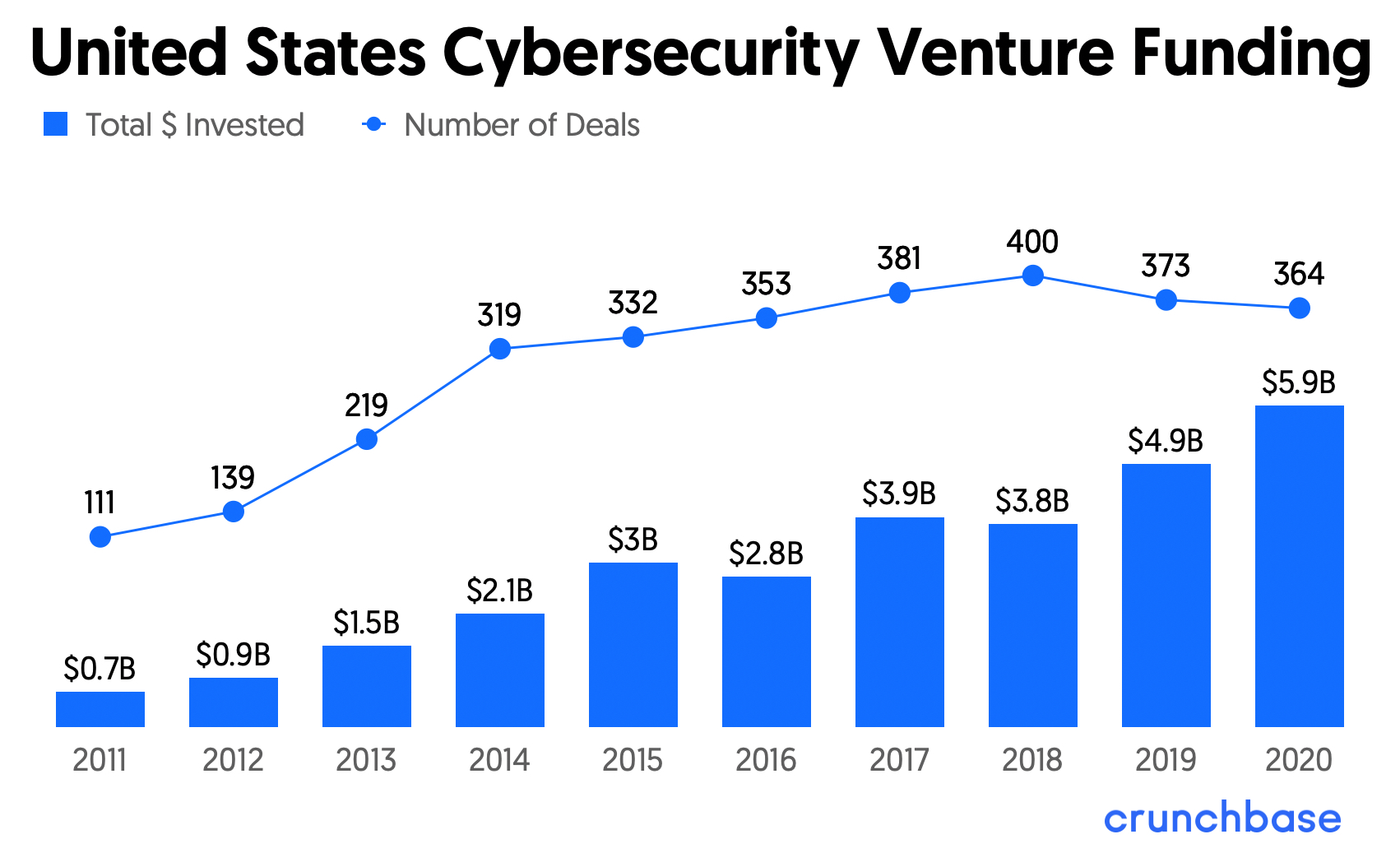

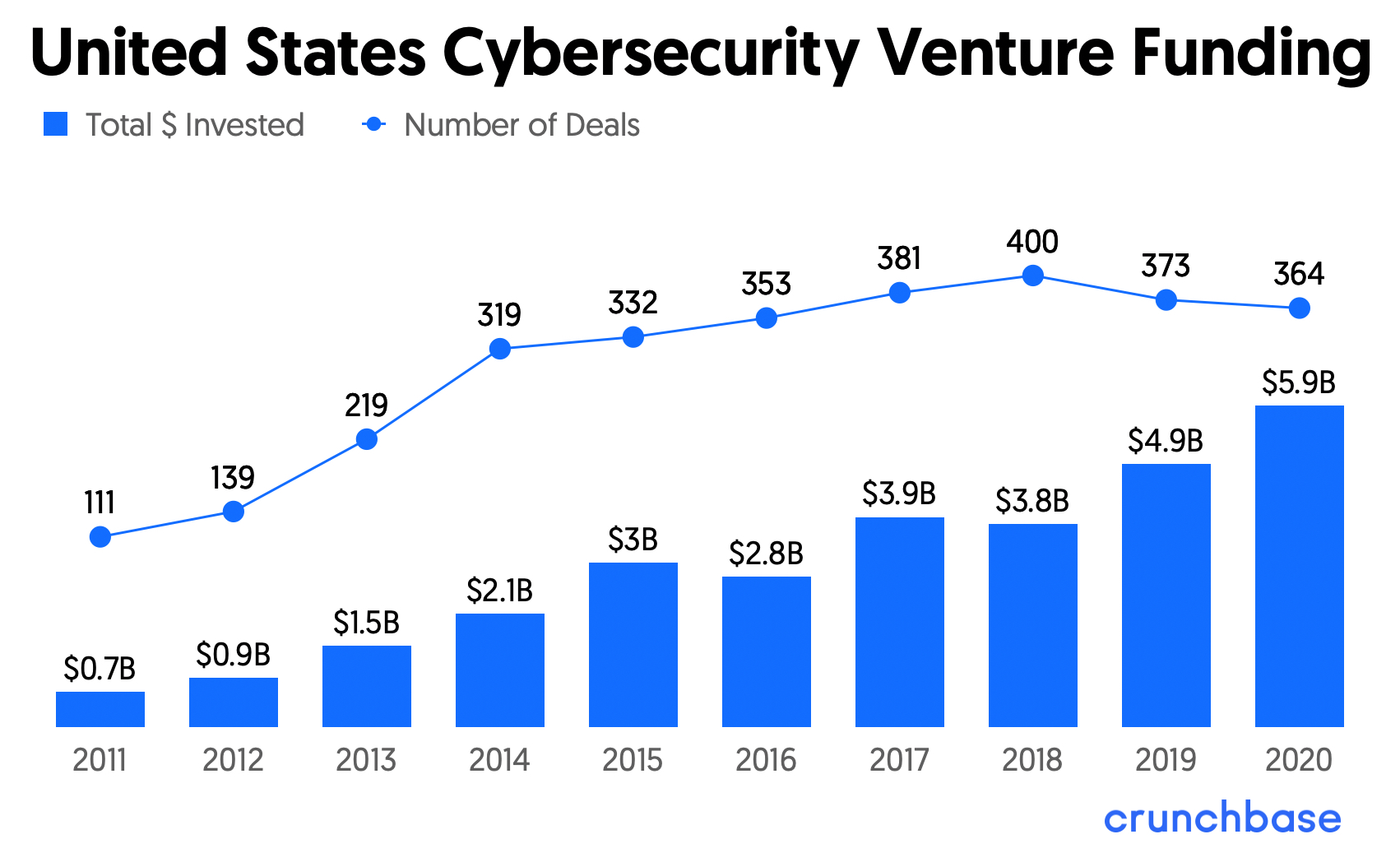

- The U.S. recorded 76% of all global cybersecurity funding in 2020, at $5.9 billion.

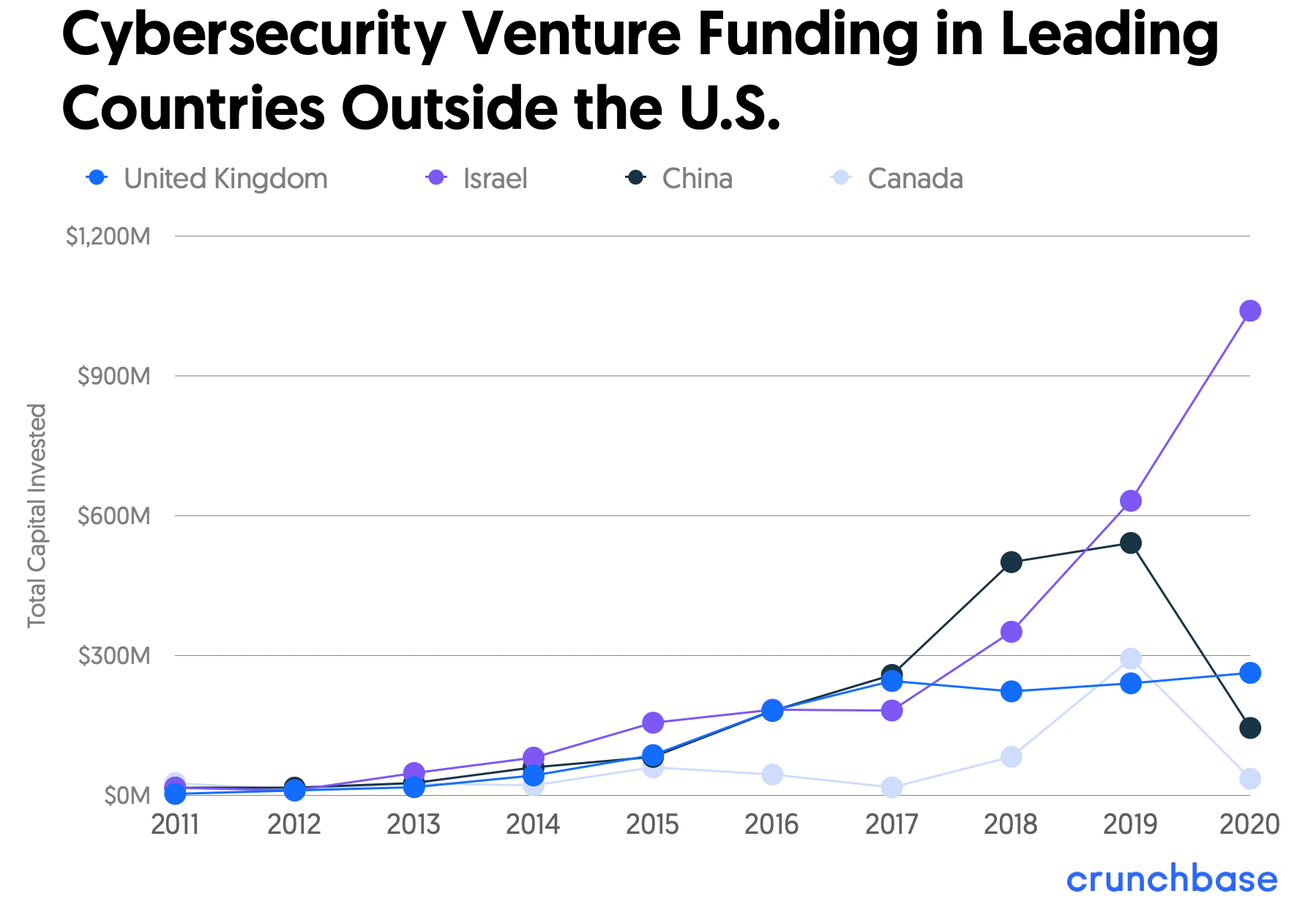

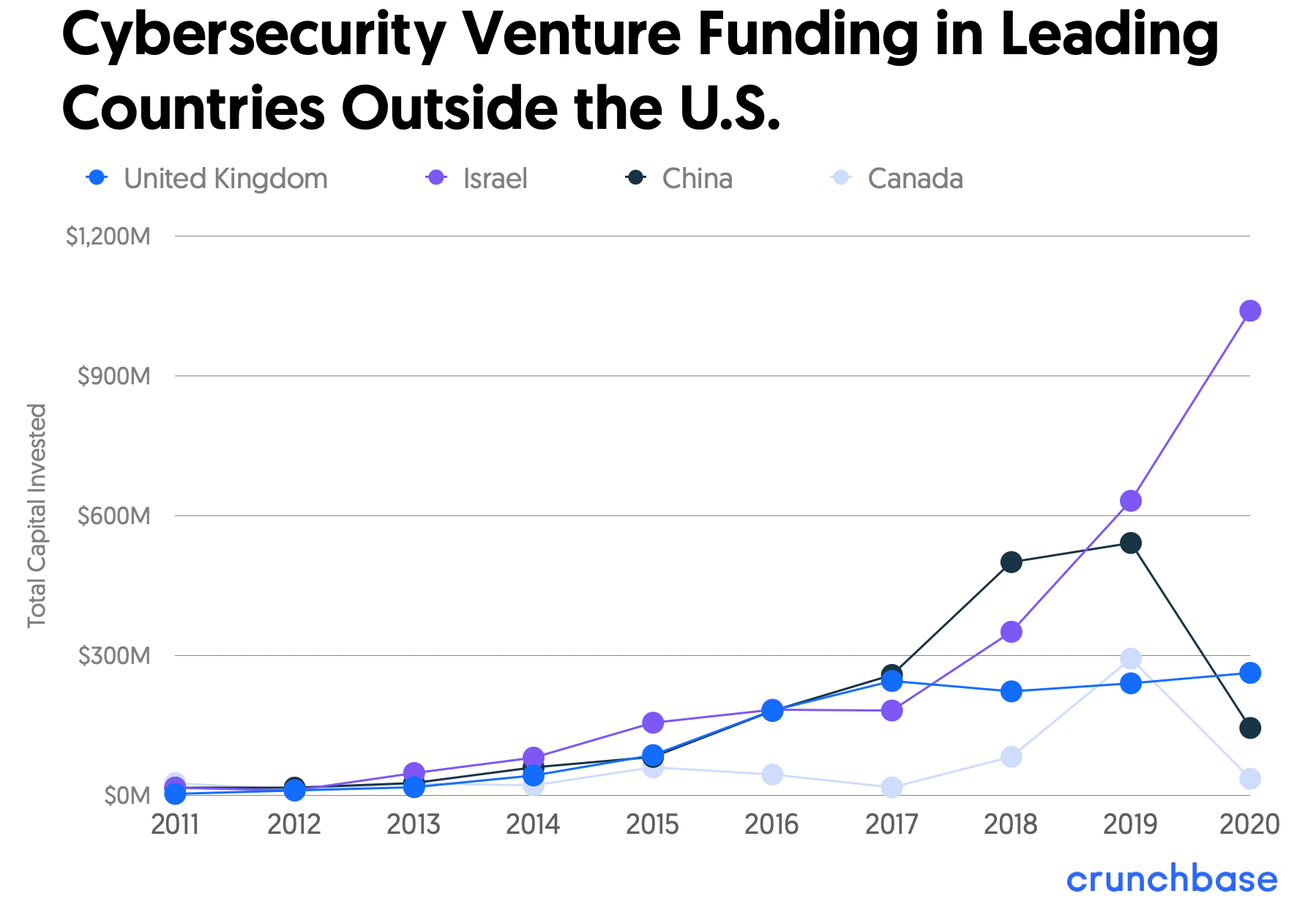

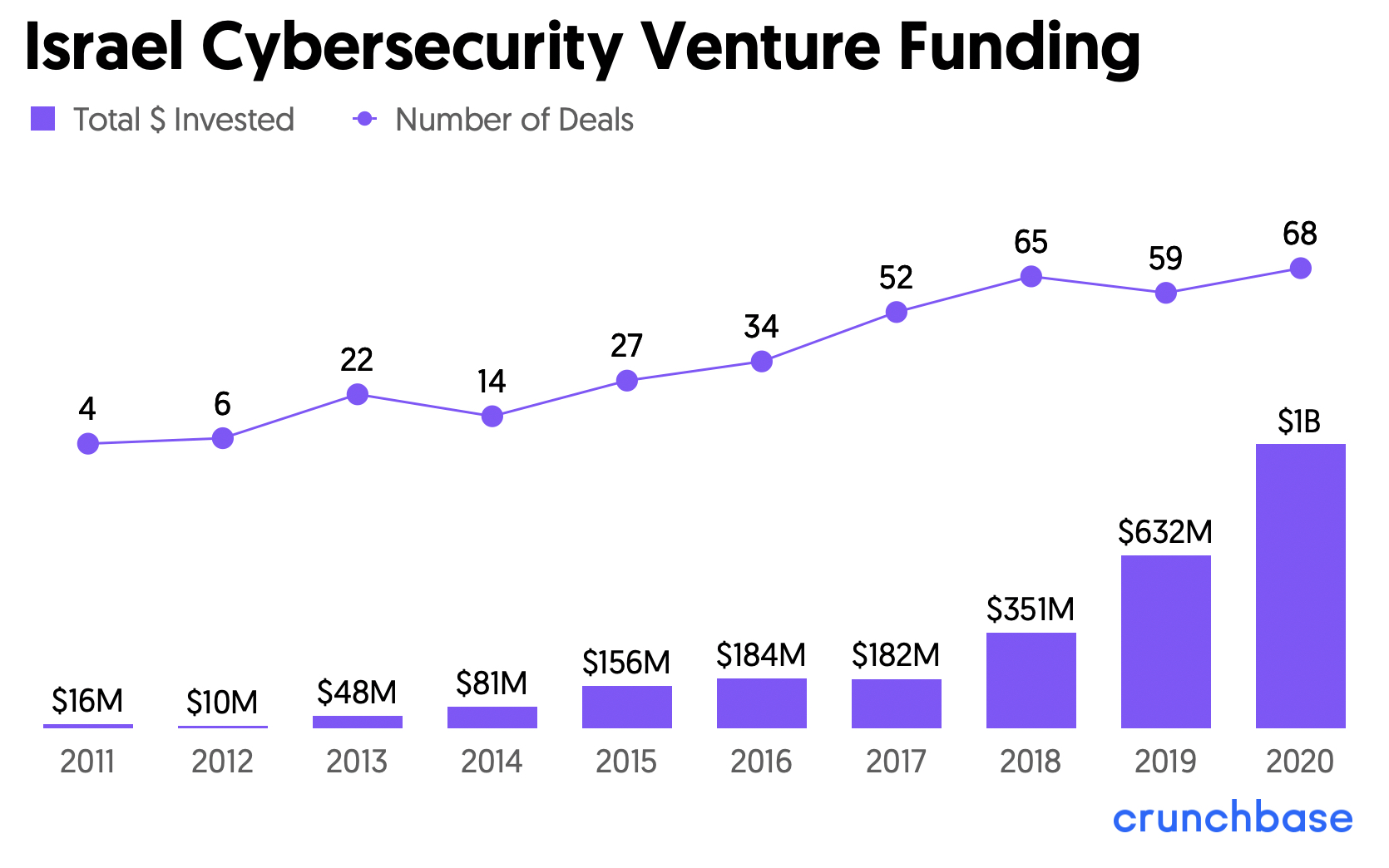

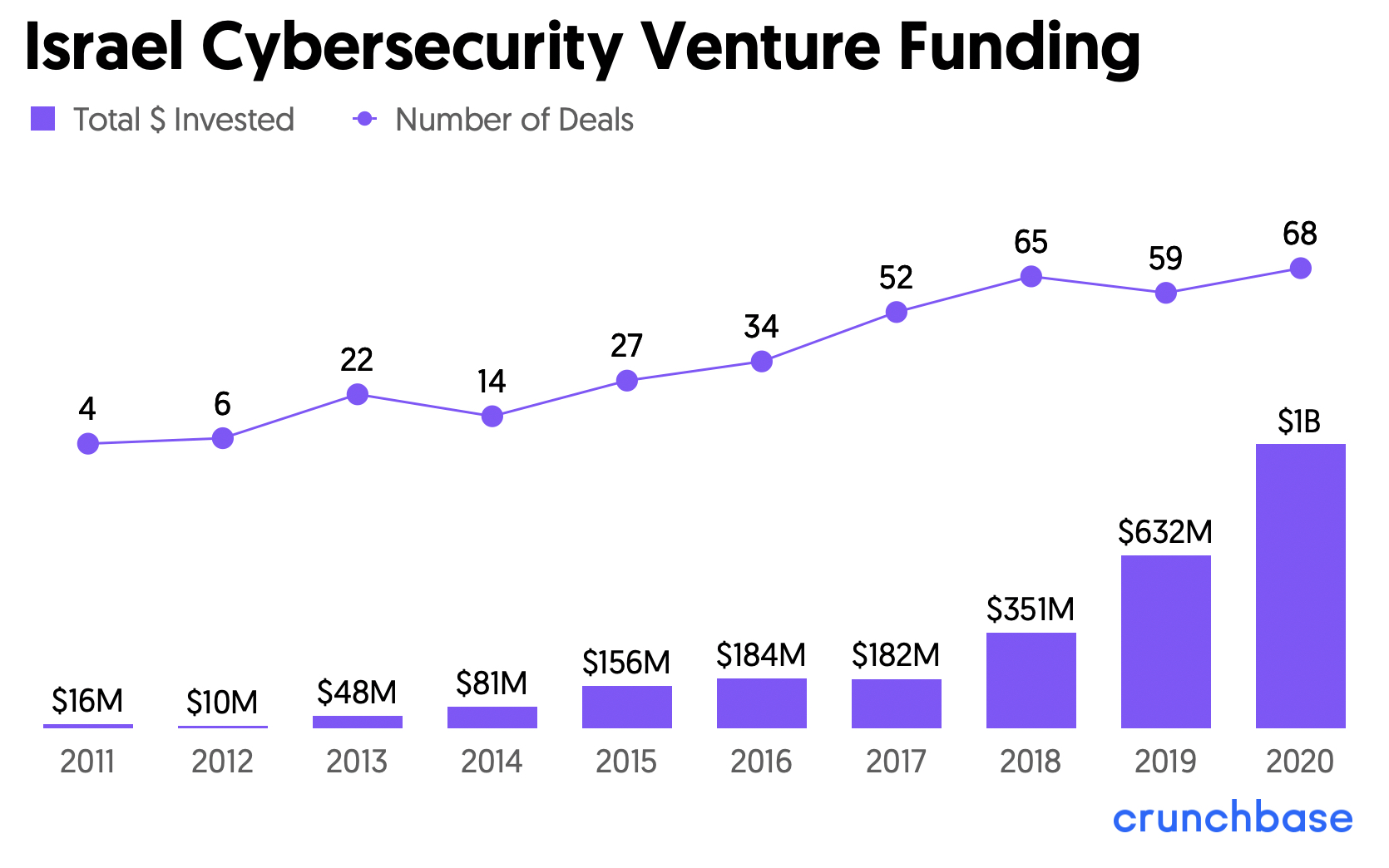

- Israel is the second leading country in the industry – over 20% of the country’s venture funding went to cybersecurity companies in 2020.

- 2020 recorded six new cybersecurity unicorns, a record for a single year at the time. Just a few months into 2021, nine new cybersecurity unicorns have already emerged, well surpassing the 2020 record.

- In 2021, over $3.7 billion in cybersecurity investments have been recorded globally so far. This is on pace to smash the 2020 record.

Introduction

As COVID-19 spread across the globe and many companies transitioned to remote work, the need for cybersecurity increased immensely. With scattered workforces, complete digital adoption was no longer a choice, but a necessity. This led to an increase in data and sensitive document transfers occurring in the cloud, and companies seeking increased protections against hackers and data breaches. In turn, it also led to the rise of new cybersecurity startups poised to capitalize on the opportunity, and venture capitalists flooding the industry with new funding.

In this report we take a look at how the cybersecurity venture capital scene has grown over the last decade, how it was impacted by the pandemic, and its outlook for 2021 and beyond.

What is cybersecurity?

Cybersecurity is the practice of defending systems from information disclosure and threats. There are several common areas of cybersecurity, including, but not limited to: network security, cloud security, data loss prevention, intrusion detection, identity and access management, endpoint protection, and anti-malware.

Why focus on cybersecurity?

Global venture funding for the cybersecurity industry hit an all-time high in 2020, reaching $7.8 billion. About 1,500 cybersecurity companies around the globe have received venture funding since 2017 and have not yet exited. About 58% are seed-stage companies, 32% are in early stage, and 10% are in late stage.

The cybersecurity industry has been experiencing rapid global growth for the past decade and, with many companies forced to transition to online, the pandemic only increased this urgency and the relevance of the industry. According to a Gartner report, end-user spending for the information security and risk management market is predicted to become a $207.7 billion market by 2024.

Highly publicized and damaging data breaches have also played a large part in the rapid expansion of the cybersecurity industry. In April 2020, the FBI’s Cyber Division reported a fourfold increase in cybersecurity complaints each day as hackers took advantage of remote workers and daily business activities moving online. Cyber breaches can be particularly expensive – both in terms of the cost to fix the problem and the potential cost of lost customers due to a lack of trust. A wide array of cybersecurity tools can help limit the likelihood of a costly breach.

While companies have been slowly moving to the cloud for the past decade, the pandemic greatly accelerated digital transformation. As companies increased their cloud usage and number of internet-connected assets, it created a much larger attack surface.

Just as the pandemic accelerated cloud transformation, it also also accelerated the momentum of cloud security companies like Lacework, Aqua Security, OwnBackup, Axonius and more, all of which have raised rounds of over $100 million since the pandemic began. And attack surface management company Expanse, which announced exceeding 100% year-over-year growth in October 2020, inked an $800 million acquisition by Palo Alto Networks.

With many companies announcing remote-first policies indefinitely and over $3.7 billion in funding already recorded in 2021, we expect this momentum to continue (find more information about 2021 funding here).

Cybersecurity Investment in the Last Decade

The cybersecurity industry has been growing steadily for the last decade, experiencing particularly explosive growth starting in 2019, with $7.6 billion invested in the industry – a 44% increase from 2018.

When looking at aggregated funding totals from 2011 to 2020 in the industry, Israel is the second leading country behind the U.S. with about $2.7 billion raised (although the majority of the funding is from the past two years). China comes in at third place, with $1.8 billion raised in 10 years. The United Kingdom and Canada ranked fourth and fifth, respectively.

Cybersecurity Funding in 2020

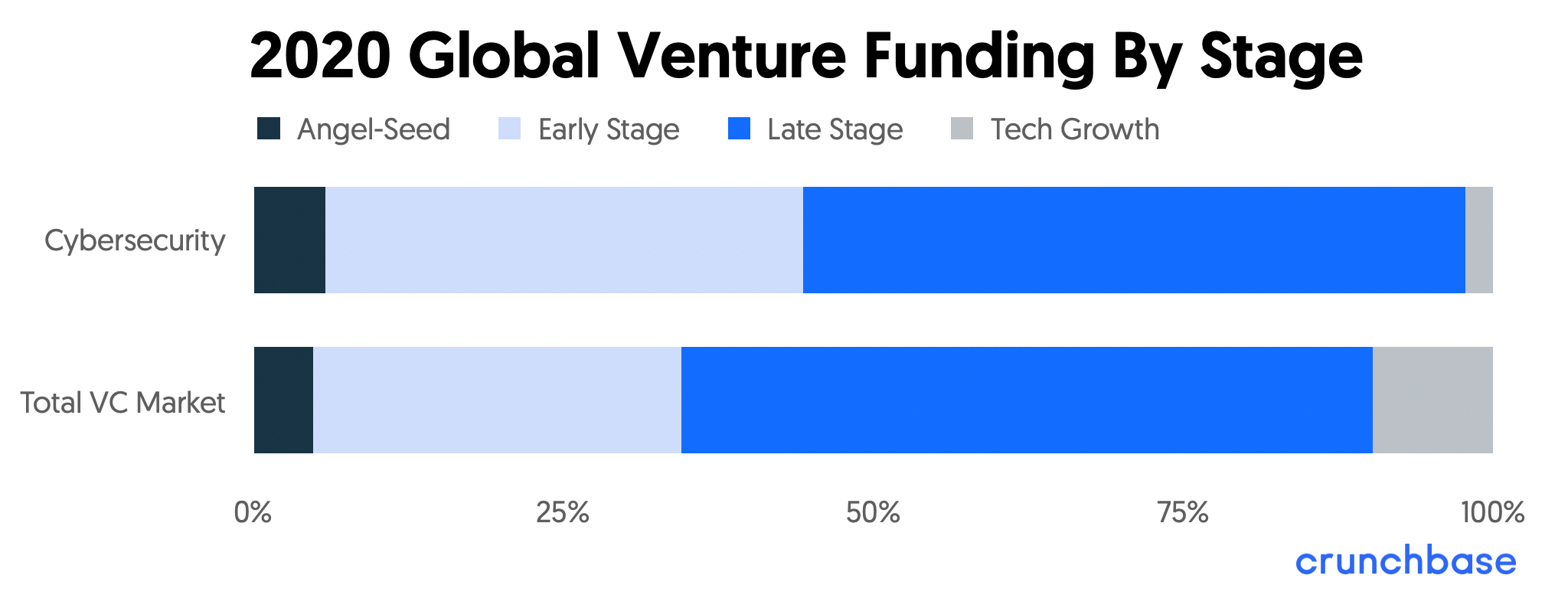

In 2020, about 6% of global cybersecurity venture dollars went to angel and seed-stage deals, 39% went to early stage, 53% to late stage, and a little over 2% to tech growth rounds.

Relative to the overall global market, which recorded a total of 35% of investment in angel, seed and early-stage rounds combined, the cybersecurity industry has a larger focus on early-stage investments with 45% total for angel, seed and early stage (click here to dig into the nine largest Series A and B rounds). This is good news for salespeople and unicorn hunters – an industry with a large percentage of early-stage companies spells fresh funding and opportunity.

The largest deal of 2020 was a $340 million Series G round for California-based cloud security company Netskope, valuing the company at $3 billion. The largest exit transaction was the acquisition of Utah-based Venafi for $1.2 billion by private equity firm Thoma Bravo.

In total, 15 rounds of $100 million-plus were raised by cybersecurity companies across the globe in 2020 – this amount includes two rounds for endpoint protection company SentinelOne ($200 million Series E and $267 million Series F), and two rounds for application security developer Snyk ($150 million Series C and $200 million Series D). Snyk has since gone on to raise a $300 million Series E round in March 2021. The largest number of $100 million-plus rounds in a single year for the cybersecurity industry at the time was 15 – 2021 has already met that number.

Hot Spots for Cybersecurity Funding Around the Globe in 2020

The U.S. and Israel combined accounted for nearly 90% of all venture funding for cybersecurity companies in 2020. The U.K. captured a little over 3% ($262 million) in 2020, largely due to an $80 million Series C round for data privacy company Privitar. Another cybersecurity company from the U.K. worth mentioning is Darktrace, a cyber AI company that reached unicorn status in 2018 and is planning on a London IPO in the first half of 2021 that will reportedly value the company at $5 billion.

U.S. Cybersecurity Funding in 2020

The U.S. accounted for 76% of global venture funding for cybersecurity companies in 2020, with $5.9 billion in capital invested.

From 2019 to 2020, cybersecurity funding in the U.S. increased 22% – significantly greater than the 15% growth of the overall U.S. venture market. In 2020, 39% of cybersecurity funding went to rounds at the angel, seed and early stage, less than the 45% figure for angel, seed and early-stage cybersecurity deals globally. As the most established cybersecurity market in the world, the U.S. sees a higher percentage of late-stage deals.

In 2020, 48% of funding, totaling $2.9 billion, for U.S. cybersecurity companies was concentrated in California. This is on par with California’s overall U.S. investment market share in 2020 of 52%. Of the $2.9 billion invested in cybersecurity, 94% went to companies based in the San Francisco Bay Area.

California Leads, New York Sees a Slice of the Pie

Although the Bay Area is the leading hub for investment in the industry in the U.S. (to no great surprise), there are pockets of opportunity across the country. New York-based cybersecurity companies raised $874 million in 2020 – nearly 15% of the U.S.’ cybersecurity funding for the year. That year also marked New York’s best ever for investment in the industry – dollars raised grew 63% from 2019, the previous record year. Nearly 100% of New York state’s cybersecurity investment money went to companies based in New York City.

Massachusetts, Texas, Minnesota and Maryland Have a Stake in the Market

Another state of note is Massachusetts, which claimed 12% (almost solely concentrated in the greater Boston area) of U.S. cybersecurity funding in 2020. In fact, Massachusetts has consistently found a share of the market, taking roughly 12% of cybersecurity funding over the last decade. So far in 2021, Massachusetts has captured 18% of U.S. cybersecurity funding, thanks to the $300 million Series E for Snyk, and a $145 million Series B for iboss.

Part of the reason for the cybersecurity concentration in the Boston area stems from Israeli cybersecurity firms moving to the area. For instance, Snyk and Cybereason both have Israeli founders but decided to set up headquarters in Boston, due in part to the large customer base available in the U.S. Additional factors for why these companies are choosing Massachusetts include the proximity to tech talent and a manageable time zone difference with Israel (where many of the R&D offices are located).

Other states with a stake in the 2020 U.S. cybersecurity industry include Texas (particularly the Austin and Dallas metro areas), which claimed 7%, and Minnesota (primarily thanks to Arctic Wolf), and Maryland, which each took around 4%.

Israel’s Investment in Cybersecurity Skyrockets

Looking beyond the U.S., cybersecurity funding in Israel surpassed $1 billion in 2020 – a nearly 65% increase from 2019. Interestingly, over 90% of this $1 billion in funding was raised in April or later – after the onset of the pandemic.

Of Israel’s total venture funding in 2020, over 20% went to cybersecurity companies, relative to the 2.5% of total funding that went to cybersecurity companies globally. This is a dramatic increase in the percentage of total investment that went to cybersecurity for the country – the previous high was 15% in 2019. So far in 2021, cybersecurity companies are receiving a whopping 28% of the country’s venture funding.

Of Israel’s cybersecurity venture deals in 2020, 53% were at the angel, seed or early stage, compared to 39% in the U.S., signaling the venture scene in Israel is still young with room to grow. Roughly 80% of Israel’s cybersecurity funding in 2020 was centered in Tel Aviv, which is home to larger venture-backed cybersecurity companies including BioCatch, Aqua Security and Cato Networks. We expect Israel’s total funding numbers to keep climbing as these early-stage companies receive larger, late-stage deals.

Although Israel appears new to the cybersecurity scene based on reported venture funding, it’s been a focus for the country for years. The Israeli government has been very active in emphasizing the importance of cybersecurity and guiding the growth of the technology in Israel. In 2012, the prime minister’s office established the Israel National Cyber Directorate, specifically responsible for promoting cybersecurity in that country. In 2017, the bureau published the Israeli Cyber Defense Methodology, a guide for how to minimize cyber-risks for organizations in Israel. The emphasis on risks and protecting businesses in Israel, paired with the rise of technology and venture capital over the last decade, spurred a cybersecurity technology boom.

Israel has had established companies in the market for years, most notably Check Point, but it’s also home to second offices for many U.S. cybersecurity companies, including Snyk, BigID, Cybereason, Axonius and more. The recent boom in new cybersecurity companies has also led to nearly 50% of all of Israel’s venture-backed cybersecurity companies being founded in 2016 or later. Given the country’s high percentage of early-stage funding, we expect funding for cybersecurity companies to continue growing in Israel.

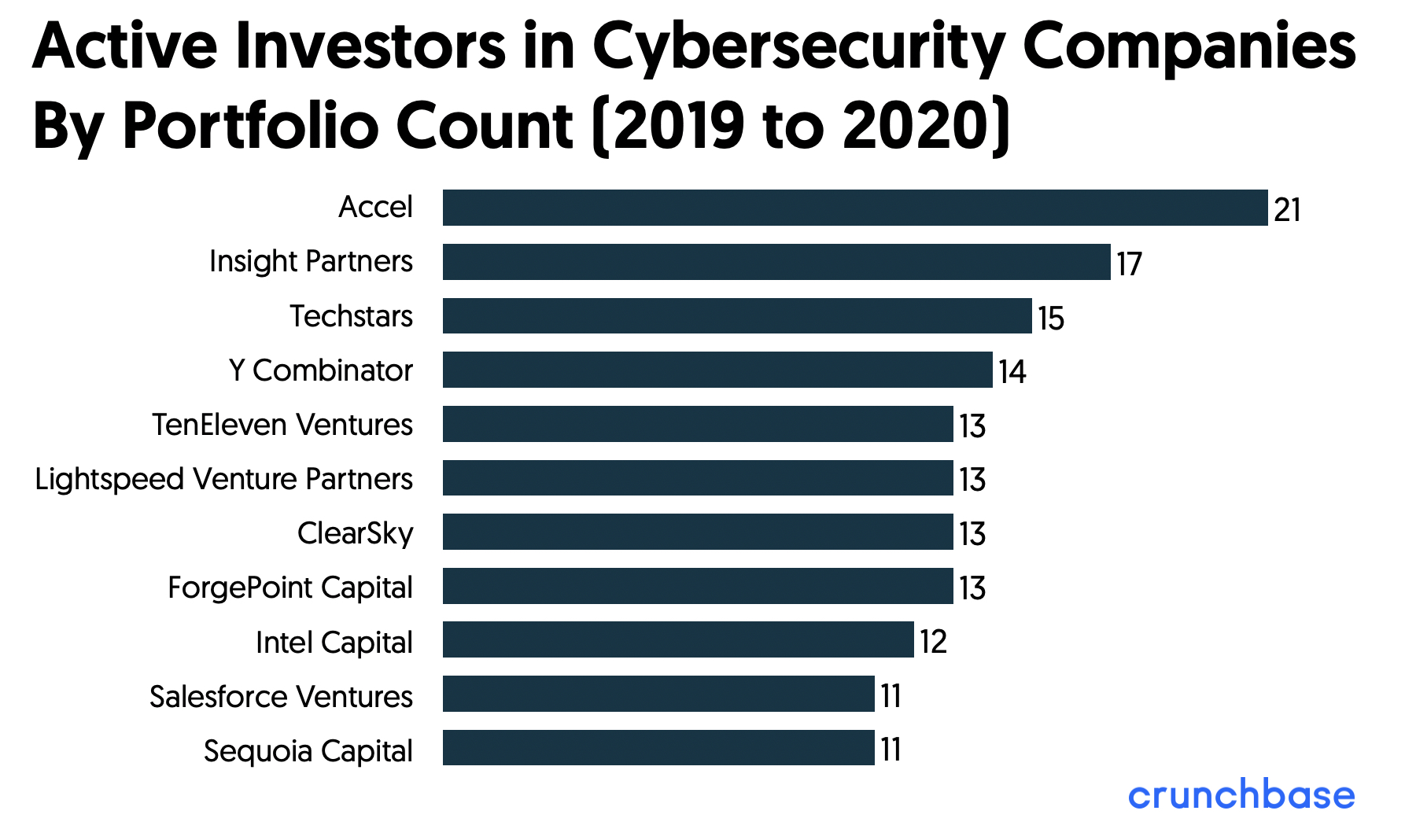

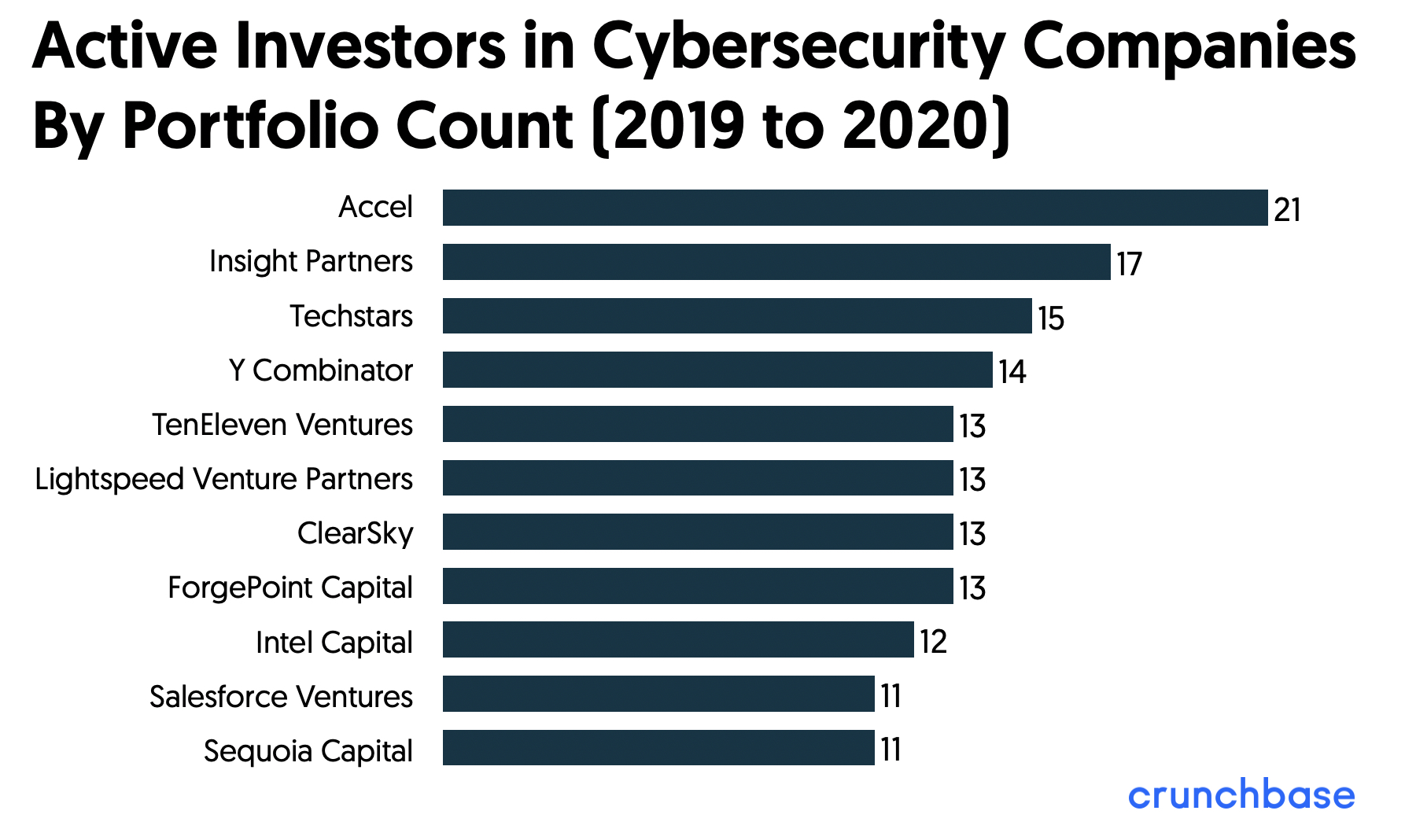

Active Investors in Cybersecurity

The top 10 investors in the cybersecurity industry from 2019 to 2020 were all based in the U.S. Accel took the lead in terms of most active seed or venture investors with 21 investments in global cybersecurity companies from 2019 to 2020. (Here is a list of all of Accel’s investments in cybersecurity companies.) Insight Partners invested in 17 companies in 2019 and 2020, Techstars in 15, and Y Combinator in 14. Two notable non-U.S. investors in the space include Israel-based OurCrowd, with investments in 10 companies in the same time frame, and Singapore-based Singtel Innov8 with investments in nine companies.

In the same 2019-2020 time frame, some of the top investors in Israeli companies include U.S.-based venture firms Blumberg Capital and YL Ventures, and Israel-based OurCrowd and Jerusalem Venture Partners.

Early Stage Cybersecurity Rounds in 2020

In 2020, nine cybersecurity companies raised early-stage rounds (Series A or B) of at least $50 million. Companies receiving large investments at this stage are typically going into hypergrowth mode and focusing on taking their business to the next level, including growing their employee base, hiring new leadership, buying new software and tools, and expanding into new markets. Eight out of nine of these companies are based in the U.S. (Wiz is headquartered in Israel), however, only three are located in the San Francisco Bay Area.

StackPath

StackPath is an edge computing and content delivery platform with edge locations in major internet exchanges around the globe.

- Headquarters: Dallas, Texas

- Funding Round: $216 million Series B

- Number of Employees: 251-500

Wiz*

Wiz is a cloud visibility solution that provides a complete view of security risks across clouds, containers and workloads. Although founded in early 2020, by year end the company had already signed some of the largest U.S. companies by revenue as customers, including DocuSign.

- Headquarters: Tel Aviv, Israel

- Funding Round: $100 million Series A

- Number of Employees: 51-100

Beyond Identity

Beyond Identity is a passwordless identity management solution that replaces passwords with secure certificates. Founded in April 2020, the company raised $105 million in two rounds with plans to use its Series B funding to increase its global footprint.

- Headquarters: New York, New York

- Funding Round: $75 million Series B

- Number of Employees: 101-250

Orca Security*

Orca Security provides security and compliance for Amazon Web Services, Azure and Google Cloud Platform.

- Headquarters: Los Angeles, California

- Funding Round: $55 million Series B

- Number of Employees: 101-250

Alkira

Alkia is a network cloud company that offers integrated network and security services when transitioning to the cloud.

- Headquarters: San Jose, California

- Funding Round: $54 million Series B

- Number of Employees: 51-100

deepwatch

deepwatch provides managed detection and response services for security operations centers.

- Headquarters: Denver, Colorado

- Funding Round: $53 million Series B

- Number of Employees: 101-250

Abnormal Security

Abnormal Security is an email security company that protects companies from targeted email attacks. The November Series B funding valued the company at $500 million. Abnormal Security claims that the increase in remote working in 2020 helped it achieve a 3x year-over-year increase in its annual recurring revenue.

- Headquarters: San Francisco, California

- Funding Round: $50 million Series B

- Number of Employees: 51-100

JSonar

JSonar, a database security security company that delivers a unified view of all database activity, was acquired by Imperva in late 2020.

- Headquarters: Waltham, Massachusetts

- Funding Round: $50 million Series A

- Number of Employees: 51-100

Securiti

Securiti is an AI-powered PrivacyOps platform that automates functions needed for privacy compliance.

- Headquarters: San Jose, California

- Funding Round: $50 million Series B

- Number of Employees: 101-250

*In March 2021, Wiz raised a $130 million Series B, and Orca Security raised a $210 million Series C, with each reaching unicorn status. Find more info about this year’s funding rounds in the 2021 section.

See the full list of early-stage funding rounds for cybersecurity companies in 2020.

Cybersecurity Unicorns in 2020

Six cybersecurity companies achieved unicorn status in 2020. Five of the six are U.S.-based, with Cato Networks being based in Tel Aviv. Companies often appoint new leadership around the unicorn stage as they expand into new markets and consider exit opportunities, so we’ve included those hires announced in 2020 for the following companies:

Snyk

Snyk is an application security developer that helps companies use open-source code to stay secure.

- Headquarters: Boston, Massachusetts

- Total Funding Amount: $470 million

- Latest Valuation: $4.7 billion

SentinelOne

SentinelOne delivers autonomous endpoint protection that prevents, detects and responds to attacks across all major vectors.

- Headquarters: Mountain View, California

- Total Funding Amount: $697 million

- Latest Valuation: $3 billion

- New Leadership Hires: Chief Financial Officer and SVP of Corporate and Business Development

Verkada

Verdaka builds security solutions that help run safer, smarter buildings. It combines security cameras and access control with intelligent, cloud-based software.

- Headquarters: San Mateo, California

- Total Funding Amount: $139 million

- Latest Valuation: $1.6 billion

Arctic Wolf

Arctic Wolf offers security operations as a concierge service, providing 24/7 monitoring, detection and response, and ongoing risk management.

- Headquarters: Eden Prairie, Minnesota

- Total Funding Amount: $348 million

- Latest Valuation: $1.3 billion

Cato Networks

Cato Networks is the provider of Cato SASE, which converges SD-WAN and security into a cloud-native service.

- Headquarters: Tel Aviv, Israel

- Total Funding Amount: $332 million

- Latest Valuation: $1 billion

BigID

BigID is a data intelligence company that helps companies secure customer data and satisfy privacy regulations.

- Headquarters: New York, New York

- Total Funding Amount: $216 million

- Latest Valuation: $1 billion

- New Leadership Hires: Chief Marketing Officer and SVP of Alliances and Channels

Since the start of 2020, over 100 venture-backed cybersecurity companies have announced new people in leadership positions.

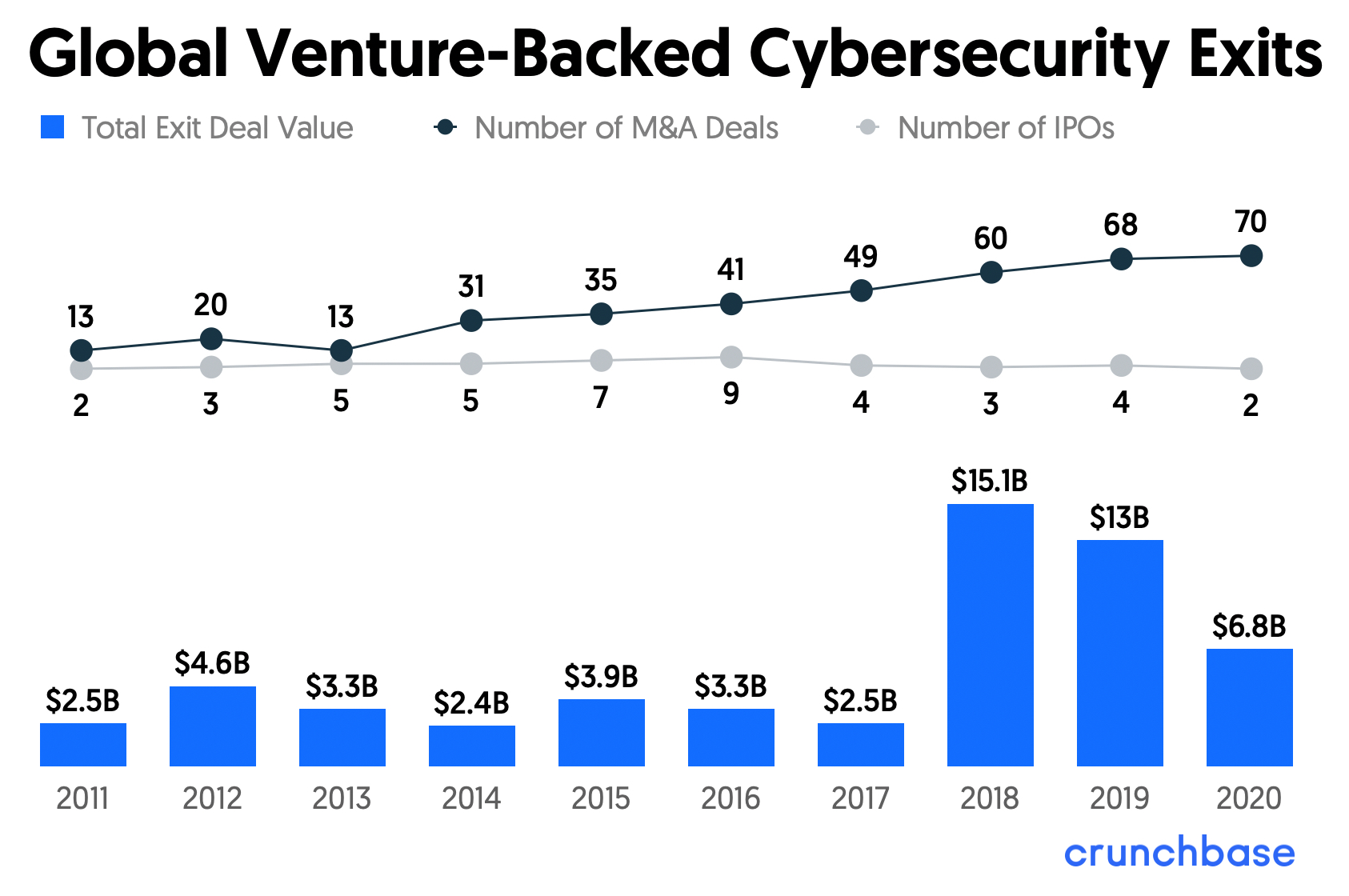

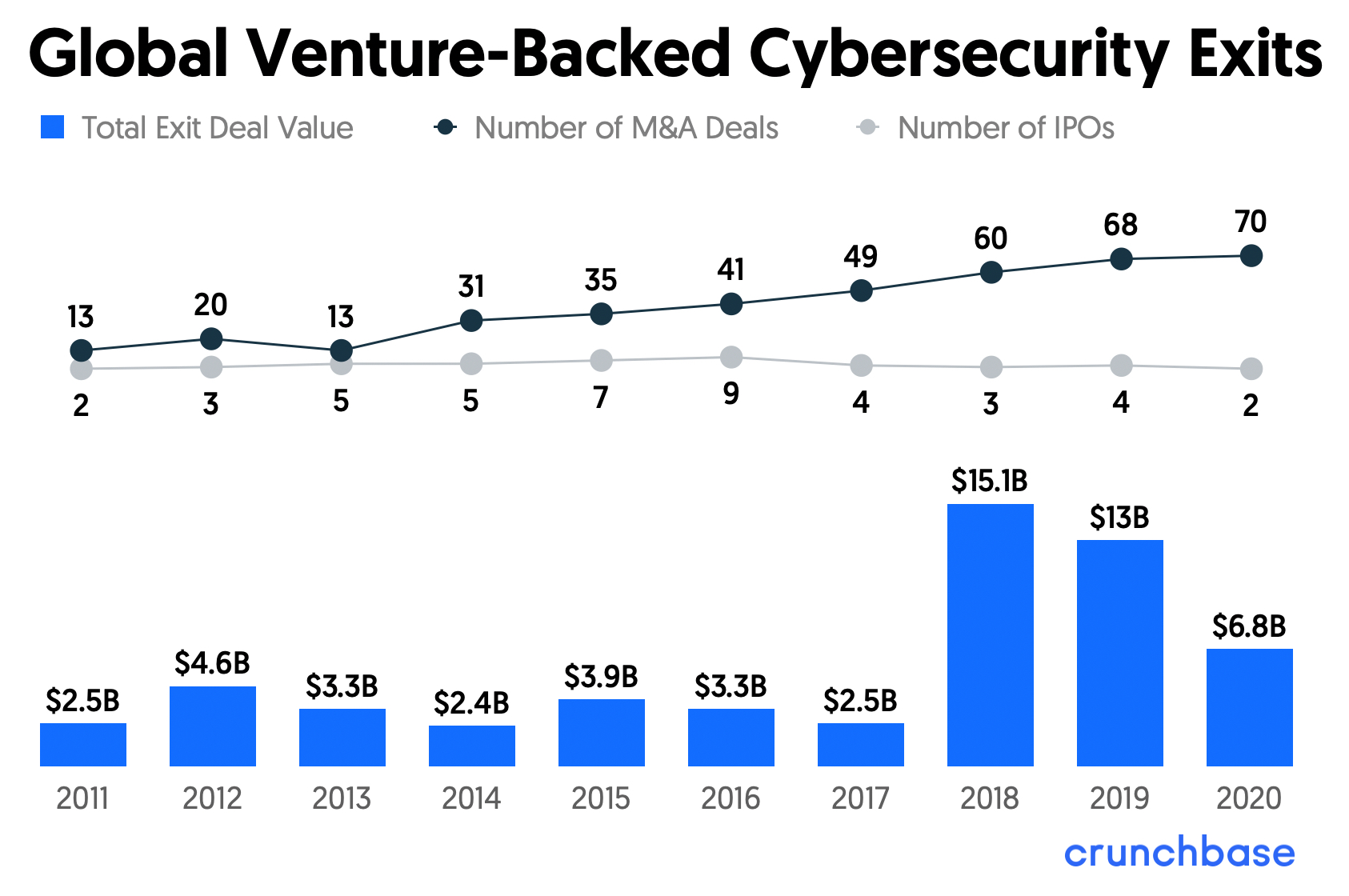

The State of Global Cybersecurity Exits

In 2020, global exit value for cybersecurity companies reached $6.8 billion across 72 transactions: 70 acquisitions and just two IPOs. The IPO market was slower in 2020 relative to the previous few years, which saw several companies including CrowdStrike and Tenable Network Security IPO at multibillion-dollar valuations. The two cybersecurity IPOs in 2020 included Virginia-based company TELOS at a valuation of $1.1 billion, and British Columbia-based company Plurilock for an undisclosed amount.

While the IPO market slowed, the number of M&A transactions has increased steadily over the last decade. Additionally, we’re seeing cybersecurity companies acquiring other small cybersecurity companies to expand their offerings and customer base; 23 of the 70 acquisitions in 2020 were made by larger cybersecurity companies.

The largest acquisitions in 2020 included:

- Venafi, a machine-identity management company based in Salt Lake City, was acquired by Thoma Bravo for $1.2 billion;

- Armis Security, an IoT security solution based in Palo Alto, was acquired by Insight Partners for $1 billion;

- Expanse, an attack surface management company based in San Francisco, was acquired by Palo Alto Networks for $800 million; and

- Signal Sciences, a web application security company based in Culver City, California, was acquired by Fastly for $775 million.

Crunchbase Pro search for recent cybersecurity acquisitions.

Global Cybersecurity Funding in 2021

Cybersecurity is expected to remain hot in 2021. As of March 30, over $3.7 billion had already been invested globally in the industry. If this pace continues, the industry could reach close to $15 billion by the end of the year.

“Security is a red hot sector with more and more money pouring into it.“

Andrew Atherton, managing director at Union Square Advisors.

In the U.S., over $3 billion has already been poured into the cybersecurity industry in 2021. East Coast-based cybersecurity companies have raised $1.5 billion, nearly half of that total. With the pandemic spurring companies to relocate away from the San Francisco Bay Area, it’s possible that the cybersecurity funding previously going to the Bay Area will become increasingly dispersed across the country.

Israel-based companies have already raised over $500 million in 2021 – with three rounds of $100 million-plus for Aqua Security, Wiz and CYE.

New Cybersecurity Unicorns in 2021

Although 2020 was a record-breaking year with six new cybersecurity unicorns, 2021 has already topped it. We’re only a few months into the year and nine new cybersecurity unicorns have already been minted. They include:

Armis Security

Armis Security is an Internet of Things security solution that lets enterprises see and control any network or device.

- Headquarters: Palo Alto, California

- Total Funding: $237 million

- Latest Valuation: $2 billion

Coalition

Coalition is a cyber insurance and cybersecurity company that helps businesses manage cyber-risks.

- Headquarters: San Francisco, California

- Total Funding: $300 million

- Latest Valuation: $1.8 billion

Wiz

Wiz is a cloud visibility solution that provides a complete view of security risks across clouds, containers and workloads.

- Headquarters: Tel Aviv, Israel

- Total Funding: $230 million

- Latest Valuation: $1.7 billion

OwnBackup

OwnBackup is a provider of cloud data protection and backup systems for companies using Salesforce.

- Headquarters: Englewood Cliffs, New Jersey

- Total Funding: $267 million

- Latest Valuation: $1.4 billion

- New Leadership Hire: Chief People Officer

Axonius

Axonius is a cybersecurity asset management platform that provides asset inventory, uncovers security solution coverage gaps, and enforces security policies.

- Headquarters: New York, New York

- Total Funding: $195 million

- Latest Valuation: $1.3 billion

Socure

Socure is a predictive analytics platform for digital identity verification of customers.

- Headquarters: New York, New York

- Total Funding: $194 million

- Latest Valuation: $1.3 billion

Orca Security

Orca Security provides security and compliance for Amazon Web Services, Azure and Google Cloud Platform.

- Headquarters: Los Angeles, California

- Total Funding: $292 million

- Latest Valuation: $1.2 billion

Lacework

Lacework is a cloud security platform that provides automated threat defense and intrusion detection for cloud workloads.

- Headquarters: San Jose, California

- Total Funding: $599 million

- Latest Valuation: $1 billion

- New Leadership Hires: Chief Executive Officer, Chief Product Officer, Chief Financial Officer and Chief Architect

Aqua Security

Aqua Security helps companies secure their cloud-native, container-based and serverless applications, providing security automation across the application life cycle.

- Headquarters: Tel Aviv, Israel

- Total Funding: $265 million

- Latest Valuation: $1 billion

Keep up with 2021 cybersecurity venture funding in real-time.

On the M&A side, we anticipate even more activity in 2021. So far this year, 29 acquisitions of venture-backed cybersecurity companies have already occurred, including a $1.4 billion acquisition of Thycotic.

Conclusion

With cyberattacks continuing to threaten businesses and jeopardize personal privacy, cybersecurity remains not only a hot topic, but an imperative investment for any company, government or organization.

Last year certainly proved cybersecurity’s increasing prominence with $7.8 billion in new funding invested over 665 deals, 72 exits and six new cybersecurity unicorns. While the industry certainly boomed in 2020 and outpaces industries like agtech and adtech, cybersecurity still remains an industry with room for even more growth.

The first months of 2021 indicate there’s no slowdown in sight for the industry, with over $3.7 billion invested and the emergence of nine new unicorns in Q1 alone. If the industry continues to grow at this pace, some predict this year’s total investment could reach a whopping $15 billion.

Crunchbase Pro can help you stay up to date on all things cybersecurity and spot other booming industries with opportunities on the horizon. Check out the resources for salespeople in the next section to learn more.

Crunchbase Pro Tips for Salespeople

- Save this Crunchbase Pro list for global 2021 cybersecurity funding to keep up to date with the latest new deals.

- Crunchbase Pro users can save lists to their account, filter by territory preferences, and match them against target customers. Crunchbase Pro users can also push companies that match their criteria to their CRM in one click.

- View the full list of private cybersecurity unicorns here and the list of emerging unicorns here.

- Learn about cybersecurity companies that recently went public, and perform Pro searches for recent venture-backed acquisitions here.

- To stay up to date on the latest trends and announcements in the industry, keep an eye on Crunchbase News.

Methodology

Data as of March 30, 2021, and includes seed, venture, corporate venture and private equity for venture-backed companies. All other private equity rounds were excluded. Valuations refer to post-money valuations.

For cybersecurity we include the following Crunchbase industries: Cyber Security, Network Security and Cloud Security.

For this report we looked at reported – not projected – data, which means that 2021 numbers will increase over time. Private market financing data is subject to reporting delays, so numbers may have changed since publication as more data gets added to Crunchbase.

Glossary of Funding Terms

- Unicorns are privately held companies with post-money valuations at or above $1 billion.

- Seed/angel includes financings that are classified as seed or angel, including accelerator funding, equity crowdfunding and venture rounds without a designated series, at $3 million and below.

- Early-stage venture includes financings that are classified as a Series A or B, and venture rounds without a designated series that are above $3 million and equal to or below $15 million.

- Late-stage venture consists of Series C, Series D, Series E and later-lettered venture rounds following the “Series [Letter]” naming convention. Also included are venture rounds of unknown series, corporate venture and other rounds above $15 million.

- Technology growth is a private-equity round raised by a company that has previously raised a “venture” round. (So basically, any round from the previously defined stages.)