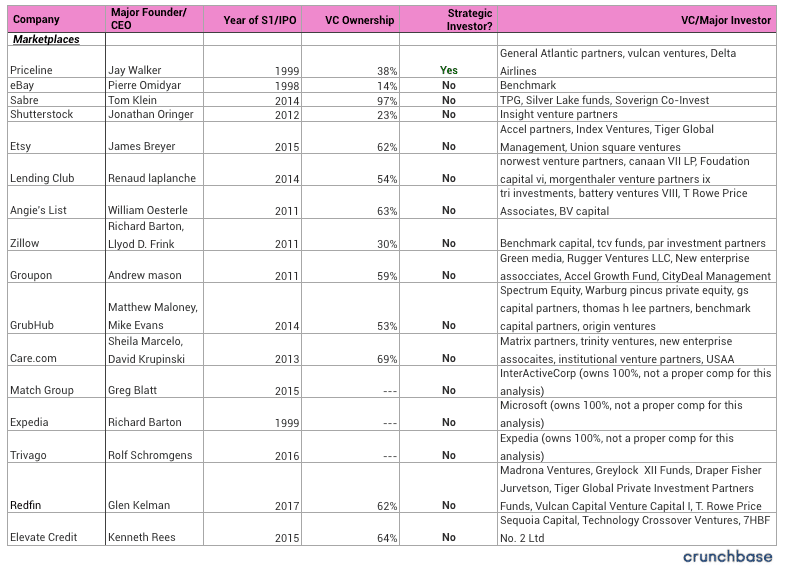

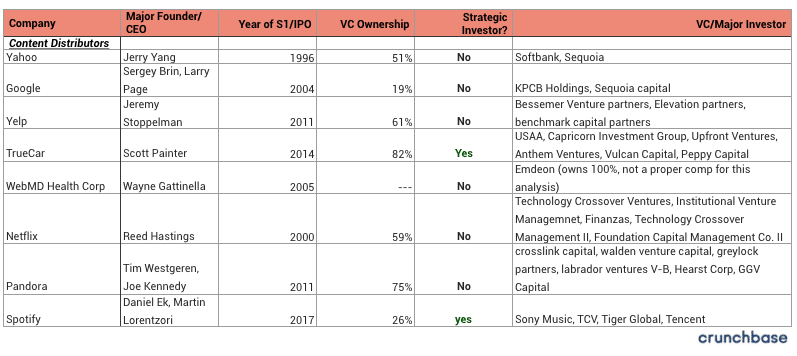

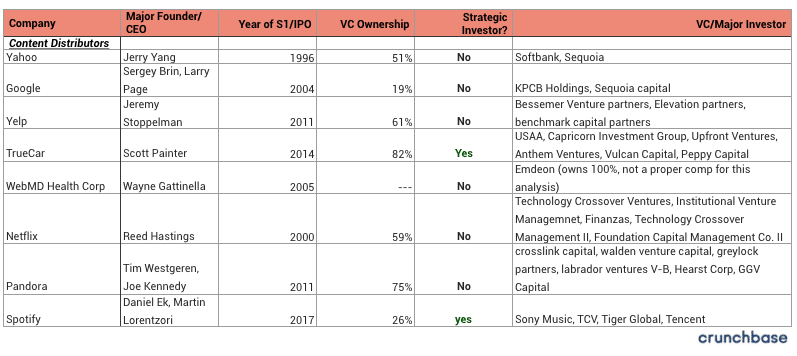

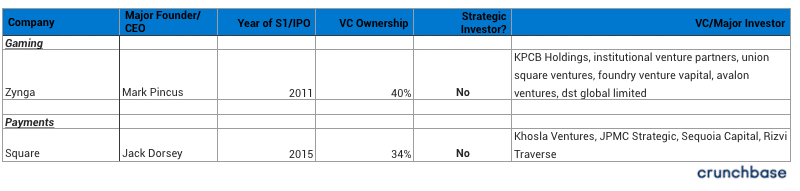

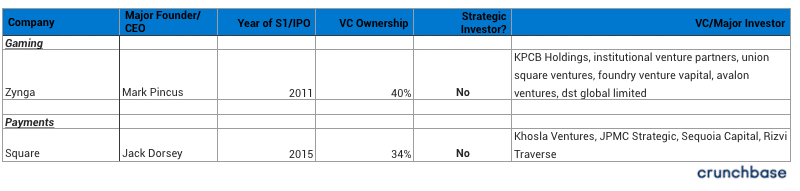

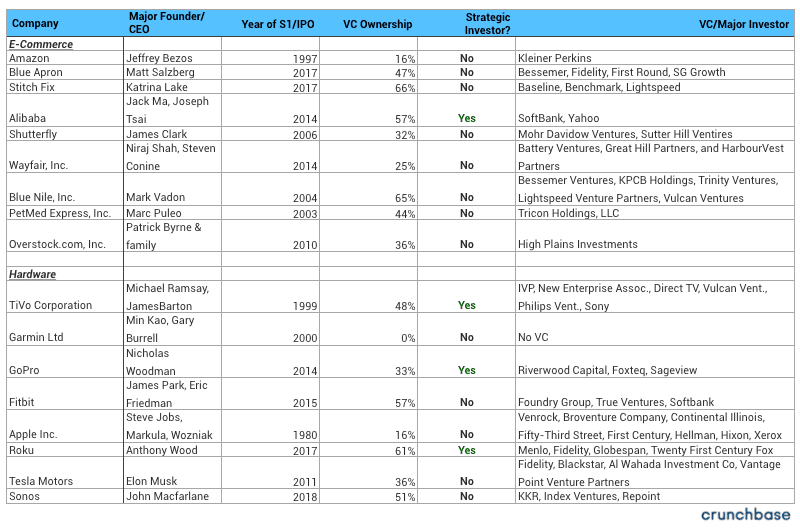

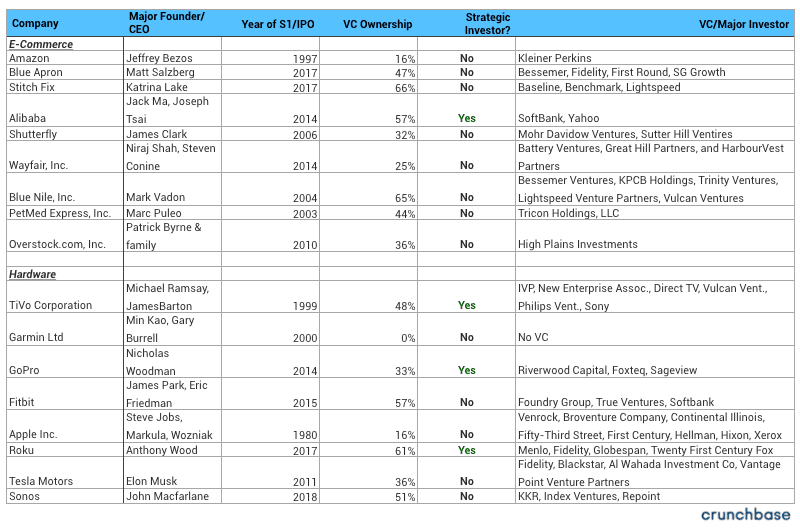

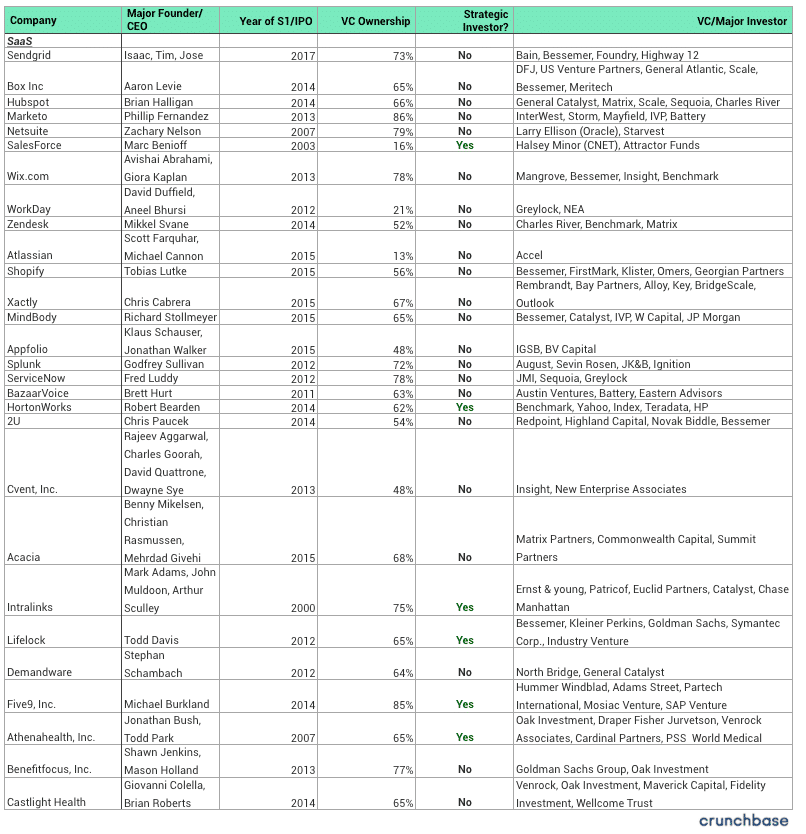

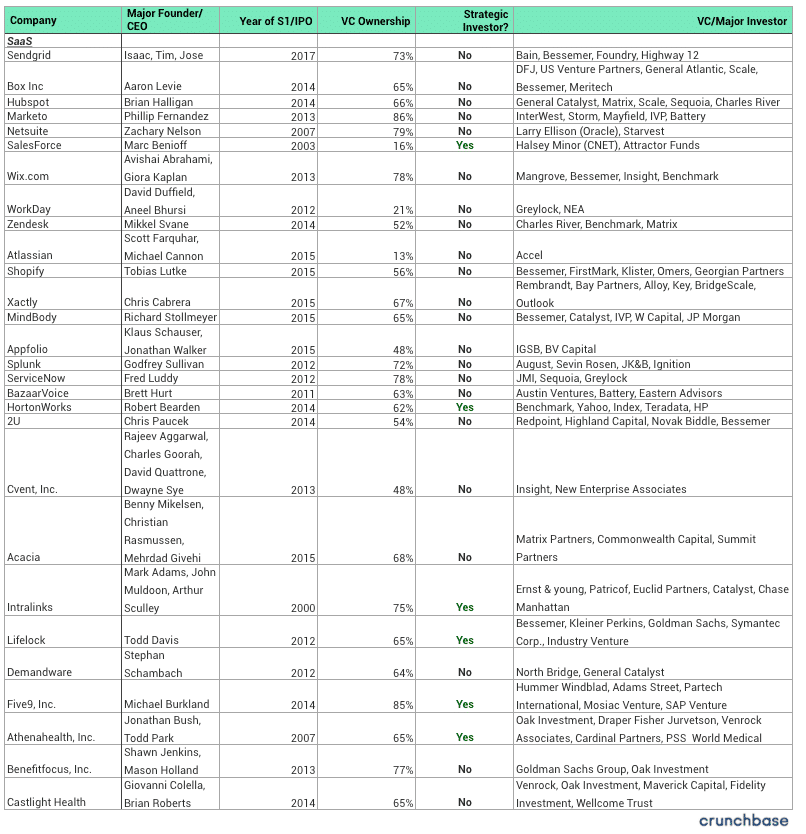

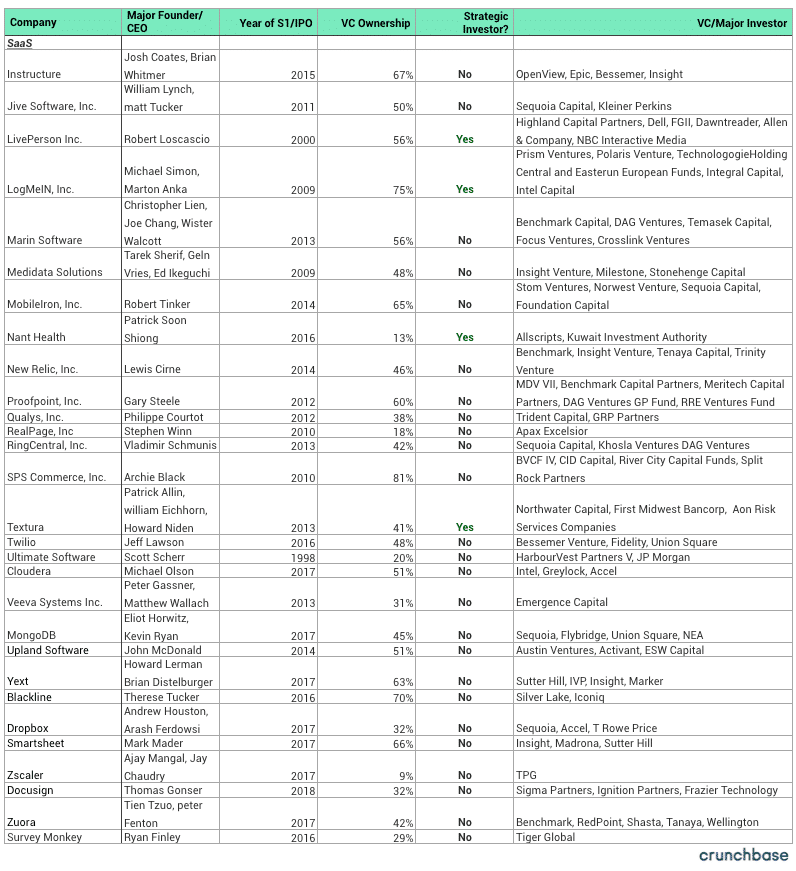

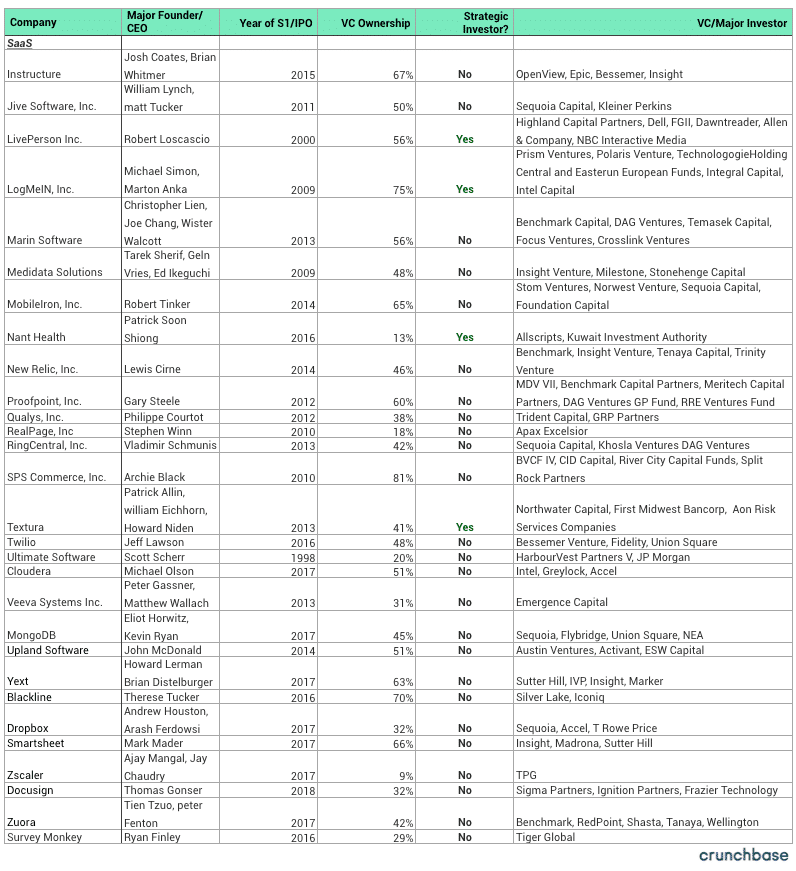

Prior to asking what percentage of my company should I give to investors, it’s helpful to know what percentage do venture capitalists take on average. We looked at the venture capitalist percentage ownership of 105 tech companies at the time they went public. The goal was to determine what percentage do venture capitalists take on average when investing in your company, and to see the VC ownership at the time of exit.

What Percentage do Venture Capitalists Take: Average Venture Capitalist Percentage Ownership

The median and average level of VC ownership at exit was 53% and 50% respectively. In other words, by the time of exit, VC will likely own half your business.

Be profitable to lower Venture Capitalist percentage ownership

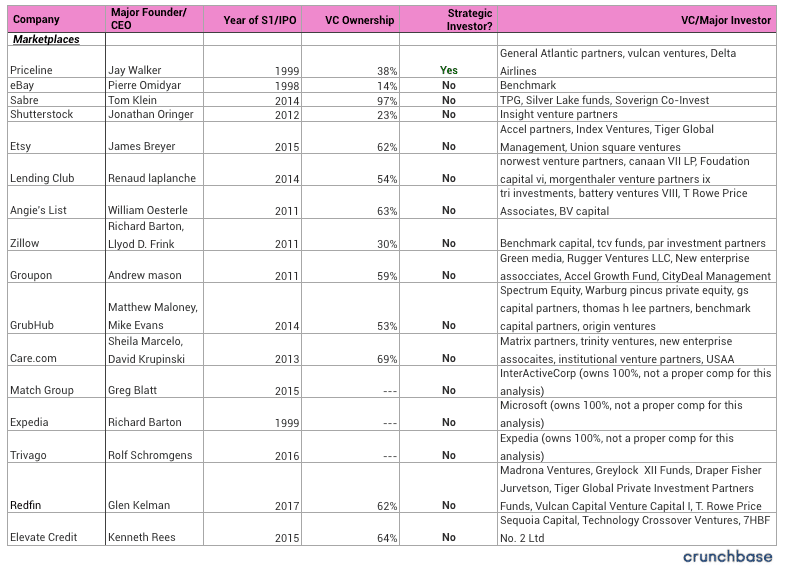

Businesses that tend to be more profitable have lower levels of Venture Capitalist ownership. For instance, e-commerce and hardware, both of which are sectors which tend to generate cash, had median VC ownership levels of 44% and 42% respectively.

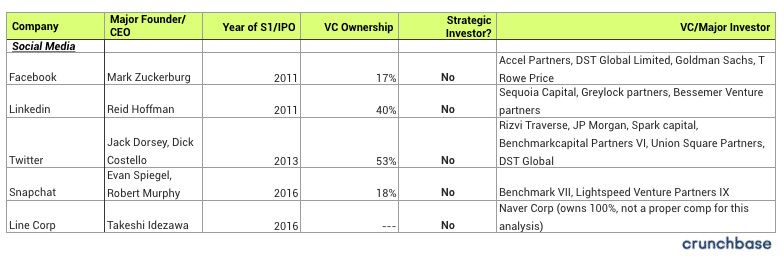

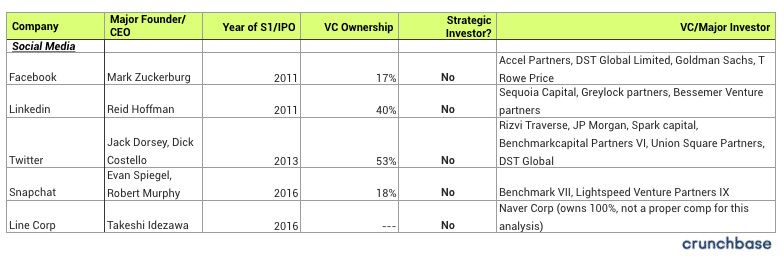

Being “hot” plays a part in VC ownership and saving equity

Raising rounds at very high valuations is another way to preserve equity. To achieve this, you’ve got to be a hot company in a hot sector such as social media. When Facebook and Snapchat IPO’d, for instance, VC ownership was only 17% and 18% respectively.

Tier 1 Venture Capitalists are real

Certain VC showed up on the list repeatedly and are considered top venture capital investors. Frequent appearances were made by Benchmark, Sequoia, Greylock, Bessemer Venture Partners, and Khosla Ventures, among others.

Indeed if you can raise capital from the names on this list, you’ll have someone in your corner that has shepherded companies to the promised land before. Arguably the odds of success (defined as going public/exiting) increase.

Strategic Investors don’t matter if you’re trying to exit

Strategic investors, which are corporations that make venture investments, were only present in 17 out of the 105 IPO’s we looked at.

It leads us to conclude that while a strategic investor can be valuable, they’re not necessary for success. Strategic investments in the list include Delta Airlines investing in Priceline, USAA investing in TrueCar, Fox investing in Roku, etc.

Where is the rest of the equity?

If VC owns on a median 53% and founders own on median 15%, where does the rest of the equity go? A variety of places including to employees via stock options, to companies you’ve acquired along the way where part of the price was paid in stock, to board members, to consultants for their services, etc. 30% is a big number so as you can see, little grants here and there add up. Be stingy.

What percentage of my company should I give to my investors?

In order to maximize your founder’s equity, run your business as lean as you can and make cash efficiency and frugality a part of the culture. Scrutinize every option grant no matter how small because over the long run it does add up.

Lastly, be very cautious about granting equity in M&A or for services — if you’re successful, those shares you gave away to your board members, lawyers, accountants, etc will end up being the most expensive services you ever bought.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.