In partnership with Crunchbase, Startup Genome has just released its Global Startup Ecosystem Report 2019, ranking startup ecosystems and providing insights on sub-sector trends. For the first time, Startup Genome has also included a global ranking of Life Sciences ecosystems.

Top Global Startup Ecosystems

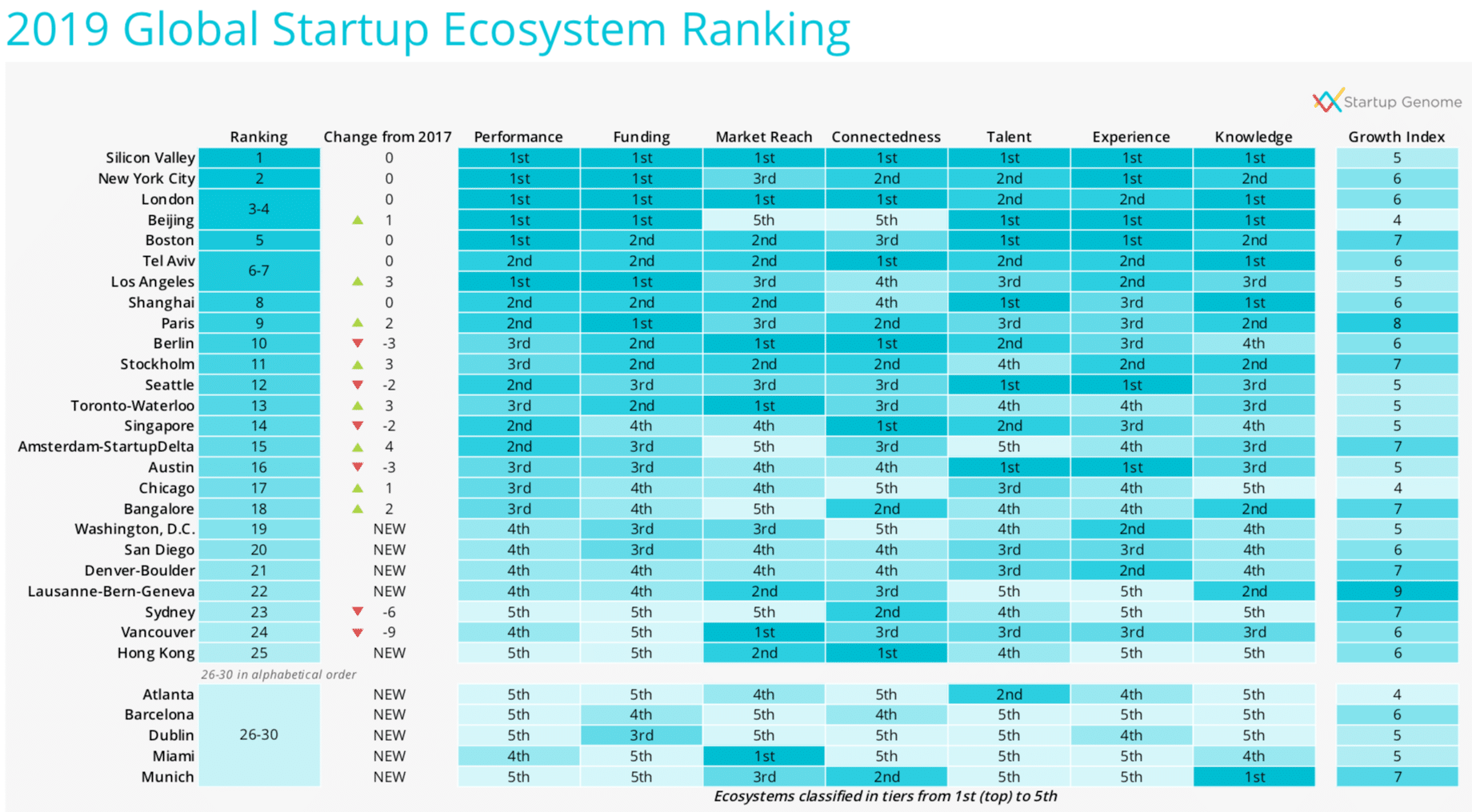

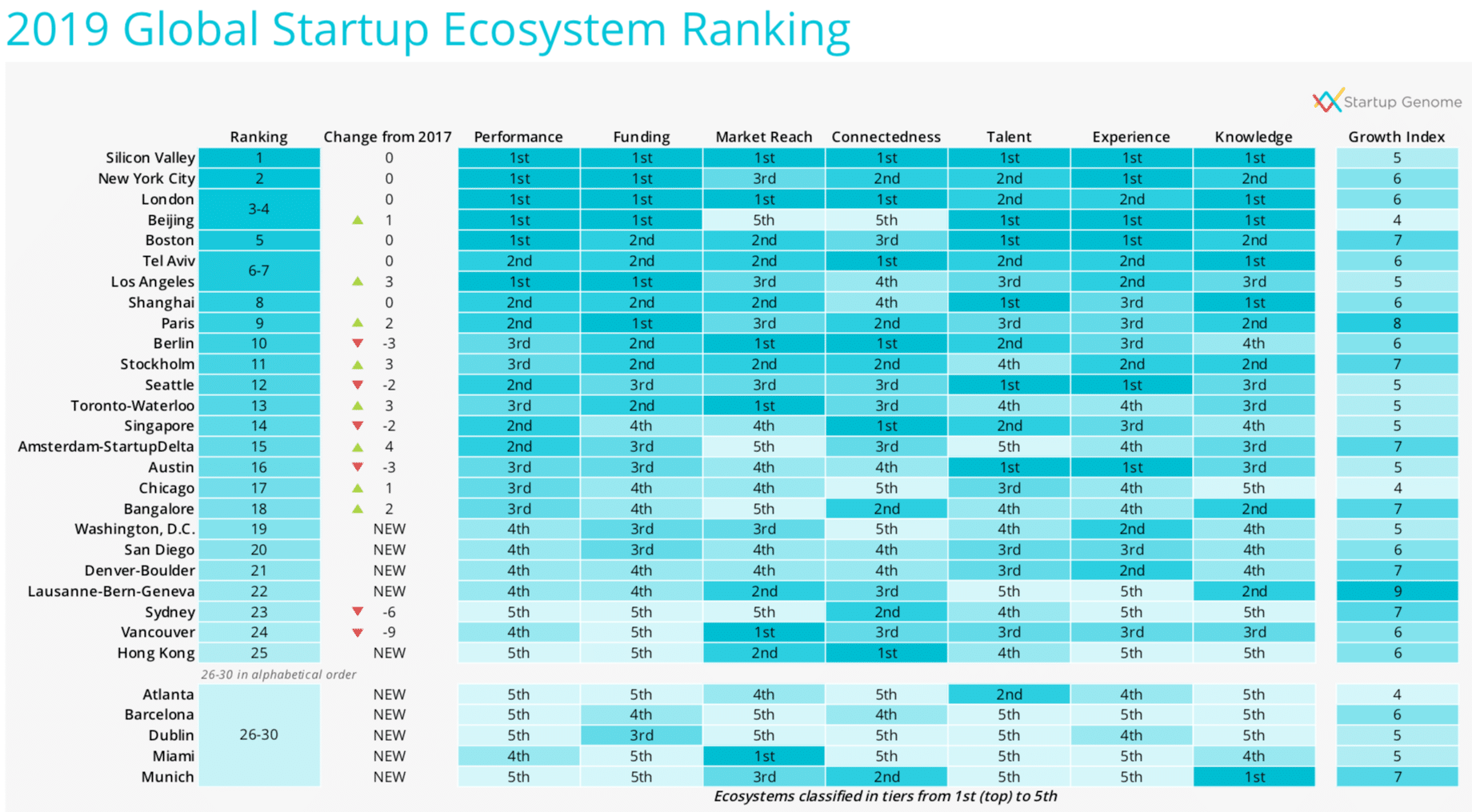

Startup Genome created its own ranking methodology based on 7 key criteria: Performance, Funding, Market Research, Connectedness, Talent, Experience, and Knowledge. To no surprise, Silicon Valley ranked as the #1 startup ecosystem globally based on these criteria. New York City came in second, London and Beijing tied for #3, and Boston rounded out the top five. The United States continues to be at the forefront with 12 ecosystems in the Top 30.

Although the top five ecosystems have stayed constant since 2017, there have been several changes in the order of the rest of the list, the most significant being Amsterdam-Startup Delta jumping from #19 in 2017 to #15 in 2019. Ten ecosystems also made it into the top 30 for the first time this year, although Startup Genome attributes some of this to the inclusion of life sciences startups in the analysis this year (specifically San Diego, Washington, D.C., Lausanne-Bern-Geneva, and Munich).

Fastest-Growing Startup Sub-Sectors

The report also shares an analysis of startup sectors, stating that “No small ecosystem can perform well and compete with places like Silicon Valley, London, Beijing, or New York across the board. But what they can do is be a hub of excellence in specific startup sub-sectors and use that advantage to build spillover effects that improve the ecosystem and economy as a whole.”

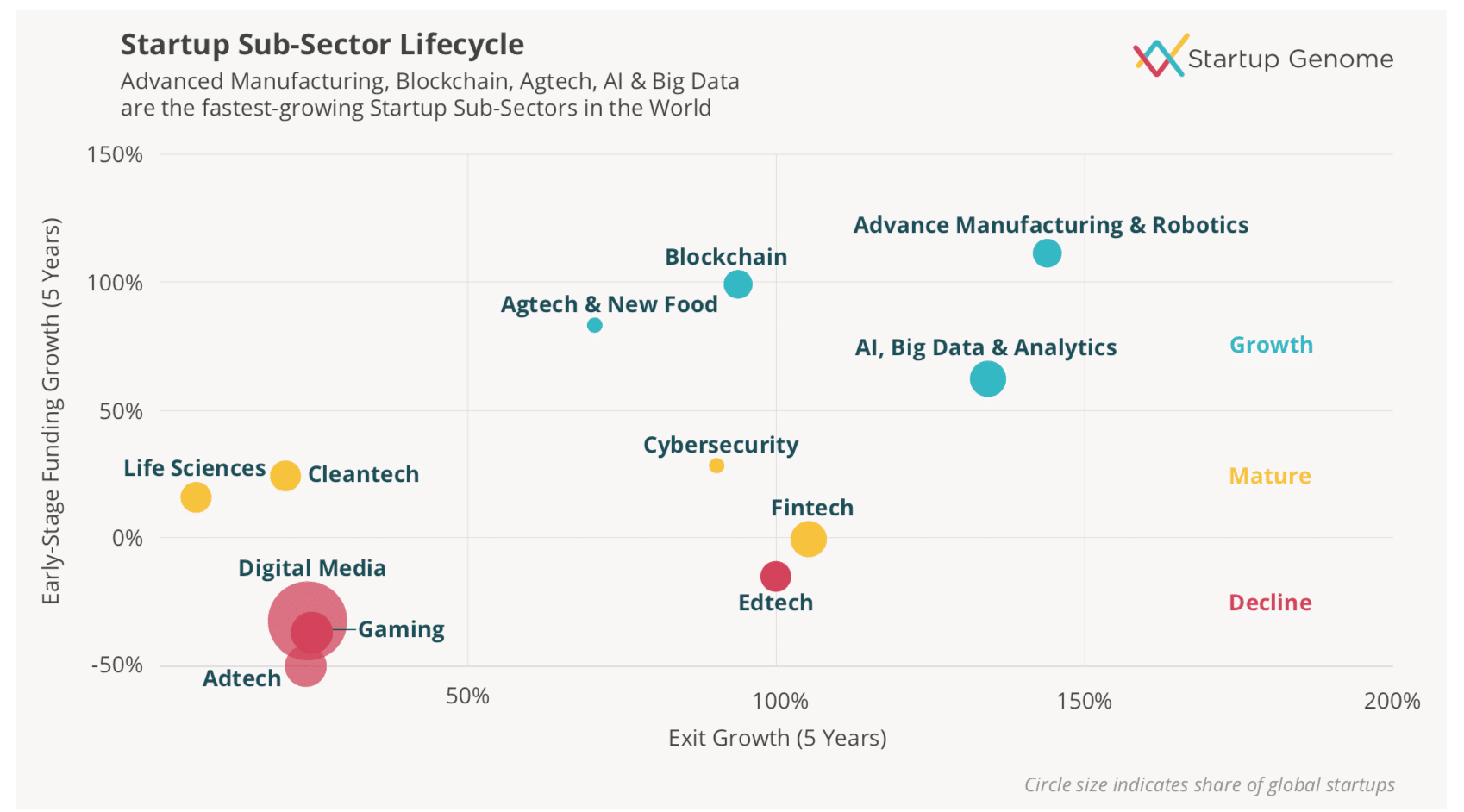

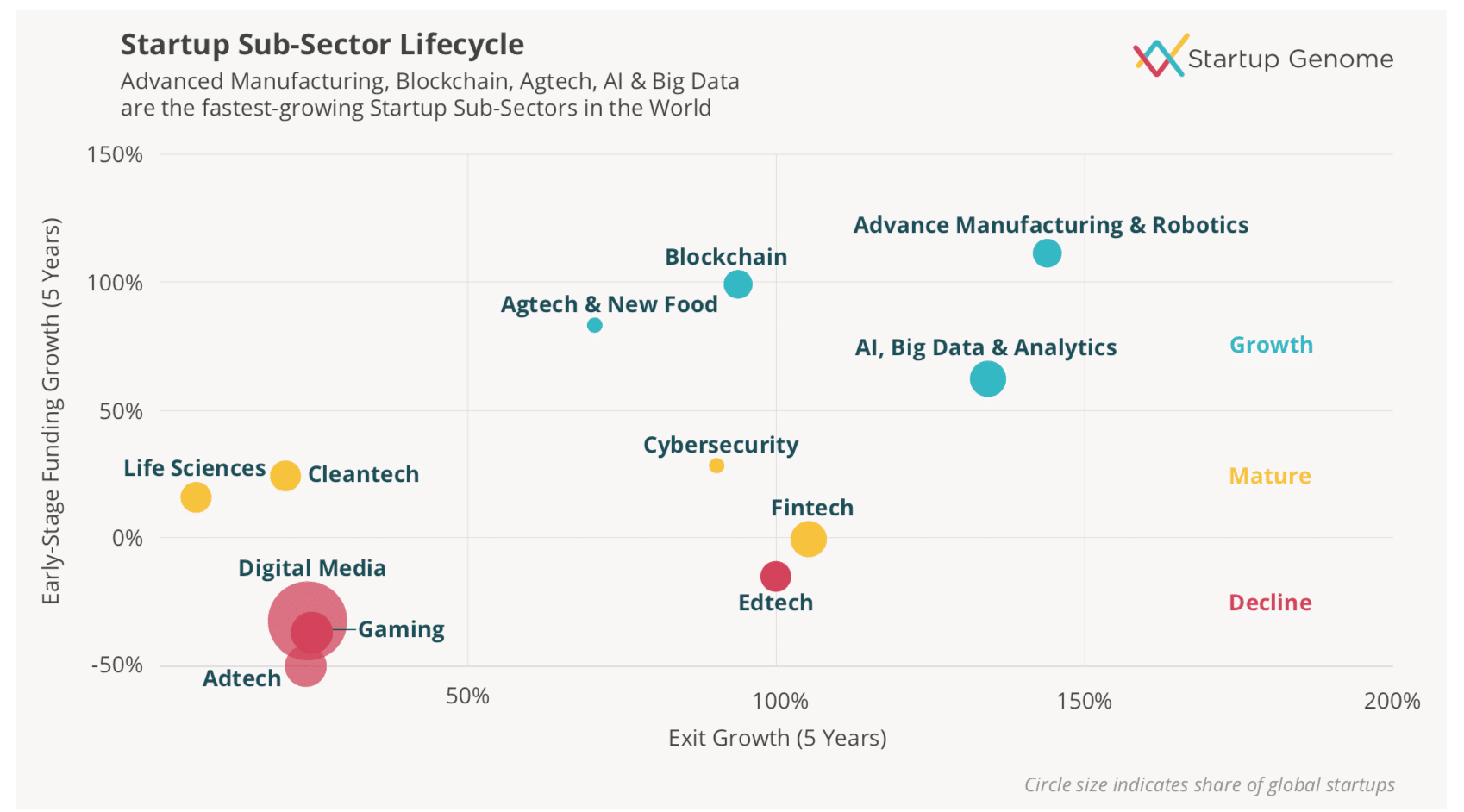

They’ve identified the top four fastest-growing startup sub-sectors as Advanced Manufacturing & Robotics, Blockchain, Agtech & New Food, and Artificial Intelligence. A few noteworthy fundings in each of these sub-sectors in 2018 include:

- $820 million in a Series C round for UBTech Robotics (Shenzhen)

- $300 million in a Series E round for Coinbase (Silicon Valley)

- $250 million in a Series E round for Indigo AG (Boston)

- $3 billion in funding for Bytedance (Beijing)

The chart below outlines the growth and maturity of each sub-sector over the past 5 years. Additionally, it also shows the decline of certain sub-sectors, including Edtech and Adtech:

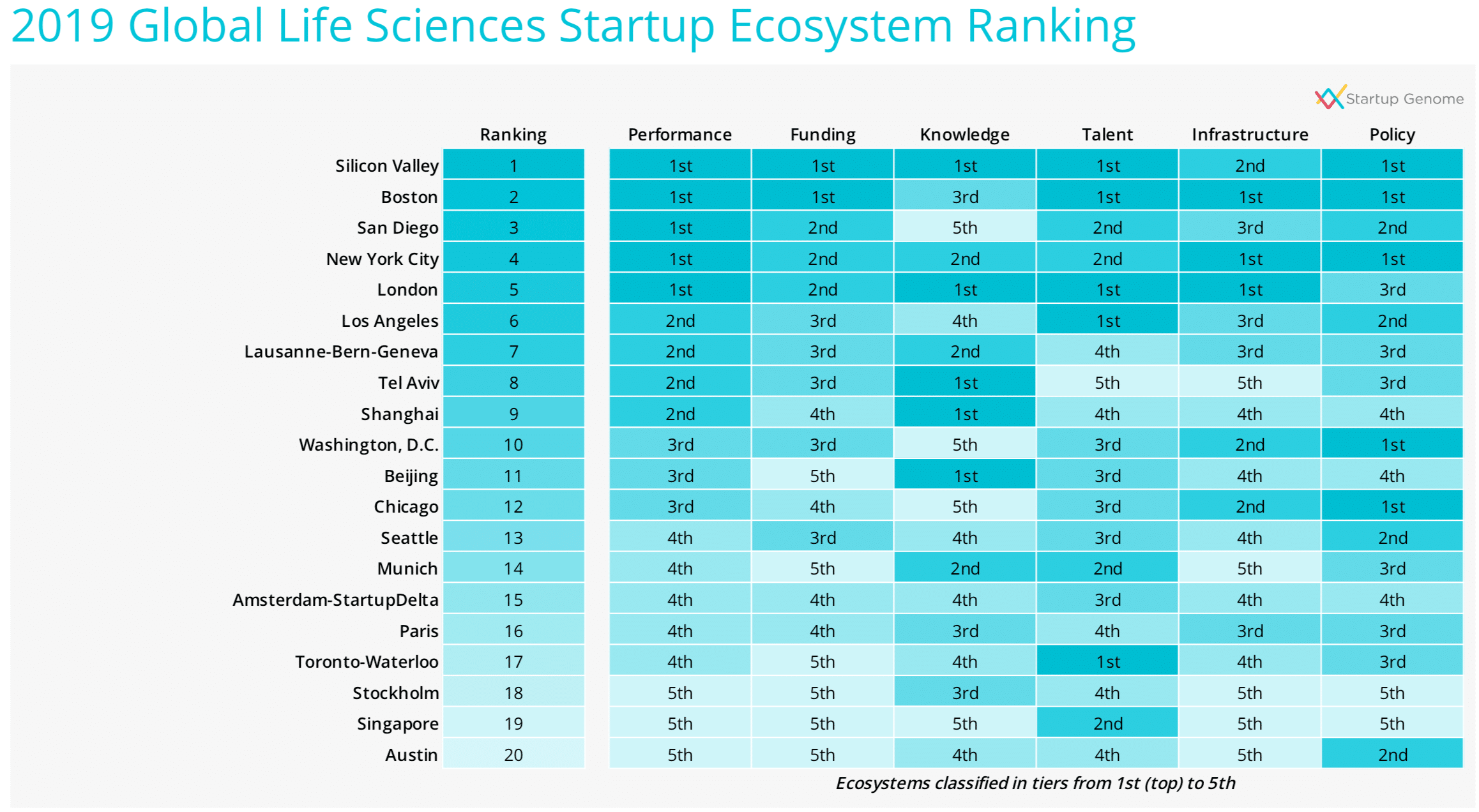

The Role of Life Sciences

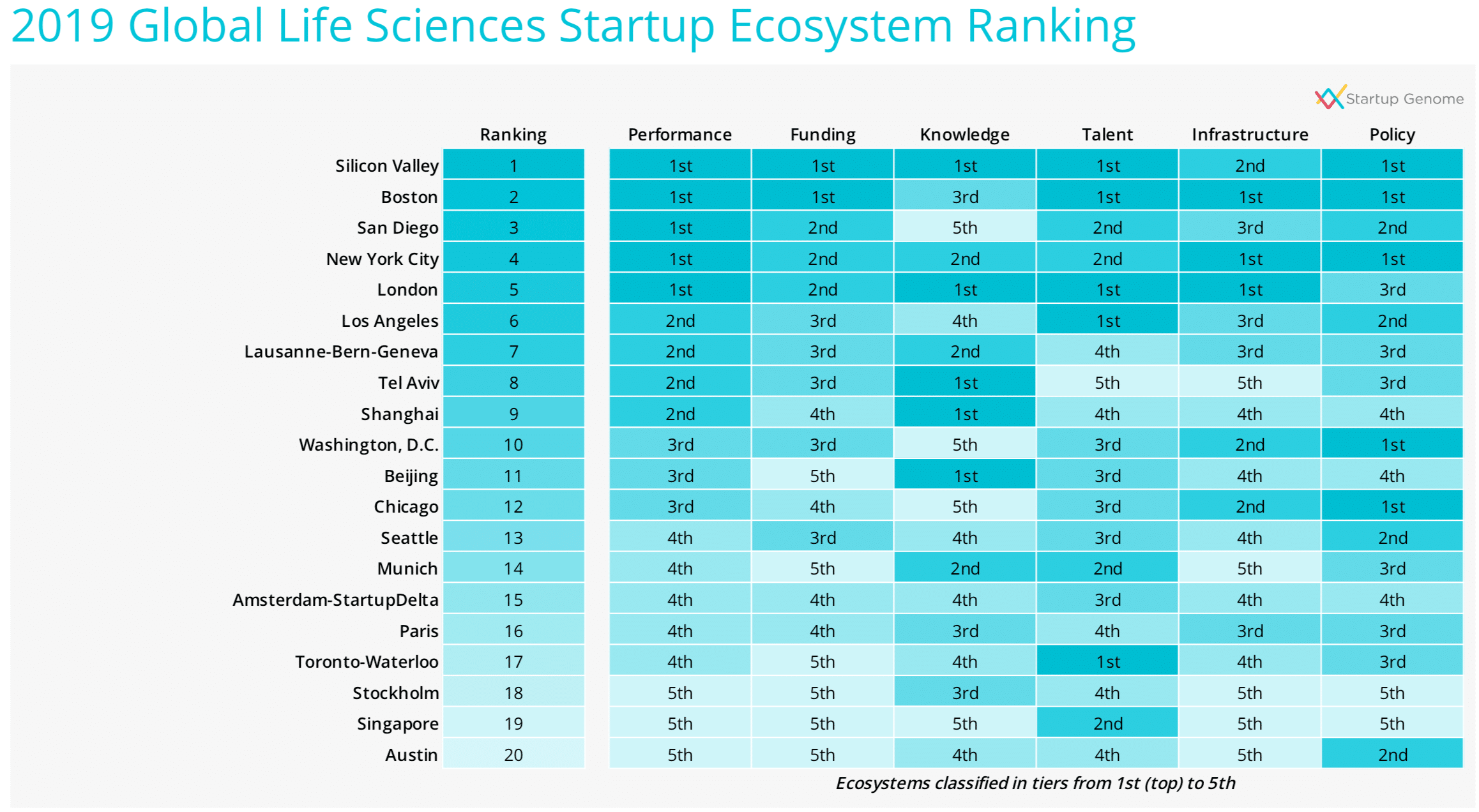

The impact of an ecosystem concentrating on a sub-sector can be seen in the rankings released for Life Science companies. For instance, while San Diego is #20 in the overall rankings, it is the #3 ecosystem globally for Life Sciences. A few life science unicorns include 23andMe (Silicon Valley), Ginkgo Bioworks (Boston), and Oxford Nanopore Technology (London). You can find more life science companies in our Life Science Startups Hub.

The Global Startup Ecosystem Report is one of the world’s most comprehensive reports on startup ecosystems. Startup Genome relies on an alliance of over 300 partners to successfully research and produce this annual report. Compared to last year, Startup Genome was able to expand its analysis to cover 150 ecosystems versus 60 ecosystems in 2018.

”One of our key primary sources, Crunchbase’s data was integral to the success of our report this year. Thanks to our partnership, we were able to leverage their global dataset and ultimately provide a more comprehensive and robust report for our startup community.” – JF Gauthier, Founder & CEO at Startup Genome