This article is part of the Crunchbase Community Contributor Series. The author is an expert in their field and a Crunchbase user. We are honored to feature and promote their contribution on the Crunchbase blog.

Please note that the author is not employed by Crunchbase and the opinions expressed in this article do not necessarily reflect official views or opinions of Crunchbase, Inc.

It’s 2021, and VC firms still have a glaring gender and racial diversity problem. Despite having access to technology, they aren’t utilizing it in a way to level the playing field. Global VC funding for female founders dramatically dropped this past year.

Crunchbase data showed that more than 800 female-founded startups globally received a total of $4.9 billion in venture funding in 2020, through mid-December, which was a 27 percent decrease over the same period last year. The drop is extremely disturbing considering the efforts of VC firms and diversity groups, founded by VCs, that have been around for years that have not made much of an impact.

The amount of funding received by Black and Latine founders is even worse. One percent of VC-backed founders are Black, according to a study by RateMyInvestor and DiversityVC. As of Aug. 31, 2020, Crunchbase found that Black and Latine founders raised $2.3 billion in funding, representing just 2.6 percent of the total $87.3 billion in funding that has gone to all founders. Moreover, it should be noted that the majority of female founders who received venture funding are white, not BIPOC.

Sadly, for many VCs, it’s performative activism. Little has been done to change the lack of diversity representation of their investing Partners and portfolios founders, and there are a lot of resulting issues.

The massive inequity is gravely disappointing considering how outspoken Silicon Valley diversity groups and VCs have been about the topic the past few years and especially post the #MeToo and #BlackLivesMatter movements. Sadly, for many VCs, it’s performative activism. Little has been done to change the lack of diversity representation of their investing partners and portfolio founders, and there are a lot of issues that must be examined.

The higher bar of traction

There is no dearth of highly qualified BIPOC and female founders who have minimized team risk, market risk, tech risk, and product-market fit. Still, many of these founders don’t even get rejected by VC firms because they cannot even get meetings to be considered by VCs. As founders, there is no question that we are held to a much higher standard because we aren’t part of the VC network and don’t match a pattern of founders that it previously funded.

According to a Harvard Business Review case study, VCs posed different questions to male and female founders: They asked men questions about the potential for gains and women about the potential for losses. The study found evidence of this bias with both male and female VCs.

The access problem

In an interview with CNBC, Marlene Orozco, lead research analyst at Stanford Latino Entrepreneurship Initiative, said “The lack of funding to Black and Latine founders is a result of historical gaps in community wealth followed by limited exposure and opportunities to secure capital.” Access to VCs is a big problem because some VCs only invest in people from their niche network or expect warm intros. Oftentimes, successful fundraising isn’t a matter of merit at all, it’s a matter of network.

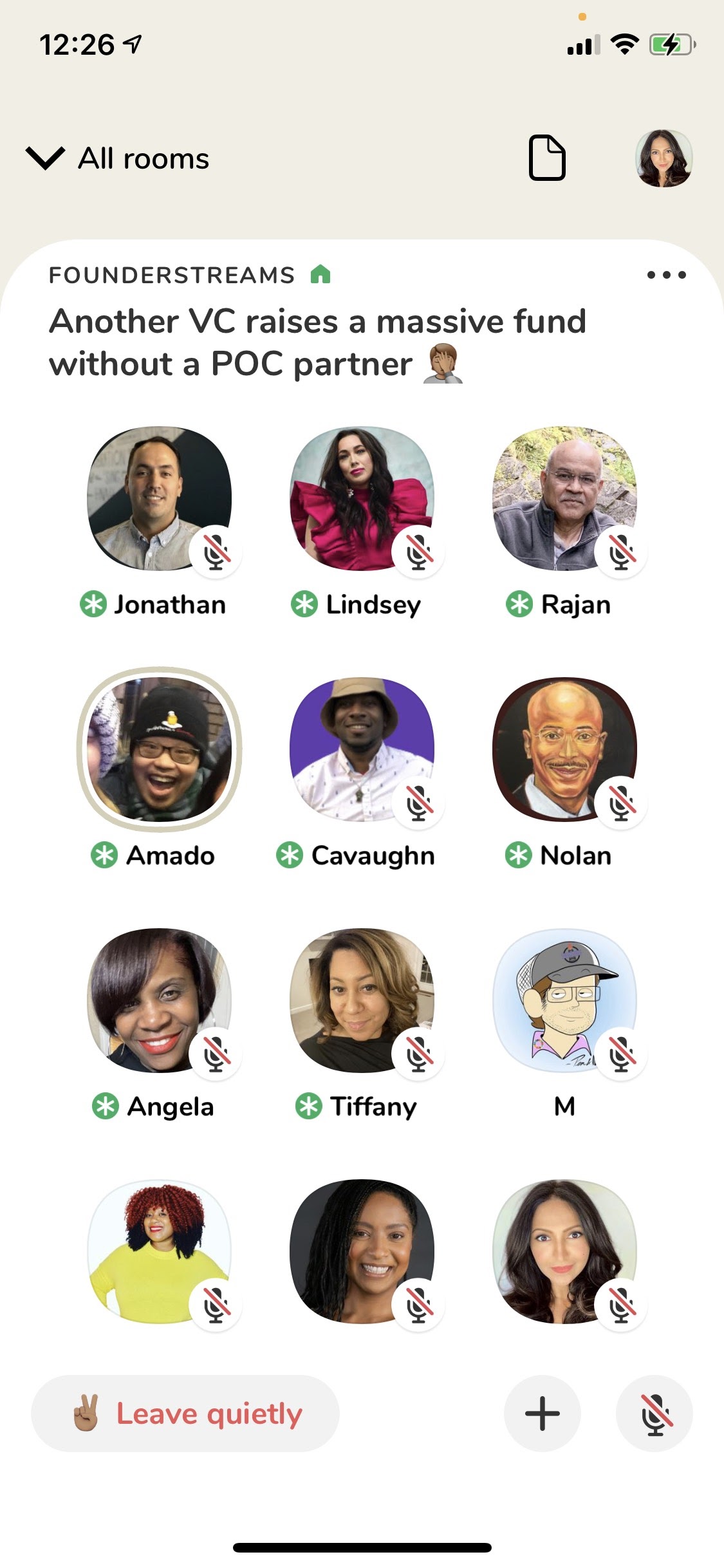

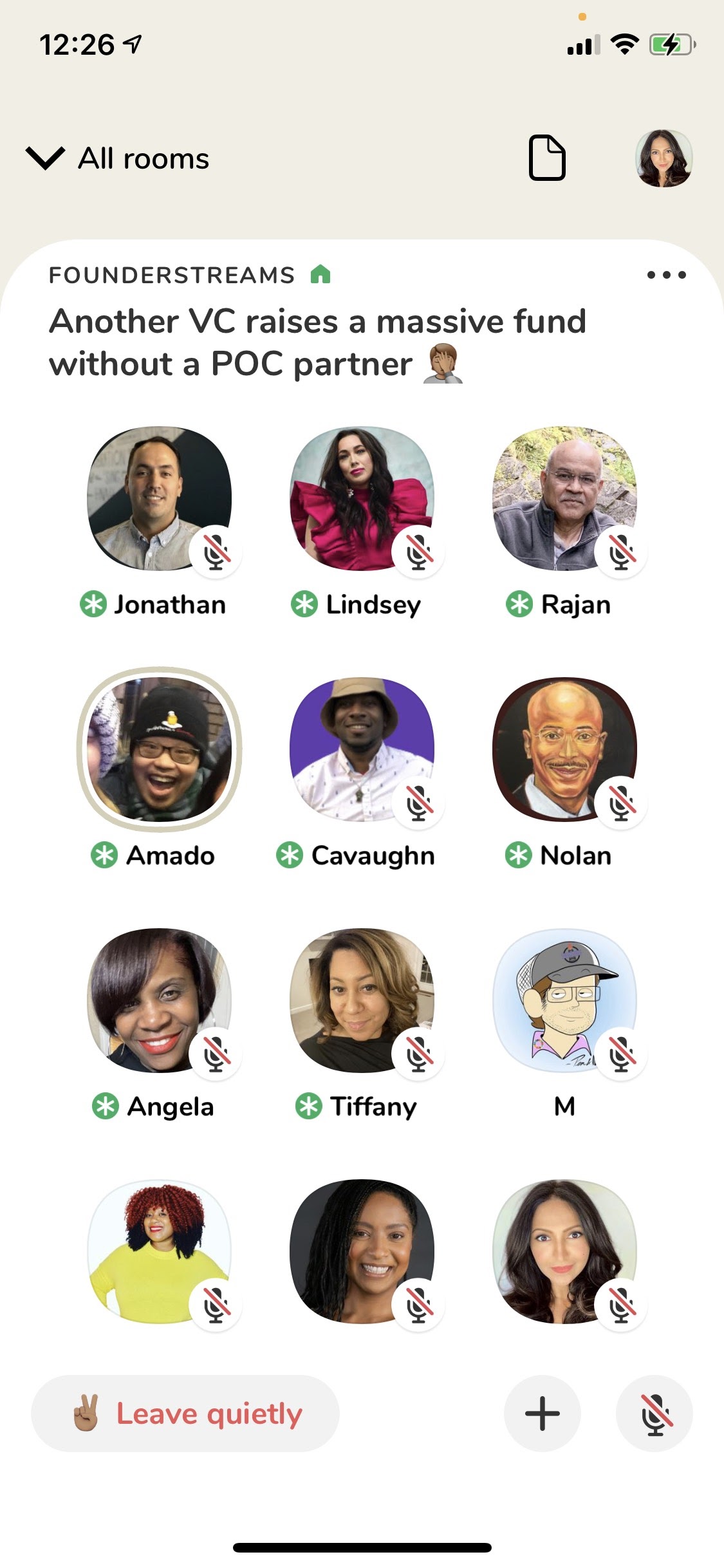

This access issue is one of the most popular topics on Clubhouse with many clubs and rooms devoted to the topic. One such club is the BLK Founders Club created by Harold Hughes, founder and CEO of Bandwagon, a VC-backed identity infrastructure company. The club’s primary aim is to help founders get ‘unstuck’ as they face challenges in fundraising. This club typically has over 2,000 people joining in for their conversations. According to Hughes, “Some of the most notable BIPOC and female founders to have received venture capital are so hard to reach that it makes it impossible to learn from their experiences, first-hand. These chosen few are outliers, that in large part end up matching some other kind of pattern whether that’s star status, pedigree, or clout. I want those of us who are successful to be more accessible to help others see that it is possible but also the steps necessary to make it possible.”

Warm intros are b.s.

Warm intros are not indicative of a founder’s ability. They do not indicate a founder’s ability to build a company, make it profitable, or pivot when necessary. Also, it should be noted that while a founder may struggle to get networked in the VC community, they may have deep domain expertise and have the perfect network in their industry to scale their business.

Del Johnson said it best in his viral Medium essay: “So if investors seek to test a founder’s ability to take a market, they should select for the skills best suited to tackle the ‘new,’ ‘intense’ challenges posed by a growing economy. That is, the ability to access and distribute to large, diverse markets, not closed, insular networks. Obtaining a good referral from one person within a niche network tells us very little about a person’s ability to build and scale an organization that reaches the masses.” He went on to say that warm introduction requirements may counterintuitively select for less-talented founders. The closer a founder’s existing connections to a VC’s network, the less “work” the founder has to do to secure an introduction. For connected founders, there is literally no “ability” to test.

Diversity theater and performative activism

Recently, diversity theater is a public relations tactic embraced by many VC firms. Outwardly, many women and BIPOC are being projected as partners at VC funds; however, when you get past the firm’s website and press, it quickly becomes clear that many of these so-called “partners” have inflated titles, and their email signature will indicate that they are business development managers or some other junior role with little influence and definitely no check-writing power. According to BLCK VC, 81 percent of VC funds have no black investors. The new GPs of funds need to be BIPOC and women, not just heads of operations and community. This problem will only be solved when there is diversity representation among investing partners. Anything less than that is just diversity theater.

Lack of diversity creates blind spots

Funding diverse founders isn’t charity. White male founders with crazy ideas are often seen as visionaries while diverse founders are seen as charity cases. As a result of their exclusivity, many VCs don’t even try to comprehend some of the problems our startups are trying to solve. Ultimately, this creates blind spots. Having diverse investing partners at VC firms is imperative in order to appreciate different problems, industries, products, and cultures.

Lack of diversity hinders innovation and even leads to missteps

Tech has long been seen as too male and white — in its leadership, its data and its product. While this lack of diversity is not fair, it also hinders innovation and even leads to ridiculous missteps.

Three years ago, a video went viral of an automatic soap dispenser that would only release soap onto white hands. The flaw occurred because the product was not tested on darker skin. Two years ago, a study by the Georgia Institute of Technology found that driverless cars are more likely to drive into black pedestrians because, by default, the technology is only designed to detect lighter skin. Last year, Black women were complaining that Snapchat filters don’t work for them since the AI does not recognize their dark skin. And last week I was in a Clubhouse room and learned that VR virtual try-on technology for things like foundation matching doesn’t work for darker skin since the AI does not recognize dark skin.

Artificial intelligence is only as inclusive as its creators. As a result, humans program the machines to behave in a certain way, which means they may be passing on their unconscious biases to the software. The machines are learning the same biases and internal prejudices of those who are developing them.

Diverse teams can also help a company avoid blunders like the ad from Ancestry that was pulled after being condemned as racist since it depicted a romance between a white man and a Black woman in the antebellum South without addressing the exploitation involved in such relationships of that era or the unequal power dynamics.

Diversity is good for business

Earlier this month, Kauffman Fellows published the study Deconstructing the Pipeline Myth and the Case for More Diverse Fund Managers, which compared the venture financings of all-white versus diverse founding teams. Despite diverse teams still receiving less funding than non-diverse teams cumulatively, the findings showed that diverse teams that do receive venture funds tend to outperform and out-raise across all rounds. They have also proven to return 30 percent more cash to investors.

Solutions

Crunchbase is doing its part to remedy the diversity problem by providing transparency with its Diversity Spotlight, which includes race and ethnicity data, initially of U.S.-based companies, to the Crunchbase dataset. It also added gender tags to enable investors to identify woman-founded and woman-led companies.

VC OpenDoor is a great platform for democratizing access to VCs. While some VCs are using it in good faith with a sincere intent to improve the ecosystem, some are just there engaging in performative activism and don’t deliver on meetings once the VCOpenDoor matches them with founders. That said, the concept is still the best solution that I’ve seen.

Startup Investor Matching Tool was launched by Lolita and Josh Taub in May 2020. This portal is similar to VC OpenDoor. Right now it’s U.S.-centric, but expanding beyond that.

BLCK VC, a new organization founded by Storm Ventures associate Frederik Groce and NEA associate Sydney Sykes, connects and advances Black venture capitalists. Their mission: Turn 200 Black investors into 400 Black investors by 2024.

Tracking on a VC firm basis: Firms should require partners to track the number of people they meet. If only one out of every 100 people they meet is an underrepresented founder, that’s bad.

Summary

If the industry as a whole uses technological solutions like VC OpenDoor’s portal with its efficient investor-start matching algorithm, VCs will gain access to new deal flow pipelines that are more diverse, and the odds that their own portfolio companies will successfully raise investment from other funds will increase.

It’s clear that diversity is good for business. We must ensure there are solutions and resources in place so that underrepresented founders are not churned out of the ecosystem. If we really want to see a paradigm shift, VCs need to do more. They need to be more transparent, and it’s time that they show us their traction.

Sindhya Valloppillil is the founder and CEO of Skin Dossier, a venture partner at NextGen Ventures, a freelance writer, and formerly a beauty industry executive and marketing professor.