According to a recent market study conducted by RISE Research in collaboration with EA Group and BGlobal Ventures, the landscape in the CCA (Caucasus and Central Asia) region has witnessed remarkable growth. This collaborative effort, involving esteemed partners like Crunchbase, the Ministry of Digital Development, Innovations and Aerospace Industry of Kazakhstan, and KPMG, aims to bridge the information gap hindering VC investment in the CCA region. The comprehensive report offers a detailed analysis of the VC landscape, investment trends, market size, and successful case studies across Central Asia and the Caucasus.

Dynamic VC ecosystem

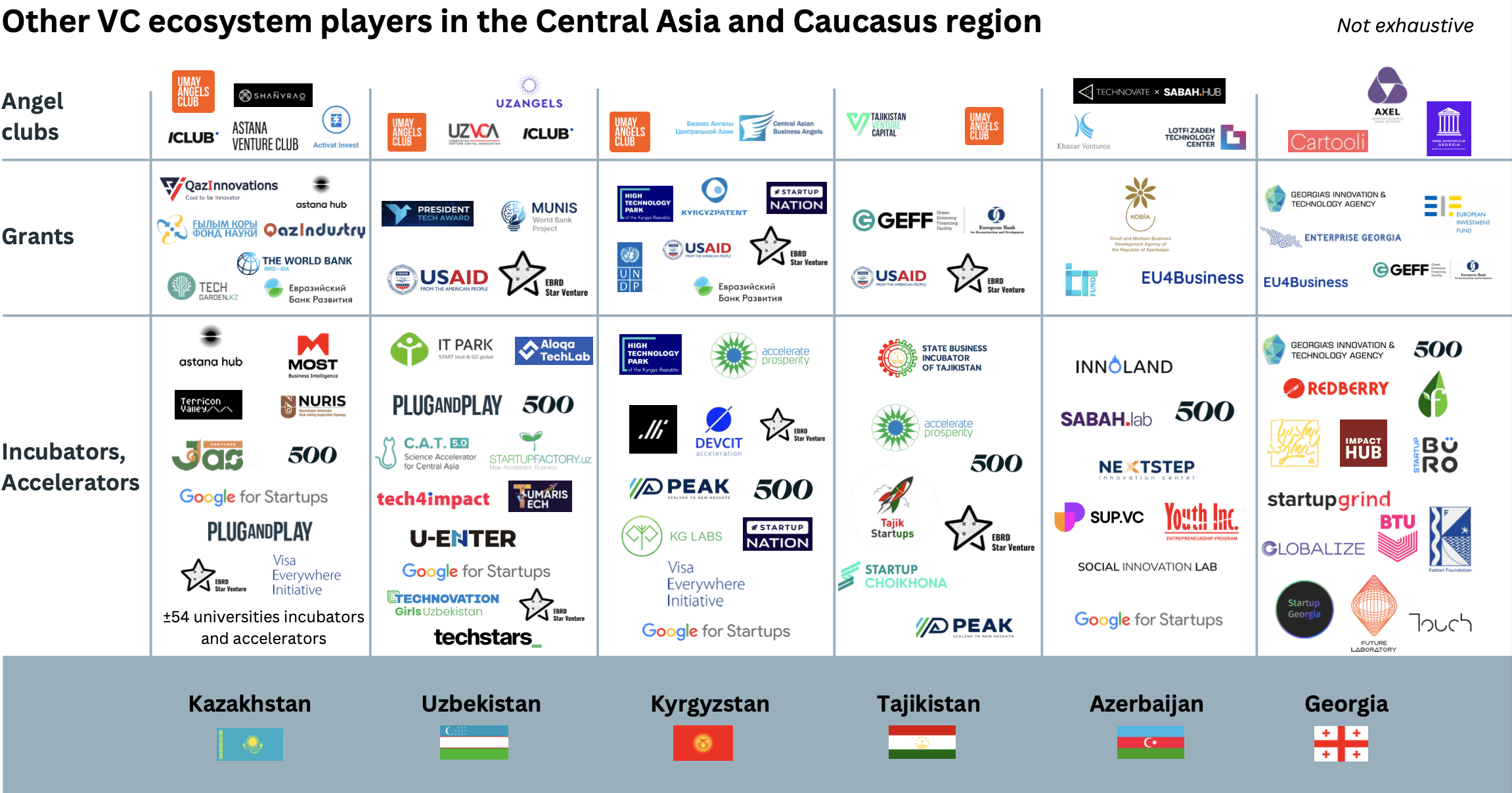

In recent years, the startup ecosystem in the Caucasus and Central Asia region has witnessed substantial growth, showcasing a matured environment featuring a plethora of startups, funds, and business angels.

“Crunchbase data shows that startup investment in the Central Asia and Caucasus region has increased in recent years, particularly for pre-seed and seed fundings in Kazakhstan, Georgia, and Azerbaijan. With a growing local venture capital ecosystem, we look forward to seeing companies progress to raise early-stage investment in 2024 and beyond.”

– Gené Teare, Crunchbase News

Across the majority of CCA nations, a concerted effort has been underway to foster the growth of the startup landscape. This initiative involves the establishment of innovation development agencies, IT parks, and FEZs, or free economic zones, as well as both public and private accelerators/incubators. Additionally, various countries in the region have introduced startup grant funding programs to further support and propel entrepreneurial endeavors.

These strategic initiatives have paved the way for establishing essential components crucial for fostering a thriving venture ecosystem.

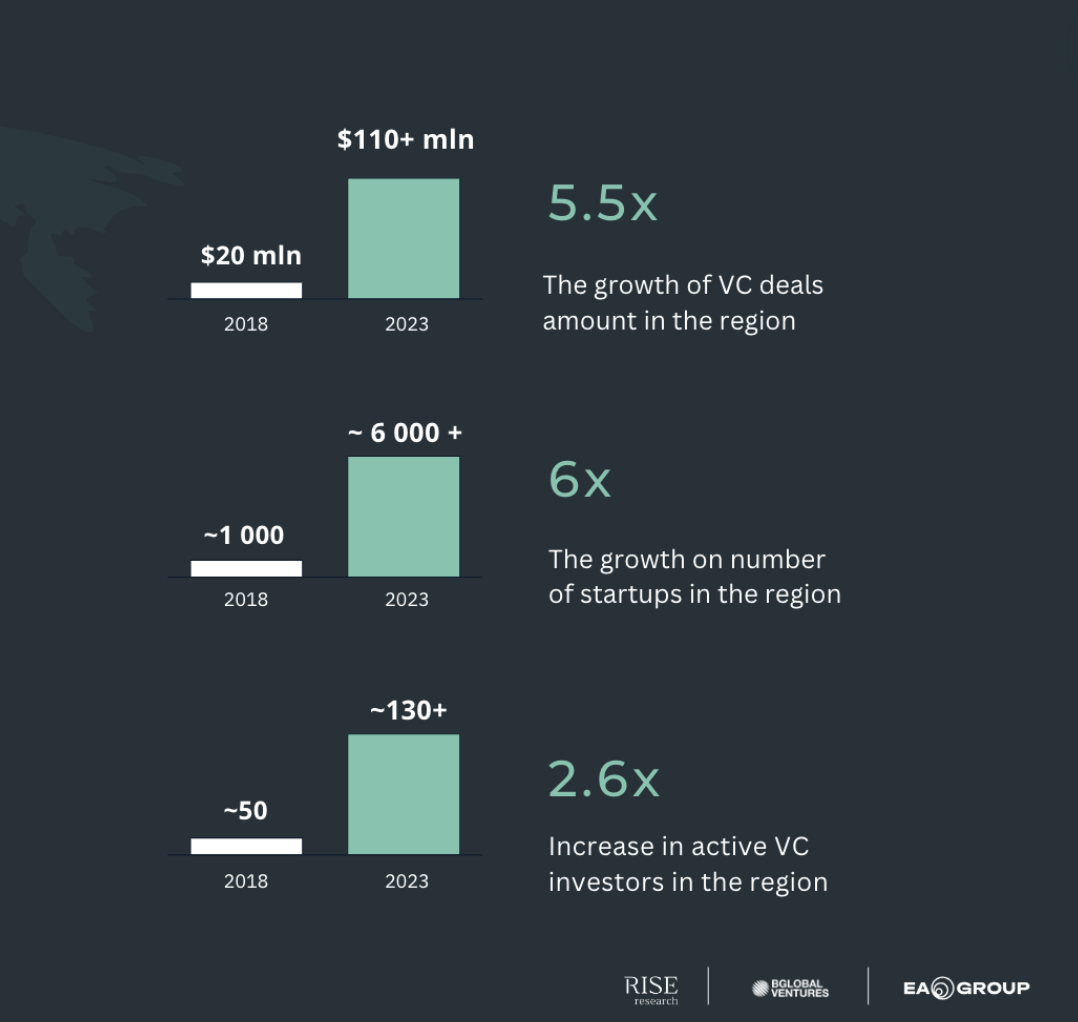

Rapid growth of VC funding

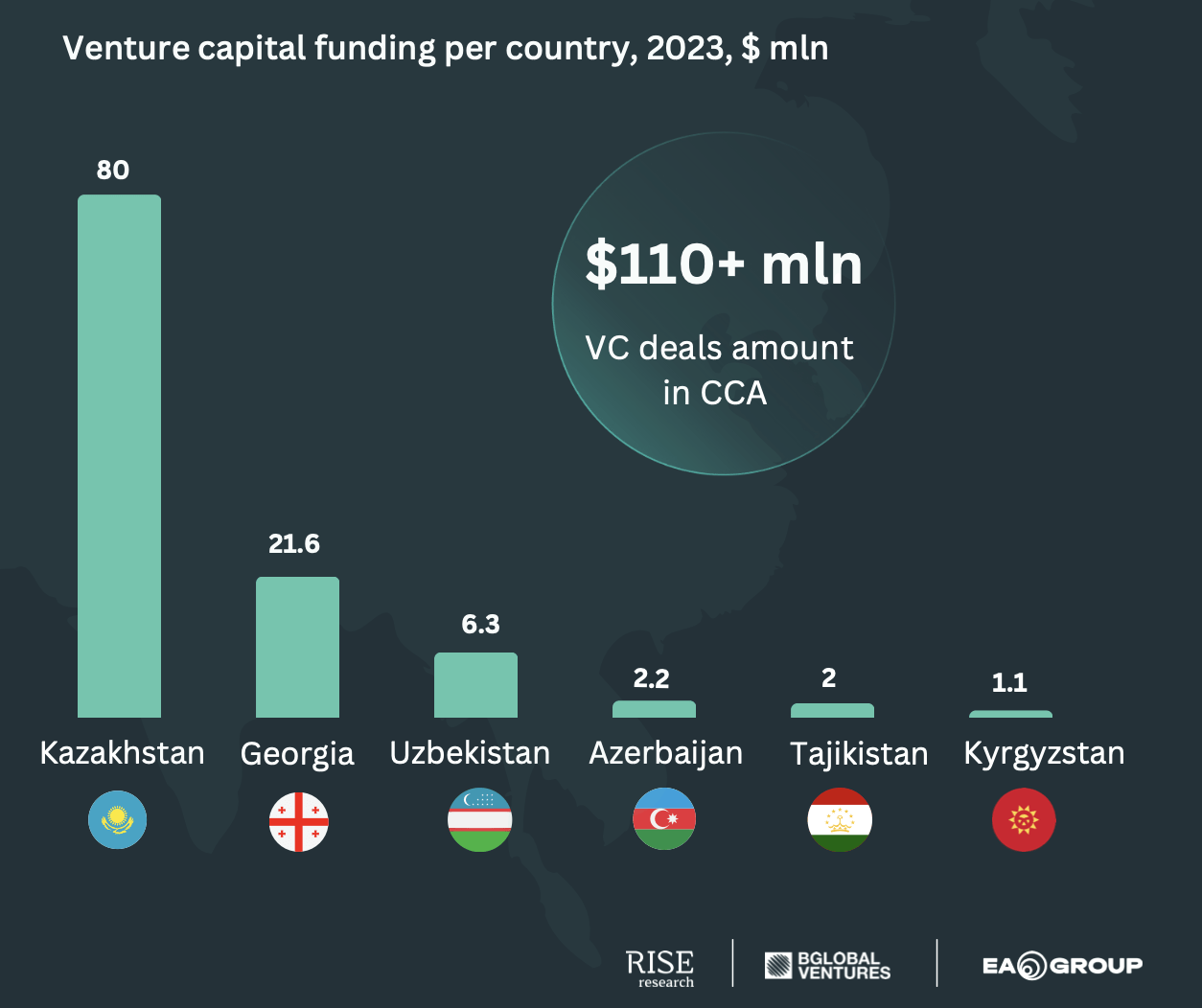

Over the past five years, venture capital funding in the CCA region has exhibited consistent expansion, surpassing $110 million in funding by 2023, reflecting a remarkable growth rate of 5.5x during this period.

Nevertheless, there is considerable potential for further investment opportunities, given that VC funding in the CEE (Central and Eastern Europe) region, in relative terms, still lags behind comparable regions, presenting an area for growth and development.

“VC funding in Central Asia and the Caucasus has grown impressively by 5.5x in the past five years. However, the ecosystem remains small, suggesting ample room for additional investment opportunities. It is important to foster consolidation within the region, creating a dynamic and attractive environment for both investors and entrepreneurs.”

– Ainur Zhanturina, Founder RISE Research

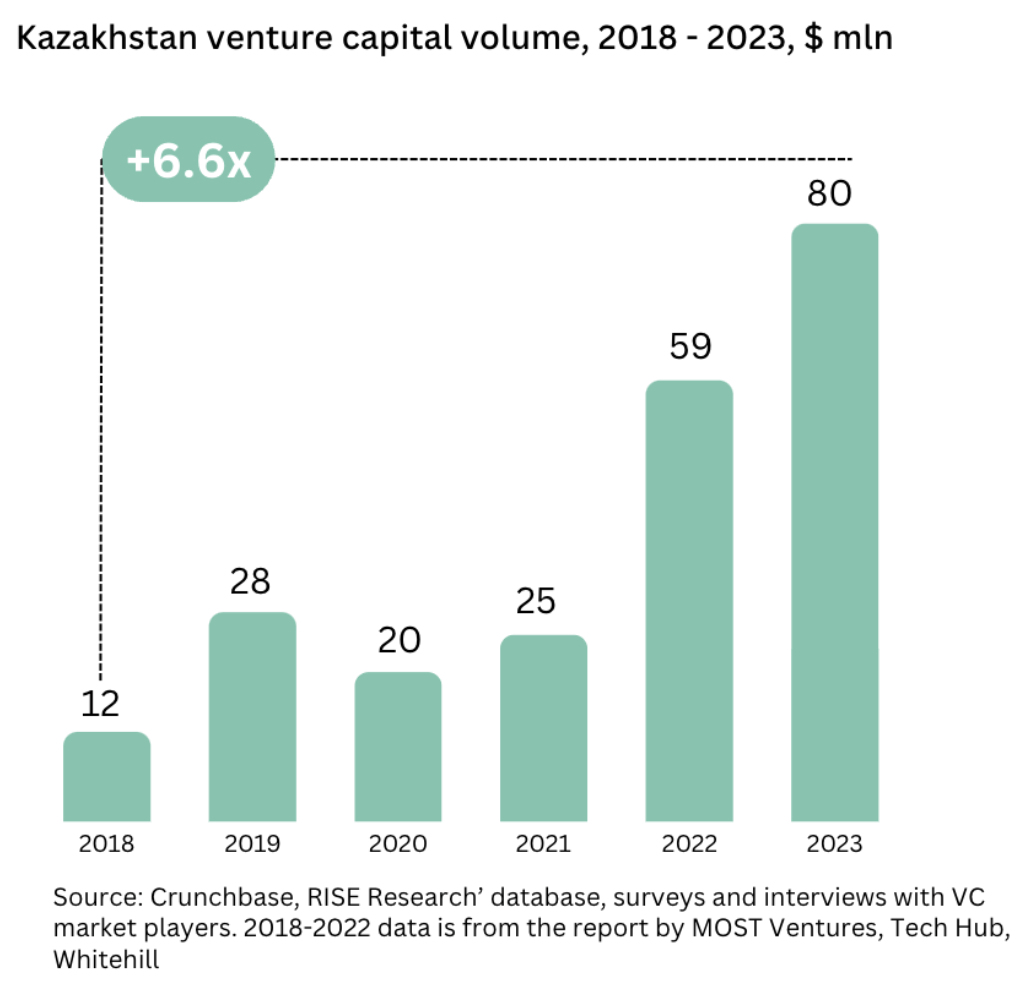

Kazakhstan

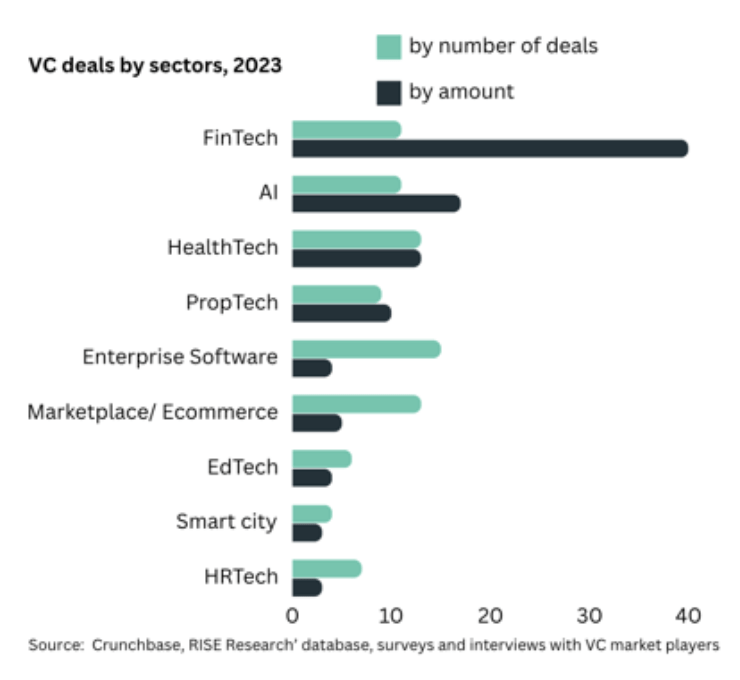

Venture capital funding has surged by over sixfold in the past six years, with fintech leading the way in VC deals in 2023. Government-led initiatives to establish technoparks and FEZs (Astana Hub and AIFC), coupled with a growing pool of skilled IT professionals (amid the emergence of a dozen new IT schools and universities), and a rising enthusiasm for VC as an alternative to conventional investments (with two major angel investor clubs and a dozen domestic venture capital funds), synergistically contributed to this remarkable growth.

“The regional venture market is becoming increasingly attractive for investment due to high growth dynamics and improving pipeline quality. However, despite the active growth in the volume and number of venture deals in recent years, our region still lacks a critical mass of active business angels and venture funds at both early and late stages to meet the demand for investments from startups.”

– Abay Absamet, CEO at BGlobal Ventures

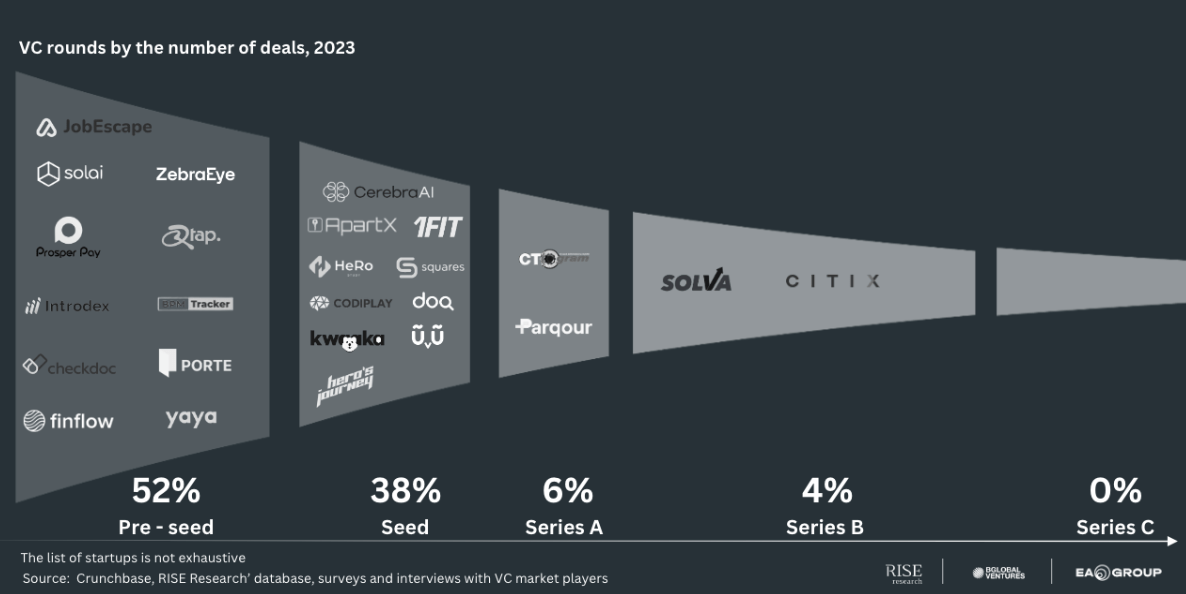

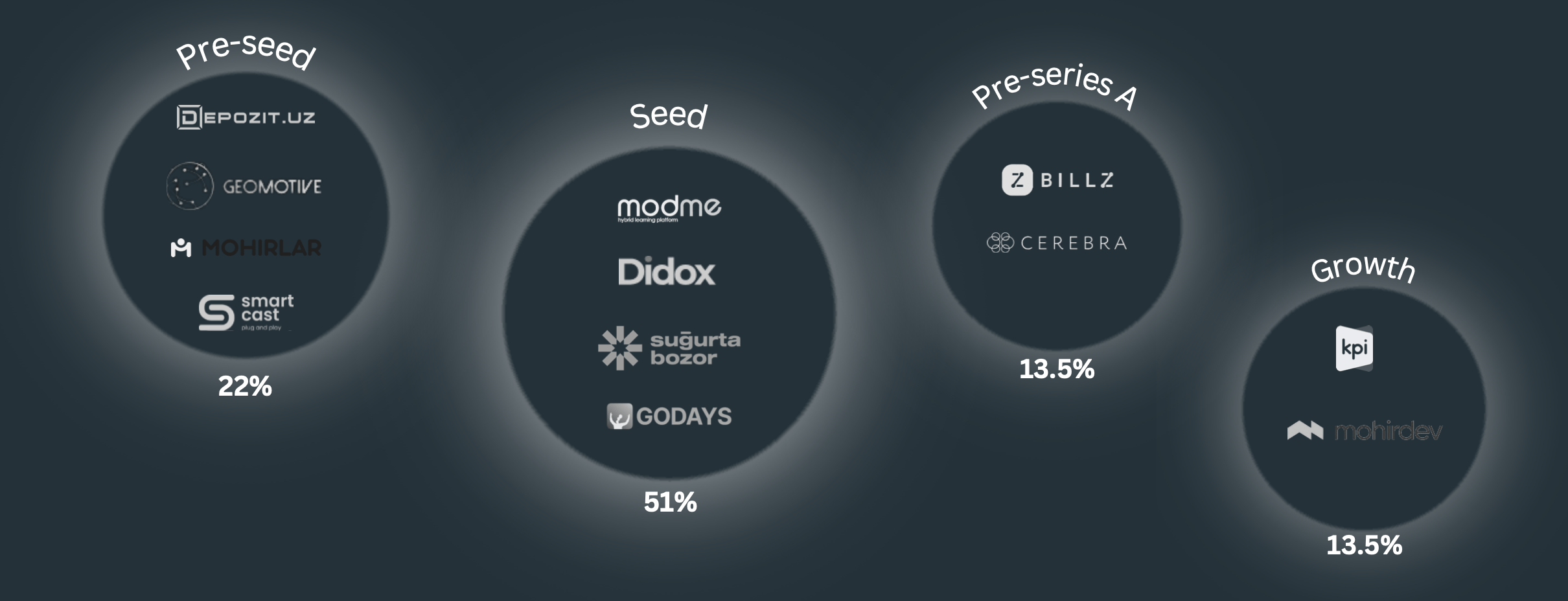

The huge growth in venture financing is fueled by pre-seed and seed stages, which can be explained by the relatively short time frame of startup ecosystem development.

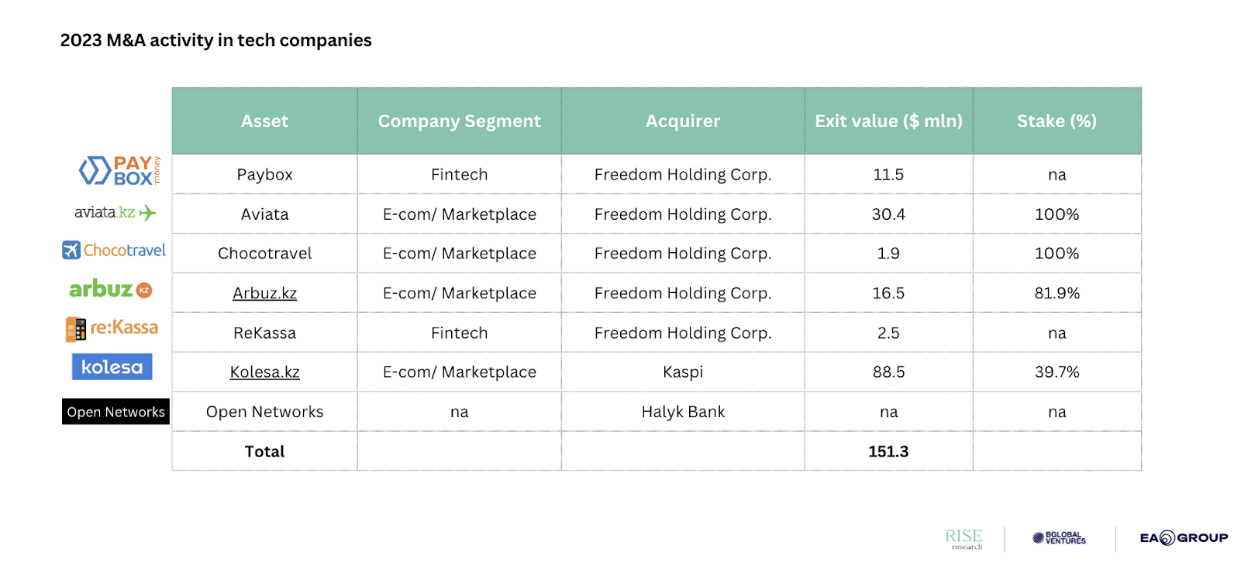

In the later stages, startups encounter a notable funding gap domestically, depending heavily on international investors for substantial financial backing. Nevertheless, over the past few years, the country’s startup market has seen a marked increase in exits through M&A. In 2023, the amount of exits reached a record $151 million, with strategic investors being mainly domestic commercial banks.

“Today there is a wide variety of startups in Kazakhstan, but unfortunately, only a few of them are thinking beyond their home region and are targeting international markets. Thus, local investors account for 80% of venture deals. We expect more international investors and funds to come to the region and bring in smart money, thus making Kazakhstan a full-fledged participant in the international venture capital and startup scene.”

– Erik Aubakirov, CEO EA Group

Uzbekistan

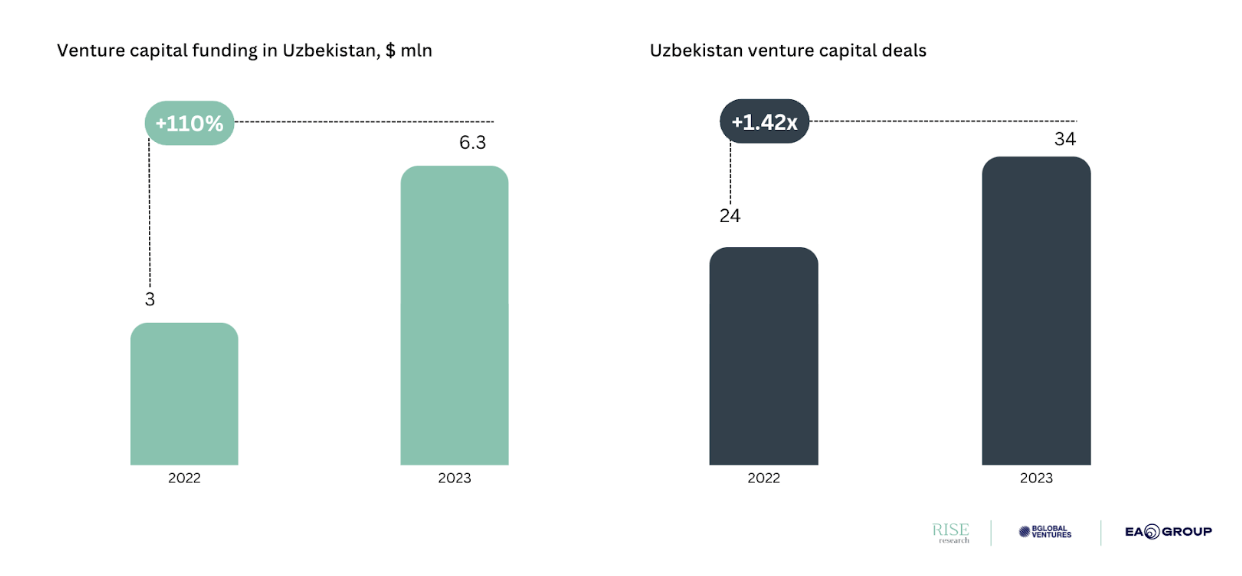

The recent adoption of a strategy focused on liberalizing and diversifying the nation’s economy encompasses a transition to technology-based industries, fostering the growth of startups and SMEs. The establishment of an IT Park, alongside the creation of various public and private venture capital funds and numerous programs for training IT specialists, has naturally contributed to the expansion of the VC market in the country.

While the majority of investments were concentrated in the seed stage, there is a noticeable expansion across various developmental phases.

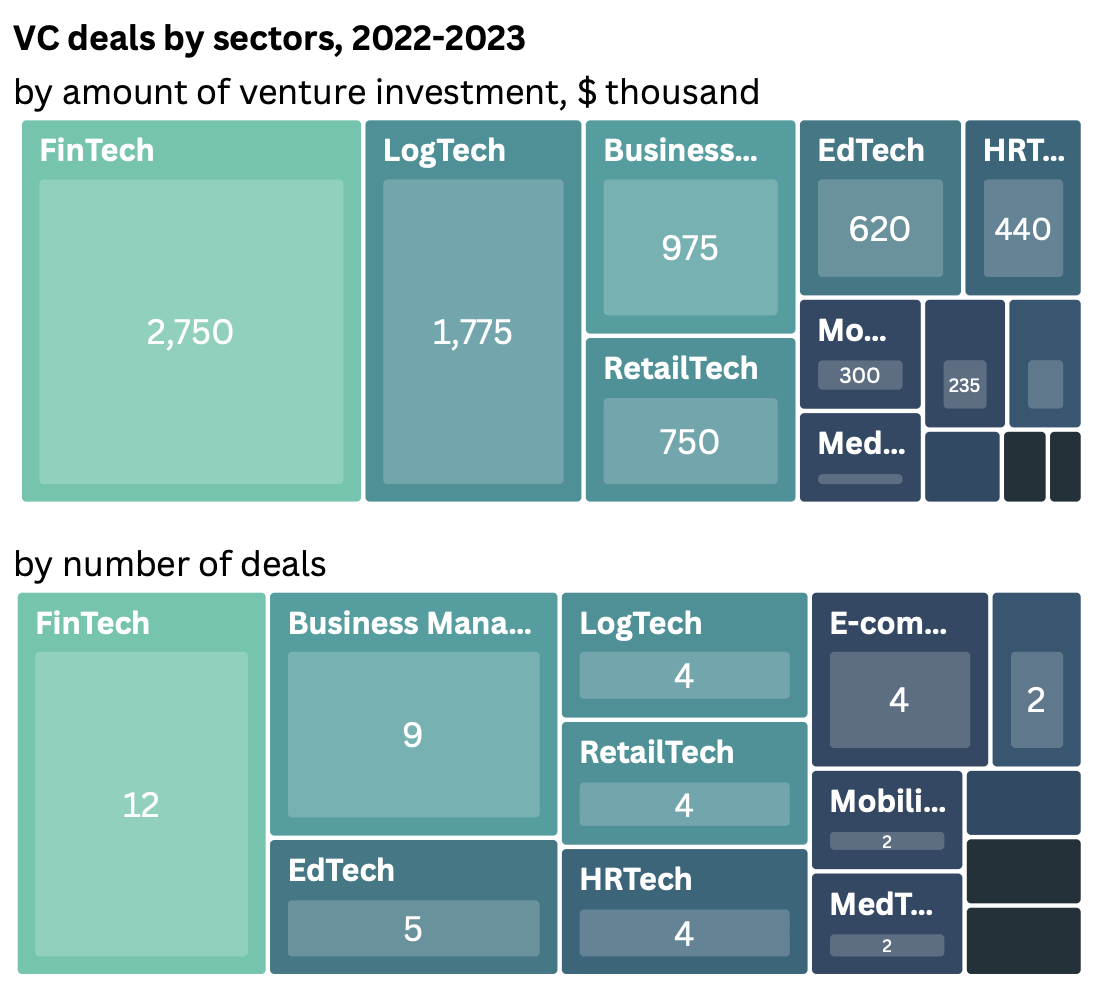

In 2023, fintech deals ranked as the most prevalent among various sectors, a result aligned with the digitalization of the country’s financial system and the large proportion of young tech-savvy citizens.

“The venture market in Uzbekistan is experiencing active growth, with IT Park taking a leading role focusing on attracting foreign venture funds and business angels to Uzbekistan. Currently, the legal framework for venture investments is under development to create a more transparent environment for venture investors, making the market more accessible and appealing.”

– Yerke Assemova, KPMG Central Asia & Caucuses

Azerbaijan

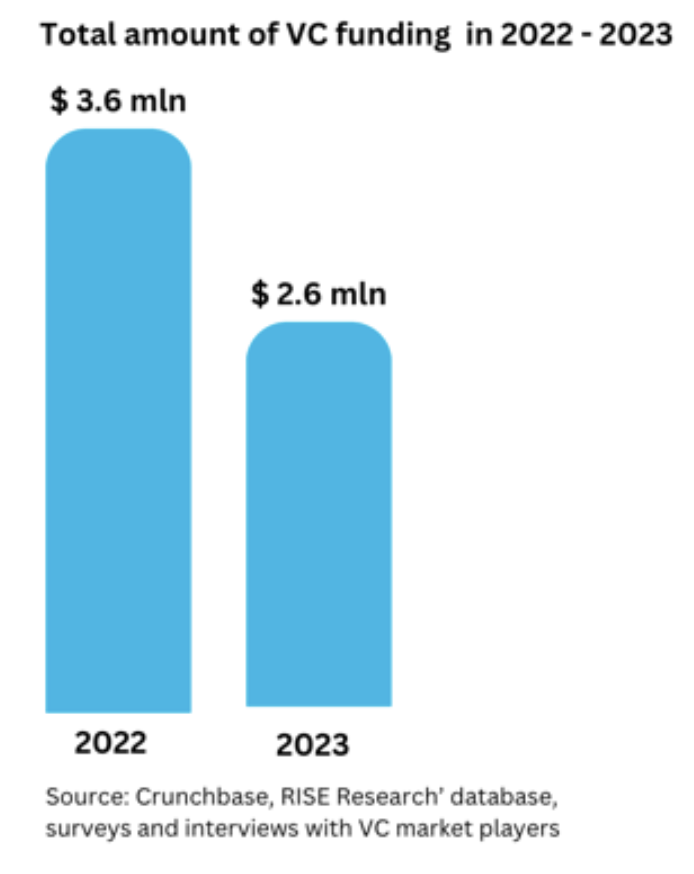

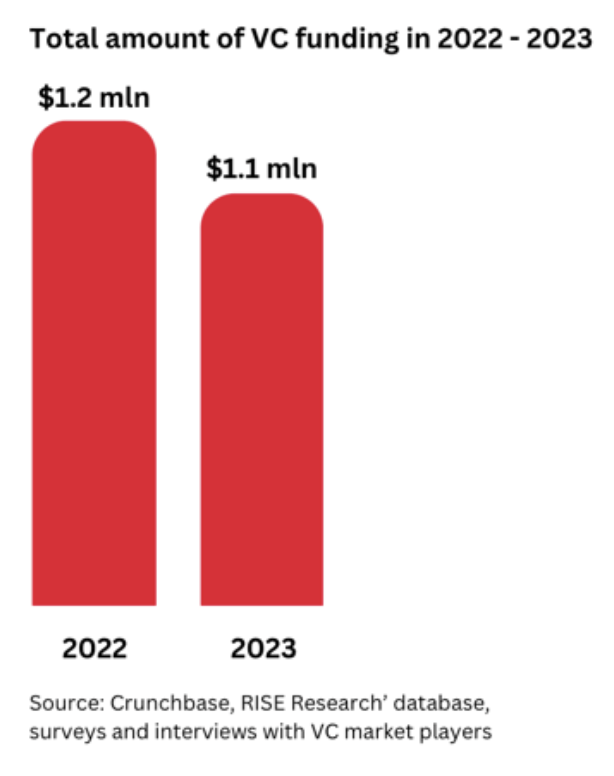

Although public data shows a decline in overall venture capital funding, the average check per round in the market is growing. So while in 2022 funding was raised at an average of $101,000 per round, in 2023 that number has risen to $194,000.

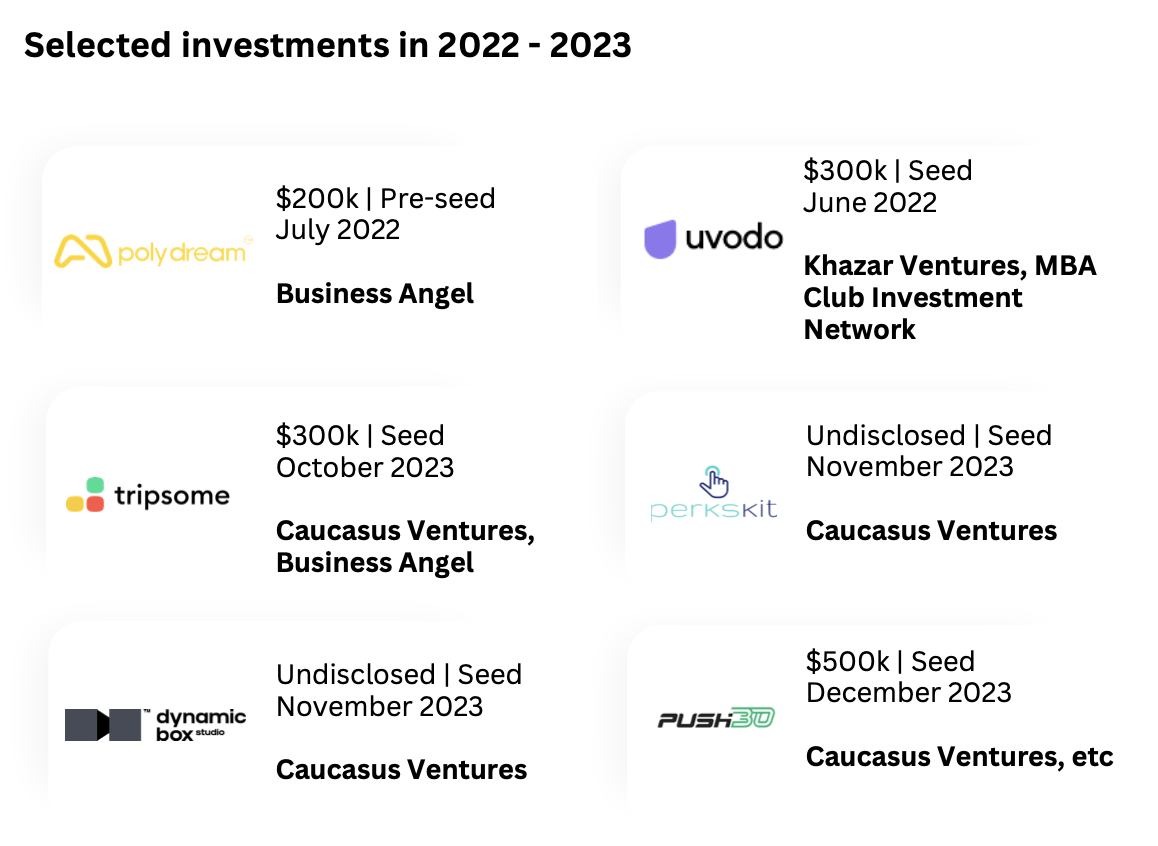

One of the reasons for consolidation is the emergence of the first large venture capital fund in the country, Caucasus Ventures. This is an impulse for the country’s ecosystem, which significantly increases market maturity.

Sectors to watch: HRTech, E-commerce, Enterprise SaaS

Modal round in 2023: Seed

“It can be affirmed that Azerbaijan has successfully established the essential components for nurturing a startup/venture ecosystem. The presence of incubation/acceleration programs, coupled with a shared understanding among the state and society, has resulted in the emergence of approximately 400 startup companies. Notably, a fully-fledged national venture fund, Caucasus Ventures, has been introduced. In our role at Caucasus Ventures, we have pioneered fund operation model, collaborated with the financial sector, and played a pivotal role in shaping the legal framework for venture investments.”

– Mammad Karim, Caucasus Ventures

Georgia

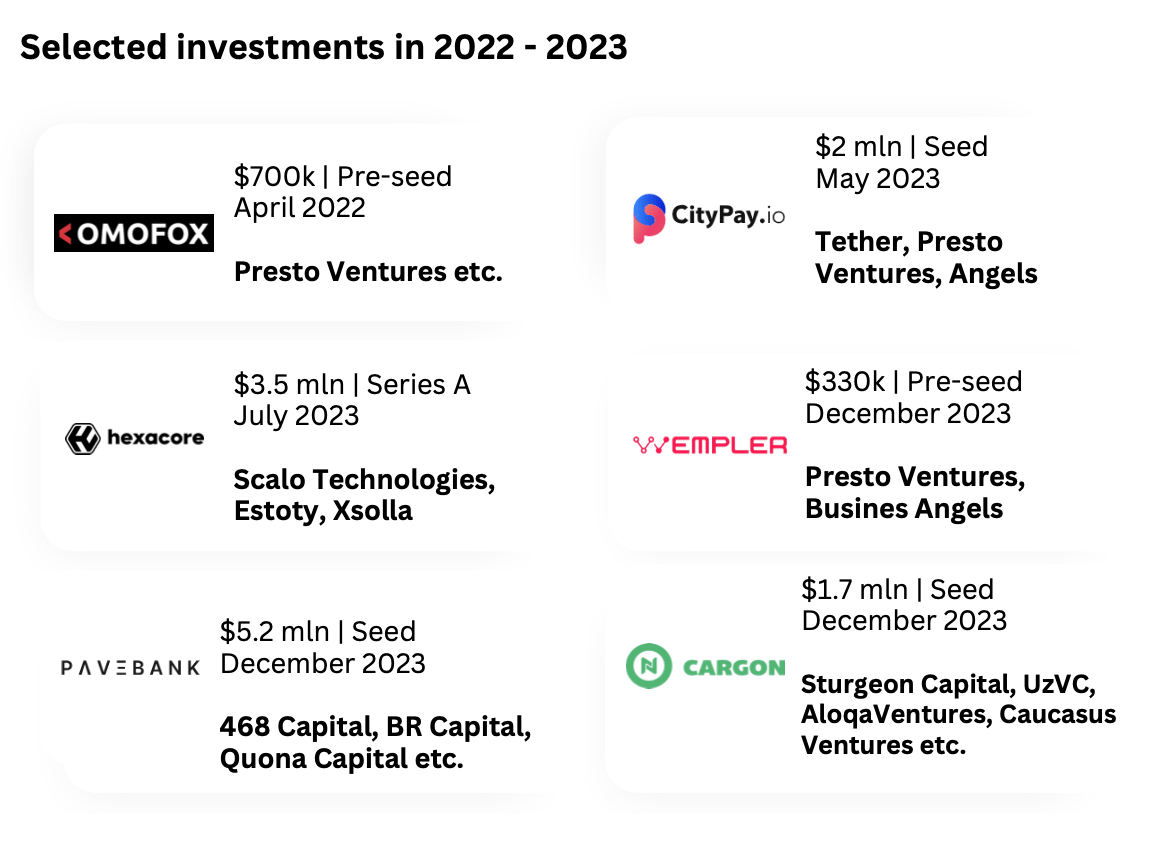

Several government initiatives, most notably the establishment of Georgia’s Innovation and Technology Agency, have led to the significant development of the country’s VC market. The agency provides grants, training and technical support, thus powering early-stage startups and attracting foreign VC funds.

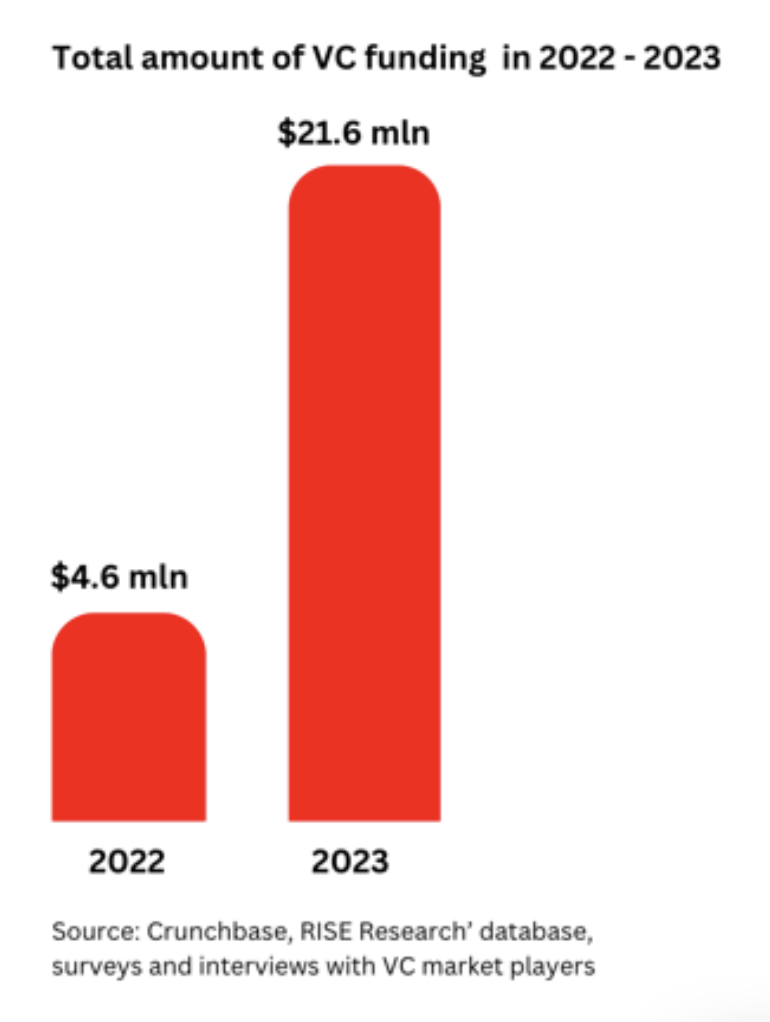

Significant growth in 2023 is largely attributable to four large deals (Pave Bank, Cargon, Hexacore and CityPay.io), which account for more than half of the total volume.

Sectors to watch: Web3, Logistics, Gaming, Fintech

Modal round in 2023: Seed

“The government’s proactive measures have spawned a flourishing startup scene, but the focus must now shift to fortifying a dynamic venture ecosystem. Venture capital remains overlooked, with the majority favoring traditional bank deposits. To propel domestic innovation, it’s essential to demystify and popularize venture capital, reducing reliance on foreign funds.”

– Irakli Kashibadze, Future Laboratory

Kyrgyzstan

In recent years, Kyrgyzstan has seen a rise in the number of skilled technical professionals. Despite this, the relatively limited domestic market and insufficient funding compel these talents to venture abroad, initiating projects that often have little or minor affiliation with Kyrgyzstan.

Among the major Kyrgyz projects abroad are Appboxo, Behavox, Kodif, EnsiliTech, etc.

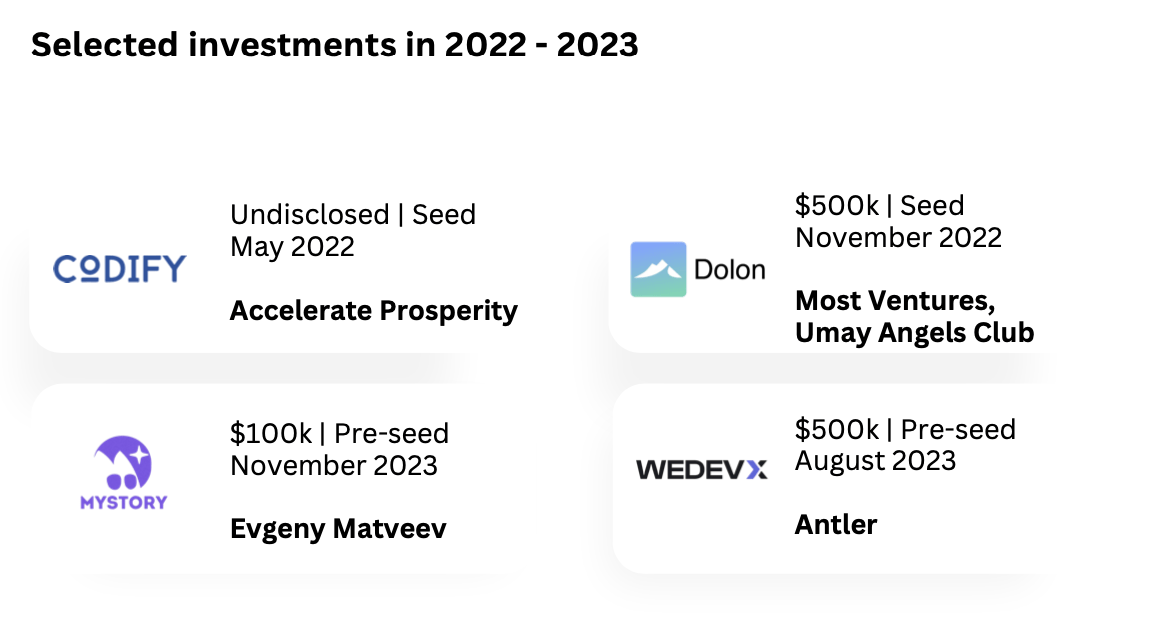

A number of initiatives and ecosystem players are being created to retain talent in the country. One of the most prominent players isAccelerate Prosperity, a global initiative of the Aga Khan Development Network.

Sectors to watch: Edtech, Retail SaaS, Fintech

Modal round in 2023: Pre-seed

“Accelerate Prosperity’s mission is to enable talented Kyrgyzstani people to grow within and beyond the country. To achieve this, we develop the entire technology ecosystem of the country by conducting industry events, challenges, incubations/accelerations, government pro bono projects, as well as providing funding to early-stage startups.”

– Jyldyz Isabekova, Accelerate Prosperity Kyrgyzstan

Tajikistan

Despite the VC market being at the very beginning of its development, two significant fintech projects have emerged in the country:

- Alif Bank — a mature digital ecosystem with a neobank in its core, that attracted a major round of VC investment in 2021.

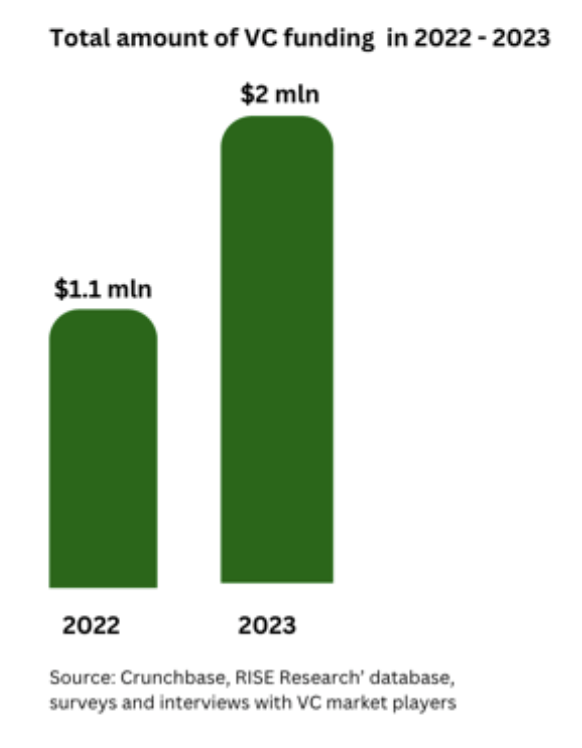

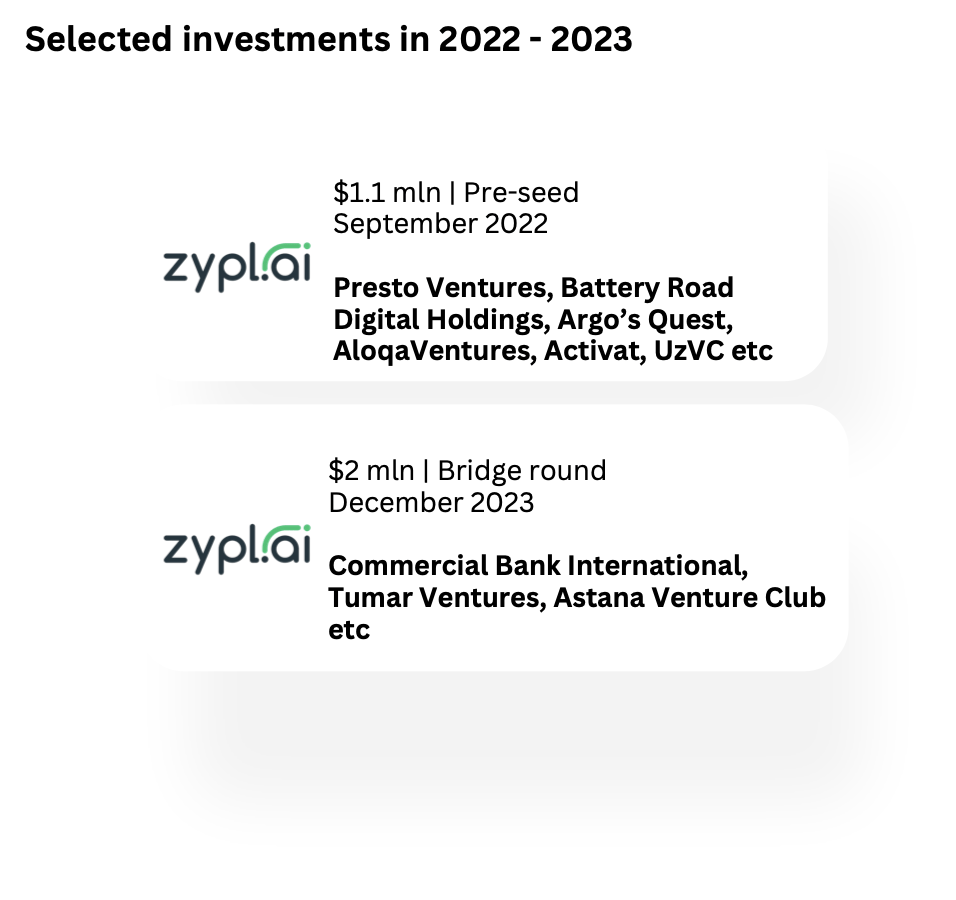

- Zypl.ai — an early-stage startup that develops an AI-powered credit scoring tool. Zypl.ai accounts for almost all disclosed VC investments in the country in 2022-2023.

Sector to watch: Fintech

Modal round in 2023: Pre-seed

“Strategic measures, including quality startup events, government-backed programs, and establishing an IT park, alongside tax benefits for VCs, angel investors, and startups, are vital for fostering growth. Improving internet infrastructure further contributes to creating an environment conducive to the development of a robust startup ecosystem.”

– Jahongir Zabirov, Alif Holding, Somon.tj

You can read the full version of the study by clicking here.

.svg)