The Lead List is a monthly series that analyzes key buy signalsfrom companies on the Crunchbase Emerging Unicorn Board with fresh funding to help you fill your pipeline with new opportunities.

Global funding slowed dramatically in the second quarter of 2022. According to Crunchbase News, funding reached $120 billion, the lowest amount recorded for a single quarter since the beginning of 2021, Crunchbase data shows. Despite the significant drop in VC funding, 15 emerging unicorn companies raised new funding in June, collectively raising over $1.5 billion.

Why emerging unicorns should be on your radar: Emerging unicorns are private, high-growth companies valued between $500 million and less than $1 billion. Why should these companies matter to you? These not-yet unicorns (unicorns are private companies valued at $1 billion or above) represent a sweet spot for salespeople. They’re established, cash-rich, growing and solving a business problem that could make them the next billion-dollar unicorn.

These emerging unicorns span a variety of industries, including fintech, video streaming, edtech and artificial intelligence. In July’s edition of The Lead List, we’ll take a look at these high-growth startups and equip you with all the information you need to sell to them.

Hot tip for salespeople: In contrast to unicorns, which get all the attention, emerging unicorns may not be as inundated with sales pitches.

Add these rapidly growing companies to your CRM

Now Pro and Enterprise users can sync accounts directly from Crunchbase to Salesforce, speeding up their prospecting workflow, and reducing time spent on manual data entry. Check out this Crunchbase list and add these emerging unicorn companies to your CRM.

Methodology

This issue of The Lead List includes companies on Crunchbase’s Emerging Unicorn Board that raised new funding throughout June. The companies are ordered based on their Crunchbase rank score (a proprietary, dynamic ranking that uses intelligent algorithms to score and rank companies) as of July 1. An entity’s Crunchbase rank is fluid and subject to rise and fall over time due to time-sensitive events such as product launches, funding events and leadership changes, so the current rank score may not reflect the listed rank scores below.

The Emerging Unicorn Board is updated whenever a new company reaches a specific valuation range (between $500 million and less than $1 billion). Once a company reaches a valuation of $1 billion, it is classified as a “unicorn” and added to The Crunchbase Unicorn Board. Companies that exit through a public listing or acquisition are removed from the Emerging Unicorn Board.

If you have any questions about companies on the board or this list, please contact us at support@crunchbase.com.

1. Entrepreneur First

Crunchbase Rank: 6

Post-Money Valuation: $560 million

Entrepreneur First brings together ambitious founders with the potential to found globally important technology companies, to meet their co-founders and build a fast-growing startup from scratch. The company recently closed on a $158 million Series C with backing from some of the world’s most well-known founders. The backers represent major tech companies including Stripe, Wise, GitHub and LinkedIn, among others. In an interview with Silicon Republic, Entrepreneur First CEO, Matt Clifford said, “It feels right that this round of funding comes from the most successful technology founders of today. Their support will build their counterparts of tomorrow.”

Why Entrepreneur First should be on your radar: Entrepreneur First was founded on the belief that the world is missing out on some of its best founders. In particular, it believes the best companies come from co-founding partnerships. But finding the right person in your existing network can be hugely challenging. According to TechCrunch, “some of the funding will be used to continue investing in more entrepreneurs and their startups, and it will be converting that investment effort into an evergreen fund.” With its impressive list of backers from fast-growing companies, it would be smart to keep Entrepreneur First on your radar.

2. Juni

Crunchbase Rank: 26

Post-Money Valuation: $800 million

Juni is a fintech company that develops a banking app and platform for e-commerce and online marketing entrepreneurs. The company recently closed on a $100 million Series B led by Mubadala Capital Ventures, an active investor in advanced technology, with participation from EQT Ventures,Felix Capital, Cherry Ventures and DST Global. In addition to the Series B funding, the company also secured $106 million in debt financing from Silicon Valley-based TriplePoint Capital. With the new funding, Juni’s will focus on, “growing the business via its new credit card offering for all markets within the European Economic Area and the UK.”

Why Juni should be on your radar:In an interview with Sifted, Juni co-founder Samir El-Sabini shared that Juni hasn’t been impacted by the slowdown in consumer spending. “When the market is under pressure, you see that a lot of customers need to save costs and be more efficient. We’ve noticed that demand for our products is growing because you want to have the best liquidity possible,” El-Sabini said. “I’m not so worried about the number of customers — I’m worried about us being able to be at our best and make sure that we get the customers, that they trust us and that we can build something long-lasting together.” As the e-commerce sector continues to grow, and with the global e-commerce market predicted to reach $7 trillion in sales by 2025 — it might be worth setting up alerts for Juni and similar companies.

Crunchbase User Tip: Do you want to monitor Juni’s activity?

With Crunchbase Pro, you can enable automatic alerts to stay up to date on high-growth company news and buy signals. With automatic alerts, you can select what you want to be notified of (funding rounds, news, etc.) by designating either Daily or Weekly updates for that alert type. Learn more about automatic alerts.

3. Codat

Crunchbase Rank: 38

Post-Money Valuation: $825 million

Codat is the universal API for small business data. The company provides real-time connectivity to enable software providers and financial institutions to build integrated products for their small business customers. Codat closed on a $100 million Series C in early June, led by JP Morgan Partners. Canapi Ventures, Shopify, Index Ventures, PayPal Ventures and Plaid, which has been publicly named as an investor for the first time, also participated in the round. According to VCA Online, “Codat will use the funds to build out their critical infrastructure to be the default means of sharing data for the small business economy.”

Why Codat should be on your radar: In Codat’s Series C press release, Pete Lord, CEO and co-founder stated, “We’ll use our Series C funds to incorporate many more integrations into our universal API, connecting to all types and providers of small business financial software across the globe. Fintech pioneers will use our API to create products that solve a wide array of challenges that small business owners face, from accessing finance to process automation and many more that we are yet to imagine.” With high-growth companies like Plaid, Shopify and American Express backing them, Codat should be on your radar as the company continues to power the next generation of technology for small businesses and expands.

4. Stashfin

Crunchbase Rank: 50

Post-Money Valuation: $750 million

Stashfin is a neo-banking platform with a mission to deliver seamless, transparent and efficient financial services to everyone. The company aims to empower customers by improving their financial health leading to inclusivity, growth and economic independence. Stashfin closed on a $70 million Series C led by Uncorrelated Ventures, Fasanara Capital and Abstract Ventures with participation from Snow Leopard Technology Ventures, Kravis Investment Partners and Altara Ventures. The round was a mix of debt financing and equity, which brought the platform closer to unicorn status, valuing it at $750 million despite an overall slowdown in funding in Q2.

Why Stashfin should be on your radar: When asked about the funding round, Stashfin founder and CEO Tushar Aggarwal said, “The fundraising is a key milestone in this challenging macro environment. Stashfin began with the purpose to serve the underserved and unserved segments of our society, and it’s heartening to see this manifesting in rapid business growth impacting millions of our customers’ lives.” The company also looks forward to pursuing global expansion. Stashfin currently is based out of Singapore, yet only caters to the Indian market. According to Mint, “Stashfin will use the funds to expand its footprint in Southeast and South Asia and upgrade its technology for new products,” indicating a clear focus on company and product growth.

5. ShopBack

Crunchbase Rank: 92

Post-Money Valuation: $555 million

ShopBack is an e-commerce loyalty platform that offers cashback services from online stores. The company recently raised an $80 million Series F led by Asia Partners Fund Management, a growth equity firm focusing on investments in technology and technology-enabled companies. Existing investor January Capital also participated in the round. According to ShopBack’s press statement, “The capital will be invested into developing new and innovative products for users and merchant partners, deepening its presence across the Asia Pacific, and building capabilities for public market readiness.”

Why ShopBack should be on your radar: Today, ShopBack is the dominant player in Southeast Asia’s e-commerce cashback market, with an established presence in Singapore, Malaysia, Indonesia, the Philippines, Thailand and Taiwan. The funding announcement comes on the heels of the launch of ShopBack Pay, where over 2 million users in Singapore and Australia can now check out conveniently with ShopBack Pay at more than 3,000 merchant outlets. In addition to global expansion, ShopBack currently has a handful of open roles for which it is hiring. The majority of these roles are for its engineering and marketing teams, indicating a focus on product growth and expansion.

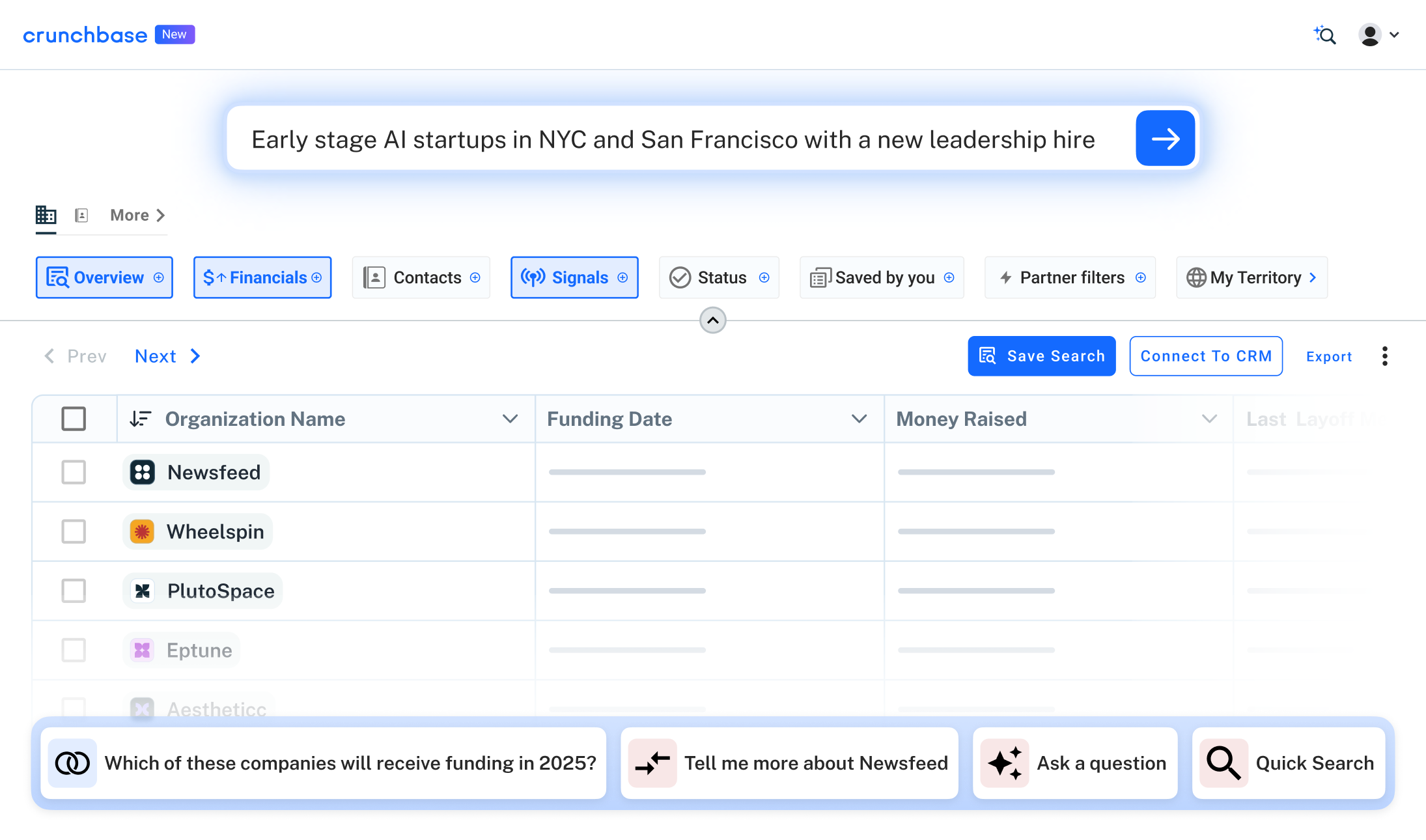

Crunchbase User Tip: Identity high-growth companies with buying power, like ShopBack, by leveraging Crunchbase’s leadership hire signal.

Crunchbase’s leadership hire signal can help you find companies that have the capacity and resources to buy a product or service. Leadership hire data will help you easily identify when companies have added a new executive (VP and above) to their leadership team, indicating that a company is expanding and that a new decision-maker is on board. Leadership hire is available as a filter on search, as well as on a company’s Crunchbase profile. Learn more about the leadership hire signal.

6. Coralogix

Crunchbase Rank: 127

Post-Money Valuation: $950 million

Coralogix is a SaaS platform that uses machine-learning algorithms to facilitate delivery and maintenance processes for software providers. The company closed on a $142 million Series D co-led by Advent International and Brighton Park Capital, with participation from Revaia, Greenfield Partners, Red Dot Capital Partners, O.G. Tech, StageOne Ventures, Joule Ventures and Maor Investments. The Israeli startup has currently raised $238.2 million to date, and according to Crunchbase data is approaching unicorn status with a valuation of $950 million. According to TechCrunch, the funding will be used to “continue investing in its [Coralogix] R&D as well as in building out more of its sales and business development globally.”

Why Coralogix should be on your radar: In the company’s Series D announcement post, it wrote, “As we move forward, and with this new round of funding, we are more committed than ever to providing our users with the best solution there is. We will continue growing our go-to-market, product, and R&D teams and expand into 10 new markets. As we expand, we will be focused on maintaining our world-class support and adding to and improving our full-stack observability platform.” In other words, the company plans to use its funding to further product development and expand its global geographic presence. As the company continues to grow and approach unicorn status, Coralogix could be your next big deal.

7. H1

Crunchbase Rank: 135

Post-Money Valuation: $773 million

H1 provides a global health care platform to help life sciences companies, hospitals, academic medical centers and health systems connect with providers, find clinical research, locate industry experts and benchmark their organizations. In July, the company announced a $23 million Series C extension in addition to the $100 million it raised in November, bringing the total Series C raise to $123 million. The round saw participation from Goldman Sachs Asset Management, Menlo Ventures, Transformation Capital and Novartis Pharma. The company is planning to use the extension to further its mission of creating a healthier future through the use of connected and accessible health care data.

Why H1 should be on your radar: Dubbedthe LinkedIn of the health care industry, the participation from existing investors shows support for and confidence in H1’s trajectory to become the industry’s standard and trusted source of health care information. “In a time of volatile markets when many are struggling to secure funding, this extension is a vote of confidence in our ability to advance our mission,” said Ariel Katz, CEO and co-founder of H1. “Our ability to raise capital at the same terms as our original Series C close is a testament to our significant market opportunity and ability to execute against it.” With a focus on company and product expansion with their latest round of funding, H1 could be on the path to unicorn status.

Crunchbase User Tip: Want to find fast-growing companies similar to H1? Let Crunchbase find hyper-targeted sales leads for you.

With similar companies, it’s easy to identify companies that resemble your recently closed deals and figure out which companies with high-growth potential to watch. Crunchbase profiles now have a new ‘similar companies’ tab that utilizes our unique machine-learning model to automatically surface similar accounts and possible competitors for the profile you’re viewing. Similar companies makes it easier to discover and qualify accounts without interrupting your workflow.

8. Fountain

Crunchbase Rank: 168

Post-Money Valuation: $950 million

Fountain is a talent platform that makes workforce management and hiring easier. The company recently raised a $100 million Series C extension in addition to the $85 million it raised in November, bringing the total Series C funding to $185 million. The extension was led by B Capital Group, with participation from SoftBank Vision Fund, Mirae Asset Venture Investment, DCM Ventures,Origin Ventures, Commerce Ventures, SemperVirens Venture Capital and Uncork Capital. “This extension of our Series C is a testament to the incredible growth Fountain has seen over the past year and will help us to continue to exceed the demands of the world’s leading brands for high volume hiring,” said Sean Behr, CEO of Fountain.

Why Fountain should be on your radar: According to Behr, the company intends to use its fresh funding to expand internationally, “Bearing witness to Fountain’s proven value and growth potential, investors continue to be eager to support the company through an extension intended to supercharge its growth and fuel international expansion.” To support this global expansion, Fountain is rapidly hiring for 33 open roles, primarily for its engineering, sales and marketing teams, indicating a focus on product growth.

9. Pixellot

Crunchbase Rank: 195

Post-Money Valuation: $500 million

Pixellot develops artificial intelligence-driven sports production and analytics software for the semiprofessional sports market. The company recently announced it successfully raised a $161 million Series D in mid-June. The funding round was led by Providence Strategic Growth, a leading growth equity firm partnering with software and technology-enabled services companies to help accelerate their growth. Shamrock Capital Advisors and Firstime Venture Capital also participated in the round, according to Broadcasting+Cable,

Why Pixellot should be on your radar: Pixellot intends to use the funds to support its global market expansion and to enhance its video, analytics and highlights value proposition to fans, athletes and coaches at all levels. In addition, as part of the funding round, Ronen Nir, managing director at PSG, and Govind Anand, principal at PSG, have both joined Pixellot’s board of directors. According to Pixellot’s press release, “With this planned expansion of services, we [Pixellot] believes it is well-positioned to expedite its expansion into new territories and verticals, such as Asia, Latin America and the global youth markets.” With well-known companies like the NBA and MLB using Pixellot’s software, it would be smart to keep Pixellot on your radar as it continues to grow in popularity and expand worldwide.

10. Progcap

Crunchbase Rank: 203

Post-Money Valuation: $600 million

Progcap is a financial service company that provides financial opportunities for micro- and small businesses. The company recently closed on a $40 million Series C, led by Tiger Global Management and Creation Investments Capital Management LLC with participation from Sequoia Capital India and new investor Google. The company plans to use the funds to support its expansion and accelerate product development. “We are looking to expand our footprint to more geographies that we will be identifying and apart from that we are working on developing our app that helps to digitize our clients’ day-to-day finances,” co-founder, Pallavi Shrivastava told Economic Times.

Why Progcap should be on your radar: According to TechCrunch, “Progcap serves more than 700,000 small retailers, who dot hundreds of Indian cities and towns. The startup extends a revolving credit line of $10,000 to $12,500 to retailers, providing them with much-needed capital to buy new inventories and grow their businesses.” This makes Progcap a promising player in its sector given that it also has attracted the attention of Facebook and Amazon in recent years. In addition, Progcap’s Series C funding round nearly tripled its valuation to $600 million since its previous valuation of $200 million in September. The company is currently hiring for 17 positions across its sales and technology team, signaling a focus on growth and expansion as the company continues to scale.

11. Leap

Crunchbase Rank: 319

Post-Money Valuation: $900 million

Leap is an edtech company that develops a guidance and financing platform for aspiring overseas students. The company raised a $75 million Series D in late-June, led by Owl Ventures with participation from Steadview Capital, Sequoia Capital India, Paramark Ventures and Jungle Ventures . The company’s valuation has doubled since its September funding round as the company approaches unicorn status. According to Crunchbase News, the edtech sector saw a spike in funding last year. VC-backed companies in the education space raised more than $20 billion in 2021, up from around $14.6 billion in 2020, per Crunchbase data.

Why Leap should be on your radar: Leap said the new investment will allow it to widen access to quality global education and continue to expand globally. “We continue to see tremendous opportunities in the study-abroad segment. The pace of Indians moving abroad to study only continues to accelerate almost every passing year. And so, we are eyeing international expansion to UAE and Africa, so more students coming from any country can avail Leap’s products and services,” said Vaibhav Singh, co-founder of Leap. Keep Leap on your radar as the company is already inching closer to unicorn status with a valuation of $900 million.

Crunchbase User Tip: Let us do the research for you.

If you are a Crunchbase Pro or Enterprise user, your recommendations page will automatically surface relevant high-growth companies to help you find your next opportunity. These recommendations are powered by machine learning and include context about why we are suggesting each company specifically for you. Learn more about Crunchbase’s company recommendation engine to automate account discovery and qualification.

12. Ataccama

CB Rank: 384

Post-Money Valuation: $550 million

Spun off from Adastra in 2007, Ataccama provides global enterprises with the ability to massively scale data-driven innovation to accelerate business outcomes. The company recently closed on a $150 million venture round, led by Bain Capital Tech Opportunities, representing a minority investment in the company.

Why Ataccama should be on your radar: The fresh funding will be used to strengthen the company’s go-to-market engine, further invest in new product innovation and expand its global reach. “These efforts will allow Ataccama to build on our significant growth and cement our position at the forefront of the data management and governance sectors,” the company said in a recent press release. “Ataccama’s cloud-friendly, best-in-class platform makes it simple for technical and nontechnical roles to collaborate on data quality and governance. Demand for the platform has driven a significant increase in the company’s average deal size, fueling incredible momentum. We see a significant runway for further growth,” said Dewey Awad, a managing director at Bain Capital Tech Opportunities. In addition, the company is hiring for multiple engineering and marketing positions, signaling a focus on company and product growth.

13. Vidio

CB Rank: 549

Post-Money Valuation: $850 million

Vidio is an over-the-top video platform that allows users to upload, watch and share videos. The company raised a $45 million venture round with a handful of investors including Dian Swastatika Sentosa, Grab and Bali United Football Club, an Indonesian football club. According to e27, “Vidio CEO Sutanto Hartono said the company is to increase its commitment to users by continuously adding the best premium content with this new fund, as well as improving the features and quality of the platform.”

Why Vidio should be on your radar: According to Deal Street Asia, “The additional funding will fuel the company’s pursuit to provide the best streaming content, and to upgrade features and the platform itself to provide reliable content.” In addition, Hartono said, “Aside from an exclusive Premier League airing in August and the World Cup in November, we will also be more aggressive in releasing local original series and quality soap operas to entertain streaming audiences in Indonesia.” The company is currently hiring for a handful of positions across it’s marketing and engineering teams, signaling a focus on growth and expansion as the company continues to scale.

14. Kerecis

CB Rank: 1,693

Post-Money Valuation: $550 million

Kerecis, which is headquartered in the small town of Ísafjörður, Iceland, makes use of fish skin and fatty acids in the globally expanding cellular therapy and infection control markets. The company recently raised a $50 million venture round, led by KIRKBI A/S, a Danish investment firm best known for being the owner of the LEGO brand.

Why Kerecis should be on your radar: According to Northstack, “Recently, Kerecis has been considering listing the company on the stock market in Sweden or the United States. The board of Kerecis has decided to abandon those plans, at least for now, in the light of the current economic landscape. Therefore, the board will have to look for other ways to fund the company’s growth. For example by securing funding from strong investors like KIRKBI.” Even without the possible IPO, Kerecis is still a company to keep on your radar as the company “experienced impressive growth in recent years and the goal is to keep that trend going. The company’s plans expect the gross income for the current financial year to more than double compared to last year’s gross income.”

15. Cleo

CB Rank: 11,119

Post-Money Valuation: $500 million

U.K.-based financial app Cleo has raised an $80 million Series C to double down on the U.S. market and help Gen Z audiences improve their financial health and well-being. The Series C was led by Sofina, a Belgium-based investment company that supports entrepreneurs and families managing growing companies, and backed by existing investors, including EQT Ventures and Balderton Capital. According to Sky News, “Sources close to Cleo said the new capital injection had been agreed at a valuation of about $500m – roughly five times the level of the December 2020 fundraising.”

Why Cleo should be on your radar: In an announcement post, Cleo said, “We are so excited to announce our Series C funding round led by Sofina. We’re doubling down on our growth and getting ready to fight even harder for the world’s financial health. We’ll be hiring a lot in the coming months. Chances are there’s going to be something for you here. (Including a product you can be proud of and really, really, great people.)” With a focus on hiring with their latest round of funding, Cleo currently has a handful of open roles. The majority of these roles are for its engineering, marketing and data science teams, indicating a focus on company and product growth.

Join us next month as we continue to keep an eye out for hot companies. You can use this list to track the cohort of new companies being added to the Emerging Unicorn Board throughout the month.

.svg)