Colorado is no longer just an early-stage ecosystem. Over the past 10 years, Colorado’s startup ecosystem has matured and, with it, venture capital investment, talent, and secondary locations (and relocations) of Fortune 500 technology companies have followed. Coinciding with this evolution, Colorado has seen a surge in advanced industries expertise, spin-off startups, and outside investment.

Prior to 2020, Colorado saw a rapid year-over-year increase in funding and deals. With the obvious impact of COVID-19 on the economy both nationally and regionally, 2020 was an interesting year to cipher. While the number of deals in 2020 decreased by 13 percent compared to 2019 due to the economic effect of COVID-19, Colorado was in range with the rest of the country which saw an overall deal decline of 10 percent.

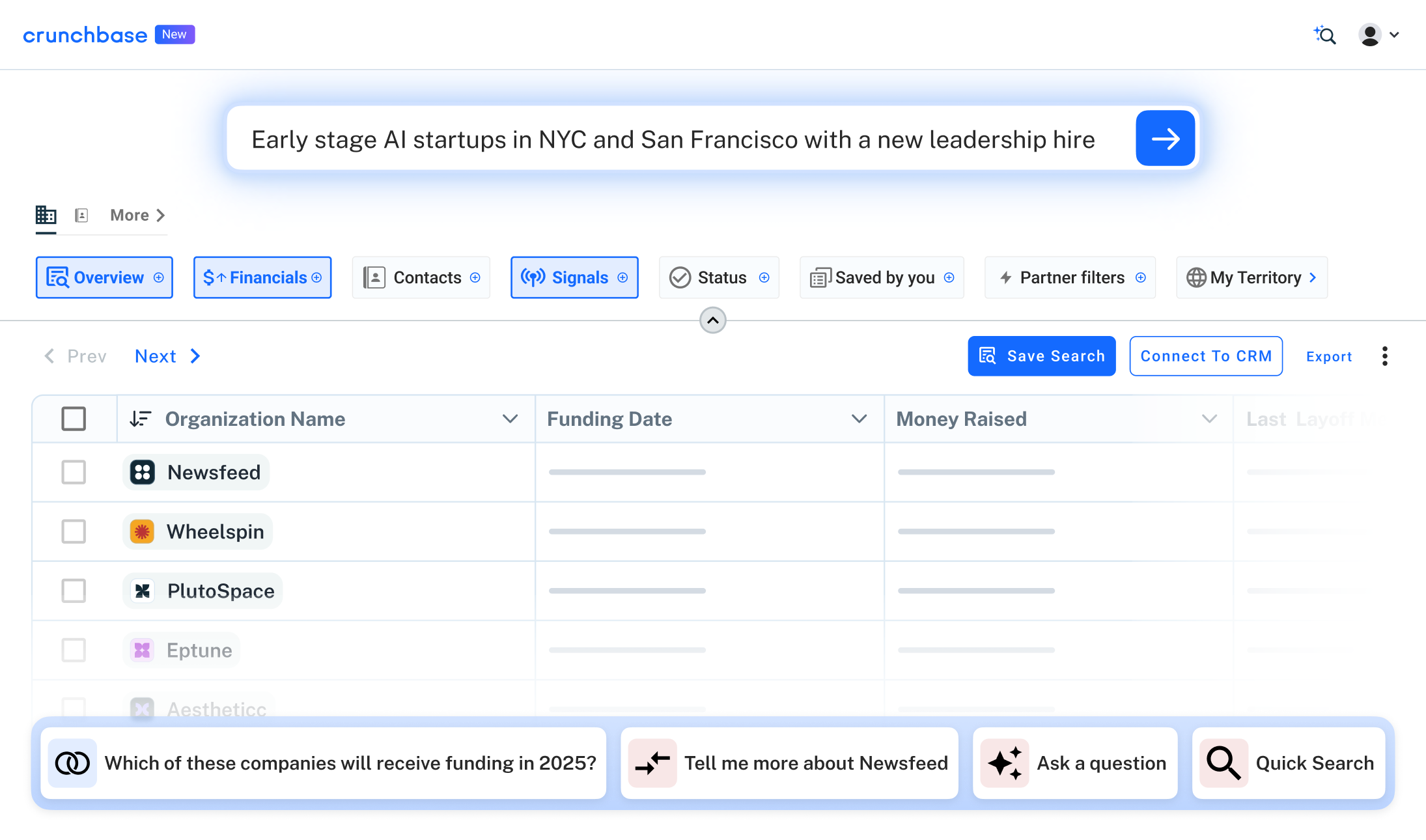

Crunchbase partnered with Access Ventures to crunch the numbers and analyze the State of VC & Investment Activity in Colorado in 2020. This report covers Colorado’s deal flow in 2020, the fastest growing industries for investment, talent trends and outside vs. inside investment in the state.

Colorado is a home away from home for national unicorns

Burgeoning tech companies have chosen Colorado time and time again as their secondary HQ location and doubled down on expanding their locations. Colorado is home to 584 tech firms with 689 in-state locations. Slack, Splunk, Facebook, Google, Palantir and Robinhood are just a few of the unicorns to set up shop in Colorado. Four local tech companies – Ibotta, Guild Education, Evercommerce and Quantum Metric – recently achieved unicorn status and joined the likes of Ping Identity and Home Advisor. Collectively, these four Colorado-native unicorns employ over 3,100 full-time employees.

How Colorado stacks up nationally

Colorado’s startup ecosystem is known for being home to Techstars and Foundry Group but there is much more activity bustling in the state. With 28 Colorado-based accelerators, 70 active investment firms and the largest startup week in the country, Colorado is climbing the ranks and attracting further outside interest.

Colorado’s venture capital and startup ecosystem is stronger than its size would suggest. Despite being in the lower 20s for rank in population and company counts, Colorado was sixth in the U.S. for the total number of VC deals and ninth in the total amount of capital invested through those deals in 2020. In 2020, Colorado startups raised $2.21 billion in funding – with a majority of that funding coming from California-based investment firms.

Trading the coasts for the mountains

Tech workers and urban dwellers alike have been keen on migrating from coastal cities to Colorado and other second-tier cities over the past five to 10 years. What was already trending was propelled even further due to COVID-19. Colorado ranks third in the country for population growth, with the highest percentage of migrants to the Greater Denver Area coming from California and New York. When it comes to remote work, Colorado is the place to be. Colorado leads the country with the highest percentage of remote workers (8.6 percent), with a majority of remote workers in the Denver-Boulder area.

What’s next?

As Colorado’s startup ecosystem continues to mature, advanced industries’ startups multiply, and more coastal VCs look for less inflated valuations, we predict additional out-of-state investment to enter the market and an even bigger increase in funding rounds to materialize. This should shrink the local funding gap that has been omnipresent for the past decade and position local VCs and early-comers to advantageously invest in the expanding market.

.svg)

.png)