The 2019 Crunchbase Annual Review

A Look Back at 2019’s Unicorns, Largest Funding Rounds, and More

Written by Gené Teare

As 2019 winds to a close, Crunchbase is taking a look back at private company investment in a year that delivered an outsized share of giant funding rounds, high profile IPOs, and a few big flameouts.

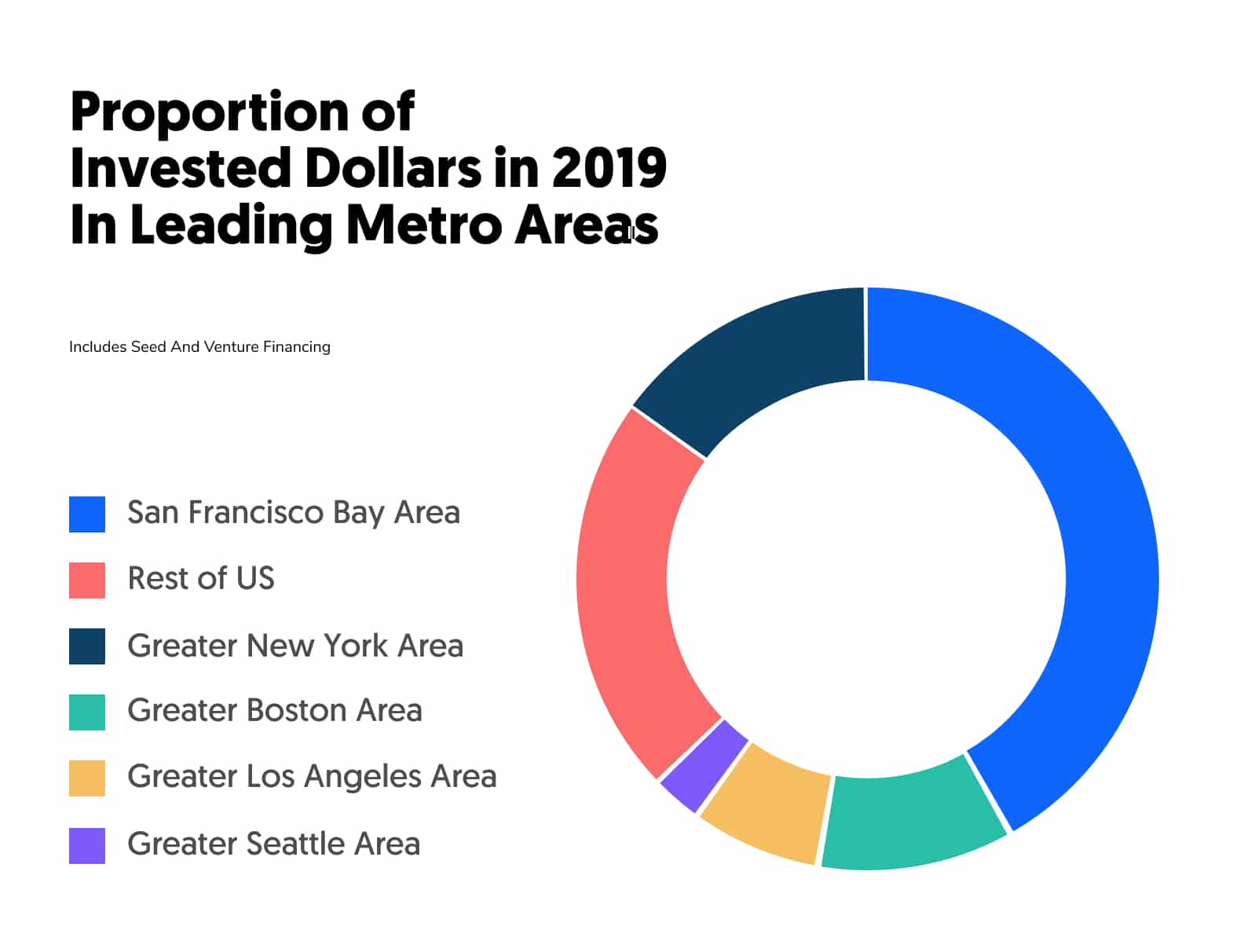

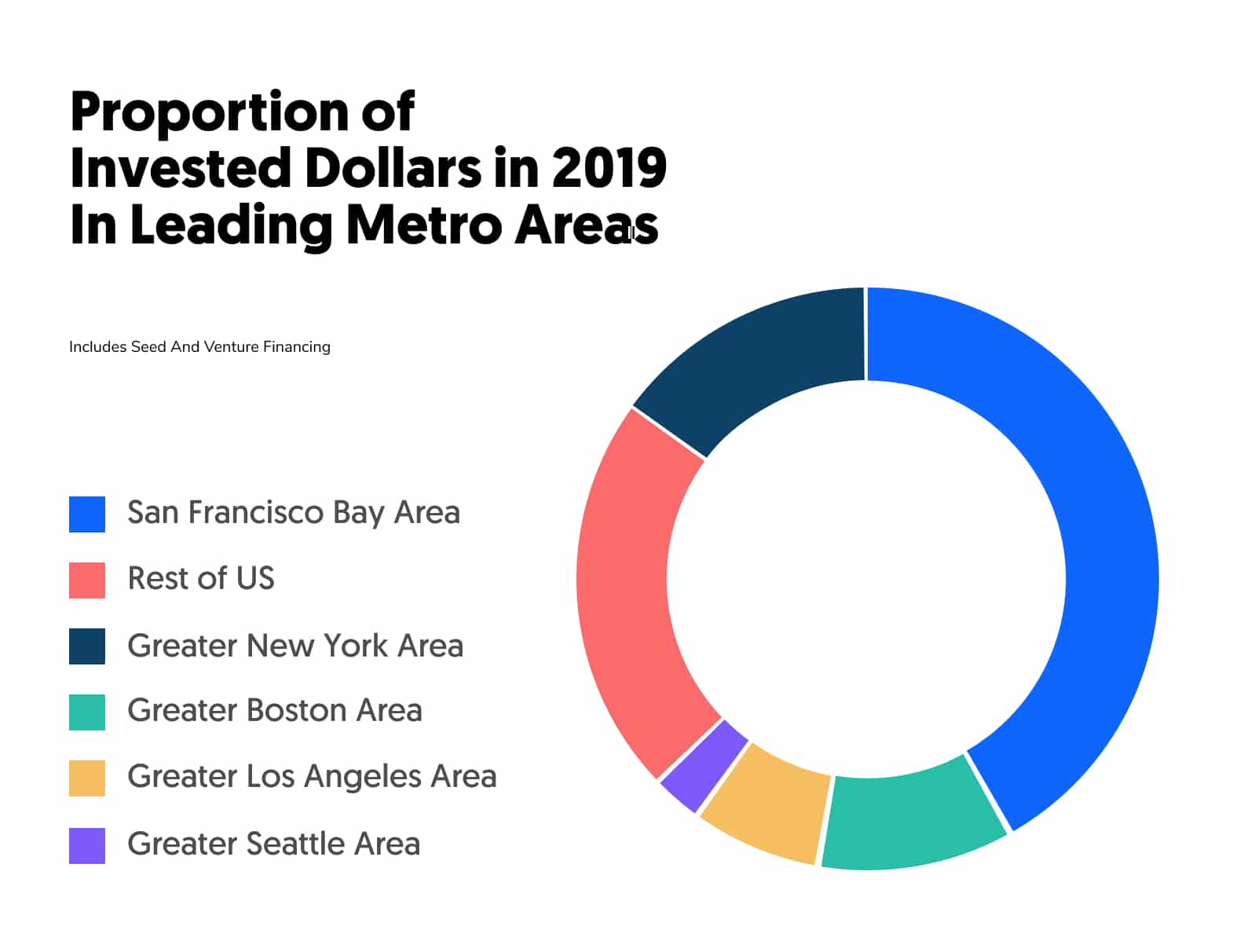

Bay Area Dominance Declines (a little)

If software is eating the world, it won’t all happen in San Francisco.

The San Francisco Bay Area raised 44 percent of US-based seed, venture and corporate venture funding dollars in 2019. This is down five percent from 49 percent in 2018.

High Growth U.S. Hubs

A few metro hubs experienced growth due to large funding rounds to a single company, notably Uber ATG in Pittsburgh, and Rivian in Detroit, NextEra Energy in the Greater Miami Area, and KnowBe4 in Tampa Bay Area.

Other ecosystems that grew year-over-year were influenced by a more diverse set of companies in the Greater Philadelphia Area, with a growing biotech and healthcare ecosystem, and Greater Atlanta with a broader range of industries in their startup ecosystem.

2019's Fastest Growing Industries

The market sectors with the most dollars invested in 2019 include: E-commerce, Health Care, Financial Services, Artificial Intelligence, and Transportation.

Year-over-year industries that saw the most growth by order include: Property Management, Energy, Supply Chain Management, Insurance, Real Estate, Video, Marketplace, and Electronics.

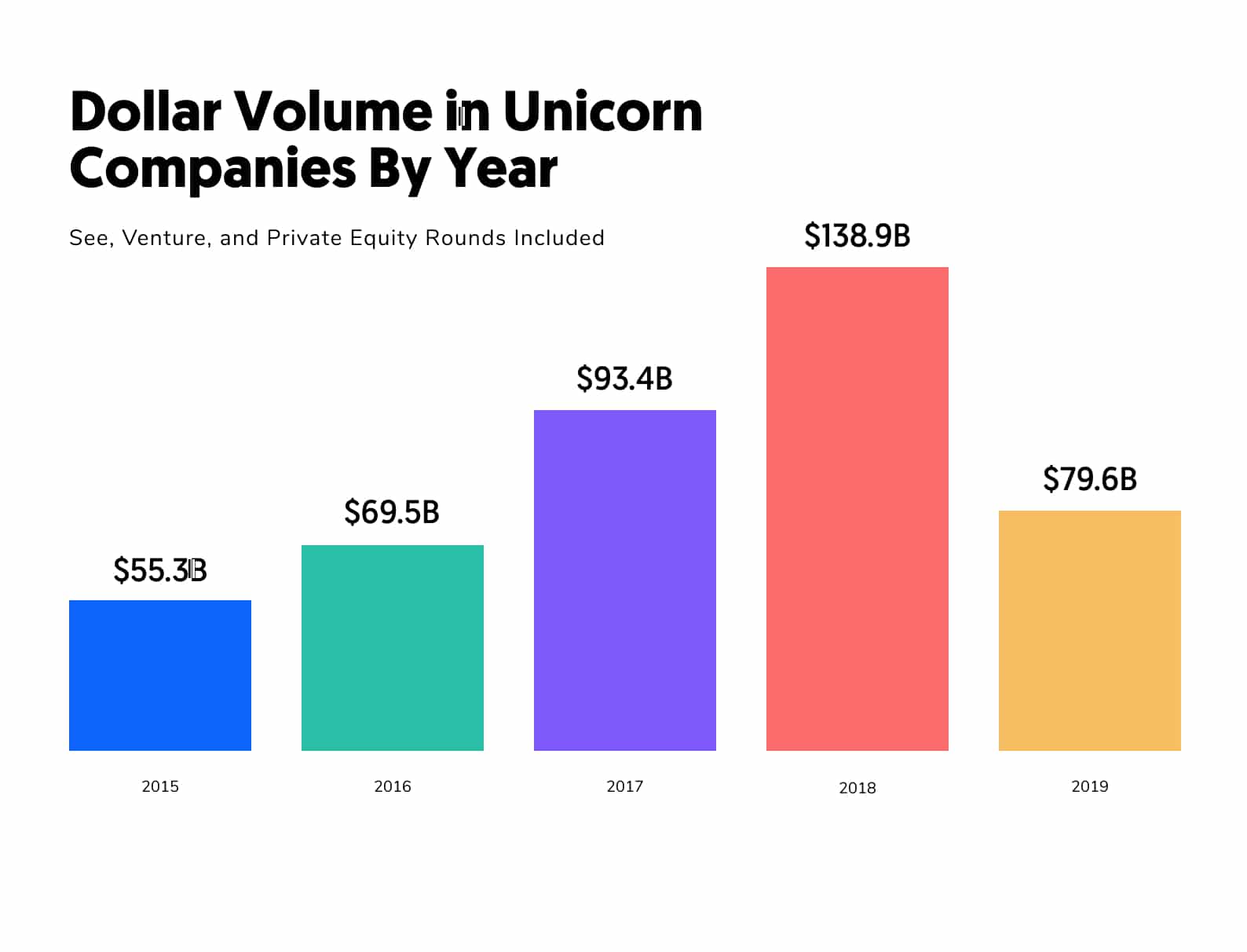

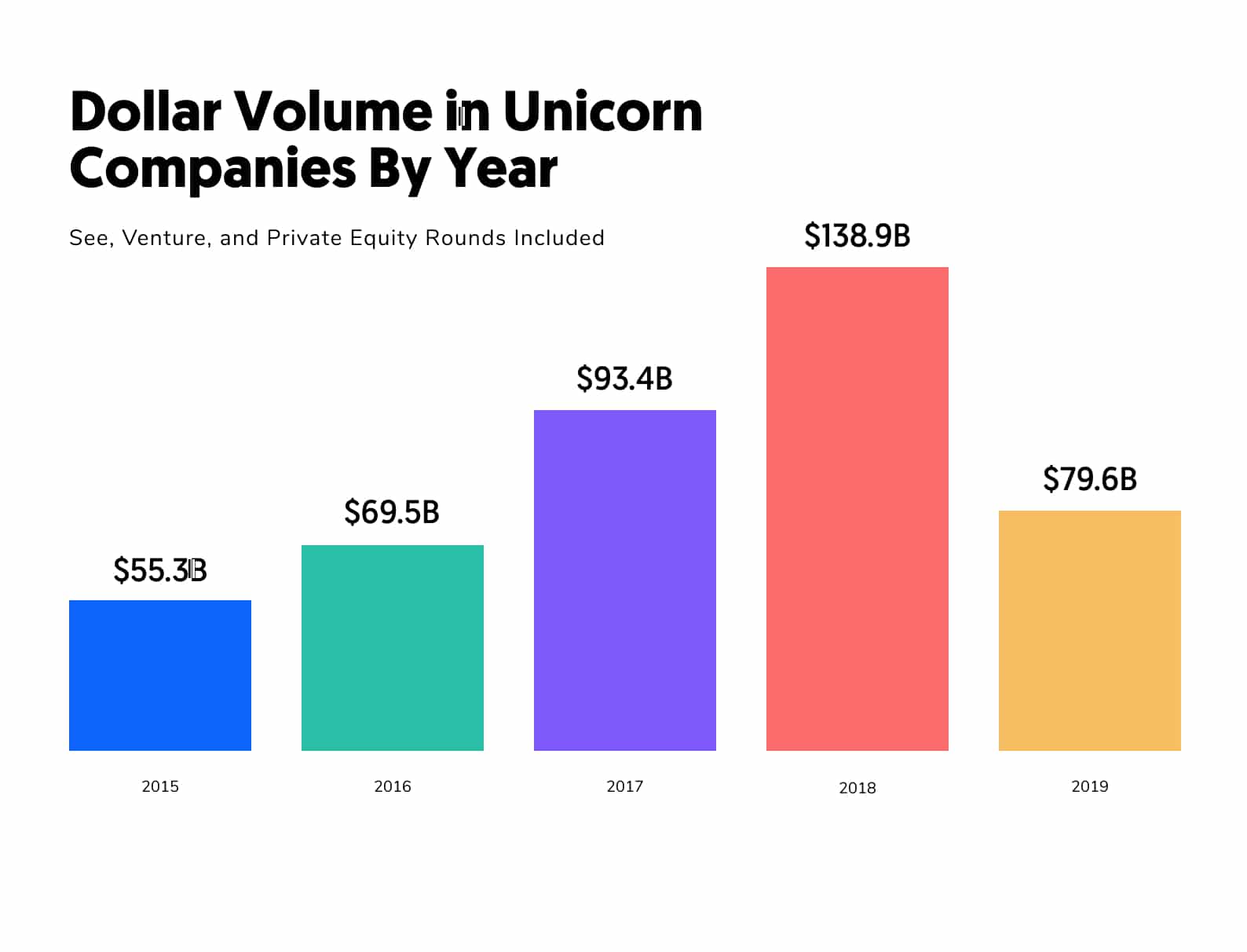

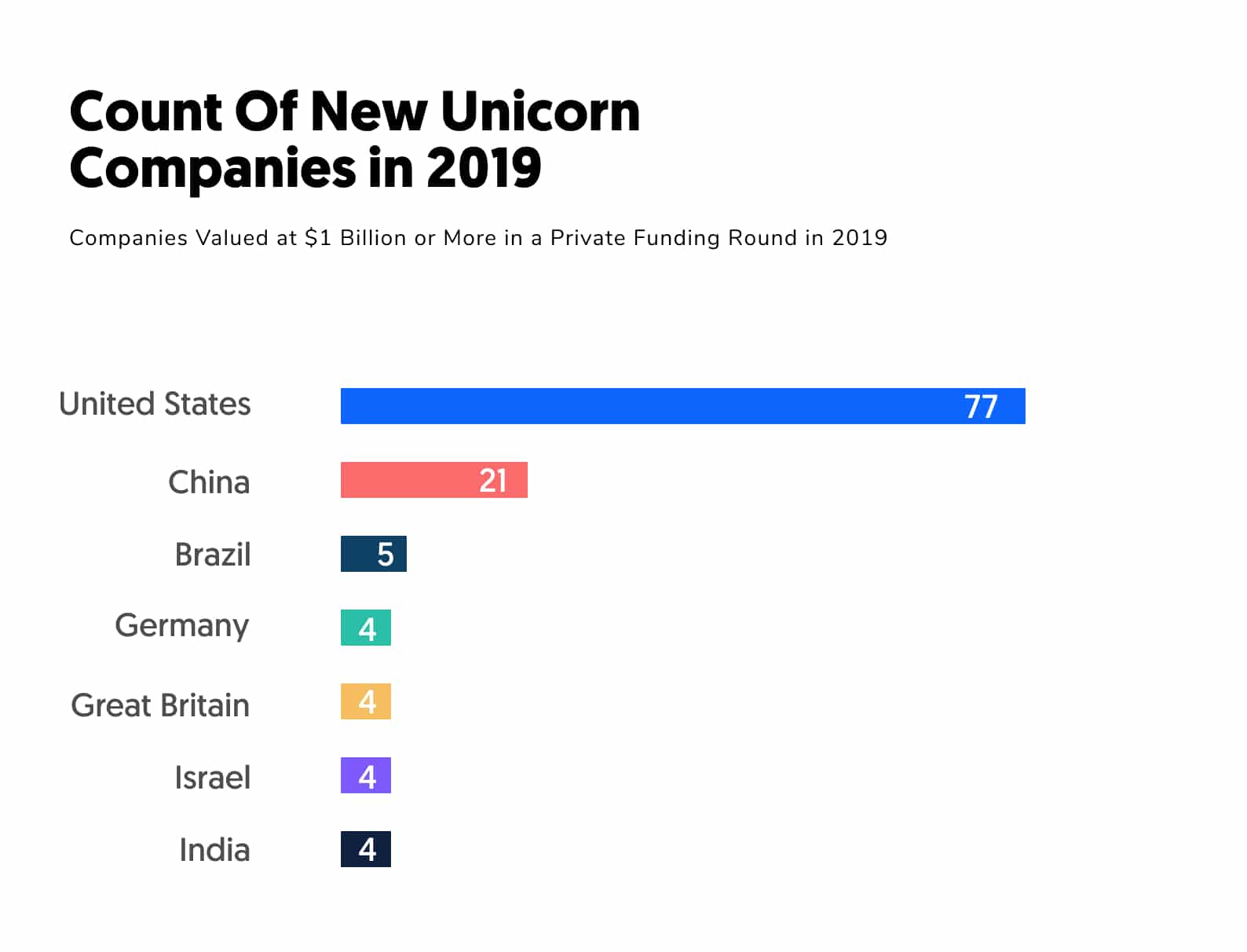

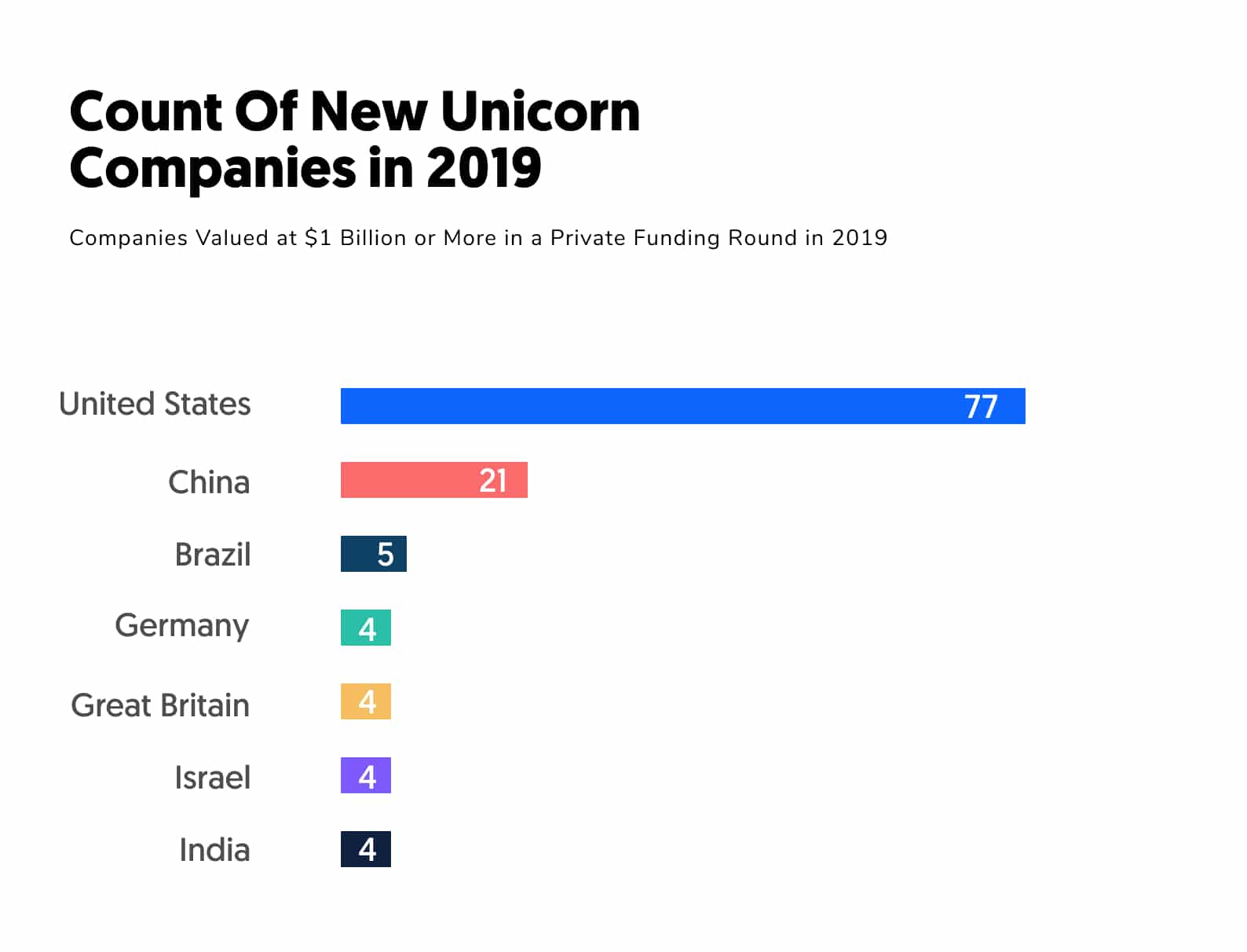

Unicorn Shake Up In 2019

Global counts of newly minted unicorns were down year over year by 15 percent with amounts invested in unicorn companies down by 43 percent year over year. However, in the US, we saw an increase in unicorn counts in 2019.

This coincided with quite a few big name unicorns going public. This suggests a robust funding environment, even through invested dollars in US-based unicorn companies were lower than 2018 by 28 percent.

The Unicorns Of 2019

In 2019, unicorns were far from mythical and Crunchbase followed them every step of the way. This year (as of December 9, 2019) 135 companies joined the Crunchbase Unicorn Board. This is less than the 2018 all time high of 158 companies, and above 2017 (101 companies), 2016 (87 companies) and 2015 (106 companies).

The five most highly valued new unicorns include: Uber Advanced Technologies Group ($7.3 billion), JD Health ($7 billion), Databricks ($6.2 billion), CloudKitchens ($5 billion), and Rivian ($5 billion).

Five companies that became unicorns in 2019 and also went public in the same year, listed in order of IPO valuation, are: 10X Genomics ($3.7 billion), Vir Biotechnology ($1.7 billion), The RealReal ($1.7 billion), Canaan Creative ($1.4 billion), and Health Catalyst ($1.3 billion).

The largest hubs by equity funding amounts in 2019 in order:

1. San Francisco Bay Area

2. Greater New York Area

3. Greater Boston Area

4. Greater Los Angeles Area

5. Greater Seattle Area

Hubs and cities that have grown the most by percent year over year in order:

1. Greater Detroit Area

2. Pittsburgh

3. Tampa Bay Area

4. Greater Miami Area

5. Greater Philadelphia Area

6. Greater Atlanta Area

6 Largest Funding Rounds

With unicorn-sized valuations come equally staggering funding rounds, and 2019 was no exception to the rule. Here are the 6 largest Series A-H funding rounds of the year for companies headquartered in the US. See the 15 largest funding rounds in our full report.

A full-service global freight forwarder and logistics platform using modern software to fix the user experience in global trade.

Round: Series D

Date: 02/21/2019

Amount: $1,000,000,000

Lead Investor: SoftBank Vision Fund

The We Company is a platform for creators that transforms buildings into dynamic environments for creativity, focus, and collaboration.

Round: Series H

Date: 01/09/2019

Amount: $1,000,000,000

Lead Investor: SoftBank

A technology company that aims to accelerate the benefits of robotics for everyday life.

Round: Series B

Date: 02/11/2019

Amount: $940,000,000

Lead Investor: SoftBank Vision Fund

DoorDash provides a delivery service that connects customers with local and national businesses.

Round: Series G

Date: 5/24/2019

Amount: $600,000,000

Lead Investor: Darsana Capital Partners

UiPath designs and develops robotic process automation and artificial intelligence software.

Round: Series D

Date: 04/30/2019

Amount: $568,000,000

Lead Investor: Coatue Management

Delivers the benefits of self-driving technology safely, quickly, and broadly.

Round: Series B

Date: 02/07/2019

Amount: $530,000,000

Lead Investor: Sequoia Capital

Download The Full Report

Understand the full 2019 landscape in Crunchbase’s 2019 Year In Review report.