For new entrepreneurs, the terms initial public offering (IPO) and public vs. private can cause a world of confusion and anxiety. In its most basic form, an IPO is when a private company offers its first group of shares into the stock market. An IPO is essentially what turns a private company into a public one. According to Forbes, less than 1% of businesses in the U.S. go public.

The benefits of an IPO

So, what’s the big deal about going public? Businesses usually offer an IPO as a way to raise capital that will allow them to grow quickly and expand. An IPO can also help companies on the verge of bankruptcy or have already filed for bankruptcy.

During 2010, just one year after filing bankruptcy, General Motors garnered $20.1 billion with its IPO. Alibaba, an ecommerce company operating in China, raised $21.4 billion after its IPO in 2014. In most cases, going public with an IPO can raise extravagant amounts of capital.

In addition to the immense amount of revenue an IPO can generate, going public opens a company to a much larger pool of investors. When a company is formed, it usually starts with a small group of investors including the founders. But after going public, the number of investors can rapidly increase. This distributes control of day-to-day operations across a larger group of people.

Track the latest IPO news using Crunchbase Pro>

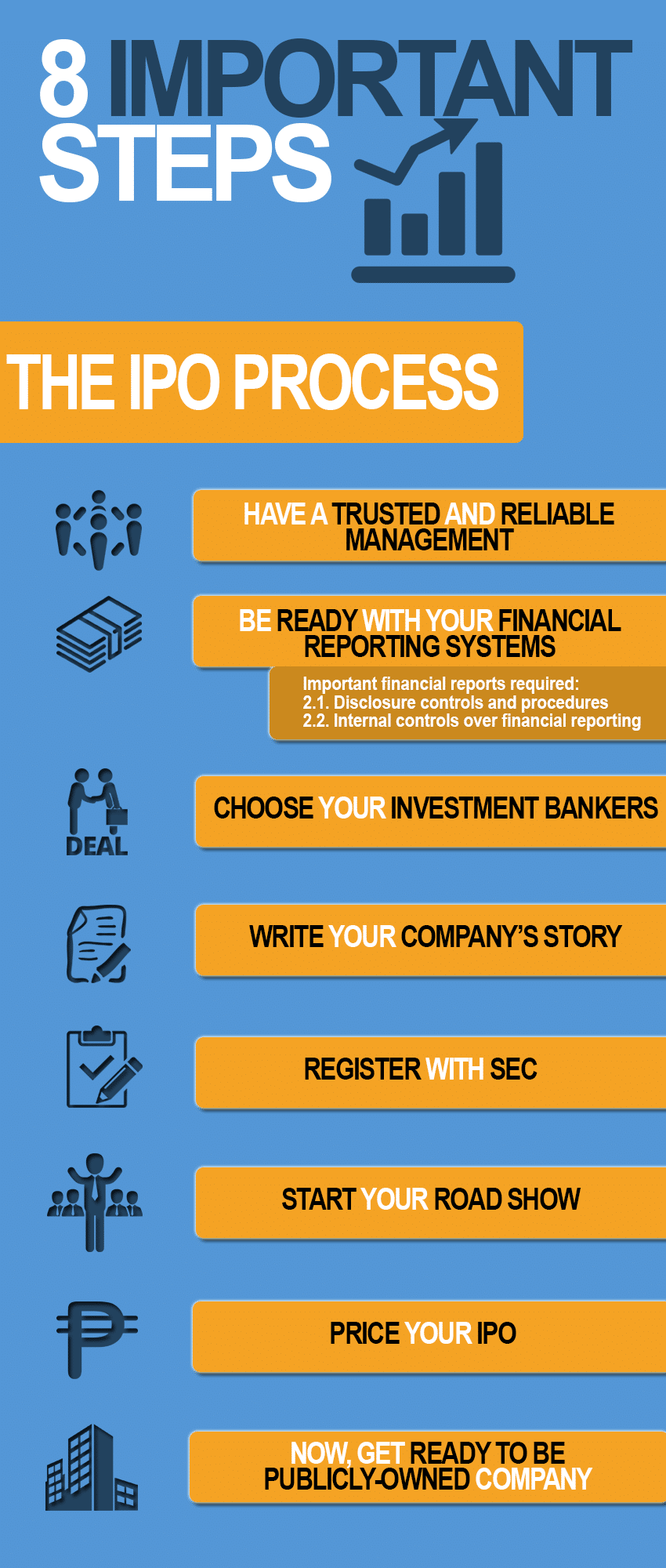

8 steps in the IPO process

The process of launching an IPO can be extensive. Here’s a list of 8 steps in the IPO process to be ready for:

- Choose trusted and reliable management

- Get financial reporting systems ready: Due diligence to get forms and documents, including a letter of intent and registration statement, is important. This is also when you’ll decide on the tentative price of your shares.

- Choose investment bankers: An investment banker will create the details of the IPO and do most of the underwriting. Choose the right bank for your business to help determine the best price for your shares.

- Write the company story

- Register with SEC

- Start your roadshow:This stage creates buzz for your upcoming IPO. You’ll market future shares to prospective buyers. The greater the attention, the more potential for increased share prices and revenue.

- Price your IPO

- Get ready to be a publicly owned company

This is followed by Once the price of shares is finalized, your company can establish its IPO in the stock market.

How salespeople can prep for an IPO

IPOs benefit salespeople because companies that go public usually have an influx of revenue, making them more likely to buy your product or service. There are a variety of ways to track IPOs, including monitoring stock exchange websites and setting up Google news alerts. As a salesperson, once you discover a company is about to go public, act quickly to make your sales pitch.

Try to set up a time immediately after an IPO to visit your lead and do your pitch. After you’ve set up a meeting time, you should do thorough research as to why the company launched its IPO. Was it due to growth and demand or declining sales or revenue? Once you understand the state of the company, you can then use that information to frame your sales pitch.

How Crunchbase can help

With Crunchbase Pro, you can set up alerts for IPOs and be notified as soon as a private company becomes public. This can give you a great time advantage in being one of the first to reach out to the newly public company with your product or service.

In addition to IPO alerts, Crunchbase Pro, combined with our advanced business database, can help you track trigger events or buy signals, including staff changes, new investments, funding activity and more. Knowing about these events gives you the opportunity to strike while the iron is hot and close more sales.