This article will cover learnings from what founders are asking for when they raise their Series A rounds. We look at the metrics around revenue, valuation, round size, and more for Series A companies.

What valuations are founders asking for when they raise their Series A round?

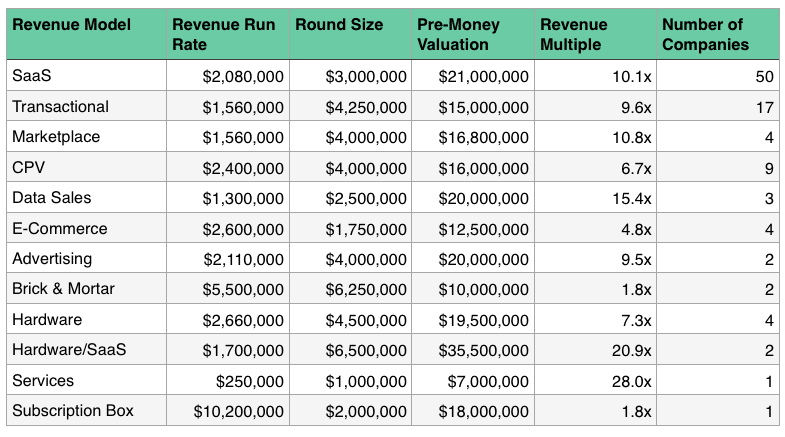

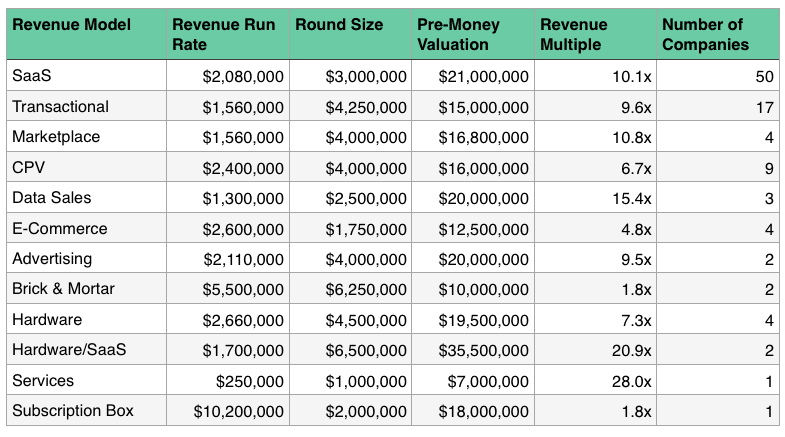

Over the last 3 months (May to July), we’ve had conversations with 99 companies about leading or following their Series A rounds. Below is aggregate data on these 99 raises. Names are redacted to preserve confidentiality. Figures like revenue, valuation, and round size are medians from the conversations.

Remember the valuations and revenue multiples presented aren’t necessarily what the founders got. Rather it’s what they asked for when talking to VCs like us.

Revenue Model: Private Companies

SaaS Companies

We’re generalists, but as you can see 50 of the companies we talked to were SaaS. The median revenue run rate was $2mm, the median round was $3mm, and the median pre-money valuation the founder was asking was $21mm. The result was a revenue multiple ask of 10x.

Transactional Models

The next largest category was “transactional,” whereby a company gets paid for each transaction it completes. We talked to 17 companies in the space. Surprisingly these businesses were asking for valuations that were 10x revenue even though the business model is not as attractive as SaaS.

Marketplaces

We talked to four marketplaces. These are companies with two sets of customers and the company takes a cut of the transaction that occurs between the customers (similar to Airbnb, Uber, Lyft, etc). The ask there was a median 10.8x revenue.

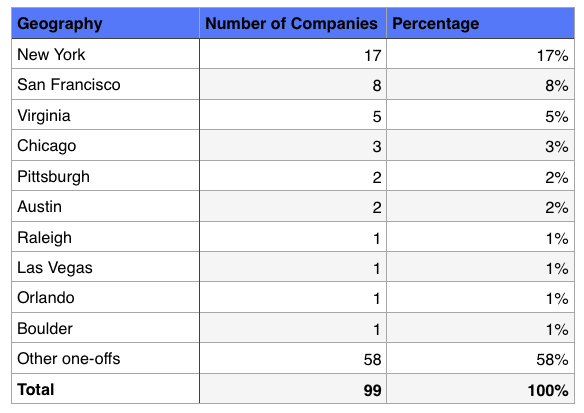

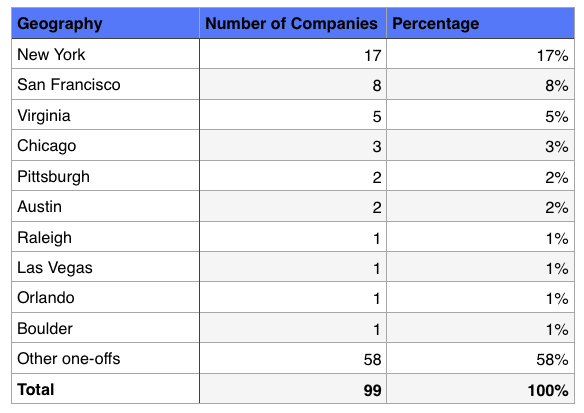

Geographic Distribution of Deal Flow

Below is the geographic spread of the companies we spoke to. While we don’t target NYC and SF, 25% of the companies came from either of those two geographies.

Advice from a VC for Raising a Series A

So what’s our view? It seems as though 10x revenue is a nice round number that founders have attached themselves to irrespective of the business model. And we believe it’s too rich for most Series A size companies.

While this is like the barber saying you need a haircut (we’re VC after all), we’d note that public SaaS companies trade at nearly 10x revenue right now so the ask on private startups is in line with the public.

We feel this is inappropriate. In our view, private companies should trade well inside of public companies. This is due to differences such as size, the liquidity of stock, scale, access to capital markets, profitability, etc. Indeed if you end up between 4x and 6x revenue on your round with a VC, you’ll be at the market for private SaaS companies based on what we’ve seen get funded and what we’ve funded ourselves.

Remember, the data above is what founders are asking. Therefore, deals are completed inside those multiples.

Founders of transactional models and marketplaces are asking for aggressive valuations in our view. For instance, public marketplaces trade at ~4x revenue. While some founders will close rounds at high asks, we believe most will have to revisit valuation.

So what’s our advice to all founders?

Fundraising is hard and distracting. I’ve literally never heard a founder say “I love fundraising.” Make it easier on yourself by being reasonable with the ask. Remember, you’re partnering with an investor who is going to be with you for the next few years. You’re not selling a car to a stranger you’ll never see again. Treat the process like you’re entering a partnership and you’ll find the optimal investor and outcome sooner.

Sammy is a co-founder of Blossom Street Ventures. We invest in companies with run-rate revenue of $2mm+ and year over year growth of 50%+. We lead or follow in $1mm to $5mm growth rounds and can do inside rounds, secondaries, restructurings and special situations. We’ve made 16 investments all over the US in SaaS, e-commerce, marketplaces, and low-tech. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.