As the San Diego tech community continues to thrive, our region has become a growing focal point for investments. In fact, funding for local tech and life science companies has increased significantly this year.

In Q3, San Diego tech companies raised $1.3 billion venture dollars. Funding has been dominated by massive biotech rounds. These rounds include $438 million by Samumed, $230 million by Gossamer Bio, and $150 million by Rakuten Aspyrian.

These overshadowed additional strong biotech fundings of $60 million by Omniome, $52 million by Epic Sciences, $45 million by biotech/tech in-between Cue, and $26 million by Mistral Therapeutics. This quarter alone of $1.3 billion as compared to 2017’s entire total of $1.9 billion in San Diego venture funding.

Funding for local technology companies was also strong. Notable funding included $21 million by NetraDyne, $20 million by Inseego, $14.8 million from Anokiwave, and $10.5 million by SOCi. However, 2017’s Q3 had more deals of this size compared to this year.

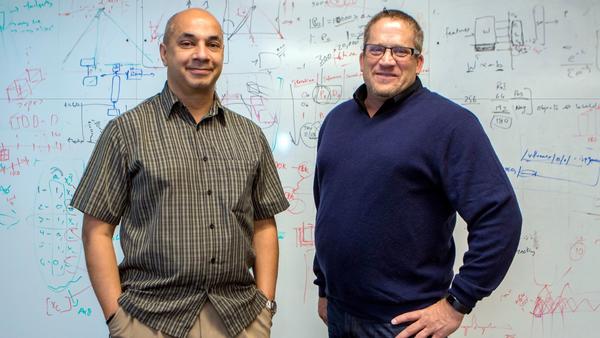

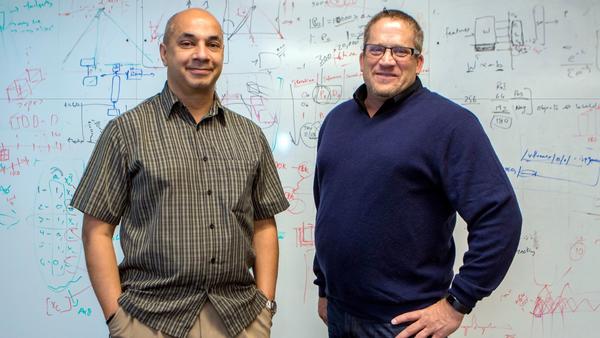

San Diego-based, Netradyne Founders Sandeep Pandya and Adam Kahn | Photo Credit: San Diego Union-Tribune

In comparison, in Q3 2017, San Diego companies had total funding of $426.5 million. This includes $114 million for Brain Corp.

These included 39 total deals in San Diego, compared to 30 deals in Q3 2018. As the late Bruce Bigelow of Xconomy noted a year ago, this follows a continuing multi-year trend of larger deal sizes but smaller total amount of deals.

| Company | Categories | Funding Date | Funding Amount |

| Tour Engine | Technology | 7/3/18 | $2.6M |

| VersaPeutics | Biotechnology | 7/6/18 | $100K |

| Mesa Biotech | Biotechnology | 7/9/18 | $12M |

| MabVax Therapeutics | Biotechnology | 7/9/18 | $11M |

| Tiled | Technology | 7/9/18 | $1.5M |

| Beauty Bakerie Cosmetics Brand | E-Commerce | 7/9/18 | $4.6M |

| Cue | Technology, Biotechnology | 7/10/18 | $45M |

| BrainLeap Technologies | Technology | 7/11/18 | $225Kk |

| Gossamer Bio | Biotechnology | 7/23/18 | $230M |

| Mistral Therapeutics | Biotechnology | 7/25/18 | $26M |

| XworX Inc. | Technology | 7/31/18 | $50K |

| Omniome | Biotechnology | 7/31/18 | $60M |

| AstroPrint | Technology | 8/1/18 | $1.1M |

| Samumed | Biotechnology | 8/6/18 | $438M |

| Inseego | Technology | 8/7/18 | $20M |

| HEROFi | Technology | 8/8/18 | $3.5M |

| AttackIQ | Technology | 8/14/18 | $5.5M |

| Peptide Logic | Biotechnology | 8/15/18 | $2.9M |

| BlueNalu | Aquaculture | 8/15/18 | $4.5M |

| Rakuten Aspyrian | Biotechnology | 8/23/18 | $150M |

| Anokiwave | Technology | 8/28/18 | $14.8M |

| SOCi | Technology | 8/29/18 | $10.5M |

| OncoSec Medical | Biotechnology | 9/4/18 | $15M |

| ThoughtSTEM | Technology | 9/10/18 | $330K |

| Epic Sciences | Biotechnology | 9/13/18 | $52M |

| ARS Pharmaceutical | Biotechnology | 9/14/18 | $8M |

| Foresee Medical | Biotechnology | 9/21/18 | $3.8M |

| ViaCyte | Biotechnology | 9/25/18 | $10M |

| NetraDyne | Technology | 9/26/18 | $21M |

Initial Public Offerings (IPOs) of San Diego Tech Companies

While the first half of 2018 saw only one San Diego IPO (One Stop Systems), the second half is shaping up to be better. Already in Q3, five San Diego companies have filed or have already debuted on the market.

Crinetics – $102 million market debut on July 17

BioNano Genomics – $20 million market debut on August 21

Equillium – $86 million IPO filed on August 23

ChaSerg Technology Company – $200 million IPO filed on September 12

Ra Medical Systems – $66 million offering debuted week of September 24

Acquisitions of San Diego Tech Companies

In Q3 2018, the acquisition of GreatCall at $800 million by Best Buy headlined the list. This was a much quicker than expected sale after the company was acquired by private equity fund GTCR only one year ago.

Moreover, other notable San Diego acquisitions include Venato by crypto exchange Coinbase (amount not disclosed), LeaseLabs by RealPages for $100 million, and EvoNexus incubator grad Approved by Credit Karma (amount not disclosed). GoDaddy has made its 2nd San Diego acquisition in as many years with Plasso.

| Company | Acquirer | Amount |

| Venovate | Coinbase | Undisclosed |

| Barhero | Airtab | Undisclosed |

| K&R Network Solutions | Winxnet | Undisclosed |

| Shield Aviation | Cubic Corp | Undisclosed |

| Zavante Therapeutics | Nabriva Therapeutics | Undisclosed |

| LeaseLabs | RealPage | $100M |

| TeraNova Mobility | Advantix | undisclosed |

| GreatCall | Best Buy | $800M |

| Approved | Credit Karma | undisclosed |

| BVAccel | August Spark | undisclosed |

| MarketingPro | FMG Suite | undisclosed |

| Solana Biosciences | Inscripta | Undisclosed |

| CPC Strategy | Elite SEM | Undisclosed |

| ACEA Bio | Agilent Technologies | Undisclosed |

| Plasso | GoDaddy | Undisclosed |

San Diego’s tech community has certainly established itself as a major player in the tech industry with many success stories in various pockets of innovation. Additionally, the region’s growing reputation for excellence in many tech sectors will no doubt bode well for our ecosystem.

San Diego’s tech community will only continue to mature. Early-stage companies will become late-stage, companies will get acquired, and founders will become funders. The biotech community continues to be strong. Biotechs themselves are looking more like tech companies too with the hiring of developers and data scientists. Here’s to an equally strong fourth quarter as well.

Neal Bloom is a serial San Diego entrepreneur, angel investor, and organizer of the San Diego tech ecosystem including Startup San Diego and San Diego Startup Week.