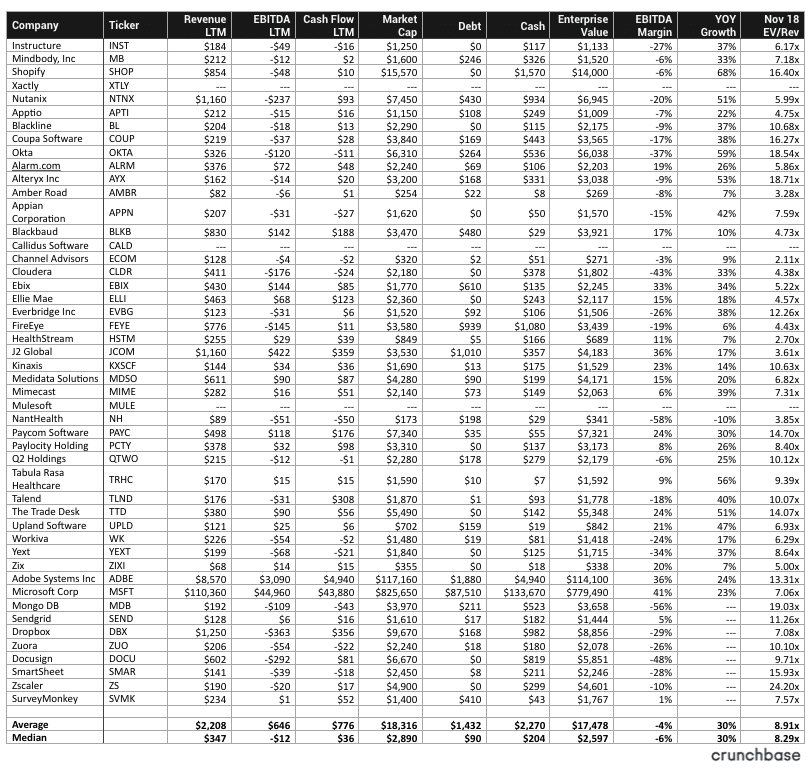

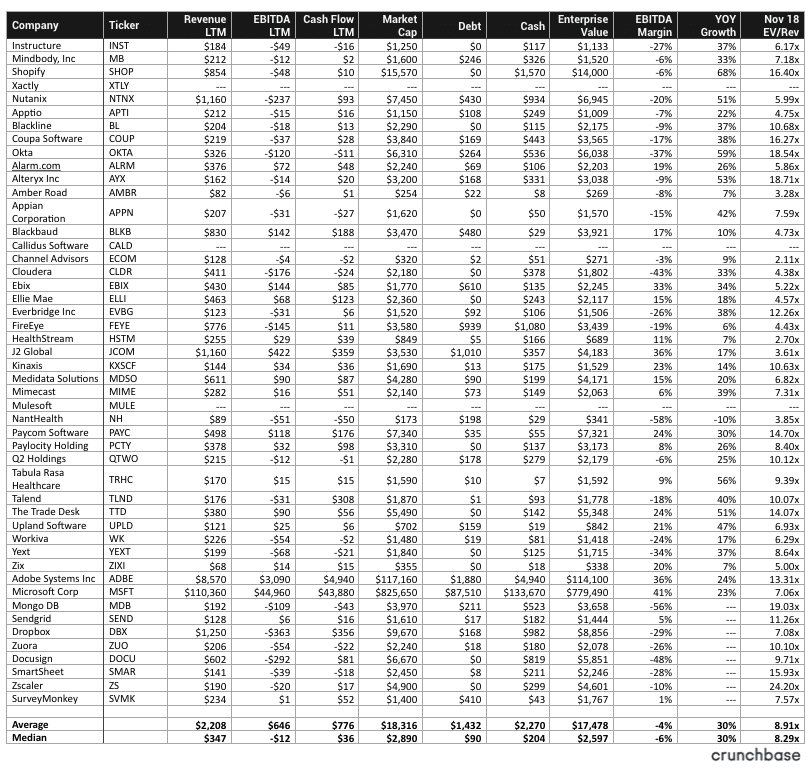

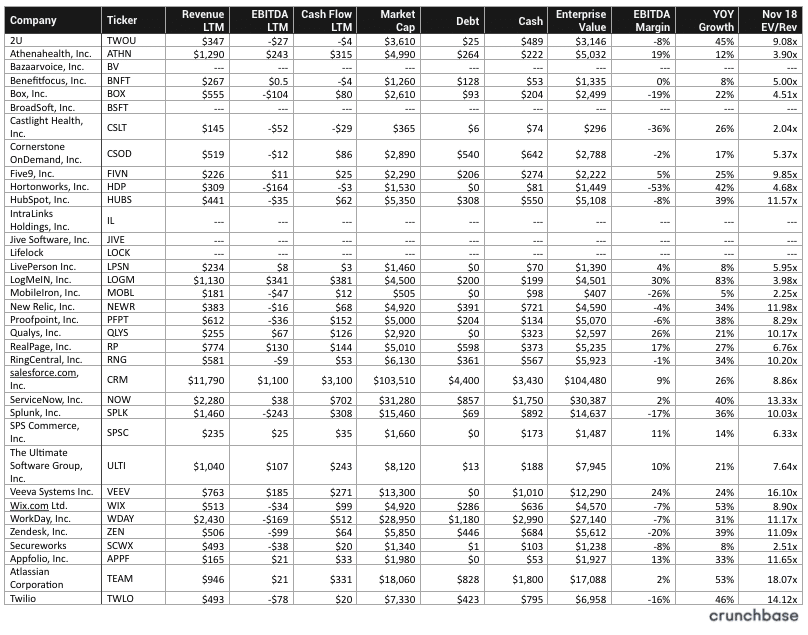

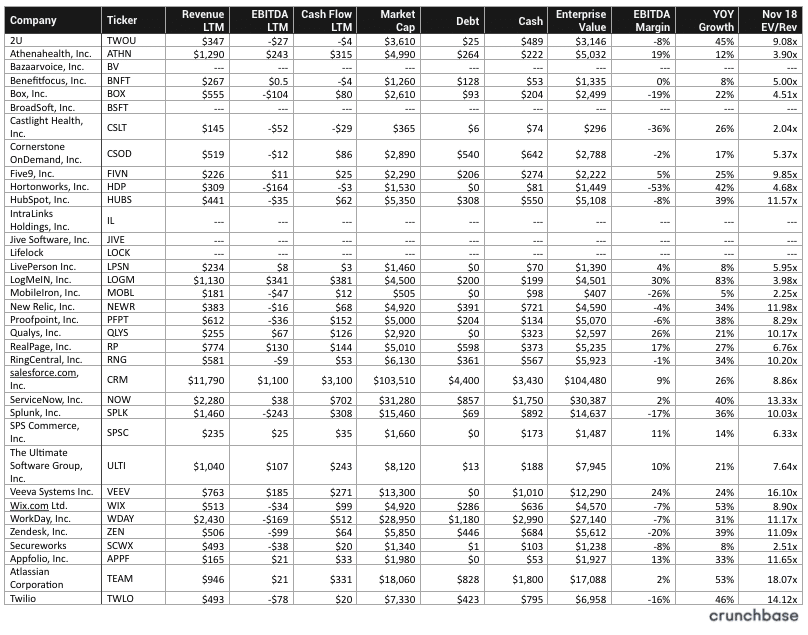

Even as stocks sell off, SaaS company valuations remain unshakeable. Of the 76 SaaS companies we track, the average public SaaS business is trading at 8.91x revenue while the median is 8.29x.

Upgrade to Crunchbase Pro and perform your own market research.

The medians and averages are nearly unchanged from July when we last presented the data, which is pretty incredible given the recent stock market turmoil. The data is below.

SaaS companies saw a negative EBITDA and a positive cash flow

The median SaaS business had a trailing-twelve-month revenue of $347mm, EBITDA of -$12mm, but positive cash flow of $36mm thanks to deferred revenue and up-front collections on annual contracts.

Indeed so long as you’re growing, investors will overlook negative EBITDA especially if the business is cash flow positive after working capital changes. Note the median annual growth rate is a respectable 30%.

The SaaS valuation trend is still strong

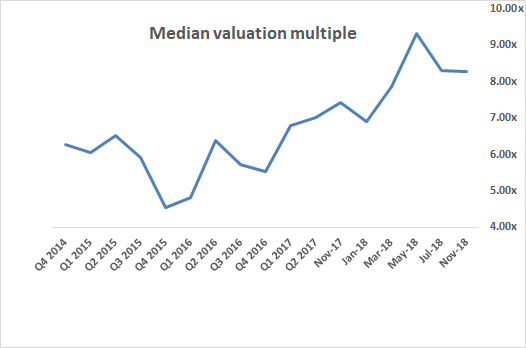

The chart below shows median revenue multiples we’ve collected since Q4 2014. During that period, the median SaaS multiple has ranged from 4.43x to 9.32x with an average of 6.69x.

Today, we’re at the high end of that range which makes valuations fragile — if you believe in mean reversion, then valuations and more likely to fall in the future. However, it hasn’t happened yet.

SaaS margins are still terrible

Investors and founders love saying “SaaS margins are great.” They’re not. They’re horrible. The median EBITDA margin for the companies above was -5% and the average was -4%.

Fixed costs for SaaS companies are terribly high and worse yet those fixed costs are mostly people, meaning the only way to materially cut costs is layoffs. If you’ve ever fired someone, you know cutting costs by cutting people is not easy and hurts the culture and morale of remaining members.

SaaS company growth is respectable

We’d actually expect stronger growth given these high valuations. 30% is not terrible, but you’re not lighting the world on fire either, especially for these premium valuations.

The profitability profile hasn’t changed. And it’s not as if the businesses are getting better, just bigger. Note the majority of SaaS companies on our list have always been unprofitable.

SaaS businesses are healthy

There is almost no debt on these businesses — banks don’t like ‘asset-lite’ businesses like software. Additionally, these companies have $204mm of cash on the balance sheet on the median, equivalent to over a decade of burn (recall EBITDA is -$12mm).

The number of years of cash on the balance sheet is less important given that these businesses are generally cash flow positive (median of $36mm), and indeed only 16 out of the 76 have negative cash flow. Note that 42 out of the 76 have negative EBITDA, but again that’s acceptable so long as the growth is there and cash flow overall is positive. Also, recall that SaaS companies perform well in a recession.

Recent SaaS exits are killing it

Four of the latest SaaS exits (Docusign, Smartsheet, ZScaler, Zuora) are trading at an average valuation of 15x revenue. It shows that now is a great time to come to market whether you’re raising money or selling the business. SurveyMonkey, the latest company to IPO, is trading at a much lower 7.57x, but that’s in large part due to its nearly flat growth.

Key learnings for private SaaS companies

So what’s this data mean for a fast-growing private SaaS business? Public multiples and trends tend to guide what’s happening in the private markets:

i) As compensation for illiquidity, size, and lack of profitability, prudent investors will look to invest in your private SaaS business somewhere below the 10x average unless your growth rate is demonstrably higher than 30% YOY.

ii) Financing will continue to come from equity, less so from debt, although we’ve seen banks like Bridge Bank get more aggressive and lenders like Lighter Capital get more creative

iii) Burning cash is still acceptable on an EBITDA basis, so long as free cash flow is positive or moving in the right direction. Finally, given the high revenue multiples, now is an excellent time to sell your business or raise money.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.