The record volume of transactions, the growth of the average round, and the development of deep tech – such trends are cited by Dsight analysts in the latest report on the Russian venture market in 2019, prepared with the support of the Innovation Hub of Kaspersky Lab, Crunchbase, DS Law, EY and NAIMA. Crunchbase served as the data partner for “The Venture World” section.

New investors and fresh business models

Venture Russia shows that advanced investment stages teemed with time-tested PE funds and family offices are pulling out all the stops to avoid much risk. At mid-level stages (A/B rounds) government VCs stepped up activity – they spawned funds and an assortment of support initiatives (National Technology Initiative grants, Industry Development Fund loans, and many more).

The pre-seed/seed stage, a traditional fiefdom of angel investors, is being actively colonized by corporations and corporate accelerators. In the past couple of years, niche funds sprang up in segments such as fintech, agritech, sports tech, and industrial tech. New angel investors and micro VCs are surfacing.

Mired in financial scarcity, many independent funds refocused on fresh business models. Some offered venture loans; others launched venture builders or studios. The latter model makes them active business developers rather than just investors. The funds increasingly act like the co-founders of a start-up, taking a substantial share in its capital.

All private VC funds, with few exceptions, set their sights on international projects or Russian ones that operate globally.

Venture deals in 2019

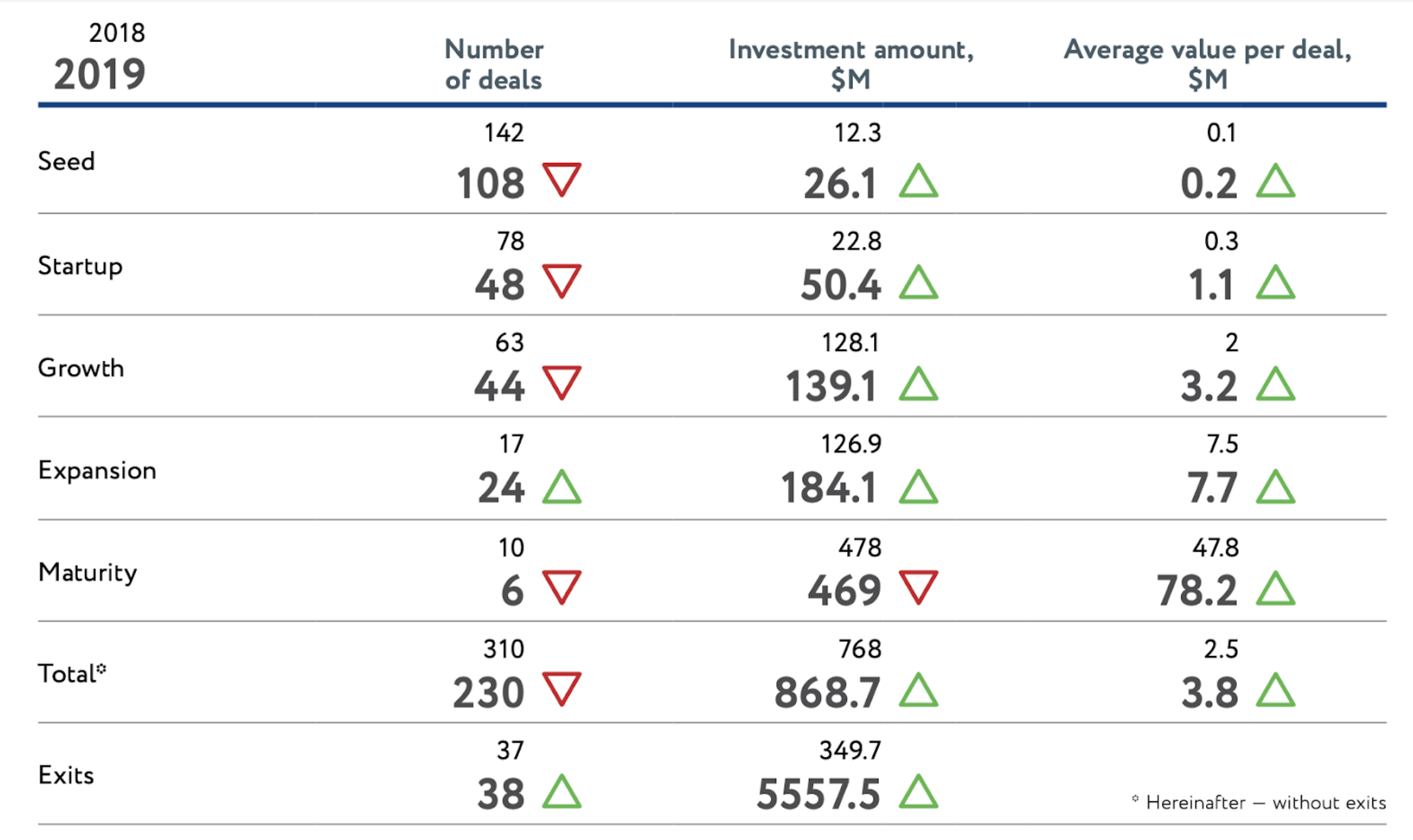

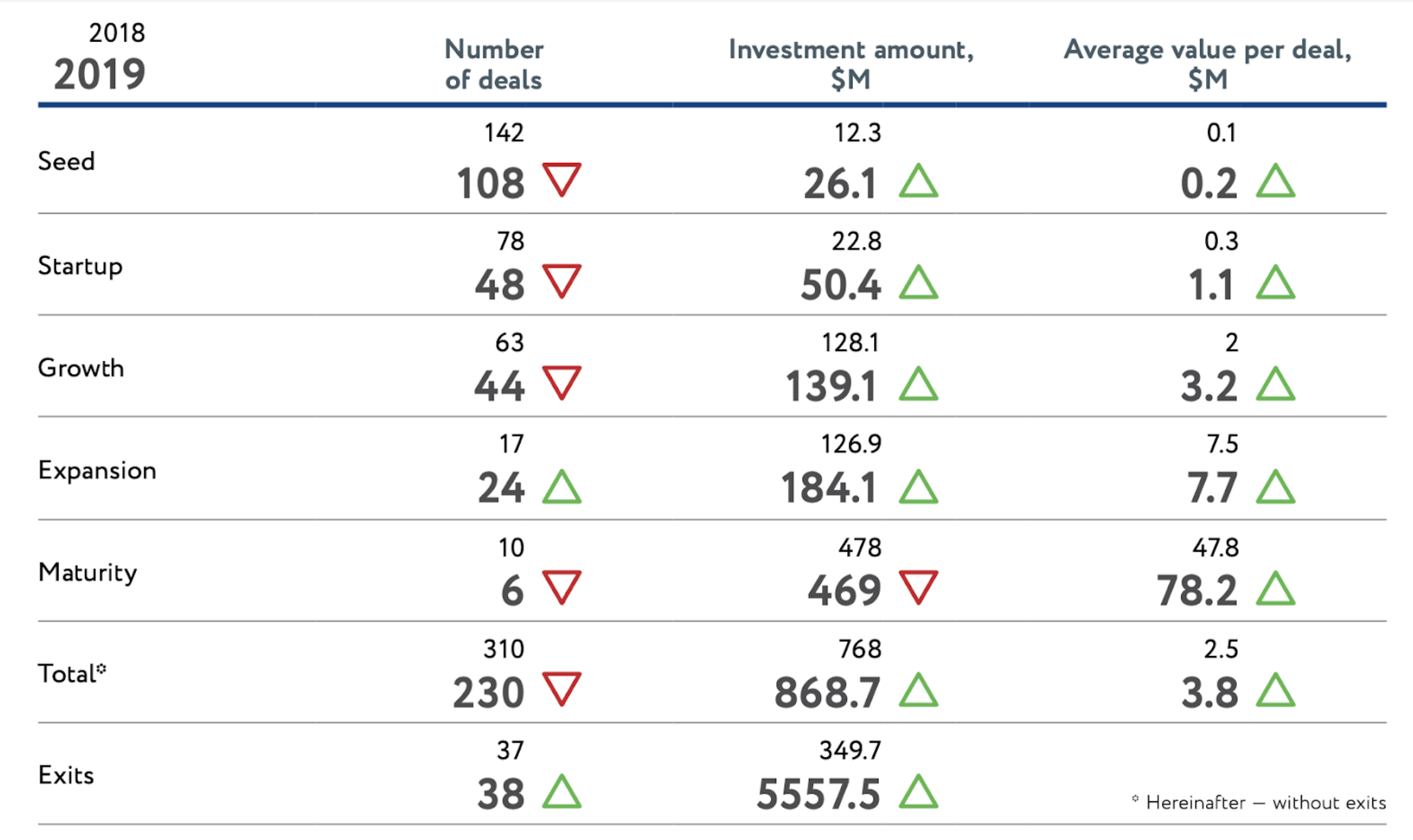

Dsight recorded 230 transactions last year, which is one and a half times less than a year earlier.

Source: Dsight

“However, the total investment in the Russian venture capital market exceeded $868.7 million, it’s an absolute record. Compared to 2018, the growth was 13 percent. And this is without considering exits, in the context of weak economic growth.” – Arseniy Dabbakh, founder of Dsight

The jump-like growth in investment volume is largely due to the growth of the average check: in transactions with mature projects, this indicator grew 1.6 times to $78 million, in seed stage transactions – doubled from $0.1 million to $0.2 million. But in total, the volume of the average transaction grew in the startup phase – more than three times: from $0.3 million to $1.1 million.

“In the early 2010s, startups like marketplaces and various aggregators were very popular. But that era is in the past. Today, the most prospective projects are focused on deep technology and narrow specializations – so-called deeptech startups. They are increasingly in demand. Their areas of expertise include such promising fields as machine learning, 5G networks, the Internet of Things (IoT), medical technology, industrial security and personal data protection.” – Vitaly Mzokov, the head of the Innovation Hub at Kaspersky Lab

The year 2020 will likely see state-owned funds and corporations, both private and parastatal, bolster their market involvement.

About Dsight

Dsight is a business intelligence platform that includes databases (startups, investors, corporations, experts and events) and automated products for Technology Monitoring, Tech Scouting and Market/Startup Research in Russia and globally. The company is a data exchange partner in Russia for Crunchbase. Dsight publishes Venture Russia reports twice a year covering VC/Hi-Tech investment deals and trends in Russia. Arseniy Dabbakh and Sergei Kantcerov are the founders of Dsight.