The venture capital industry continues to suffer from a lack of diversity, according to the 2023 State of Black Venture Report from BLCK VC, a nonprofit organization dedicated to increasing the representation of Black investors in venture capital.

Developed in partnership with Silicon Valley Bank, this edition of the report tracks partner- and non partner-level representation of Black investors. The report reveals a continued lack of diversity and the negative impacts of industry dynamics on venture capital decision-making and financial returns. It also offers actionable guidance on how stakeholders can collaborate to create an inclusive and innovative ecosystem.

Today, Black investors make up 4% of venture capitalists in the United States. Only 3% of Black investors hold key decision-making roles within venture firms. The representation gap is particularly acute among Black women, who comprise only 1% of the U.S. venture community. While these statistics provide a sobering perspective on the industry’s homogeneity, there is a growing movement at individual and community levels to strengthen diversity across the venture capital industry.

Some of the best-known entrepreneurial success stories have been fueled by financing from venture capital, and the industry is a long-critical driver of economic growth. However, despite the billions invested annually, Black talent is rarely represented in VC firms, even though Black Americans make up about 14% of the U.S. population.

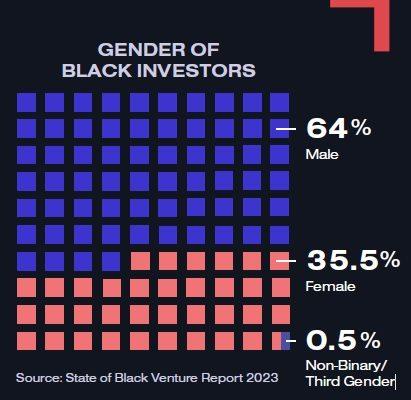

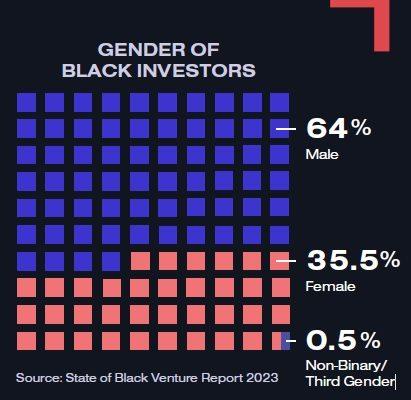

Gender parity for Black women in venture continues to lag

Findings in the report align with industry-wide data on the poor representation of women. When it comes to check-writing, women are still vastly underrepresented. Today, only 16% of venture partners are women, and only 35% of venture firms have female partners. Additionally, only 1% of Black women hold investor positions, with only a fraction of them holding partner positions.

Only 16.7% of Black women in our sample hold partner-level roles, with higher representation of Black women among junior and mid-level talent. This number emphasizes a significant opportunity for venture capitalists to create a more inclusive ecosystem by enhancing support and access for Black women to advance to leadership positions. The lack of representation impacts the funding allocated to Black women entrepreneurs, who received only 0.34% of venture capital in 2021.

Investing in diverse teams is essential and leads to greater decision-making and better financial returns. According to Paul Gompers, professor of business administration at Harvard Business School, “After examining tens of thousands of VC investments, diversity significantly improves financial performances on measures such as profitable investments at the individual portfolio-company level and overall fund returns.”

By overlooking Black women, venture capitalists are missing out on a new generation of successful startups and limiting the success of their investment strategy.

Black junior- and mid-level talent disrupts the status quo

The report reveals that 45% of Black partner-level investors in venture capital have obtained their highest degree from an Ivy League university. When considering junior- to mid-level talent, only 26% of these individuals hold degrees from the Ivy League. The data suggests that while partner-level investors conform to the industry trend of Ivy League representation, there is greater diversity in university pedigree among junior- and mid-level talent. Shifts in education background are a positive development within the industry, leading to a more diverse range of perspectives and ideas as they reach partner roles.

Research shows that investment teams composed of people from similar backgrounds hurt financial outcomes, and investments made by partners with shared school backgrounds have an 11.5% lower success rate in acquisitions and IPOs than those made by partners from different schools.

To support this claim, Gompers noted that even though associating with similar people could have social benefits, it could potentially lead to investors and firms leaving a myriad of money on the table. Our study aligns with his viewpoint and found that firms must hire new talent outside their respective university networks to generate higher returns. Additionally, firms must support the advancement of all individuals and provide them with equal opportunities and resources.

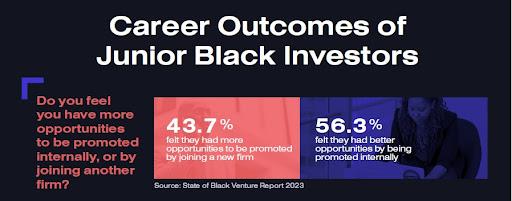

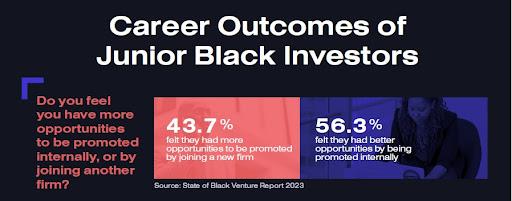

The potential of junior Black investors through mentorship

The report found that trends across career paths of Black investors offered a more complex image of existing barriers. The data indicates that while 42.5% of the individuals in our sample did not receive a promotion in the past year, the majority of those promoted rose from analyst and associate positions — a positive trend for junior talent. However, most investors in the sample have yet to be promoted, suggesting that Black investors often leave their firms in search of advancement. The trend highlights the need for clear career advancement paths and leadership development opportunities for Black investors at venture firms.

The data also shows that Black investors are taking the lead in mentoring junior talent, with 72.4% of Black junior-level investors having a Black mentor in the venture community. By providing mentorship and job opportunities to the next generation of investors, Black investors are creating a solid foundation for a more diverse and inclusive venture capital industry that promotes growth in the long term.

Our study shows that 29.9% of Black investors surveyed hold positions at funds with assets under management over $1 billion. Within the subset, 16.3% of these investors hold partner-level positions. This is a positive trend, as it suggests a growing presence of Black investors at more significant funds. However, support should not be carried only by Black investors, but by those of all backgrounds.

Black fund managers need to focus on later-stage investments

The overall number of first-time Black fund managers is growing, with 28.6% of Black fund managers launching their first fund in the past year. Increased Black checkwriters across venture capital can bring diversity and representation to the industry, leading to more inclusive growth and opportunities for Black investors. Our data indicate that Black fund managers typically focus on early-stage investments with smaller check sizes, which can limit the community’s reach and influence.

Our study also shows that the median check size of Black fund managers is $450,000. Black women fund managers have even smaller check sizes, with a median of $350,000 — as opposed to $625,000 for non-Black fund managers. Additionally, Black fund managers are raising funds that are 35% smaller than their target fund size, showing that persistent barriers may inhibit their ability to achieve the intended fund size, which can negatively impact their ability to execute against their portfolio construction strategy.

To expand the reach and influence of the Black venture capital community, Black fund managers must raise more significant funds to focus on later-stage investments and build a healthy pipeline of companies that can scale and drive returns. More Black fund managers in later-stage investments may be essential to getting more funding for Black founders. This notion would allow managers to invest in more mature companies with a higher potential for returns in addition to helping these companies scale and grow, paving the way for more Black founder-led unicorns that can be funded by Black venture investors.

Five ways to take action for the Black venture community

We encourage industry leaders and stakeholders to use these results to inspire a shift and produce a more inclusive and innovative ecosystem for Black investors:

- Open access to networks and resources to mentor and provide opportunities for junior-level Black investors;

- Champion Black investors, which will improve professional development and advancement opportunities for Black venture capitalists;

- Oppose unconscious bias and pattern-matching with expanded benchmarks for evaluating new hires by considering skill sets and ideas and demonstrating an understanding of unique markets and consumers;

- Increase access to capital to support the growth of the Black venture community by supplying more funding and investment opportunities for Black-led venture capital firms; and

- Take action by sharing the State of Black Venture Report in your network to help us accurately evaluate the diversity of the investor community and drive change.

Working together to address Black investors’ systemic barriers in the venture capital industry will yield outsized benefits for individual Black investors, the industry and society as a whole.

Read the full report here for more information on our 2023 findings.

Samer Yousif is the interim CEO at BLCK VC, an organization for Black venture investors working to close the racial wealth gap in venture capital. He leads the organization’s strategy development and execution, fundraising, partnerships, and manages the team. Previously, he was BLCK VC’s chief program officer, overseeing the strategy and execution of programs and strategic initiatives to empower, educate, connect, and inspire venture investors. Yousif is also the managing director of Investors of Color, a consortium of Black, Latinx, Asian and ally investors building wealth by investing in high-growth companies serving communities of color.