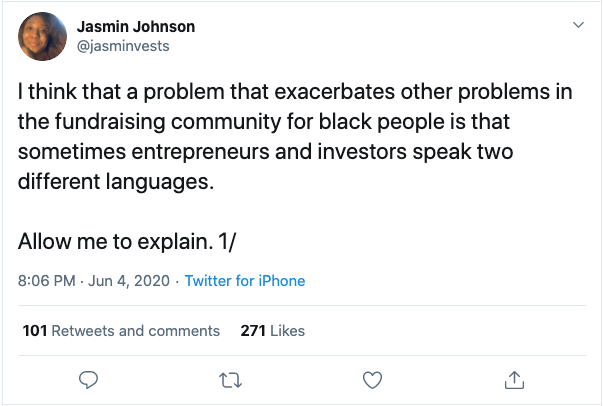

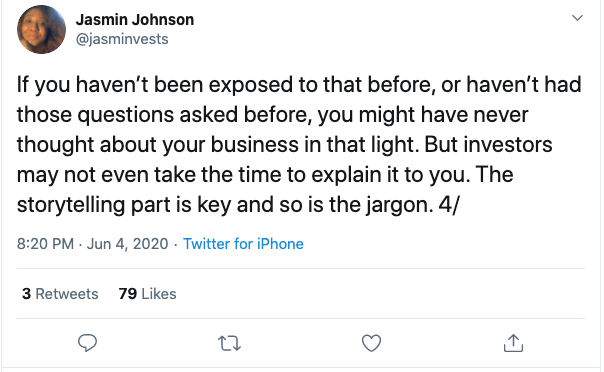

A few weeks ago Jasmin Johnson, one of only a few Black female investors, tweeted:

As I read it, it resonated strongly. Storytelling is hard and, for many entrepreneurs, counterintuitive. And the less experience a founder has with investors the more counterintuitive it can be.

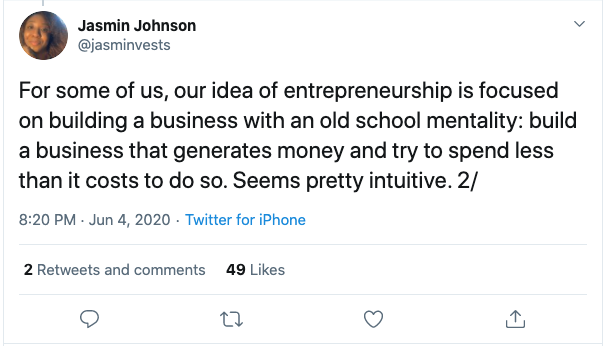

The reason is easy to understand. Founders are laser-focused on executing. The next few minutes, hours or days dominate their thoughts. And investors have recently made it a requirement for a founder to prove “traction”–a short-term measure of success at best.

Investors, on the other hand, have a long-term goal of returning their fund at a multiple that makes their investors happy–typically two or three times the fund. That mismatch between the daily life of company-building and the 10- to 12-year horizon of a fund leads to a mismatch between short-term execution and long-term goals or the end game.

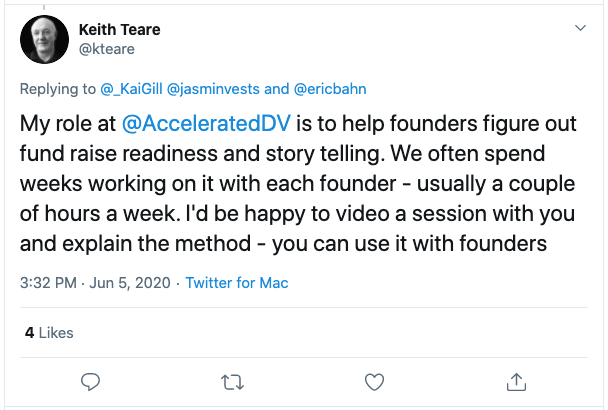

I responded to Jasmin:

In the midst of the turmoil that we are living through, and after Jasmin had shown interest in this, I promptly put it on a list. A little over a week later, I did it.

I have been involved in over $500 million of fund raises in my four-decade career. I hope I am able to share some of what I learned.

If you are a founder and want to learn the art of telling your story to an investor, here is my take on a good approach to that.

The video has a Creative Commons license, so please feel free to link to it and use it in developing your story.

It refers to two documents that I have now made open source so again, feel free to use them:

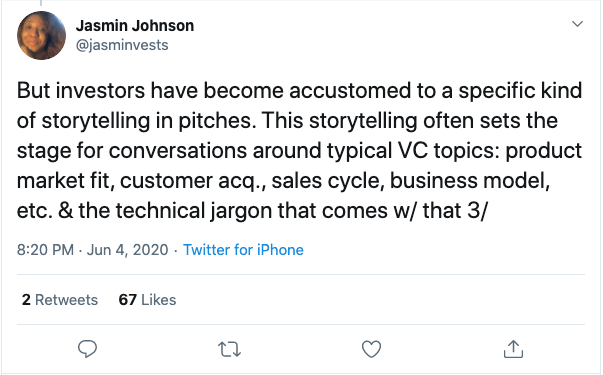

Jasmin also wrote a post in her new newsletter.

Keith Teare is U.S. managing partner at U.K. venture fund Accelerated Digital Ventures and has his own angel portfolio at archimedes.studio in Palo Alto, California. He was the founding shareholder in TechCrunch and writes a weekly newsletter called That Was The Week.