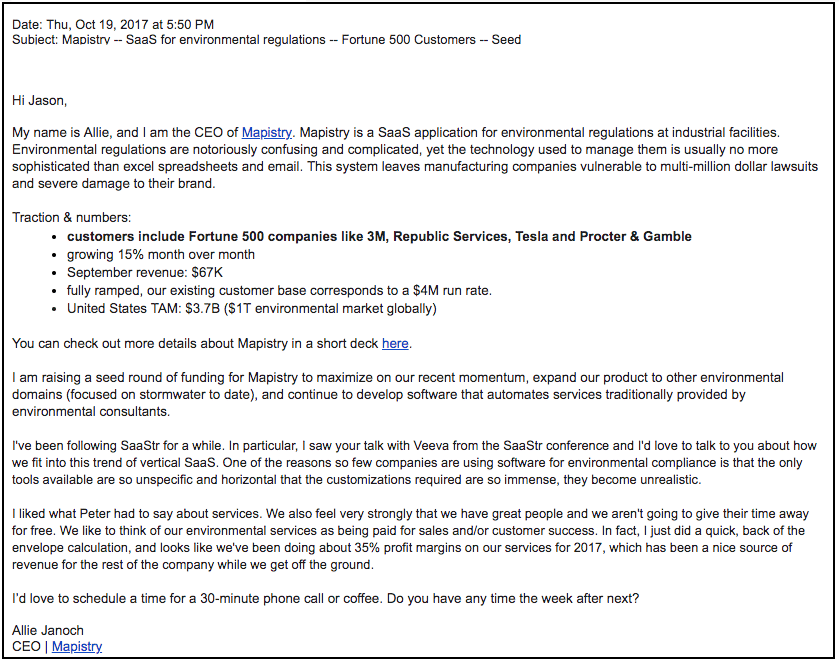

If you’re a startup on Crunchbase or have had any kind of publicity, chances are good that VCs are emailing you about raising money. Here are some tips to maximize the benefit of these inquiries and a review on how to email a VC:

Find your next investor with Crunchbase Pro — start your free trial.

How to Email a VC: Consider Who the Email Is From

Emails From Decision Makers Are Good

Knowing principals, managing directors, and original founders at venture funds is a good thing. These individuals are real decision-makers, won’t waste your time or theirs, and should try to ascertain fit quickly. If they reach out and you have the time for a call or are fundraising, take it.

Emails From Associates

More than likely, you’re going to get an email from an associate. Unless you’re raising, feel free to ignore this. The job of an associate is to get on the phone with as many startups as possible so they will waste your time just to stay busy in front of their boss. It’s not out of line to politely ask to be connected with a principal. If the associate won’t push you up promptly, they’re just fishing.

Prioritize Your Time

Don’t Feel the Need to Respond or Take Calls

Even if you’re emailed by a well-known venture investor, don’t feel pressured to take the call, especially if you’re very busy or not raising any time soon.

Believe me, we’ll email you in a few months. Another acceptable deferral is to intro them to one of your board members and let that board member handle the communication. Using your board is a very effective way to save your time while also building familiarity with a venture firm.

Biggest Don’ts of Emailing a Venture Capitalist

Don’t Give Away Valuable Information:

Beware of those fishing for information. Before taking a call with a VC, make sure they don’t have competitors in their portfolio. If they do, then it’s likely they’re wasting your time just trying to get intel. Feel free to be upfront and ask that question directly.

Don’t Ask One Really Annoying Question

Responding with “so what value are you going to add” is like a job interview where you’re asked, “so what are your strengths?” It’s a bad question that’s going to get a bad answer, and at worst you’ll turn off the really good VC who will view this question as arrogant.

Finding out about the value-add of an investor is best done by asking for reference calls to other companies in their portfolio during your raise.

Biggest Do When Corresponding With a Venture Capitalist

Save the email address

If you don’t respond, no problem. Do save the email address though and reach out to that person when you are about to raise.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.